piranka/E+ via Getty Images

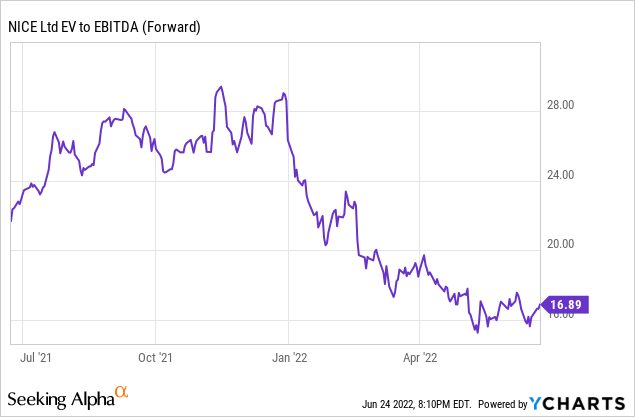

During its latest investor day event, global enterprise software provider NICE Ltd (NASDAQ:NICE) outlined its updated financial goals through fiscal 2026, headlined by a double-digit % revenue growth target (80+% from the cloud) and 30+% operating margins. The outlook was largely in-line with the industry-wide ramp up in contact-center modernization efforts amid the post-pandemic digital transformation shift. Considering the clear benefits of cloud contact center technology and the migration of enterprise contact centers to the cloud, I see a clear path to durable top-line growth and consistent margin expansion in the upcoming years. While NICE shares trade at a premium c. 17x EBITDA, its superior profitability and growth outlook justify the valuation.

CCaaS Remains a Compelling Secular Growth Opportunity

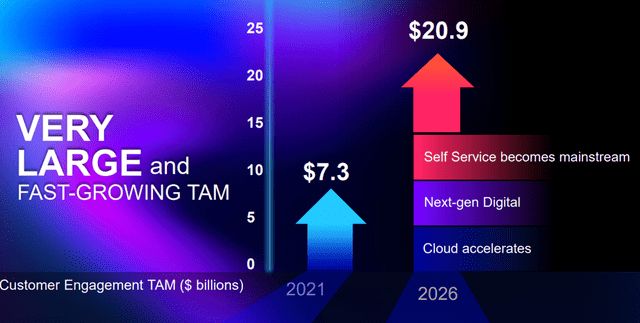

Driven by strong enterprise traction, international demand, and AI capabilities, NICE has seen its leading cloud-based contact center solution go from strength to strength in the last few years. Looking ahead, the growth outlook appears highly favorable – the addressable market opportunity for customer engagement is expected to hit c. $21 billion in fiscal 2026 (up from c. $7 billion last year). Key drivers include the accelerated adoption of cloud and next-generation digital solutions, along with self-service customer engagement becoming increasingly mainstream. Despite the post-pandemic acceleration, we remain in the early stages of the CCaaS (“contact center as a service”) adoption curve. And with less than 10% of contact center agents currently using a true cloud solution globally, I see a long runway of growth ahead.

NICE Investor Presentation Slides

A key advantage for NICE in CCaaS is the high barriers to entry – other large tech players such as Zoom (ZM) and Amazon (AMZN) have attempted to enter the CCaaS market themselves, but the level of expertise required to succeed, along with the required level of investment necessary (a minimum of $200-250 million in R&D) have prevented them from properly ramping a competitive CCaaS product. While M&A is another way to potentially enter the market, there are not many scaled assets available for acquisition in the space. As such, I view NICE, one of the top vendors for CCaaS, as the ideal vehicle to gain exposure to CCaaS growth over the medium to longer term.

Plenty of Upside to the Medium-Term Financial Model

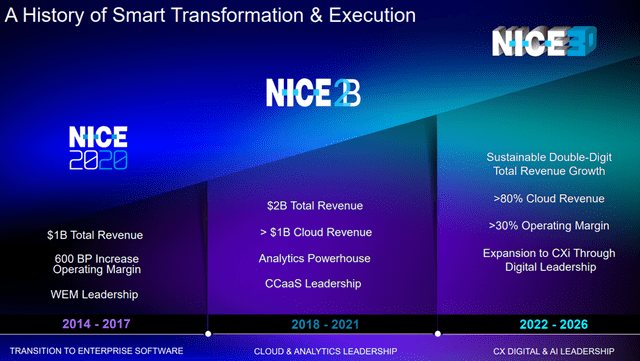

Building on its recent growth milestones (cloud revenue of $1+ billion and total revenue of $2+ billion), NICE reiterated its ambitious medium-term targets with its NICE3D strategic plan. The fiscal 2026 framework shows the company has left its financial targets largely unchanged, reiterating its 70+% gross margin goal and double-digit % top-line growth, driven by an 80+% cloud contribution. Somewhat surprisingly, the 30+% operating margin target (initially introduced in fiscal 2019) was also reiterated despite the sizeable operating leverage opportunity as the cloud business further ramps up. Notably, NICE’s recent quarterly results already showed cloud growth of 29% Y/Y on the back of multiple large deals involving its cloud-native customer experience platform, CXone. And having unlocked almost 900bps over the last three years from momentum in the cloud business, NICE margins are already at c. 28%, highlighting the conservatism embedded in these targets.

NICE Investor Presentation Slides

Looking ahead, a major driver of growth and margins will also be the increasing share of enterprises in the business mix. These customers tend to have higher gross margins than small-medium businesses due to less usage revenue and more high-margin products, including WEM (“Workforce Engagement Management”) and automation. NICE has also been investing in international expansion, a potentially huge growth opportunity considering its limited EMEA and APAC footprint at c. 14% and c. 5% of the top-line, respectively. Scaling the international business could unlock operating leverage on cloud infrastructure and go-to-market investments, offering incremental upside to current medium-term targets. While the outlined growth initiatives are positive, I think it is just as important that NICE follows through with a more balanced approach to growth in these areas (for instance, by ensuring G&A expense control) in light of tighter liquidity conditions.

Strong Financial Position Allows for Opportunistic Capital Deployment

While the recession concerns and rate hikes have led to a sharp de-rating in unprofitable tech stocks YTD, the high-quality nature of NICE’s business stands out. NICE has never had a ‘growth at all costs’ approach, instead opting for a highly disciplined balance between growth and profitability. And as NICE continues to prove out its medium-term strategy, I think investors will give more credit to the attractive financial model. Thus far, NICE has maintained a robust financial position, with c. $1.5 billion of cash (including short-term investments) and free cash flow generation of $450-500 million/year. This puts the company in a great position to capitalize on shareholder-accretive capital allocation opportunities at a time when venture financing is slowing down. Future M&A will likely be focused on Israel, where NICE is seeing many opportunities for interesting small tuck-in acquisitions. Other capital deployment options include a larger share repurchase program – in FQ1 ’22 alone, NICE repurchased c. $64 million of shares (vs. c. $73 million for all of 2021) amid the ongoing market weakness.

Final Take

The emphasis on NICE’s profitability and strong cash flow generation at this year’s investor day event was perhaps unsurprising in light of the broader market trends at play. The 2026 financial targets for double-digit top-line growth and 30+% operating margins were positive, while the strong balance sheet and consistent cash flow generation through the cycles mean NICE is well-positioned to weather any downturns ahead. Longer-term, NICE’s dominant position as the leading player within the attractive CCaaS market also appears intact, supported by its prioritization of digital transformation initiatives and the limited competitor set able to offer similar feature functionalities at scale. NICE shares trade at a c. 17x EV/EBITDA multiple, which I view as justified in light of its durable free cash flow generation and growth opportunities ahead.

Be the first to comment