Mario Tama/Getty Images News

On April 20, Netflix, Inc. (NASDAQ:NFLX) announced its results for the first quarter and showed that they lost a small number of members, but increased revenue and earnings. The lack of growth was a huge disappointment to the market and shares fell 35%, but a deeper look into Netflix results shows the business continues to earn and will keep growing over time. I’ve been supportive even from higher prices as you can see from my poorly-timed prior article, but as I’ll explain below I think these numbers aren’t as bad as they look at first. At these prices, it’s a great idea to “Buy Netflix and Chill.”

Subscriptions are Actually Growing

Normally I’d go over some background about Netflix’s business, but in this case, I think their service is so well-known that everyone reading this article understands that Netflix is a paid, streaming video on-demand service.

The headline number most people seem to have focused on for Netflix is a net subscriber loss of 200,000. As the company explained in its Shareholder letter, Netflix suspended service to Russia last quarter resulting in a loss of 700,000 paid subscribers. So without cutting off service in Russia, Netflix would have reported a gain of 500,000 subscribers. (On the company’s conference call, they also reported that Central European customer churn seems to be higher than normal and this may be related to Russia’s invasion of Ukraine.) So the first thing to note is that the service is not shrinking.

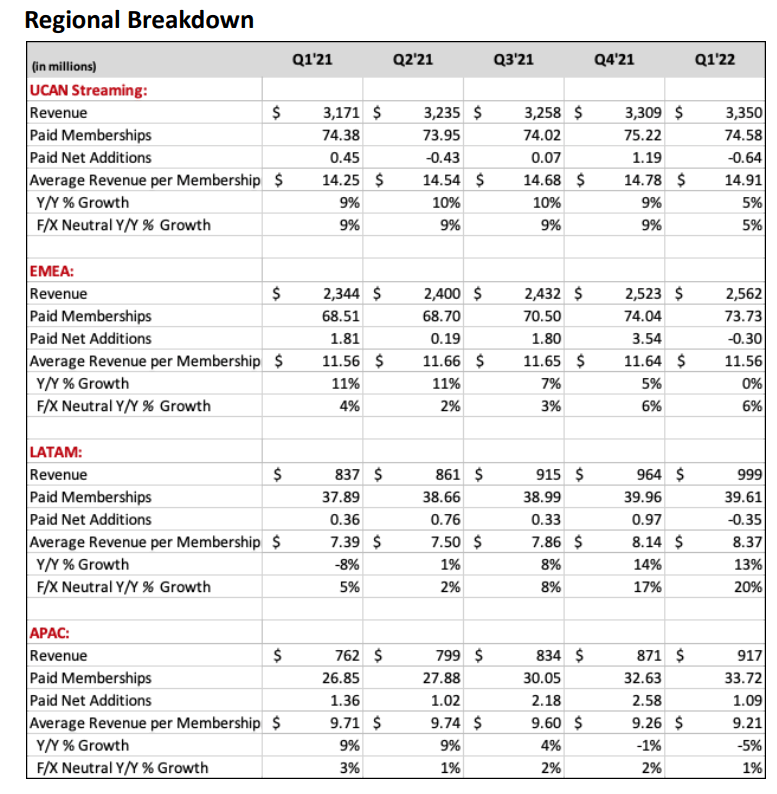

Netflix’s shareholder letter breaks down operating results by region, which paints a good picture.

Subscriber Information (Netflix)

As you can see above, the “UCAN Region” (United States and Canada) lost a small number of “Paid Memberships” from last quarter, but the total number of customers is still higher than it was one year ago. Likewise, UCAN revenue continued going up every quarter even though the number of customers declined slightly. The company identified four reasons for gaining far fewer subscribers (500,000) than they guided for in last quarter’s shareholder letter (“For Q1’22, we forecast paid net adds of 2.5m vs. 4.0m in the year-ago quarter”).

Management identified four reasons for this: broadband adoption and data costs, already high levels of market penetration, growing competition, and macro headwinds. I’ll talk about market penetration and competition in the next section, but here it’s worth noting that with rising costs for gasoline and natural gas, apartment rents, and food, inflation is clearly taking a bite out of the spending power of many US consumers. It makes sense that some of them would stop paying for Netflix.

I can’t predict how much worse this will get or when it will stop, but I do believe pretty strongly that someday the recessionary pressures of inflation will subside and the country will grow again, and it’s pretty short-sighted to think US households will always feel the need to cut back. (I’m 41, and some of my earliest memories of watching the news with the adults in my family were about the US recession of the early 90s; it was all people seemed to talk about at the time – but in retrospect, how many of us remember what caused it, or think it was a good reason not to buy stocks?).

You can see from the chart above that Netflix’s Latin American and Asian segments continue growing apace, and revenue and memberships are higher. Even the “Europe, Middle East and Africa” segments grew revenue despite the loss of Russia.

Focus on Results, Not Expectations

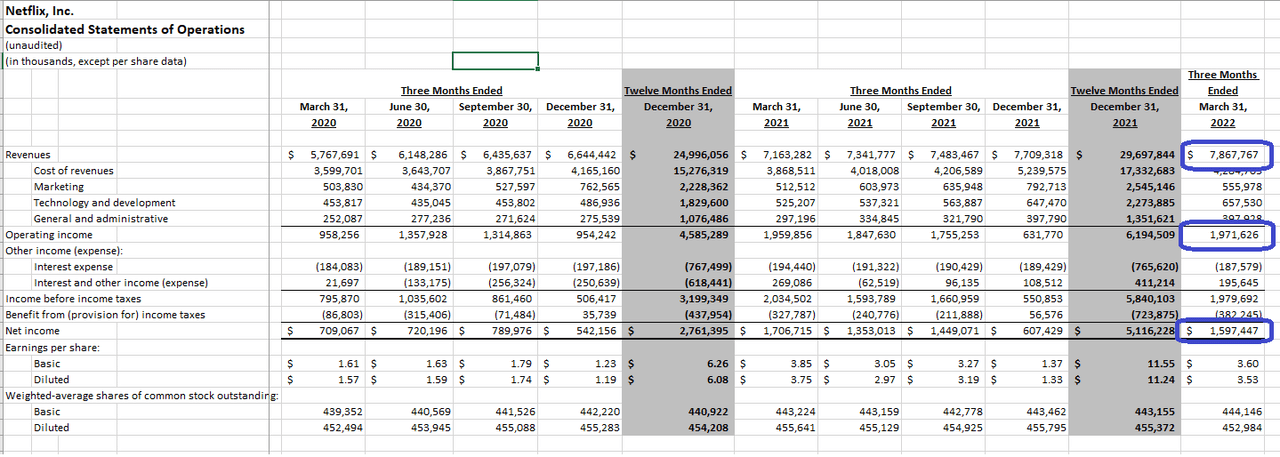

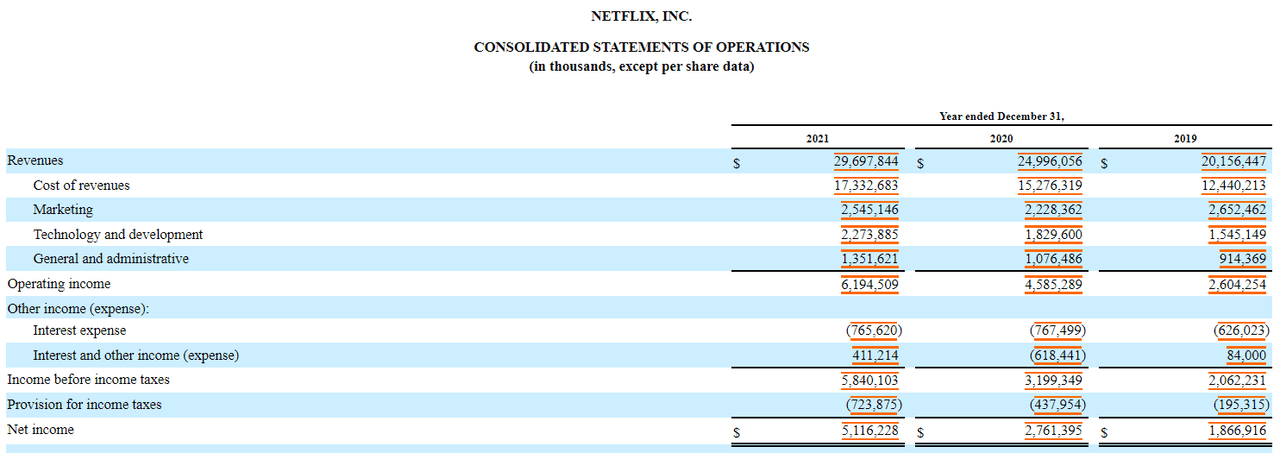

As we’ve shown above, Netflix is actually growing and not shrinking. So what does all that mean for the company’s financials? I want to point to both the most recent income statement (excel file) and the trailing three years’ worth of results (copied from Form 10-K) to show that they’re actually earning quite a bit of money.

2022Q1 Income Statement (Netflix)

Annual Income Statement (Netflix Form 10-K)

As you can see, the company earned more than $5 billion in net income last year, and in the last quarter, they earned almost $1.6 billion. That Q1 net income was slightly lower than 2021’s Q1, but the difference was from “other income” rather than operations.

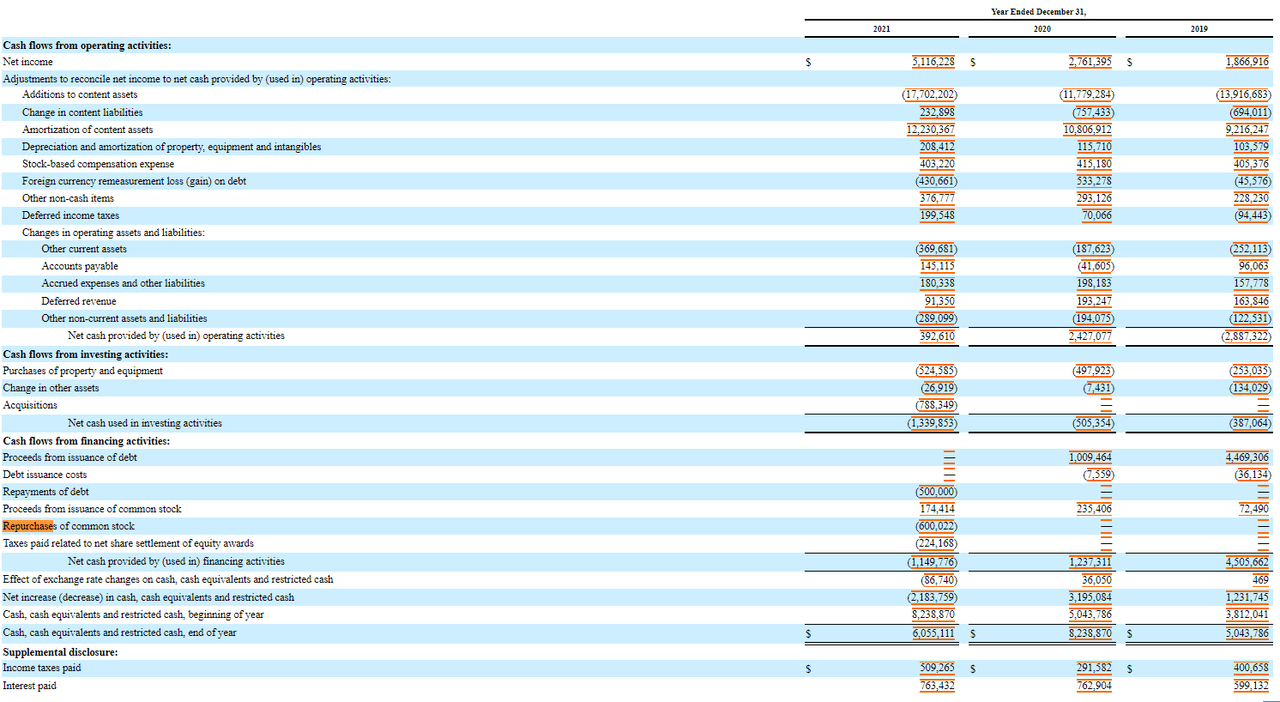

Some observe that for such a profitable business, they should have more free cash flow. As you can see from the Cash Flow Statement in the 10-K, Netflix acquired a number of businesses, repaid loans and repurchased shares.

Cash Flow Statement (Netflix Form 10-K)

I do have a complaint that the repurchase was over-prized and poorly timed, but these are not the problems of a business that simply can’t produce cash.

“There’s No Accounting for Taste”

(This section is my attempt at something technical, and many readers may not find it interesting or helpful.)

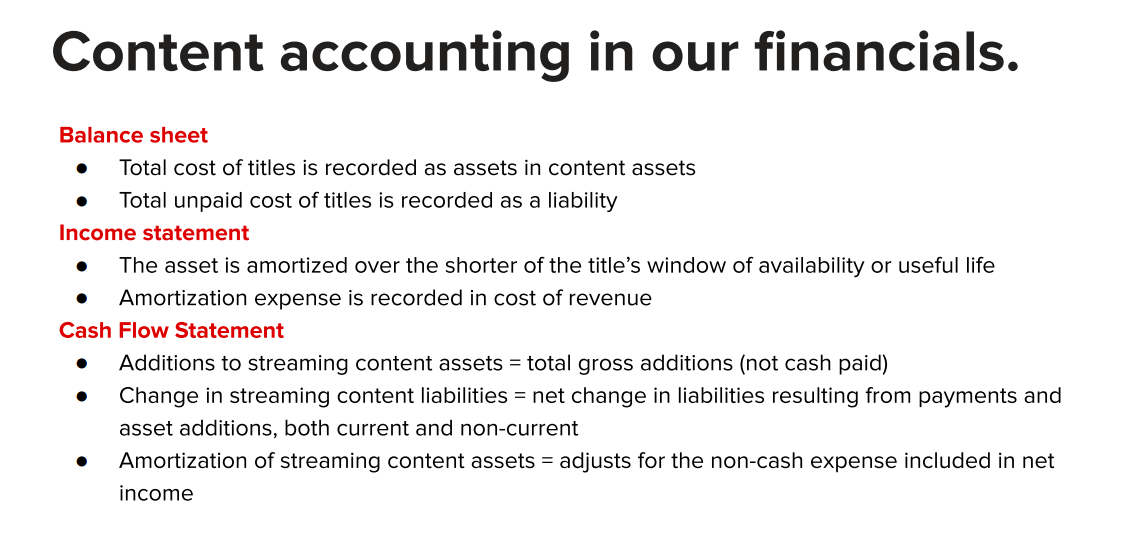

A number of stock market observers have questioned Netflix accounting and accused Netflix of understating the amortization cost of their content which they claim inflates earnings, but we can see from the financial statements that this criticism doesn’t make sense. The company has addressed this question quite clearly with its own content accounting presentation, and this slide summarizes the issue.

Content Accounting Presentation Summary (Netflix)

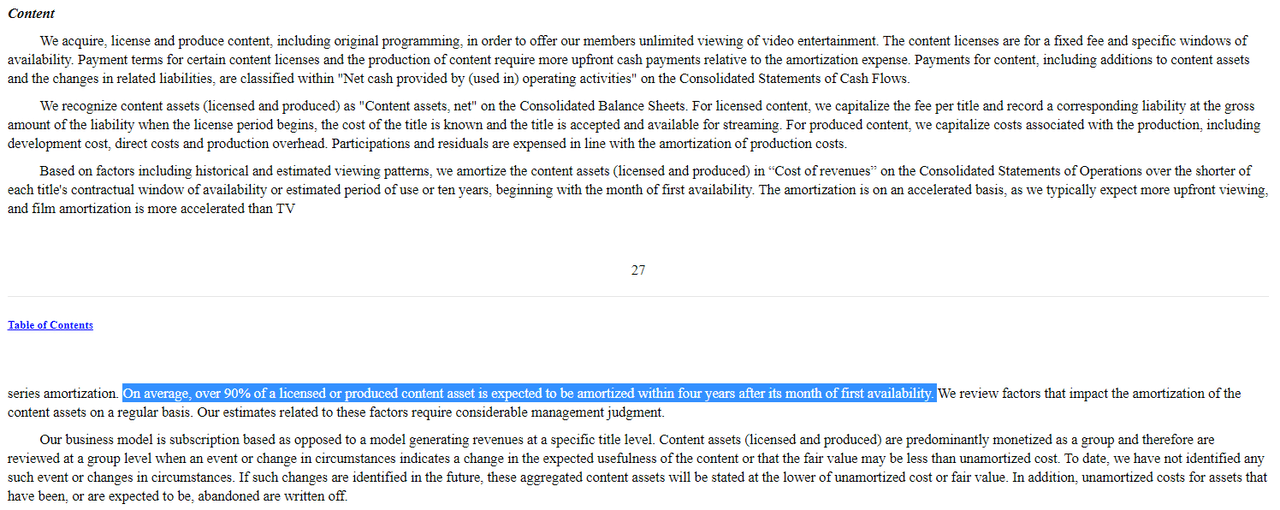

You can verify how this works yourself by following the financial statements, Netflix explains very clearly that 90% of its content is amortized over 4 years.

Content Amortization Policy (Netflix Form 10-K)

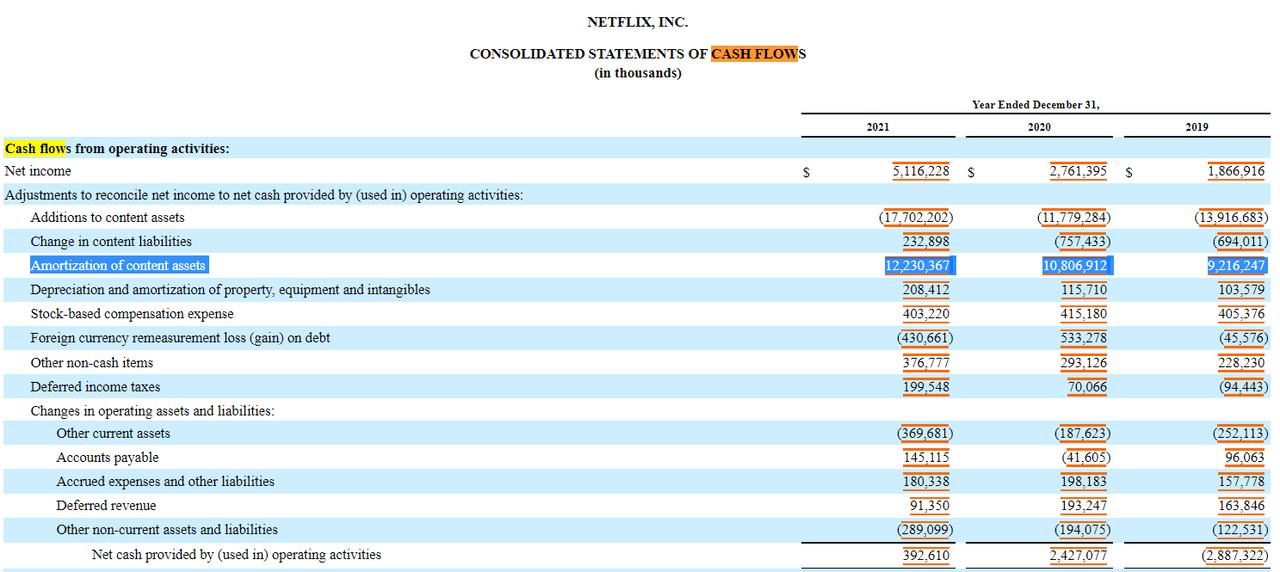

Second, we can see clearly from the Statement of Cash Flows how much they amortize.

Cash Flow Statement (Netflix Form 10-K)

So for the previous year, Netflix said on the income statement that it cost them $17.3 billion in “Cost of Revenues,” and then they said on the cash flow statement that $12.2 billion of that was amortization of content (meaning they’re writing down the value of things they bought in previous years).

To compare a counter-factual, what would the financial statements look like if they expensed all content spending every year? The first thing to do would be to take the entire “additions to content” spend ($17.7 billion in 2021) and use that in place of the amortization ($12.3 billion) used for costs of revenues, meaning the total operating income for 2021 would be about $5.472 billion lower, and operating income would be about $722 million instead of $6.1 billion. So the first thing that happens is that pre-tax income would be about $400 million and taxes would be closer to $100 million than their most recent $724 million. (Netflix won’t get the whole benefit of that change though, because some of the amortization occurs in Year 1 in either scenario. I’m just teasing out the discussion.)

The second issue is that the amortization amount is always backward-looking, so it’s a function of money spent in prior years, and that will always be lower than the amounts spent in current or future years. As you can see from lower than average spending on new content in 2020, this backward-looking number made 2021 look more profitable than it would have been if you expensed all the content – but it also made 2020 look less profitable than it would have been! So as long as the company is consistent throughout each of these years, the problem works itself out. But third, annual expensing just doesn’t represent the economic reality. After all, customers spend a significant time watching content made in previous years (for example, I’m still a fan of Narcos).

Competition and Market Penetration are real Headwinds

The company discussed in depth the impact of competition from services such as Disney+ (DIS), Amazon Prime (AMZN), HBO’s streaming service (WBD), Hulu, and others. There’s no way to whitewash this: competition drives down profits as some users choose not to subscribe to Netflix, Netflix has to spend more to attract and retain customers, and there is a ceiling on how much they can charge for the service. While I agree that Netflix is a less profitable company than it would be if it faced no competition, the question to ask is, “how much of the effects of that competition are priced into Netflix’s results?” I don’t have any reason to think competitors will gain on Netflix fast than they did last year, and I think this headwind is fairly priced.

The next interesting issue is that of market penetration, which goes hand-in-hand with the question of sharing subscriptions. As we discussed above, 75 million households in the US and Canada have a paid membership to Netflix. Management has also explained that while 220 million households subscribe, another 100 million households watch without paying. So we can an infer that somewhere between ⅓ and ⅔ of those tag-along households are in the US and Canada. All-in-all, if there are 150 million households in the US and Canada, being included in 100 million or more (two out of three!) is an amazing achievement. On the one hand, this means it will be hard for Netflix to grow. On the other hand, Netflix now receives zero revenue for ⅓ of its total viewership. It’s unrealistic to think they’ll convert all of them to paying subscribers, but it should be clear that whether by adding a requirement to pay for other viewers or by advertising to those viewers, there is actually still room to keep growing.

So I don’t find either of these problems insurmountable and I think the current market cap reflects a lot of skepticism already.

“Don’t Fight the Fed” and Mr. Market

One last thing to note is the effect of interest rates on stock prices. To take an easy example, if a 10-year bond is issued with a 1% coupon and interest rates rise to 2%, the price of that bond has to fall by almost one-tenth in order to adjust to the new reality. Stock prices fall quite a bit because, while on the one hand, their earnings can theoretically grow forever while bond coupons are limited, on the other hand, those earnings are uncertain and can be hard to forecast. So all that is to say that there’s a lot of well-founded bearishness right now pulling stock prices lower. Some of that sentiment feeds back onto itself and may affect one’s view of not just asset valuations, but also business dynamics. In short, I think rising rates are making it popular to be bearish, and that’s not well-founded here.

Attractive Valuation

It’s clear to me that Netflix is earning money and growing, and I expect them to be on track to earn $6 billion this year. At 16 times this year’s earnings, that’s a very low valuation for a company that can grow in its main markets despite penetration and also has a long runway in the fast-growing rest-of-the-world. I have bought shares, and I would be interested in buying up to 20 times that $6 billion estimate, or $271/share. I would consider shares fully valued at 25 times earnings, or $325 per share.

Risks to the Thesis

The biggest problem with my idea is that I might be wrong about Netflix’s competitive position. They may continue to lose US customers while other services gain. In that case, the stock price could easily fall to $150/share. The other thing to be concerned about would be continued weakness of US consumer spending and the possibility of an ongoing stock market correction that drives all share prices lower.

Conclusion

I wish I had waited to write last quarter’s article about how I liked Netflix until this week. But being early then doesn’t change my conclusion now. I think this is a good business that makes a large and growing amount of money, and I’m pleased to buy shares at these prices.

Thanks for reading. Good luck to all!

Be the first to comment