choochart choochaikupt/iStock via Getty Images

Do one thing and do it well

Labrador Iron Ore Royalty Corporation (LIF:CA) is a boring open-ended trust. The corporation has a 15% interest in the Iron Ore Corporation (IOC). IOC is a vertically-integrated operation that produces iron ore pellets. It has been mining the iron ore deposits near Labrador City in Newfoundland, Canada since 1962, concentrating the ore in a plant nearby, converting the refined ore into pellets, and then shipping it with a wholly-owned rail line to the wholly-owned terminal in the Sept-Iles, Quebec seaport.

The operations are run by Rio Tinto (RIO), the global major miner that also owns a majority stake in IOC with 58.7% of the shares. The balance is owned by Mitsubishi Corporation (OTCPK:MSBHF).

The Iron Ore Corporation has reserves of 1100 million tons which it mines in a relatively simple open pit at a rate of up to 55 million tons per year.

Simple.

Variable dividends

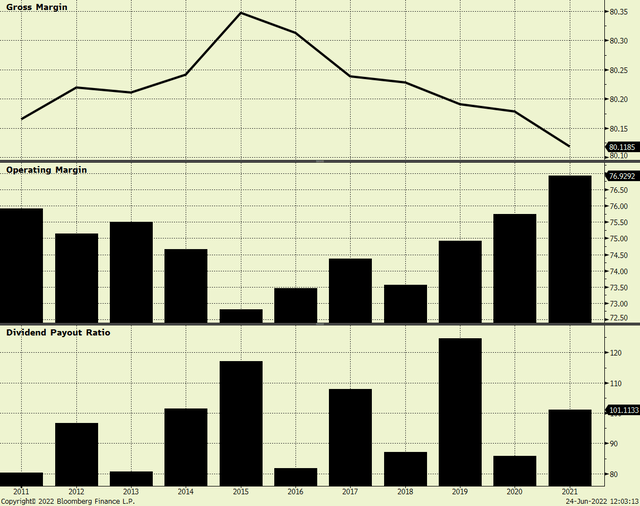

The Labrador Iron Ore Royalty Corporation is a simple pass-through vehicle. LIORC’s gross margins have held steady between 80.1% and 80.3% for years, while its operating margin has been on a slow, somewhat choppy uptrend. The company is a textbook example of a cash cow, with a dividend payout ratio below 85% only twice in the last decade, and over 95% in six of the last ten full years.

Labrador Iron Royalty Corporation’s select financial ratios (Bloomberg)

The steadiness of the company’s operations and its pass-through of revenue as dividends to shareholders comes with a downside: since the revenue is variable, so are the dividends. This contrasts with a blue-chip dividend payer like IBM (IBM) which makes a particular effort to keep dividends steady and growing despite fluctuating revenue. The revenue of LIORC is directly tied to the price of iron. When iron prices go up, so does the dividend; when it goes down, so does the dividend. These fluctuations in dividends can be dramatic, and perhaps severe to those relying on the income. For example, in the third quarter of 2021 the company paid $2.10 per share while a year prior the company paid $0.45.

The dividend yield, however, is generally high — as expected from a company whose operations can be summarized as processing royalty payments and issuing dividend cheques. The dividend yield has been in excess of 5% since 2015 and has often exceeded 10%. This will sometimes lead to dramatic changes in the stock price, and you should be prepared for that should you hold it.

Holding for the long term

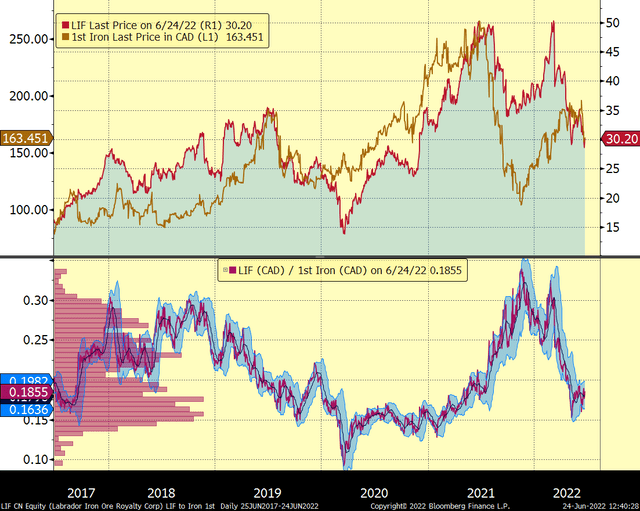

Currently the price of the shares is low, relative to the price of iron. This is in contrast to the last several months when the shares were relatively expensive, vis-à-vis the price in Canadian dollars of the front month futures contract for 100 metric tonnes on the DCE (Dalian Commodity Exchange) which is widely considered the standard measure of iron prices and is quoted in Chinese yuan.

Top panel: price of LIF shares and 1st Iron futures. Bottom panel: ratio of LIF to iron prices (Bloomberg)

As the distribution of the ratio between the price of LIF shares and the price of the iron futures in the bottom panel of the chart above shows, there are likely two or three regimes to this ratio. That’s why the overall distribution looks like two or three overlapping single-mode distributions and why there are two (or three) “peaks”. What the chart shows is that the ratio is hovering around the lower mode, which translates to a lower ratio of LIF to iron prices, which means that LIF shares are relatively cheap. This contrasts to the period from the second half of 2021 and earlier this year when the price of LIF shares were relatively expensive. The top panel shows that while the price of iron dropped precipitously in the second half of 2021, the price of LIF shares followed, but not as much. This is likely due to the large dividends that shareholders received, cushioning the fall in the price of the stock.

The price of iron bottomed in late 2021 and has been increasing since. However, the price of the shares peaked in early 2022 and has declined since then, creating an entry-point. Of course, one could attribute the decline in share price to a decline in global growth expectations, which would lead to a lower global consumption of iron in the medium-term.

However, because this stock pays high but variable dividends, if you don’t need to rely on the income, this is a fair moment to accumulating. There is good value in LIF shares and excluding the rock-bottom prices that prevailed during the pandemic sell-off of March 2020, this is one of the better moments in the last five years to get in. The mining property has huge reserves, the IOC controls the entire value-chain from extraction to loading iron pellets into ocean-going vessels. The world will continue to need iron. Yes, there is a risk the price of the shares will go down, as they are ultimately tied to the price of iron. But these shares should continue to provide you with dividends for decades. The current yield is hovering 12% so if you neither need the capital nor the income for some years, I reiterate that this is probably a fair moment to make a long-term purchase.

Be the first to comment