Lemon_tm

The market is volatile right now and it is causing a lot of investors to panic.

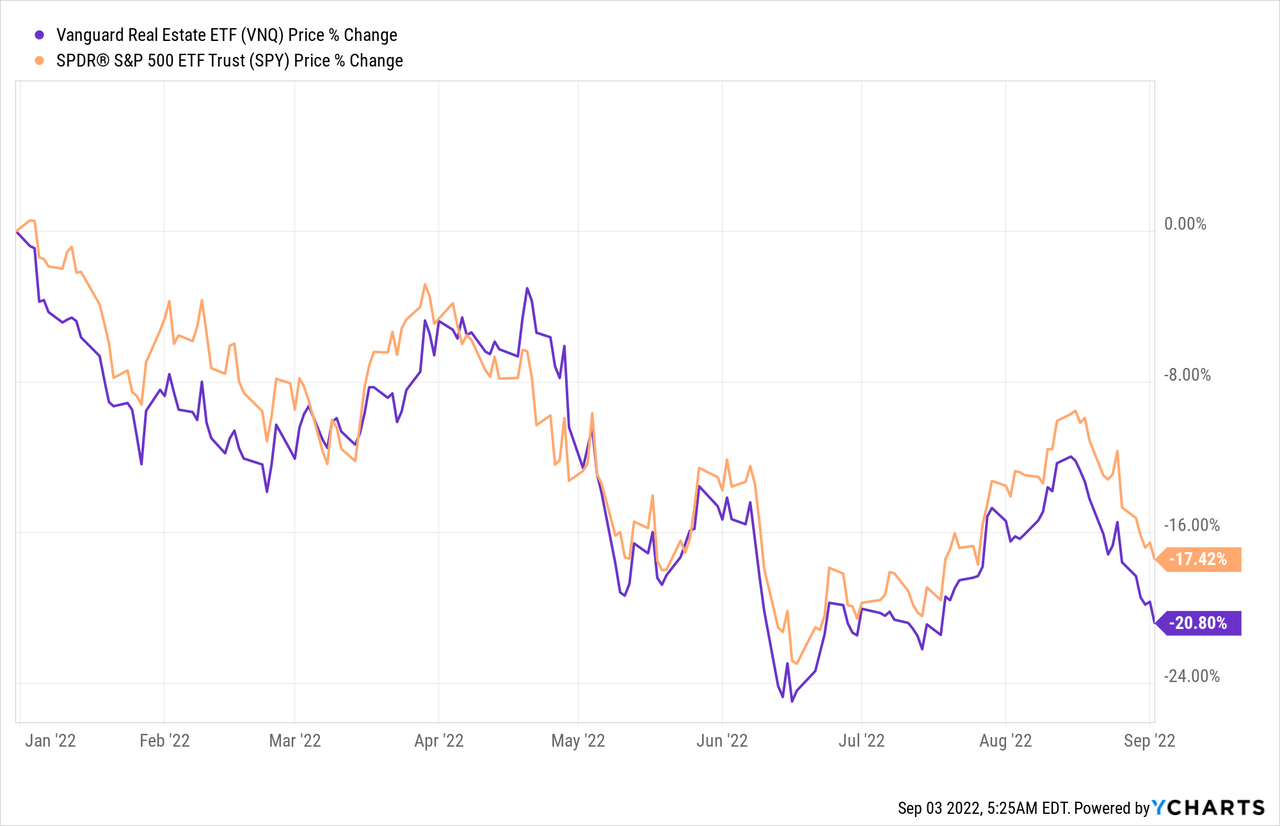

REITs (VNQ), in particular, have performed poorly this year, down even more than the rest of the market:

This is of course the result of rising interest rates, which are scaring investors away from the REIT sector.

The common narrative is that REITs should do poorly in such an environment because they are heavily leveraged. Higher interest rates should directly impact their profits and permanently reduce their fair value.

That’s at least what I read in the comment sections of our REIT-related articles. Some go as far as to claim that REITs will vanish as interest rates keep on rising and make their businesses unprofitable.

But how much truth is there really in this?

Will your REIT really vanish as interest rates keep on rising?

These questions are actually quite simple to answer if you take the time to study how much debt REITs are really using and how their maturities are structured. Bears are quick to claim that “REITs are highly leveraged”, but it seems that they haven’t actually checked how much debt REITs are using.

NAREIT posts every quarter a report that lists quarterly performance measures of the REIT sector, monitoring their growth rates and also the strength of their balance sheets.

The last one was recently released and you can find it by clicking here.

In short, the main takeaway is that: no, your REITs won’t vanish.

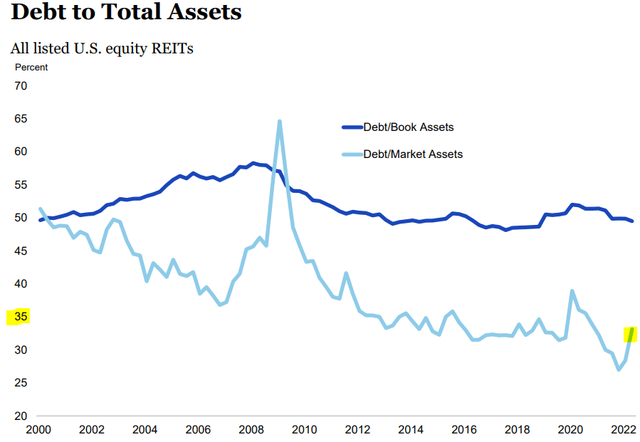

REITs learned their lesson from the 2008-2009 financial crisis and have ever since then been focused on strengthening their balance sheets.

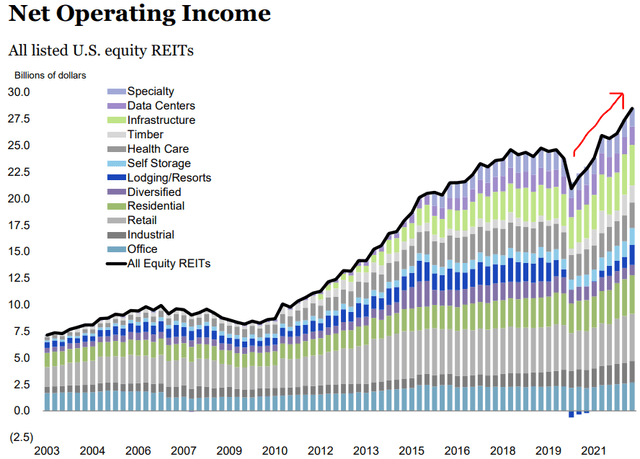

As a result, REIT balance sheets are today the strongest in their history with low levels of debt, high interest rate coverage, and long, well-laddered maturities.

LTVs are right around 35%, which is historically low, and very conservative when compared to what private investors are commonly using. It is not uncommon for people to buy rental properties with 80%+ LTVs and they feel safe about it. REITs are only taking 35% of the purchase price in debt and have financed the rest with equity:

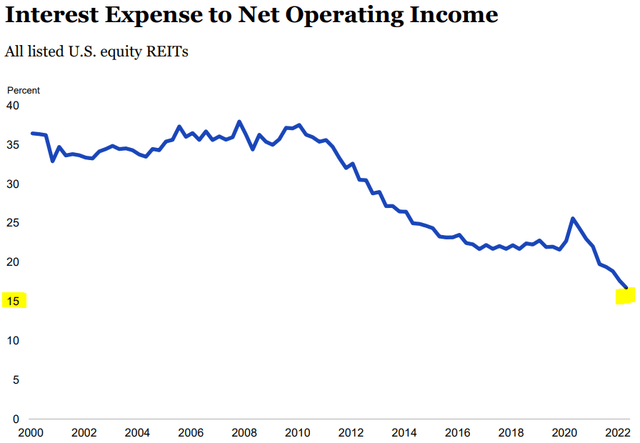

Since leverage is so low, the interest expense as a percentage of net operating income is also very low at just around 15%:

So it is only this 15% that’s impacted by rising interest rates.

Meanwhile the entire 100% of the net operating income is rising with inflation.

So it is easy to understand why the cash flow of REITs has kept on rising. The positive impact of inflation on rents is simply far superior than the negative impact of rate hikes on interest expense.

And it gets even better.

Because REITs are managed by smart people, they took advantage of the low interest rates of the past years to lengthen their debt maturities. To give you an example: National Retail Properties (NNN) secured some debt that matures in 2050. Simon Property Group (SPG) did it as well.

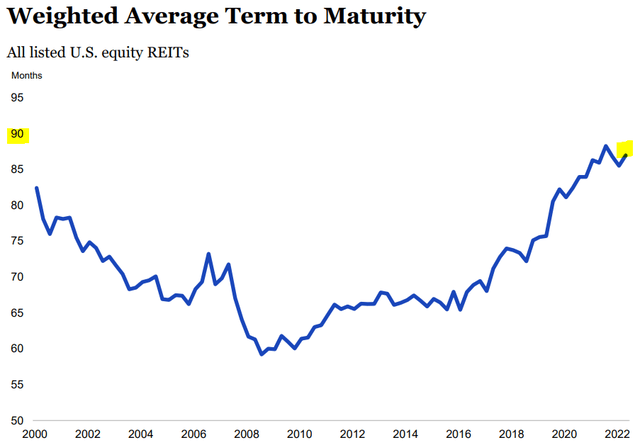

As a result, debt maturities are now the longest in history at ~8 years:

This means that the average REIT will have only ~10% of its debt maturing each year. And since their LTVs are 35% on average, it represents just 3-4% of their total asset value.

A lot of REITs have enough cash and retain enough cash flow (after dividend payments) to repay their annual debt maturities if they don’t want to refinance it at higher rates.

Alternatively, a lot of REITs, including STORE Capital (STOR) and STAG Industrial (STAG), are constantly also selling properties at a gain to generate liquidity and redeploy the proceeds opportunistically. This increases their resilience even further since they can also use this cash to pay off debt maturities if desired.

Finally, since rents are also rising, the net impact of rising interest rates really shouldn’t be material.

Going back to STORE Capital: it has 15+ year-long leases with automatic annual 2% rent escalations. Moreover, it retains a lot of cash flow, which allows it to keep buying more properties. All in all, it can grow organically its FFO per share at 5% per year, and then you can add another 2-3% of external growth to that.

So with stable interest rates, its growth rate might be 7-8% in a typical year. (Quick side note: this year, its growth will be closer to 10%). This means that even if it is forced to refinance its debt maturities at materially higher rates, it will still generate solid growth in any given year. It surely won’t become unprofitable or suffer severe negative growth in cash flow as many of the bears may seem to believe.

The reality is that debt is not such a big deal for REITs since they don’t use it heavily, have long maturities, and rising rates are typically the result of inflation and/or economic growth, which also leads to rising rents.

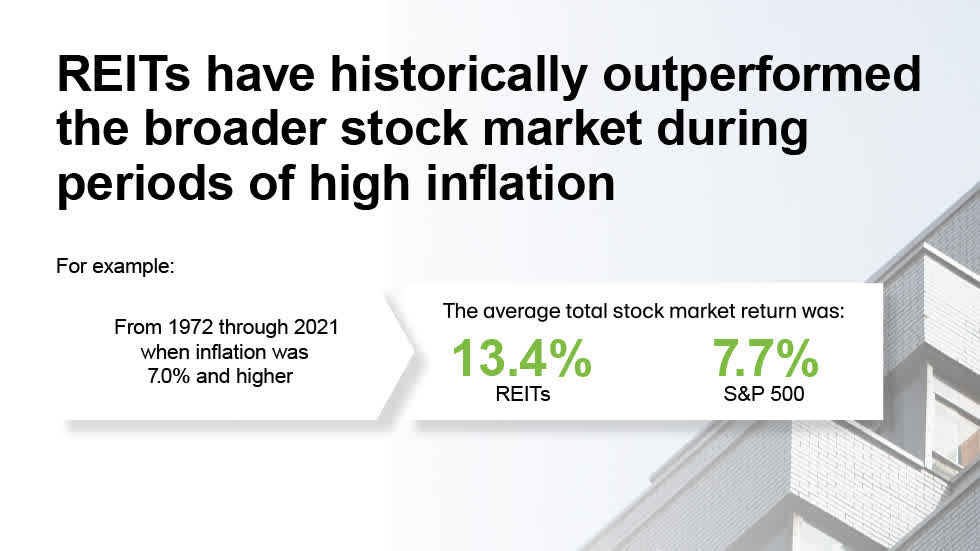

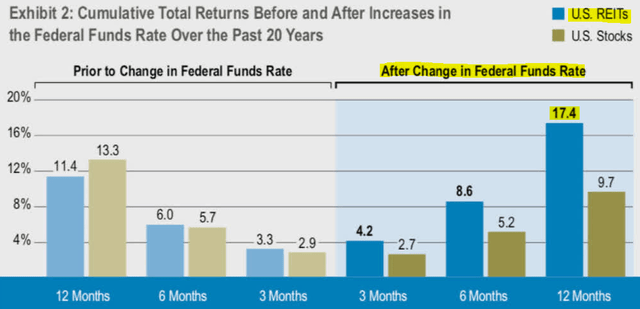

This explains why REITs have historically generated high total returns during times of rising interest rates and high inflation:

So again, no, your REITs won’t vanish.

On the contrary, REITs are growing nicely even in today’s environment and this is also well reflected in recent dividend announcements.

From the top of my head: EastGroup Properties (EGP) just hiked its dividend by 13.6%. NewLake Capital Partners (OTCQX:NLCP) hiked its dividend by 6%. Simon Property (SPG) hiked it by 6%… and there are many other examples.

Does it still seem to you that your REITs will vanish?

They survived the pandemic, which was the worst possible crisis for them, as people were literally locked inside and tenants couldn’t operate their businesses or go to work.

They also survived the worst possible financial crisis in 2008-2009 when they were far more heavily leveraged and banks suddenly stopped working.

In both instances, REITs not only survived but also bounced back very quickly.

Will this time be different?

I highly doubt it. Yes, rates are rising, but as we demonstrated in this article, it actually isn’t a big problem for most REITs. Besides, REITs also benefit from inflation and its positive impact is greater than the negative impact of rising interest rates.

So the bottom line is this: REITs have sold off due to irrational fears and are now historically cheap and opportunistic for long-term-oriented investors.

Blackstone (BX), the biggest private equity investment firm in the world, has bought $30 billion worth of REITs in 2022 and noted on their most recent conference call that they are spending a lot of time looking at REITs following their recent drop:

The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.

But what do they know? They only have nearly $1 trillion worth of assets and a fantastic track record across different asset classes…

Bottom Line

The best time to invest is when people are running away.

That’s the case of REITs today.

Investors have sold REITs due to fears of interest rate hikes, not understanding their balance sheet strength, and underestimating the positive impact of inflation on their cash flow.

Valuations are now at a multi-year low and we are accumulating REITs at prices that we haven’t seen since the beginning of the pandemic. While we wait for the recovery, we earn generous dividend income.

Be the first to comment