Urupong/iStock via Getty Images

A Quick Take On Phunware

Phunware (NASDAQ:PHUN) recently reported its Q2 2022 financial results on August 11, 2022, missing expected revenue and EPS estimates.

The company provides a mobile engagement platform that assists companies in maximizing the value of their investments in mobile applications.

PHUN has expanded its focus to include low-margin hardware and highly volatile crypto while operating losses have ballooned.

I’m on Hold for PHUN until we see revenue predictability and a meaningful move toward operating breakeven.

Phunware Overview

Austin, Texas-based Phunware was founded in 2009 to develop an integrated software platform that helps organizations improve their mobile engagement processes and results.

The firm is headed by co-founder, President and CEO, Alan Knitowski, who was previously President for Alternative Investments at Curo Capital, LLC and Managing Director at Trymetris Capital Management, LLC.

The company’s primary offerings include:

-

Data

-

Media Services

-

Blockchain

-

Mobile Engagement

-

Location Based Services

-

Content Management

-

Analytics

-

Audience Monetization

The firm acquires customers via direct sales efforts, through inbound response and through partner referrals.

Phunware’s Market & Competition

According to a 2017 market research report by MarketsandMarkets, the global market for mobile engagement software and services was an estimated $2.3 billion in 2016 and is forecast to reach nearly $39 billion by 2023.

This represents a forecast CAGR of 43.5%, a very high rate of projected growth.

The main drivers for this expected growth are strong demand from consumers in using internet-connected services via their mobile devices and a desire by companies to improve and automate their prospect and customer engagement processes.

Major competitive or other industry participants include:

-

Oracle

-

IBM

-

Urban Airship

-

Salesforce

-

Appboy

-

Adobe Systems

-

Vibes

-

Swrve

-

Localytics

-

Marketo

-

Selligent

-

Tapjoy

Phunware also operates in the gaming PC market, has blockchain rewards-related offerings and holds cryptocurrencies including Bitcoin, Ethereum and DeFi (Decentralized Finance) positions which management reported were valued at around $17 million as of August 11, 2022.

Phunware’s Recent Financial Performance

-

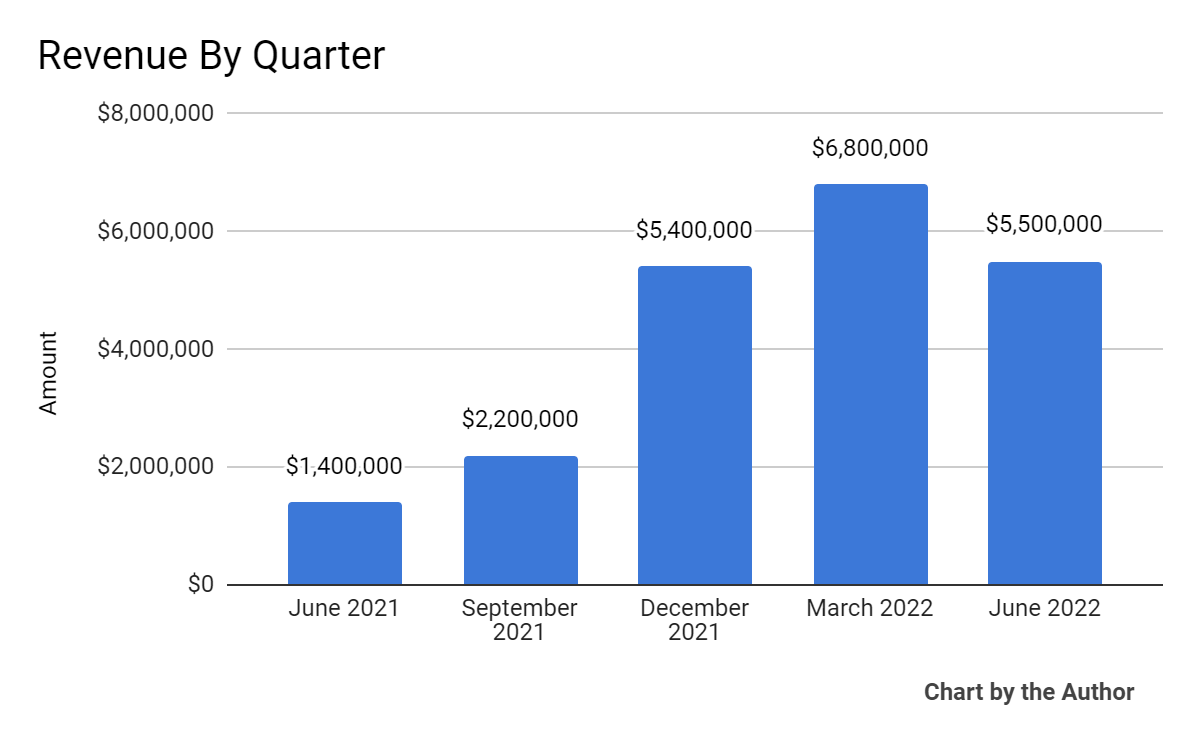

Total revenue by quarter has risen significantly in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

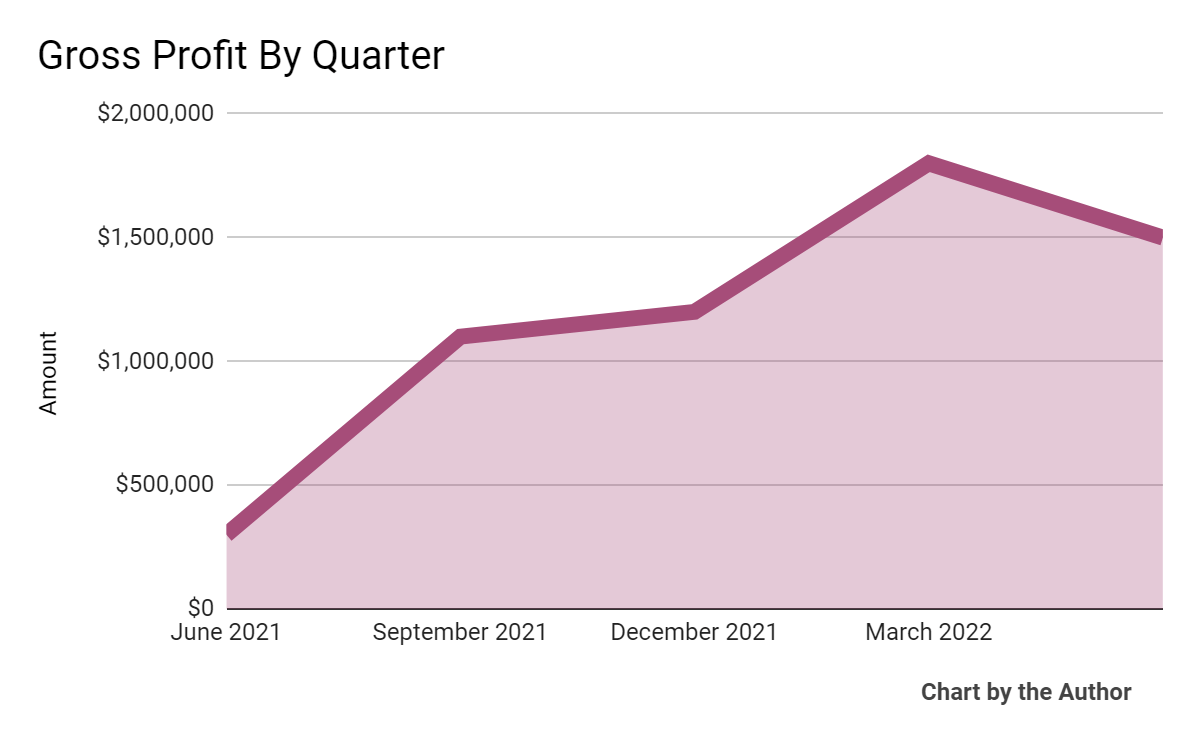

Gross profit by quarter has followed a similar trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

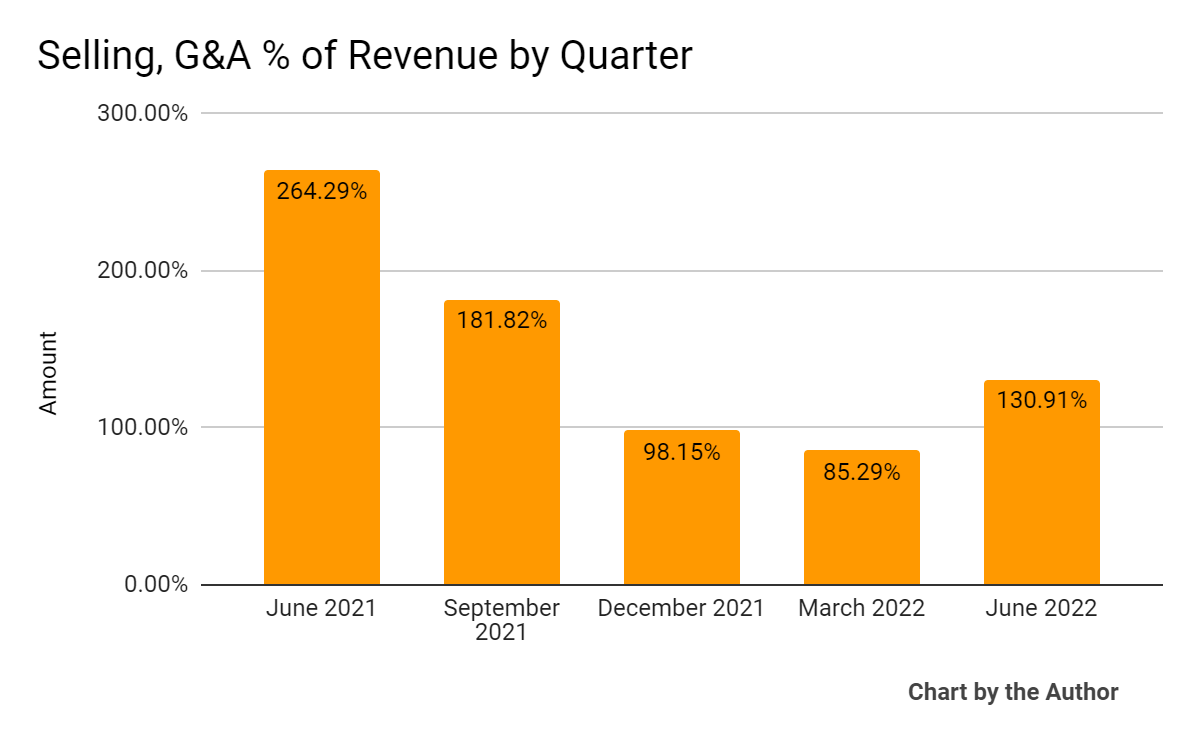

Selling, G&A expenses as a percentage of total revenue by quarter have remained above 100% of revenue in three of the last five quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

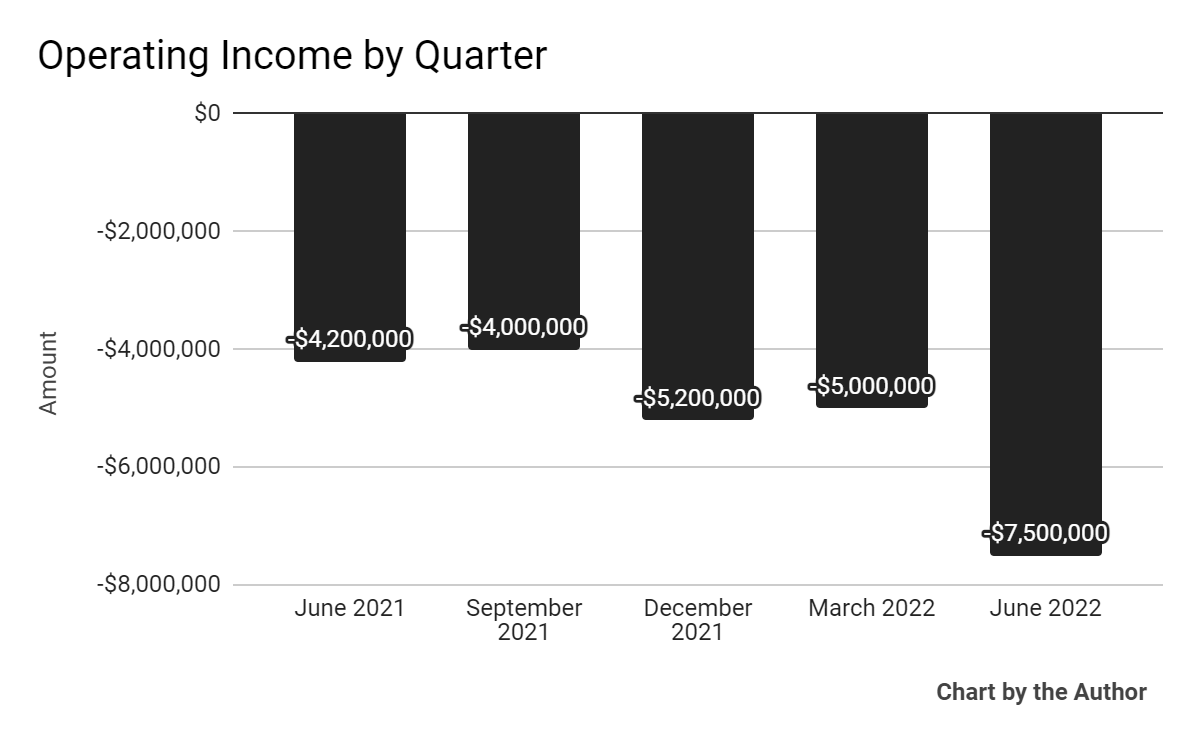

Operating losses by quarter have worsened in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

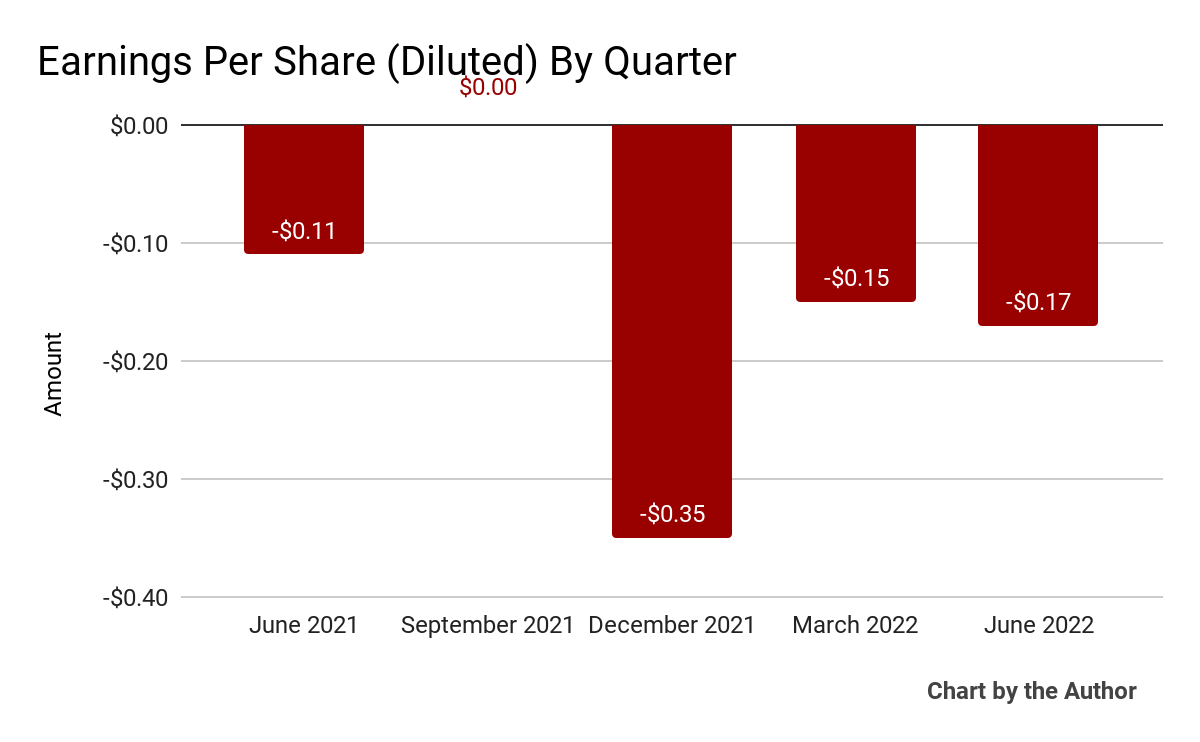

Earnings per share (Diluted) have remained negative in four of the past five quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

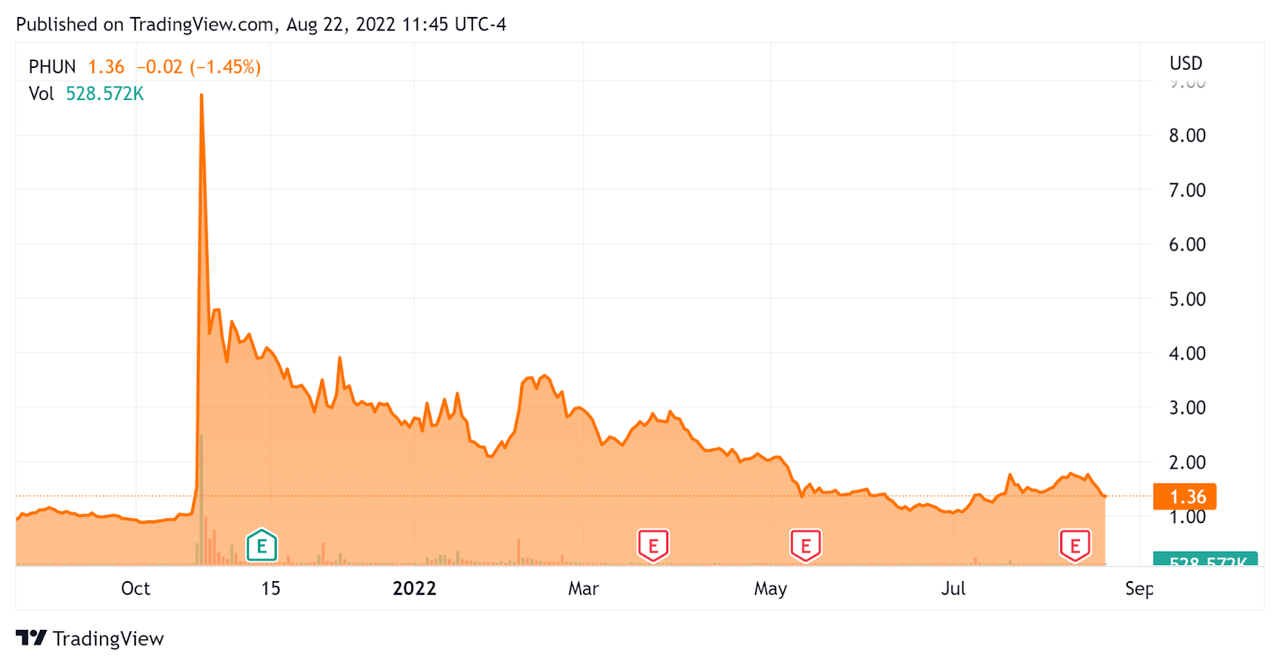

In the past 12 months, PHUN’s stock price has risen 49.5% vs. the U.S. S&P 500 Index’s fall of around 5.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Phunware

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

6.96 |

|

Revenue Growth Rate |

140.9% |

|

GAAP EBITDA % |

-108.5% |

|

Market Capitalization |

$135,770,000 |

|

Enterprise Value |

$137,950,000 |

|

Operating Cash Flow |

-$23,130,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.67 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PHUN’s most recent GAAP Rule of 40 calculation was 32.4% as of Q2 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

140.9% |

|

GAAP EBITDA % |

-108.5% |

|

Total |

32.4% |

(Source – Seeking Alpha)

Commentary On Phunware

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the growth of its Multiscreen-as-a-Service offering and record revenue as a public company.

The firm also continued to invest in scaling its Lyte high performance gaming PC business which it acquired in October 2021 for about $3.32 million, which it paid for with cash and unsecured, non-dilutive debt.

Lyte is essentially a system integrator, and while the acquisition will add inorganic revenue and a new hardware business, the business only produced gross margin of 12%, which is low.

Given the firm’s shift from a low-margin, transaction business to a higher-margin SaaS licensing business, the acquisition of a low-margin gaming hardware segment is perplexing.

As to its financial results, total revenue rose by 282% year-over-year, with hardware revenue from its Lyte segment representing 70% of net revenue.

The company did not disclose its net dollar retention rate, which is an important metric for a SaaS firm.

For the balance sheet, the company ended the quarter with $2.7 million in cash and $2 million in debt while recently increasing its borrowing capacity to $12 million.

The firm also holds various cryptocurrencies, including Bitcoin and Ethereum. This may add volatility to the company’s earnings, especially to the downside, as intangible valuation losses (impairment) must be booked as they occur while gains are not unless the asset is sold.

In fact, the current quarter just saw such an impairment booking of $12.2 million.

Looking ahead, management said it was ‘extremely pleased with our bookings to start Q3 and our pipeline for the second half of the year.’

However, backlog and deferred revenue was $5.2 million at quarter end, a significant reduction from $8.6 million at the end of Q2 2021.

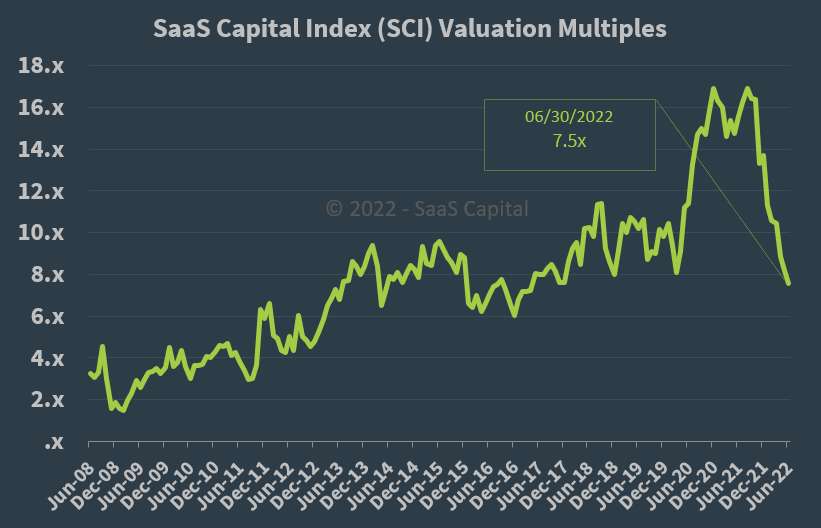

Regarding valuation, the market is valuing PHUN at an EV/Sales multiple of around 7.0x.

The SaaS Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, PHUN is currently valued by the market at a slight discount to the SaaS Capital Index, at least as of June 30, 2022.

However, PHUN is no longer primarily a SaaS company, at least in terms of topline revenue mix, which is now mostly hardware sales.

The major risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

Also, with 70% of its topline revenue coming from sales of discretionary category items of high-performance gaming PCs, the firm is exposed to negative effects from an economic slowdown, which would hit discretionary purchases first.

I would like to see the firm focus on its high margin and predictable core business, which is its SaaS mobile engagement platform offerings, with further emphasis on the industry verticals it sees the most promise in, currently healthcare, hospitality and sports & entertainment.

But, currently, it seems management is broadening the company’s focus, so we’ll just have to wait and see if it can make progress toward operating breakeven and more predictable financial results.

Until I see greater predictability in business growth and reaching operating breakeven, I’m on Hold for PHUN.

Be the first to comment