Leon Neal

Published on the Value Lab 31/8/22.

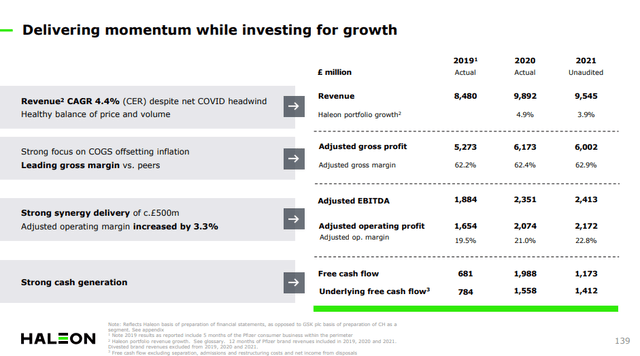

Haleon plc (NYSE:HLN) has a range of brands that command serious share in their consumer healthcare markets, with special positioning in some of the higher growth categories. The company guides towards 4-6% revenue growth in the medium-term. We think this is entirely achievable thanks to resilience in its product classes to headwinds and large TAMs in their business lines. The Rx-to-OTC switch execution is also a nice lever to make total addressable markets (“TAMs”) large for their products. We think they will demonstrate their qualities in the upcoming earnings in September and continue to maintain disciplined, profitable growth thanks to their pricing levers.

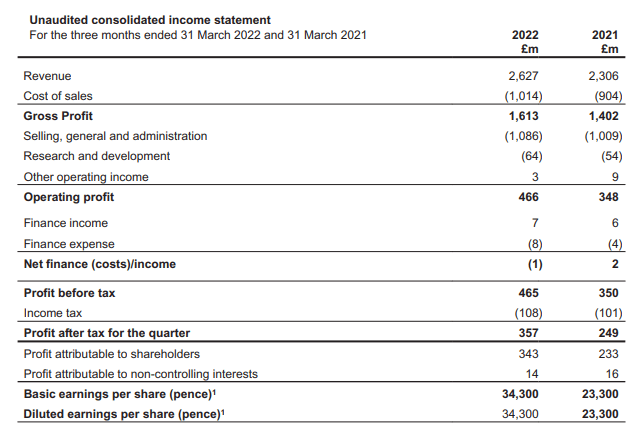

A Look At Haleon’s Q1 Earnings Results

Q1 doesn’t yet include the pressures brought on by a drop in consumer confidence, which became more pronounced as the Fed shifted its tone to higher rates. However, consumer confidence declines did also somewhat precede that with consumers’ reaction to inflation. Nonetheless, HLN performs well so far into the year.

IS (Prospectus)

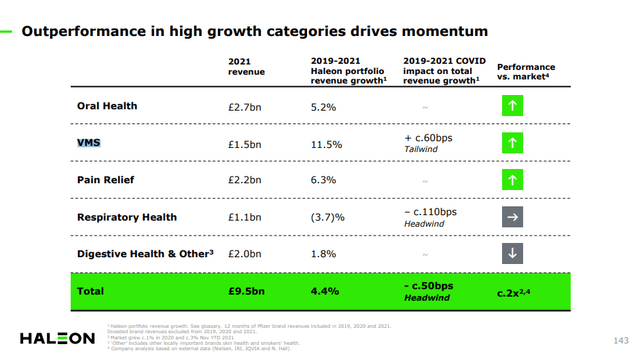

There were declines from 2020 into 2021 as the peak buying in 2020, which affected all sorts of consumer products companies, created a tough comp for the next year. It could have been a worse comparison if it weren’t for vitamin and supplement growth. Levels in 2021 were still far ahead of pre-COVID levels.

Broader

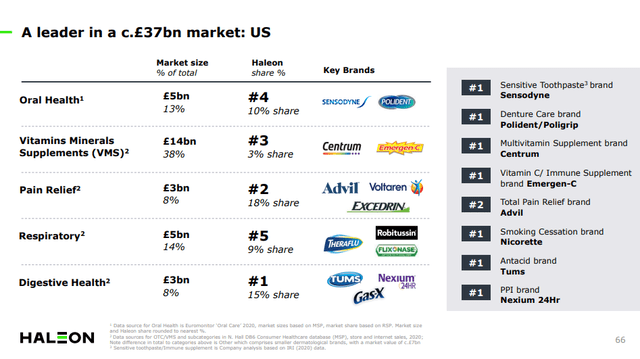

Profitable growth comes from strong marketing capabilities, but what’s important is the underlying growth, which has to come from attractive markets.

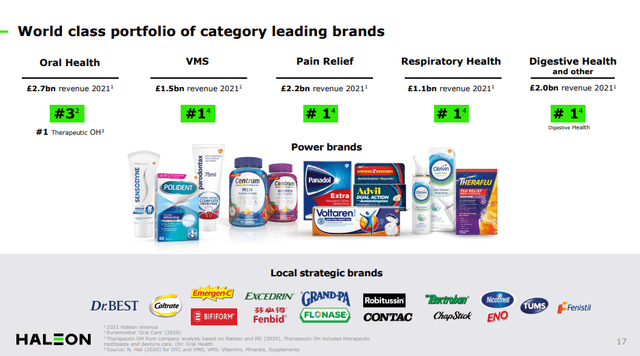

Firstly, in key markets HLN commands strong market shares. The VMS market is particularly fast-growing, and in the U.S. the share is strong. VMS revenues from the U.S. are particularly strong contributors to the topline, but maybe less so to the bottom line. In EMEA and LATAM they are less popular but only because the broader VMS market has more scope to grow there.

In terms of mix, they are trying to push their power brands, which include VMS products for growth, but also some of their other greatest hits all constituting large-scale multi-national power brands. The reality is that these are already the most of their revenue, around 70%, with the rest being local strategic brands. Still, they offer the most scope for leverage into new markets like APAC where growth rates are still strong.

Power Brands (CMD Pres) Segments (CMD)

They have other growth levers to pull. APAC is growing at twice the rate of the other regions thanks to the fact that products like HLN’s still haven’t penetrated them yet. China included. Again, these products don’t require a booming macro environment to support their markets either, so the woes of China are not such a concern for their launch into those markets.

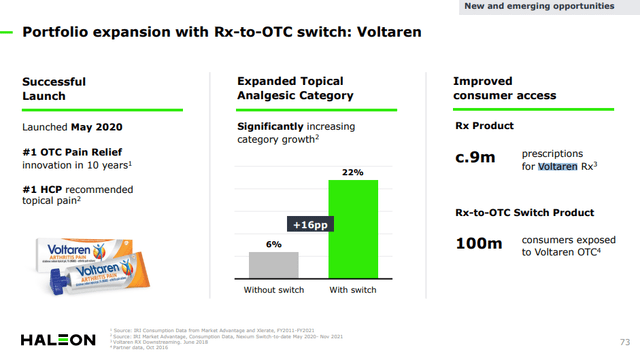

Finally, from a growth perspective they have the Rx-to-OTC switch lever. We like this, because it also begins to leak into the issue of profitability. When acquiring brands, they have an edge in being a partner capable of successfully making those switches. Voltaren is an example, and that is definitely a product whose impact you don’t expect to get as easily as OTC. By bringing it to the OTC market you can 4x its reach. They have managed four of these switches in the last 8 years, but when it happens it drives growth like with Voltaren. These pain relief markets are pretty big.

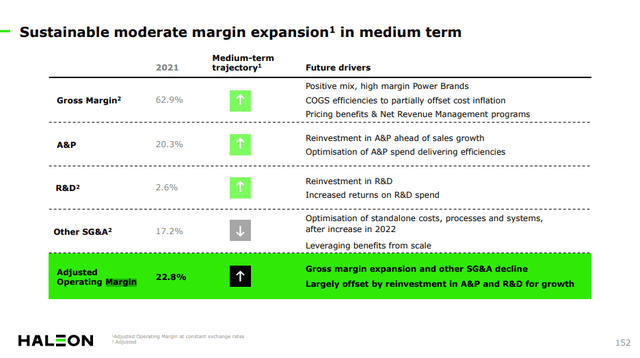

In terms of profitable growth, it will be about leveraging brands into as many markets as possible with able regulatory positioning. APAC will be a new sink for brands. Getting that leverage off is the best way to create scale and get good value on marketing dollars. Margins are already high, too, which indicates that these brands do have pricing power. A useful lever again to create markup when economic conditions are concerning and inflation is affecting input costs.

Conclusions

Haleon trades reasonably cheaply at around a 15x EV/EBIT multiple and just over 10x in EV/EBITDA. That’s about right for a consumer products company, especially one that isn’t having profit issues. Indeed, the multiple is the same as Kimberly-Clark’s (KMB) pre-inflation concerns. Forecast medium-term growth is between 4-6%, and with pricing as well as resilience on top of other execution levers for marketing products being helpful for that, markets are quite large, and there is scope to grow both in current and new regions with emerging, better margin products as well as more stalwart segments too. That 4-6% growth at only slightly higher margins is an achievable target.

For 10x EV/EBITDA, getting stable growth in the current environment for cheap isn’t easy. We think that HLN is actually quite a good deal. Doesn’t blow our socks off, but as far as consumer products companies go, it can pass as a good GARP investment.

Be the first to comment