studiocasper/E+ via Getty Images

Thesis

Signet’s (NYSE:SIG) management is doing all the right things – whether it’s making smart acquisitions, divesting a risky sub-prime financing business, shutting underperforming stores, or maintaining strong margins. We hope to demonstrate that the stock could have 50% upside potential.

The Basics

Signet Jewelers has aggressively consolidated its position as the largest retail player in the diamond and jewelry industry over the last 24 months. Signet traditionally focuses the middle of the market (sales between $500 – $10,000), but has its sights set on the next tier up with its recent acquisition of Blue Nile, the purchase of which was completed in August 2022. Management has been largely mum about what the Blue Nile acquisition means in the short term, but we believe that after comparing this acquisition with 2021’s purchase of Diamonds Direct it will be clear that the market is not pricing in the top-line bump that Signet is set to receive in Q3 and Q4 of 2022. There are other synergies for the acquisition as well included—you guessed it—the war in Ukraine.

First, some basic background. Signet owns some of the largest names in retail jewelry: Zales, Kay, Jared, James Allen, and jewelry rental service RocksBox. In 2021 the company made its first serious foray into online retailing with its purchase of Diamonds Direct. There were two principal motivators for acquiring Diamonds Direct—1) to offer a robust online sales funnel, and 2) to increase online price vs. in-store comparisons between Signet entities (in other words, folks in a Zales store would find their way to Diamonds Direct on their phone and still make a purchase from Signet either way).

Through all these channels however, Signet is and always has been firmly mid-market, with Jared and James Allen offering the majority of Signet’s higher end goods. High-end diamonds are typically the purview of name brand, boutique firms (think: Harry Winston, David Yurman). With this in mind, Signet’s management made—in my opinion, and hopefully soon yours—an incredibly savvy purchase with Blue Nile.

Blue Nile is a distinctively upper-crust diamond retailer with a strong online sales channel and 23 physical retail locations in high-end shopping centers. In contrast to Signet’s middle-market, floor-to-ceiling merchandising strategy, Blue Nile is starkly the opposite. Blue Nile stores are what might be called ‘strategically under-merchandised.’ This is a cost advantage for the company as it takes less capital to stock the showroom. Signet CEO Virginia Drosos addressed this both on the company’s Q2 earnings call and at the recent Goldman Sachs Annual Global Retail Conference—“Blue Nile has showrooms that are obviously capital-light from a working capital perspective,” she said. “We’re very interested in understanding more about that dynamic and how it might play for other banners in Signet.” This is not an inconsequential comment as Drosos has committed multiple times to retaining double-digit gross margins for Signet.

The Online Sales Channel

We mentioned earlier that Diamonds Direct was Signet’s first serious foray into the online diamond space. It was a good acquisition, in my opinion, given that company caters principally to Signet’s core market. Blue Nile, however, has an online sales experience that belongs in a different atmosphere.

Selling a diamond online is particularly tricky since not only are you selling an item at a high price point, but the clarity of the image is incredibly important. Signet and Blue Nile leverage proprietary photography processes to provide a stunningly clear picture of each diamond in their inventory, but Blue Nile takes it a step further. Below are screenshots from the same stage in the search process from Diamonds Direct and Blue Nile.

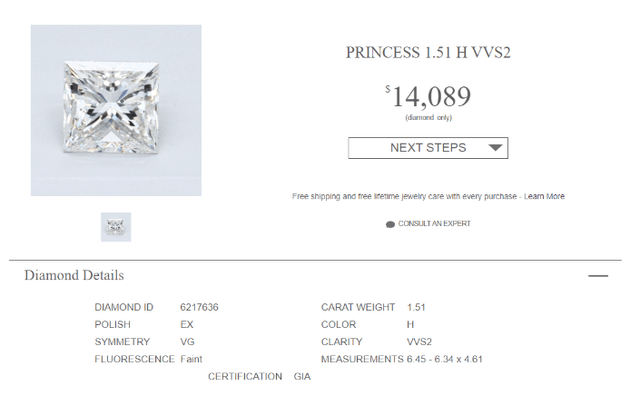

Diamond Direct Online Experience (Author Screenshot)

Diamonds direct provides a shopper with the basics—the type of diamond you’re looking at the color, clarity, weight, etc. But apart from that, We don’t get much else. The customer is not given any perspective on where ‘H’ sits on the color scale. What’s the quality of ‘VG’ when it comes to symmetry? The customer may not know, and isn’t told.

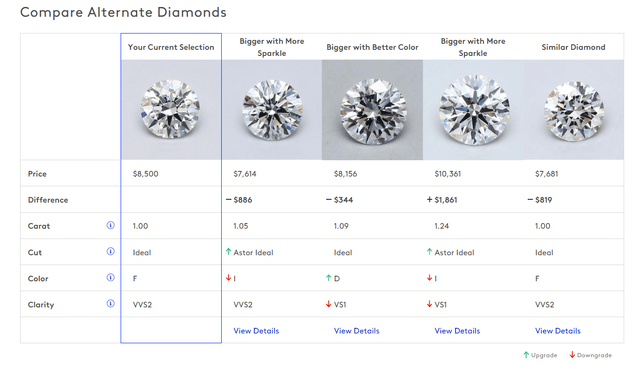

Contrast this with the online offering from Blue Diamond. Blue Diamond automatically stacks up similar diamonds in their inventory, ranks the price difference, carat, cut, color, and clarity, with simple-to understand indicators to let you know how these diamonds stack up against each other. It’s far more intuitive, and easier to use. It even headlines each comparative diamond with a succinct description of the difference—Bigger with more sparkle, bigger with better color, etc.

Online Shopping with Blue Nile (Author Screenshot)

OK—so what? What does this have to do with the business? Well, this online experience is more important than it may seem at first glance. Buying a diamond is a major purchase unique from other types. For one, the diamond buying process is not like buying, say, a car. Car buyers more often than not have a fairly specific idea in their head of what they want to buy—before someone even steps on the lot, they will likely have strong if not locked-in preferences on brand, color, vehicle type (sedan, coupe, truck, SUV), etc.

Diamond buying is not like that. The diamond shopping process is more often than not a game of comparison given the unique nature of each stone. So even if someone has a specific cut of diamond in mind, they aren’t going to buy the first one they see. We would not be surprised to see Signet leverage Blue Nile’s exceptional online abilities across all of their platforms in the near future.

Now let’s talk about visits and how Signet could leverage and implement Blue Nile’s top-end user interface. Diamonds Direct averages roughly 140k visits per month. Blue Nile, on the other hand, averages about 4 million. Pairing that level of traffic with Signet’s inventory and other brand channels could create a powerful online sales machine–a potential that is in no way baked into the current stock price.

What Signet Offers Blue Nile

Before we get to the big reveal on what We believe the market is missing from Signet, We want to make a point that Blue Nile’s business should benefit materially from merging with Signet.

Standalone companies like Blue Nile don’t have the leverage that large companies like Signet do in the world of wholesale diamond purchasing. Signet, with its international size, is a DeBeers Sightholder. This means that Signet receives an annual allocation of rough diamonds from DeBeers—the largest diamond producer in the world—and does not have to go to middlemen in Antwerp, Israel, or elsewhere—to procure its diamonds. Blue Nile traditionally has had to do so. Thus, it can be reasonable expected that Blue Nile’s gross margins will benefit immediately from Signet’s worldwide industry reach.

Signet’s standing with DeBeers is especially important given that DeBeers’s primary competitor is Alrosa, the Russian diamond producer that found itself in OFAC’s sights in April 2022, and which created an immediate panic in the diamond market. While Alrosa has reportedly been able to circumvent sanctions to some degree by selling rough diamonds to polishing hubs in India, We would wager a hefty sum that European and American diamond distributors will do everything in their power to avoid purchasing an Alrosa-produced stone and keep themselves out of the vision of the all-seeing-eye of OFAC.

This leaves DeBeers as the only major player available to companies like Blue Nile. Being owned by a huge player with a dedicated seat at the DeBeers table is a major score.

A Top-Line Bump…?

Management has stated that they expect bottom-line synergies to begin accruing within 3-4 quarters, but has been reluctant to speculate on what exactly the Blue Nile acquisition will bring to the topline. Blue Nile’s financials were omitted from the deal documents, but a little scratching around yields some very intriguing numbers. This is setting up the potential for a very nice top line surprise in the back half of 2022.

Q3 is traditionally the slowest quarter of the year for jewelers, while Q4 is the busiest time of year. The acquisition of Diamonds Direct in November of 2021 added $132M to the top line in the remaining portion of the year (about 45-60 days), and $219M in the first half of 2022.

Blue Nile and Diamonds Direct had similar physical footprints at the time of their acquisitions, with store counts in the mid-20s and a robust online presence. Due to the timing of the deal closure with Diamonds Direct, management included revenue estimates for Diamonds Direct in its Q4 2021 guidance. Interestingly, management did not update their Q3 2022 guidance with Blue Nile sales estimates (We suspect some sort of lesson was learned here by management about tipping hands).

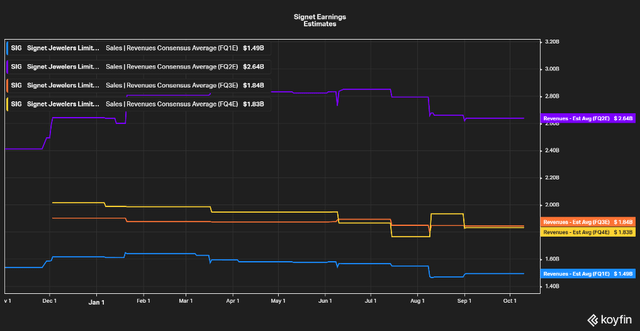

At any rate, after the Q3 2021 call, analysts dutifully adjusted their revenue targets in line with management’s guidance as illustrated in the chart below. After the latest call, however, with the announcement of the Blue Nile acquisition without any revenue guidance, none of the estimates changed.

Signet Quarterly Revenue Estimates (Koyfin)

Now, we’re unsure why Signet management is playing this so coyly. Adding a company of at least similar size to an acquisition you made less than one year ago doesn’t present a complete and total mystery when it comes to revenue. The only hint management would provide about Blue Nile is that it would be bottom-line accretive in a few quarters.

The only financial information about Blue Nile disclosed by Signet is tucked away an in 8-K filed on August 5th, in which Signet discloses that Blue Niles revenue was north of $500M in 2021. Based on Signet’s quarter by quarter figures, a little less than 50% of yearly business is conducted in the first half of the year, about 20% in Q3, and the Q4 holidays comprise about 34% of business.

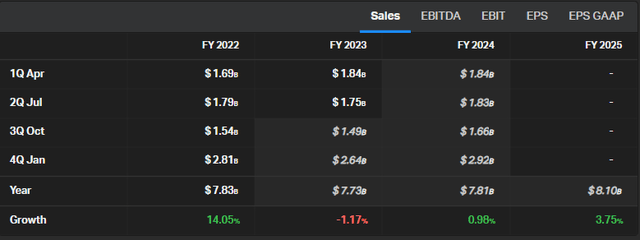

Signet Sales Estimates (Koyfin)

So now there are a few things we know—Signet expects that its overall business will decline between 1-2% this year. It’s also bolting on a new business with roughly the same economics that we can estimate will generate $450M of revenue in the back half of 2022 (accounting for dead days in the quarter pre-transaction closing and a close to 5% decline in Blue Nile’s business). That would give us, according to the typical quarterly breakout of jewelry revenue, a top line bump of around $100M in Q3 and around $150M in Q4.

A lot of this seems obvious when you dig in. So why aren’t the analysts who cover the stock adjusting their models?

A few reasons.

First, analysts generally aren’t going to alter their models unless they have hard data to back it up. The only number we have here in regards to Blue Nile is a top-line revenue from 2022, nothing more. Current management has a largely positive track record, and so analysts at this point don’t have much reason to doubt what they say. Second, management expressed that Q3 is moving along nicely in the Q2 call. Vaguely upbeat, sure, but in the heavily scripted world of earnings call theater, it means something. Third, analysts typically don’t want to make a call (especially a negative call) unless they have a very high degree of certainty.

What could this mean for the stock?

Overall we are bullish on Signet. The bear case against the stock rests largely on:

- forecasted demand destruction via inflation,

- operational risk from acquisitions,

- management’s inability to continue delivering high margins.

We’ll address these at a high-level and then, with that base case laid, address the potential the stock may have. We believe that demand destruction is overblown. Yes, lower end purchases are falling off, but higher-end demand (especially in the bridal segment) remains robust. Breaking into the top-tier of jewelry purchases as well with the Blue Nile acquisition will help to insulate Signet from near term lower-tier decline. Operational risk is always a tricky thing to forecast because we can’t see inside the companies. However, Signet plans to integrate operations within James Allen with Blue Nile, and management has just recently had success doing the same with Diamonds Direct. Blue Nile will retain its own identity, so we aren’t talking about having to reconfigure auto assembly plants—the high level vision shouldn’t be terribly difficult to implement. While margins are, to paraphrase Jeremy Grantham, one of the most mean-reverting numbers on Earth, we believe management can maintain them. They’ve closed 20% of underperforming stores and slimmed their SG&A expense over the last 18 months. Management isn’t relying purely on macro forces to preserve margins, and so we think they are likely to be sustainable.

Blue Nile’s impact on top-line revenue may provide a near term catalyst for the market to recognize that Signet has value that isn’t being recognized. Let’s dive in.

It’s difficult to find a true competitor for Signet since the market is so fragmented. Companies like Evnela (ELA) and Birks (BGI) are so small that a financial comparison with the industry behemoth makes little sense. It’s not difficult, however, to ascertain that Signet is cheap. It currently trades at 4.7x NTM EV/EBITDA. For reference, the only other company in the specialty retail space we could find with a market cap over $1B that trades below 5x NTM EV/EBITDA is The Buckle (BKE). Its forward P/E is 6.2, which is, again, quite low.

Signet has only $147M of long term debt, and roughly $900M cash on hand, as well as $2.1B in inventory (a nice thing about this business is that inventory tends to appreciate). Signet kicked off $1.1B in free cash flow for 2021, with a market cap of a little over $2B. Trailing 12-month FCF is around $500M.

Signet has a 5-year forward P/E average of 10.1x, and we believe some mean reversion here is in order. Given the stock’s current forward P/E of 6.3x and estimated earnings of $10.87 per share, a reasonable price target would be $109.

However, let’s take a bit of allowance for a deteriorating macro environment, and shave the estimated EPS a bit to $8.87. Doing so with a historical forward P/E of 10.1x puts us at a target price of $89, a roughly 50% upside from the price today.

The Bottom Line

In conclusion, we believe that the bear case for Signet is short-term, and a bit overblown. The company’s management has been adept at maintaining strong margins and making smart acquisitions that are accretive to growth and should further solidify the company’s standing as the number one player in the space. For these reasons we believe that the market is treating Signet’s stock unfairly, and that it may be primed for a long-term move upward as management’s strategies continue to bear fruit.

Be the first to comment