MonumentalDoom/iStock via Getty Images

Every now and then an investment opportunity will cross your path for which the narrative seems too good to be true. TMC the metals company Inc. (NASDAQ:TMC) leverages the scarcity of metals and proposes to harvest polymetallic nodules from the deep sea to make the energy transition possible.

Extraction of nodules from the seabed is technically viable and TMC partner Allseas Group S.A. will prove this over the coming months, as others did before. This is, however, the first time a system will be tested which has the potential to make commercial extraction feasible.

This potential has been leveraged by TMC to perform another round of fundraising. As the success of TMC hinges on the capabilities of Allseas’ performance, this article presents more information on this company and its dealings.

Brief history of TMC

The Metals Company, formerly known as DeepGreen Metals, was formed in 2011. The goal of the company is to harvest polymetallic nodules from the seabed as these nodules contain battery materials such as nickel, copper and manganese.

Together with strategic investor Maersk (OTCPK:AMKBY, OTCPK:AMKBF), the company undertook several offshore campaigns in the Clarion Clipperton Zone (CCZ) in the Pacific to perform surveys, studies and take samples. A brief overview of the campaigns is given on the website of Maersk Supply Services.

The name change from DeepGreen to TMC the metals company Inc. occurred when the company was taken public in a SPAC deal. Besides the cash this deal generated, more importantly, private offshore contractor Allseas came onboard.

The narrative

TMC the metals company claims the harvesting of polymetallic nodules is necessary to make the transition from a fossil fuel powered society to one powered by renewables possible. This point of view was recently supported by Barrick Gold (GOLD) CEO Mark Bristow:

We just don’t have the copper to support the vision of being a greener planet into the future.

So, TMC is jumping on the ESG bandwagon to create support for their plans of nodule harvesting in the deep sea. The claim is deep sea harvesting will require a fraction of the environmental and social impact when compared to onshore mineral extraction. To sweeten the deal even further, the company claims to develop a near-zero solid waste flow sheet as the nodules contain very low concentrations of hazardous elements. As this implies no tailings are produced, the need for tailing dams is eliminated. Producing metals without the need for tailing dams is already an appealing prospect by itself from a safety and environmental point of view, as investors in Vale (VALE) can tell you.

For investors who are not particularly keen on ESG metrics, the company has another appealing narrative. The U.S. is increasingly dependent on foreign sources for many of the processed versions of the minerals found in nodules. Globally, China controls most of the market for processing and refining for cobalt, lithium, rare earth metals and other critical minerals. As a result, the U.S. government released a fact sheet last February to “Announce Major Investments to Expand Domestic Critical Minerals Supply Chain, Breaking Dependence on China.”

Allseas

Since TMC welcomed Allseas onboard, the development of commercial deep sea nodule collection seems to have entered a new phase. Allseas purchased and converted a former drill ship into a deep sea mining vessel. The company completed initial trials and is currently preparing for a test campaign in the Pacific, where it will test the riser system which will transport the nodules from the seabed to the surface.

Although Allseas is well-known in the offshore industry, many investors will not have heard of this privately owned construction company. The most media coverage was likely generated when senators Cruz and Johnson put the company on formal legal notice to persuade them to cease installation of the notorious NordStream 2 pipeline, a job executed by the world’s largest vessel the Pioneering Spirit, see figure 1.

Figure 1 – Allseas’ Pioneering Spirit crossing under the Bosporus bridge, Turkey (hka.com)

The relevance of this vessel in relation to the endeavors of TMC is twofold. First it is testimony to the technical capabilities of Allseas. Second, it indicates the company cares about prestige. The problem with prestige, however, is that it’s often accompanied by poor economics.

Technology feasible

In the 70’s, multiple companies successfully collected nodules from the deep sea. There are more recent examples, but never before was it attempted to mine nodules at the scale TMC and Allseas now envision. The Pioneering Spirit is testimony to the technological capabilities of Allseas. The vessel boasts multiple feats which are either one-off and/or have never been made before, the point being the company has a highly skilled workforce that’s used to develop new technology.

On top of this, a source familiar with the matter indicated the company has been investigation deep sea mining since 2012. In other words, these operations have been prepared for a decade. In that sense TMC partnered with the right company to ensure technological feasibility.

Bad investment

As early as 1987, Allseas’ CEO Eduard Heerema floated the idea for the concept of the enormous Pioneering Spirit. Some thirty years later, it became reality, no expenses spared. Just the building costs alone are an estimated €3Bn.

The CEO runs a company flush with cash and can afford to think long term as noted in this interview dating from 2012:

Edward Heerema has over the years made clear his disdain for stock market-driven business cultures. (…) We would not have taken such big, bold steps (…) if we had first had to convince a lot of co-investors that it was the right thing to do. They generally think only in the short term and would therefore never have the courage. We can afford to think ahead 10, 15 or 20 years if we want to, and accept that we may well make a loss in the initial years.

Some five years later, however, the CEO admitted the world’s largest vessel was a bad investment, and therein lies a risk. The cautionary notes regarding forward looking statements in TMC’s 10-K filing are worth a read. Simply put, TMC is a very high risk investment and the company makes no secret of this.

TMC CEO Gerrard Barron has now joined forces with a like-minded person with even deeper pockets who is not afraid to incur losses over a longer period, but who also dares to pursue an opportunity for which the economics do not add up and possibly never will. As a result, Allseas purchased and converted a former drill ship into a nodule collection vessel named the Hidden Gem.

The numbers

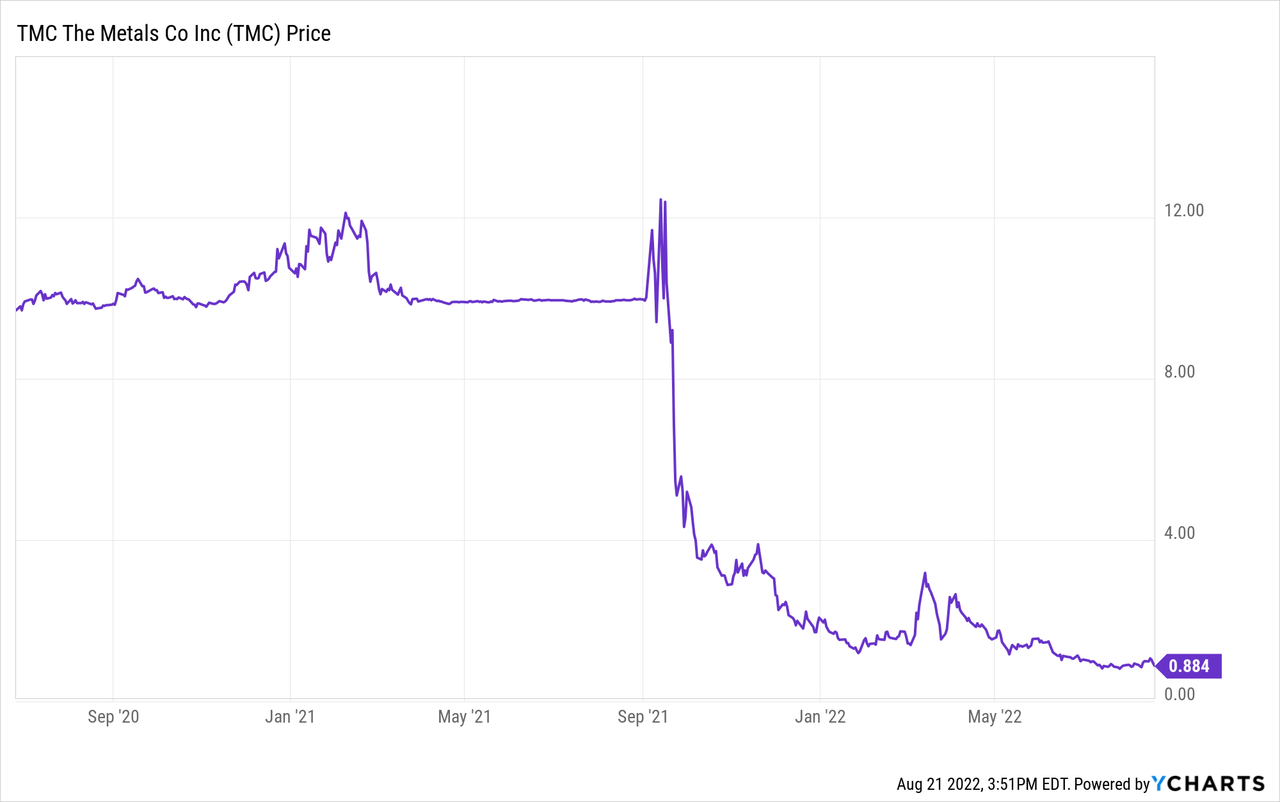

Since the SPAC in September 2021, the performance of TMC has left investors with a headache, see the next figure.

The finances of the TMC are not appealing, although the company has no debt, it has no revenue either. Basically the main asset of the company are exploration licenses and/or commercial rights to three of the 17 designated contract areas in the Clarion Clipperton Zone.

To fund operations the company issues stock for which it needs to issue ever more as the stock price deteriorates. The latest fund raiser was announced on August 15th as the company issued 38 million shares to raise US$ 30 million. After 22Q1 the company already had 226 million shares outstanding (205 million after 21Q4) to which another 38 million are now added. Bottom line, stock based compensation and share issuance is diluting the holdings of investors at an alarming rate.

Now, for a start up these numbers may not be so bad, but with the era of easy money rapidly ending, investors may prefer safer options.

GSR

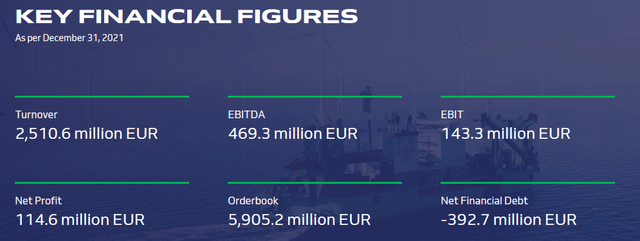

DEME is an offshore contractor renowned in the offshore wind and dredging business. On the 30th of June 2022 the stock became listed on the Euronext Brussels. A summary of the 2021 key figures is given in figure 3.

Figure 3 – DEME key financial figures 2021 (www.deme-group.com/)

Clearly DEME is a company with a healthy turnover and profit margin. Moreover, the company has a 145-year long history in dredging. For this reason the company has a subsidiary, GSR, which focuses on deep sea mining.

GSR last year successfully executed a test campaign to collect nodules in the Belgian and German contract areas of the CCZ. In addition, the company was granted a mineral exploration license for the Cook Islands Exclusive Economic Zone.

Prior to the test campaign, GSR shared the outlook of its operations in a presentation given in January 2021. Not surprisingly, the company plans to use a vessel which looks suspiciously similar to the Hidden Gem, the vessel Allseas has procured and modified for this purpose.

Another appealing feat is the fact GSR has contracted Umicore (OTCPK:UMICF, OTCPK:UMICY) to process the collected minerals. Umicore is an experienced and well known global materials technology and recycling group, see here.

The similarities between TMC and GSR are striking, but the risk profiles are completely different.

Risks

The technological feasibility is not one of my concerns given the capabilities of Allseas and the test campaigns performed by other companies. The financial viability poses a bigger question mark but the test campaign will provide essential information on the energy required to harvest the nodules, meaning the company can substantiate the business case further. Assuming the finances are adding up as well, there remains what is likely the biggest issue.

Mining operations can only start after the International Seabed Authority (ISA) grants approval for the commercial harvesting of nodules. This decision is subject to massive opposition from environmentalist and some governments calling for a moratorium on deep sea mining. This has prompted some commercial parties such as BMW (OTCPK:BMWYY, OTCPK:BAMXF) and Samsung (OTCPK:SSNLF, OTCPK:SSNNF) to support this moratorium.

The current state of affairs is that the ISA is still working on the regulations for mining in the CCZ. However, if the regulations are not adopted by the 9th of July 2023, ISA has to provisionally approve work plans for the commercial exploitation of polymetallic nodules. For this reason, TMC raised more funds this month to remain in business past this deadline.

Conclusion

TMC the metals company presents an alluring narrative for polymetallic nodule harvesting. As a result, offshore contractor Allseas invested in a large-scale harvesting vessel to test the commercial feasibility.

Technical feasibility of nodule harvesting at large water depths is increasingly likely but the financial viability still needs to be proven. The biggest risk however is if environmental concerns can be addressed before a license will be granted by the International Seabed Authority, a requirement to start commercial mining operations.

Subjected to the same risks is GSR, a mining subsidiary from the DEME group. Stocks of DEME however present a low risk opportunity for investors to benefit from the potential of deep sea mining. In the event deep sea mining will not be allowed or feasible, TMC will most likely go bankrupt whereas DEME will continue business as usual. Depending on one’s appetite for risk it’s suggested to avoid TMC and consider DEME instead.

Be the first to comment