imaginima

Reports indicate that Berry Corporation (NASDAQ:BRY) may be exploring a possible sale. I believe that Berry is still undervalued at its current share price, with an estimated value of $12 in a long-term $75 Brent scenario. There is both commodity pricing risk and California regulatory risk that may hinder its ability to achieve that value though.

Deal premiums for E&P companies are fairly modest though, so if Berry is acquired in the near term, the deal price may be closer to $10 though.

Compared to my earlier expectations for Berry, it may be able to keep operating expenses a bit lower than what I had previously modeled, although I still believe it will be difficult for Berry to achieve its full-year guidance around operating expenses.

Exploring Strategic Options

The news that Berry was exploring strategic options (including a possible sale) helped push Berry’s share price up by around 10% on Thursday.

One thing to note though is that while I believe Berry is still undervalued at its current share price, the typical premium for an upstream acquisition has been fairly limited (such as ~10%). So a deal for Berry at this point in time might value it at no more than $10.

An acquisition by a private equity company would result in a cash payment, while an acquisition by another public company could result in payment in shares of that company or a mix of cash and shares.

Notes On Operating Expenses

One of the areas I have tried to dive into about Berry is its level of operating expenses going forward. While Berry has still maintained its full-year guidance for operating expenses at $20 to $22 per BOE, I am finding it difficult to see how it could get the full-year number down to that level.

The challenge for Berry is that its first half costs were quite high. Berry’s Q1 2022 operating expenses were $25.64 per BOE and this increased slightly to $25.97 per BOE. This means that Berry will likely need 2H 2022 operating expenses to be around $18.25 per BOE to end up at around $22 per BOE for the full year.

I’ve taken a look at the components of Berry’s operating expenses and think that it could get to around $20.40 per BOE in the second half of 2022 if things go well for it. This would be a significant improvement, but would still leave it at over $23 per BOE for the full year.

Berry’s Q2 2022 non-energy operating expenses were inflated due to a variety of factors including its field optimization program, higher workover expenses and maintenance expenses. I’ve assumed that Berry can reduce non-energy operating expenses down close to its Q3 2021 to Q1 2022 levels, with a bit of inflation factored in.

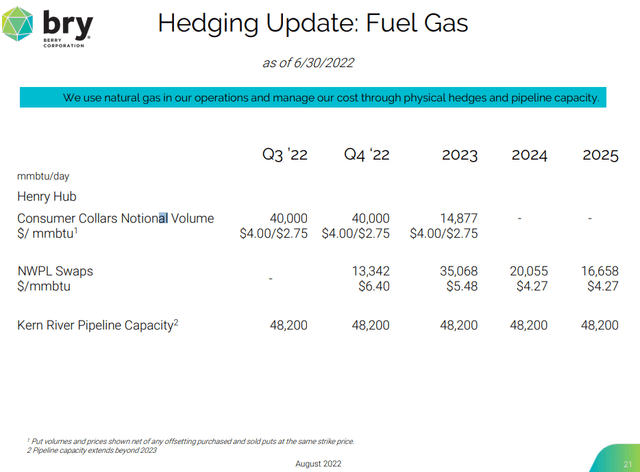

Berry’s unhedged energy costs should improve due to increased Kern River Pipeline capacity. As well, net electricity revenues should increase in the second half of the year due to seasonality. Around 65% of Berry’s full-year net electricity revenues (from 2018 to 2021) were generated in the second half of the year.

| Per BOE | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | 2H 2022 (Estimated) |

| Non-Energy Opex (Excluding Transportation) | $12.92 | $12.77 | $13.12 | $15.69 | $13.50 |

| Unhedged Energy Costs | $11.27 | $13.45 | $13.14 | $14.68 | $13.00 |

| Gas Hedges | ($5.60) | ($3.37) | ($0.69) | ($4.27) | ($5.00) |

| Net Electricity Revenues | ($2.08) | ($1.03) | ($0.39) | ($0.54) | ($1.50) |

| Net Transportation Expenses | $0.67 | $0.64 | $0.46 | $0.41 | $0.40 |

| Total Opex | $17.18 | $22.46 | $25.64 | $25.97 | $20.40 |

This leads to an estimate that Berry could reduce operating costs to around $20.40 per BOE in the second half of 2022, although that is probably on the more optimistic side.

Berry’s consumer hedges are expected to provide less benefit in 2023, so that may bump up its costs a bit (such as to the $22 to $23 per BOE level) compared to the second half of 2022.

Berry’s Consumer Hedges (bry.com)

Notes On Valuation

I am keeping my estimate of Berry’s value at $12 per share, assuming a longer-term $75 Brent oil environment. After taking a deeper look at the components of Berry’s operating costs, I believe that it can probably do a bit better than what I previously expected in terms of longer-term operating costs. However, the positive effect this has on Berry’s estimate value is offset by lower near-term cash flow projections. Despite the recent rebound in oil prices, strip prices are still several dollars below early August levels (when I last looked at Berry).

Conclusion

I believe Berry is worth around $12 per share in a longer-term $75 Brent environment, so a potential acquirer could still get a reasonably good deal if it paid a modest premium (typical of upstream acquisitions) to Berry’s current price. In the current environment, an offer for Berry may be around $10 per share.

Berry’s operating expenses remain something to watch. It should be able to lower operating expenses noticeably in 2H 2022 compared to 1H 2022 levels, although I still expect it to end up above its full year guidance for that.

Be the first to comment