jetcityimage/iStock Editorial via Getty Images

The food industry is changing as input prices rise, and many people look toward healthier options. These trends have threatened food giants such as Kraft Heinz (NASDAQ:KHC), which faces increasing costs and strains across its global supply chain network. Kraft Heinz has seen sales per share decline for years following its merger deal with 3G capital. 3G recently reduced its position in the company and has a new CEO without direct affiliation with the firm. To many investors, this change is a sign that the company is turning a corner that will bring it back toward growth.

While the change is undoubtedly positive, it may be too little too late as Kraft has fallen behind in shifting toward products consumers desire. Even more, Kraft’s industrial business model faces immense exposure to rising costs. The company has been paying a higher dividend than its earnings for some time and, with costs likely still rising, may need to reduce its dividend in the foreseeable future. I believe this situation makes KHC a poor investment opportunity with a higher downside risk than upside potential.

Can Kraft Heinz Keep Up With Inflation?

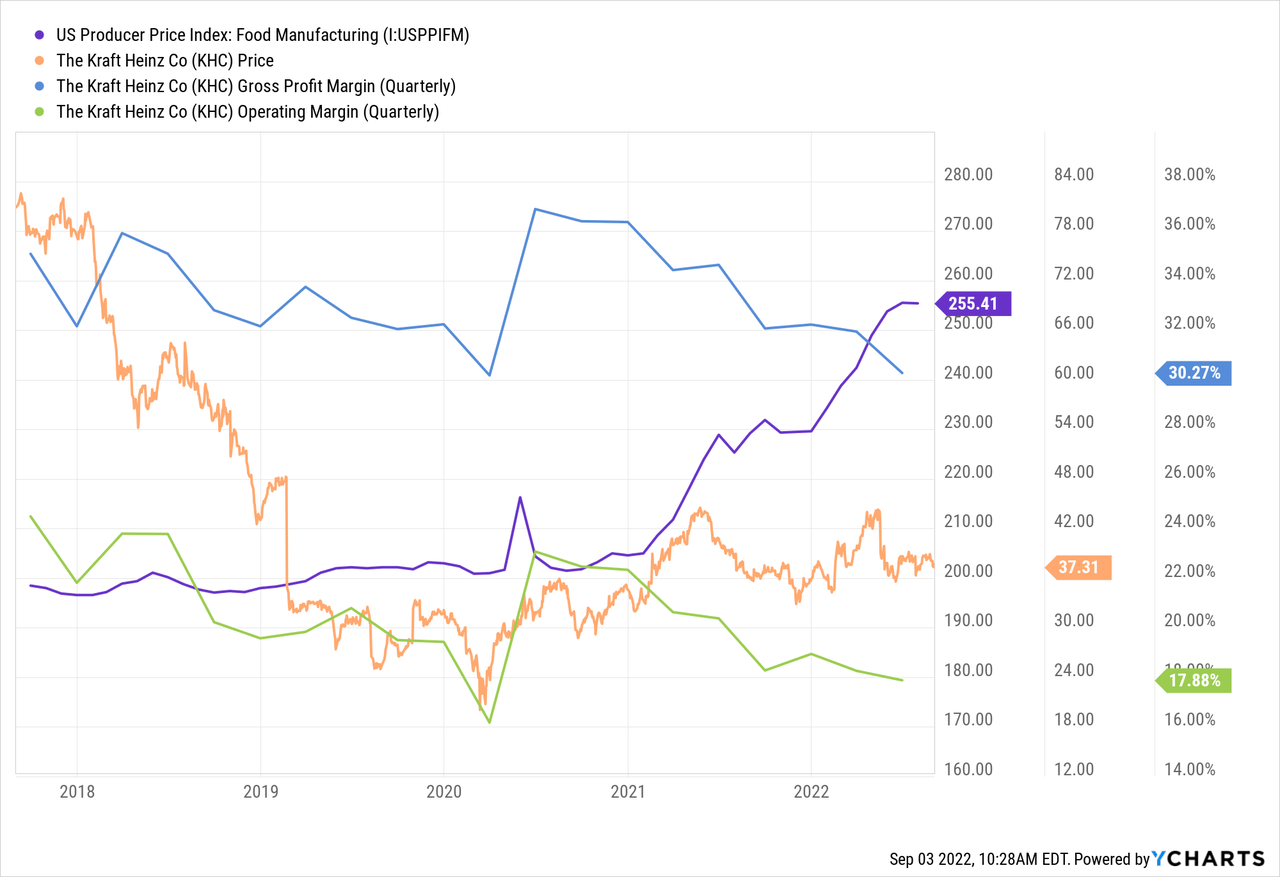

In general, manufacturing businesses benefit from economies of scale. However, the opposite may be true for certain firms with complex global supply chains. With around 60% of the ketchup market share, Kraft is one of the largest buyers of tomatoes and other agricultural items. It is not best to be the primary global purchaser during a period when many goods are in shortage. Kraft has had to rapidly switch supply sources for many items to maintain production levels. The company is also shipping its goods worldwide, increasing its exposure to fuel prices. Kraft has raised prices materially to keep up with rising costs but is still seeing its gross margins and operating margins decline as the PPI rises. See below:

I believe Kraft may be disadvantaged compared to smaller localized competitors in this current dynamic. In general, smaller food producers are likely to have more direct supply chains between farms to buyers, lowering their cost exposure to transportation. Additionally, Kraft cannot as easily develop relationships with local farms and may struggle to keep up with the growing demand for organically sourced foods.

While there has been a slight decline in the producer price index’s growth rate, I do not expect it to continue to trend lower. Agricultural prices have declined slightly over the past two months, with many fertilizers becoming cheaper. These trends may slightly reduce pricing pressure on Kraft during Q3. However, food prices today do not necessarily reflect the impact of the coming fall crop. California’s tomato crop is expected to be abysmal as it faces its worst drought in 1,200 years. Europe is also facing the worst drought in 500 years, indicating double-digit declines in harvests for many essential items. Ukraine, a key producer of numerous food items, has seen food exports decline by almost half this year.

High natural gas prices in the U.S and Europe (in particular) will likely raise Kraft’s manufacturing costs. Transportation prices have slipped slightly with gasoline, but evidence suggests it may become much more expensive by winter. Thus far, Kraft has generally managed to maintain sales while raising prices. However, if Kraft’s input costs continue to rise, I believe we will see more demand destruction and potential switching toward more competitive brands.

Kraft Lagging Consumer Preferences

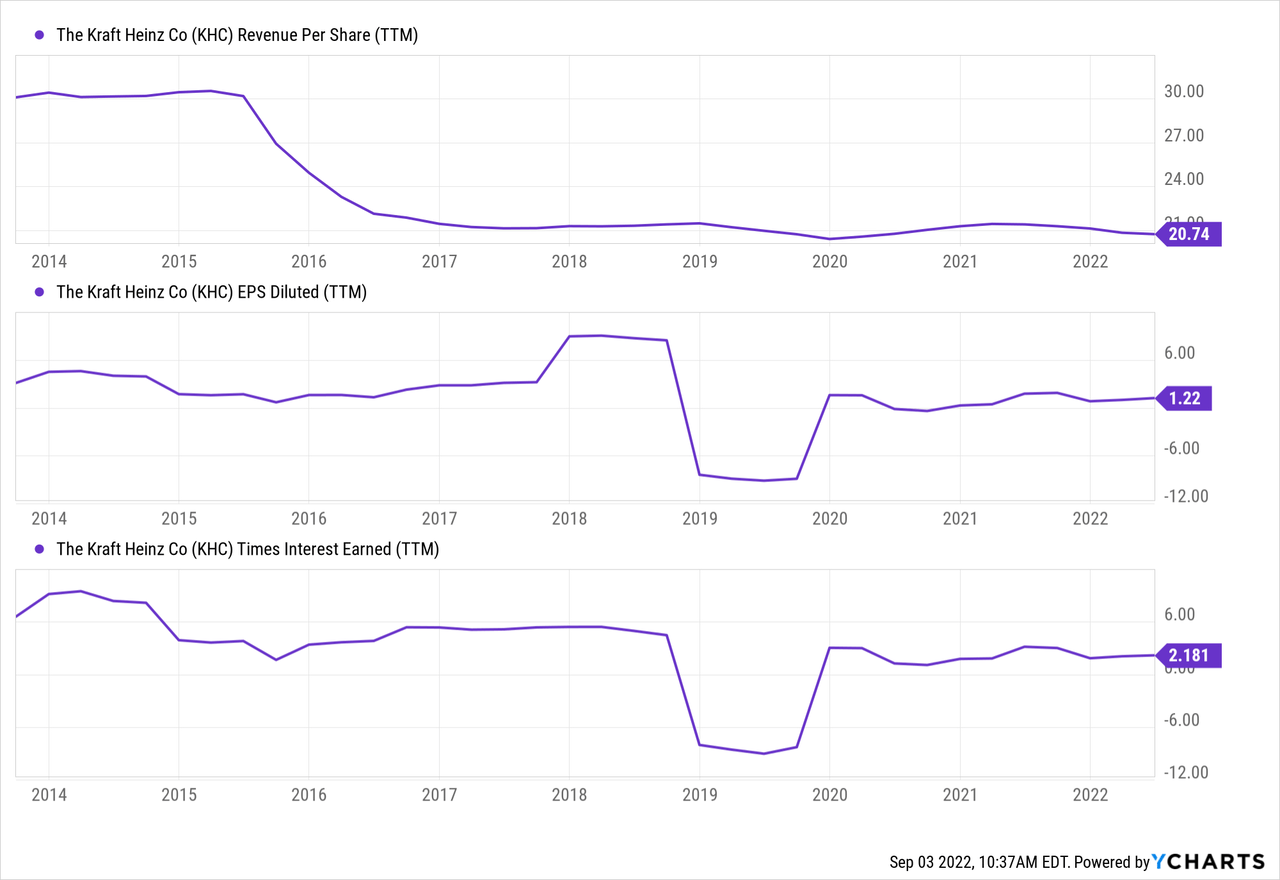

While 3G more directly controlled Kraft, the company focused primarily on cost-cutting and not keeping up with changing consumer preferences, in my opinion. Unsurprisingly, this led Kraft to lose some market share and caused its revenue per share and earnings per share to decline materially. The associated growth in leverage has also created some solvency risks for the firm as its “EBIT-to-interest expensive” ratio (or Times Interest Earned) has declined to “high risk” levels. See below:

Kraft has stagnated after suffering declines, as seen in its revenue and EPS. The company has not seen its earnings return to pre-COVID levels and may see its EPS decline over the coming quarters as its struggles to keep up with costs pressures. Its relatively low times interest earned ratio and negative (and down trending) working capital also signify growing cash flow and financial risks, particularly as borrowing interest rates rise dramatically.

Most importantly, Kraft has failed to keep up with changing consumer demand. As mentioned in its last investor presentation, the company has made a small effort to make its products healthier, such as reducing sugar content in Capri Sun and growing its “Primal Kitchen” brand. Of course, Kraft’s effort to slow falling demand for its Capri Sun brand may be upset in Q3 following its recent cleaning solution contamination event.

Additionally, Kraft’s most significant brand is Heinz Ketchup, among the few that still use high fructose corn syrup, giving it a greater competition with the growing number of much healthier brands. In my opinion, Kraft’s management is not in touch with shifting consumer preferences toward more nutritious options. This issue has gone as far as creating advertisements that disparage health foods despite recently being sued for high levels of toxins (phthalates) in some of its products. While Kraft’s specific allowance of these toxins may technically be legal, growing consumer preferences for clean food certainly put Kraft in a poor competitive position as the number of healthier alternatives rise.

The Bottom Line

Overall, Kraft is in a difficult position as it faces risks in both demand for its products and the cost of producing its goods. Rising inflationary pressures, and the potentially significant decline in fall crops, are the most direct threat to Kraft and, I believe, will cause the firm’s EPS to decline over the coming year. In the long run, Kraft will likely need to dramatically shift and rebrand many of its products to keep up with the growing demand for healthier foods. Of course, an effort to rebrand and clean its manufacturing to avoid food toxins may increase production costs, but I doubt Kraft’s products will stay in a dominant position if these changes are not made.

Additionally, Kraft has relatively high debt and low working capital, meaning it may need to actively raise cash balances, particularly if its EPS declines and borrowing costs rise simultaneously. Since mid-2020, Kraft has been paying a dividend generally slightly above its EPS. In my view, Kraft will likely need to reduce its dividend to shore up cash, particularly considering much more money may be required to stop its stagnancy.

I believe KHC’s “P/E” of 14X is too high considering its high potential for significant EPS declines. Indeed, KHC may be a potential short opportunity since the stock has been in a trading range since 2019 and, in my view, is showing no signs of achieving renewed growth, giving it a lower upside risk to sellers. Indeed, the most significant risk for sellers may be if KHC looks to divest its many brands. The company recently sold its B2B powdered cheese businesses and may accelerate portfolio optimization. Hypothetically, this effort may restore KHC’s balance sheet, allow it to focus more capital on growth businesses, and mitigate some supply chain complexity. Even then, I believe KHC is likelier to break below its support level by year-end as its EPS outlook declines.

Be the first to comment