Thinglass

Free lunches are rare in the market and most of the time there is a risk-return reward trade off. Take for example mortgage REITs. Investors tend to chase their high yields little realizing that they remain money depleting pits that offer capital depreciation about as much as they yield annually. But one thing investors can do to improve their return profile is to stock with the best and in the mortgage REIT space that would be Dynex Capital (NYSE:DX) and PennyMac Mortgage Investment Trust (NYSE:PMT). While we have traded the common equities of both before, we are going to focus this discussion on the fixed to floating rate preferred shares from both organizations.

Why These Two?

We view mortgage REITs as exceptionally poor businesses and, in general, the preferred shares, even though higher up the chain, have not paid us enough to be involved. The recent blowout in yields have warmed us up to the point we can consider this equity class from these two. In other words, we are getting paid today to take these up and we are only getting paid enough in relation to risk, from only these two mortgage REITs.

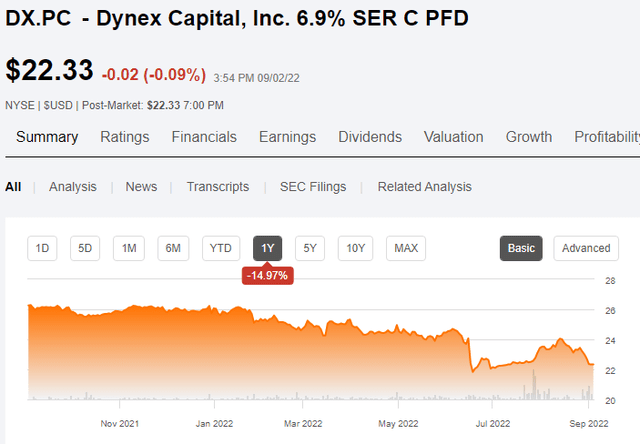

Dynex Capital, Inc. 6.9% SER C PFD (NYSE:DX.PC) is the first of our contenders and the only preferred share offering currently on the roster of Dynex. DX.PC offers a fixed 6.9% yield on par currently and that works to a stripped yield of 7.86%. The stock has been on a downtrend and is close to 52-week lows.

It floats on April 15, 2025 (unless called) at a LIBOR plus 5.461%. With the 3-month LIBOR at 3.08%, we are looking at a floating yield of 9.8%!

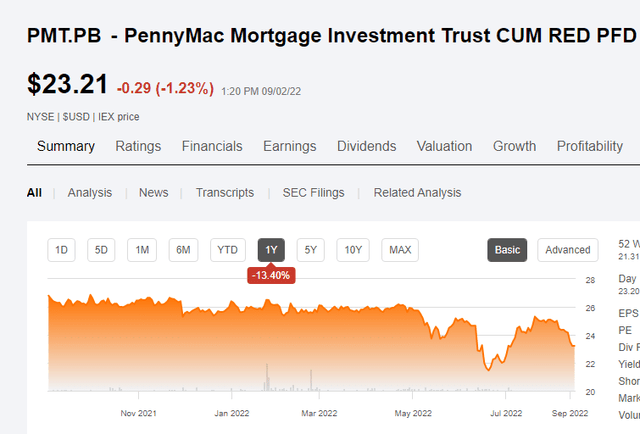

PennyMac Mortgage Investment Trust CUM RED PFD B (NYSE:PMT.PB) is our comparative from PennyMac, although PennyMac Mortgage Investment Trust PFD SER A (NYSE:PMT.PA) is very similar in nature. We chose PMT.PB as it was more attractively priced out of the two when we wrote this. PMT.PB offers a fixed 8.0% yield on par currently and that works to a stripped yield of 8.65%.

It floats on June 15, 2024 (unless called) at a LIBOR plus 5.99%. With the 3-month LIBOR at 3.08%, we are looking at a stripped floating yield of 9.85%!

Key differences here are that PMT.PB provides a floating rate sooner and also offers 0.8% more today. PMT.PB has a higher LIBOR spread, but that is made up for in the fact that it is more expensive than DX.PC today on pure price.

The Relative Value

While the shares give PMT.PB an edge for better immediate income, what about the quality of equity backing these preferred shares? We assess that by four metrics.

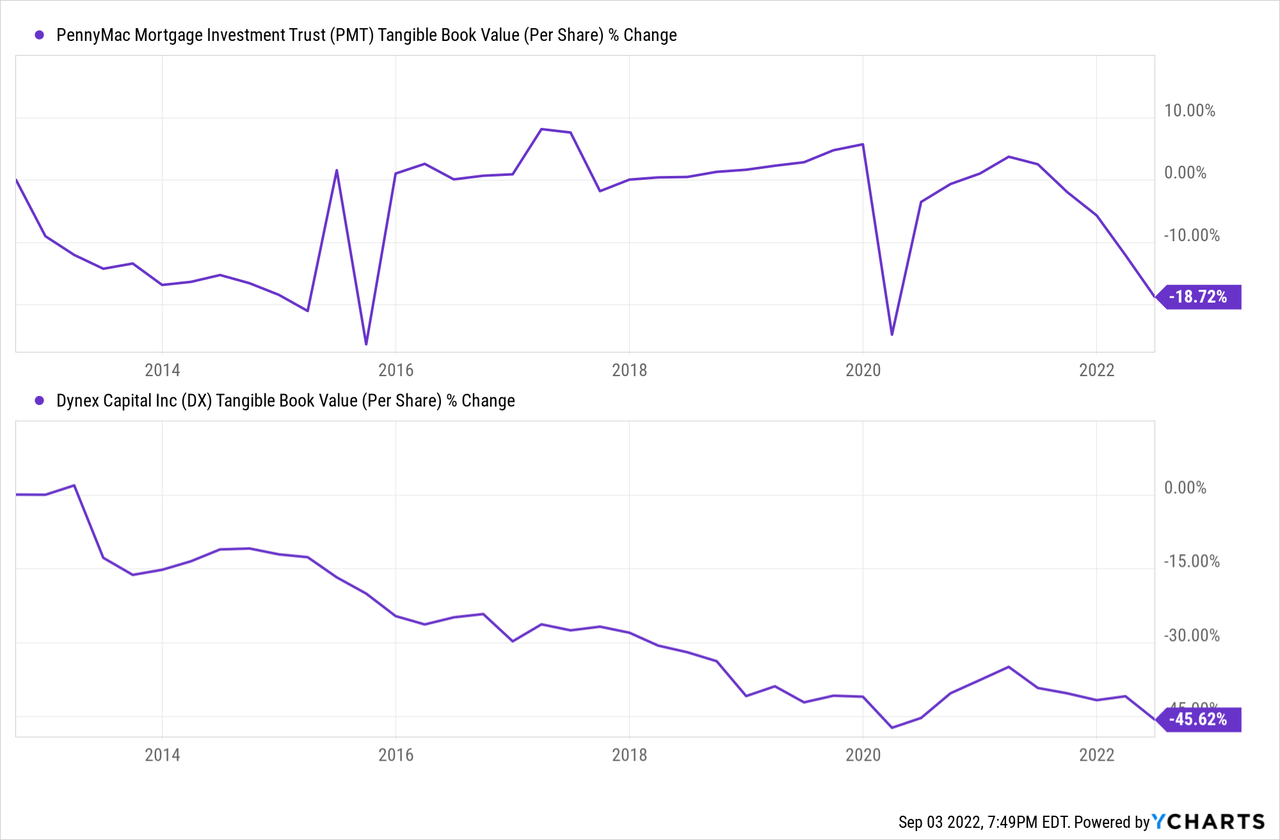

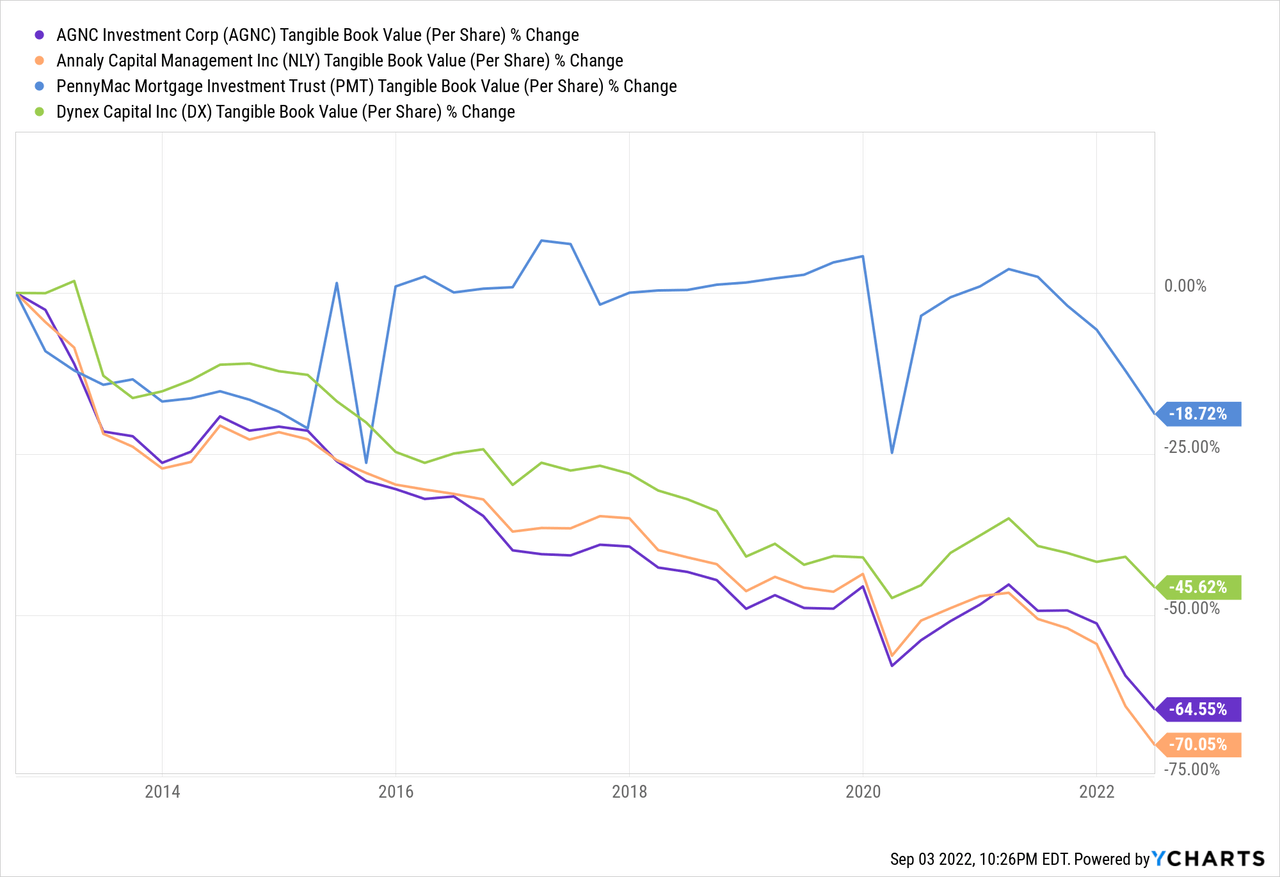

Our primary assessment for mortgage REITs comes from the ability to preserve tangible book value over long periods. While both have lost tangible book value over the last decade, PMT clearly shines in this area.

One point we will note that while those two don’t look impressive, they are better than the alternatives like AGNC Investment Corp. (AGNC) and Annaly Capital Management Inc. (NLY).

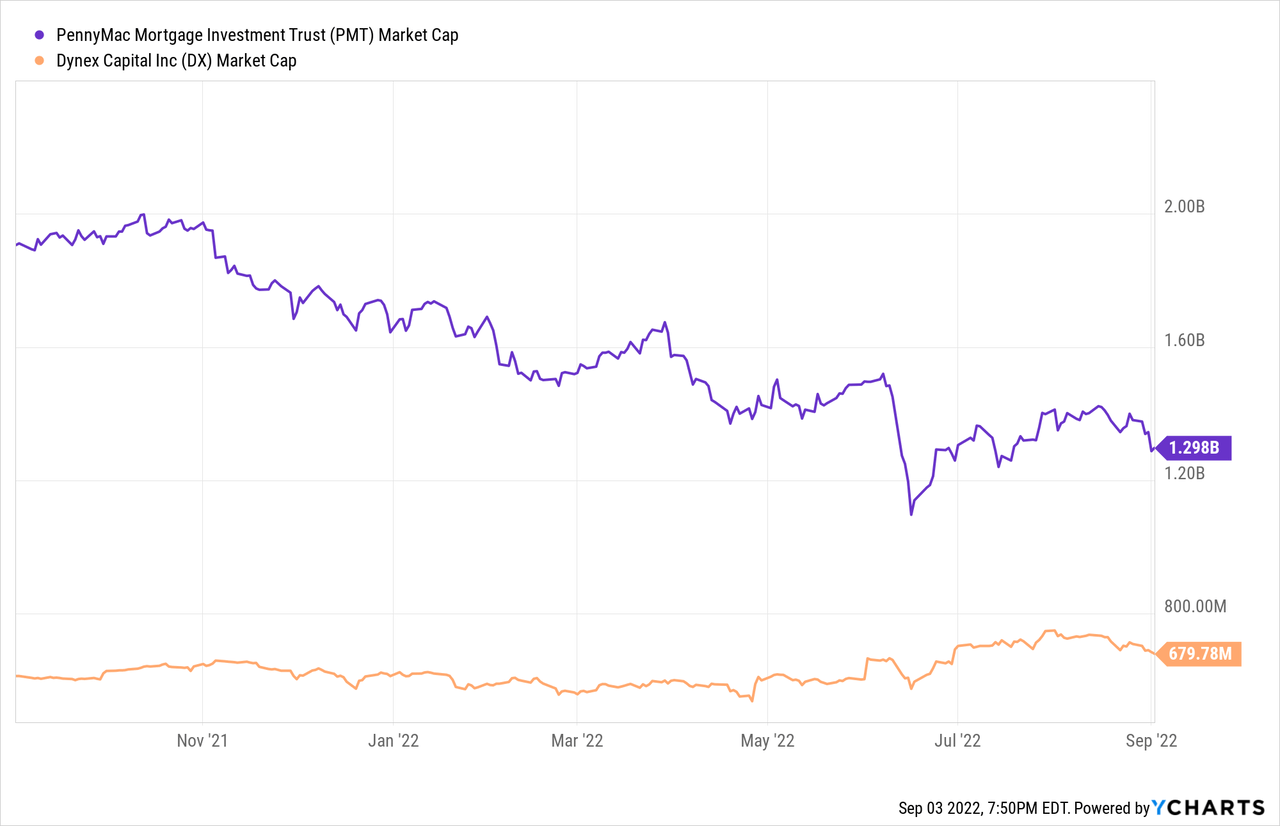

The second criteria here is market capitalization. Simply, larger firms have an advantage during turbulence (and we expect plenty). PennyMac wins here again.

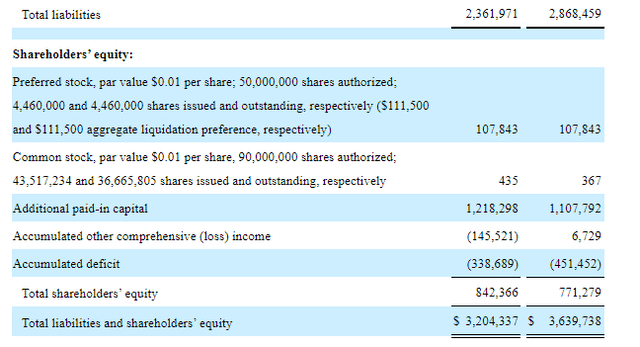

The next thing to look at is the relative levels of leverage. Dynex’s total liabilities (10-Q) are running at about 3X total equity.

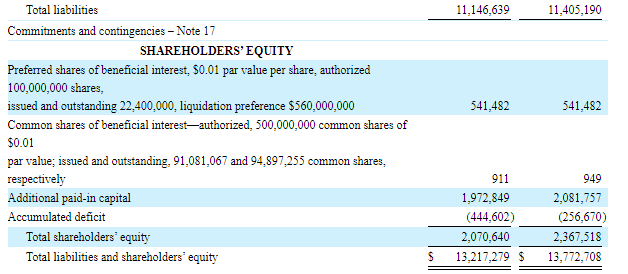

PennyMac (10-Q) is more riskier by this measure and runs total liabilities at 5.5X total equity.

PMT 10-Q

The final measure here is to break down the relative distribution of preferred and common equity. A safer option is when preferred equity forms a smaller part of the total. Such a structure is also less vulnerable to even a temporary dividend cut during exceptionally stressful events. With the same pictures above, we can see that Dynex preferred equity is a far smaller portion of the pie than PennyMac’s.

Verdict

The results lead to a tie with PennyMac winning the first two rounds and Dynex punching above its weight class in rounds three and four. Of course the tie here suggests that we weigh all 4 equally and that is not true. As fans of lower leverage, we have to give the overall win here to DX.PC. But here is the thing, PMT.PB’s slightly higher current yield compensates for this! So while DX.PC is better, PMT.PB pays just enough extra for this. In other words, we are actually seeing market efficiency! We like both securities for income and think investors should stick to the best in the mortgage REIT space for returns.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment