serg3d/iStock Editorial via Getty Images

All eyes will be on PayPal Holdings, Inc. (NASDAQ:PYPL) when it reports its Q1 results next week on Wednesday (4/27). Investors are curiously waiting to see if the company can post a large enough revenue beat to quash all slowdown-related bearish concerns. But, in addition to tracking in headline revenue figure, investors may also want to closely monitor its total payments volume, active accounts additions, bifurcated financials, and its management‘s revenue outlook for Q2. These items will better highlight the company‘s near-term prospects and are likely to influence where its shares head next. Let‘s take a closer look at it all.

Measuring Customer Traction

Let me start by saying that competition is rapidly intensifying in the payments processing, wallets, and personal finance management space. While some players are thriving on the back of niche offerings and/or seamless integrations, others are starting to see their growth rates plateau. PayPal, in particular, seems to be suffering as its management has had to temper their revenue guidance last quarter. So, as investors, the first order of business should be to monitor how well is PayPal withstanding these competitive pressures and if it‘s having any adverse effects in customer traction metrics.

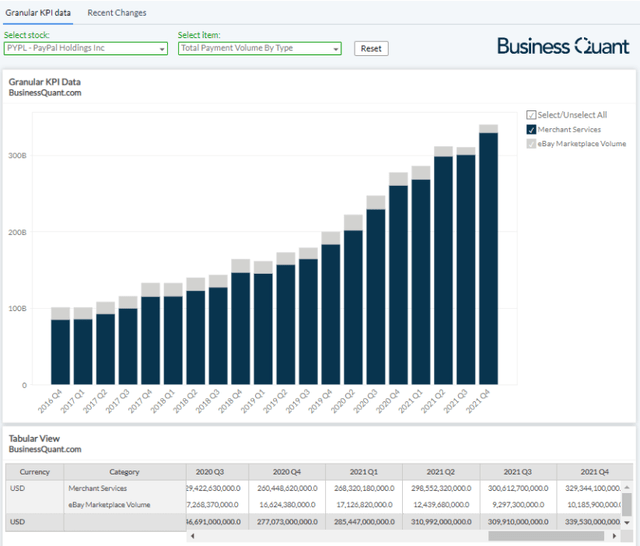

We can start by looking at PayPal‘s total payments volume (or TPV). For the uninitiated, it‘s essentially the dollar-value of all the payments that were processed through PayPal‘s networks, on which the company is likely to generate revenue on. So, it‘s in the best interest of the company and its shareholders if its TPV figure grew at a rapid rate. In fact, that has been the case in the past – its TPV has risen sequentially in 18 of the last 23 quarters.

Although PayPal has performed fantastically on this front in the past, we must take into account that the global payments firm shut down its services in Russia in the first week of March. It hasn‘t yet disclosed its revenue or TPV exposure to the Russian market, so we can‘t reliably estimate the extent of damage here. But as far as guesstimates go, we could be looking at a 1% drop in PayPal‘s TPV in its Q1 due to its exit from Russia.

Besides, PayPal‘s TPV has declined between 0.7% and 7.1% in prior Q1s, on a sequential basis. This happens because e-commerce activity is typically elevated during the holiday season, which falls in Q4. So, I‘ll take the mid-point of the two figures, and estimate that PayPal‘s TPV will decline by around 3.9% in Q1 due to this cyclical factor. Overall, with the Russian exit and the cyclicality at play, we‘re looking at a TPV decline of as much as 4.9% in Q1.

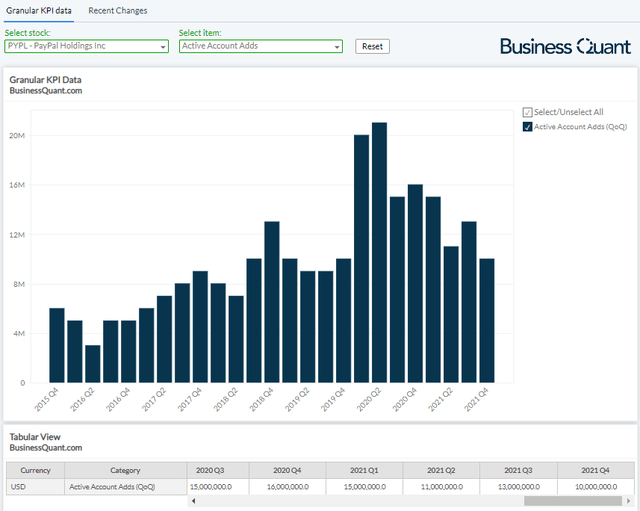

Having said that, we must also monitor PayPal‘s active accounts additions. It‘s a good gauge to measure whether PayPal is growing in popularity amongst the masses or if it‘s succumbing to competitive pressures. Our database at Business Quant reveals that PayPal‘s active account additions have declined in 4 of its last 7 quarters. Due to the absence of any new growth initiatives on the company‘s part, to reverse this ongoing decline, I expect the figure to drop to around 8.5 million in Q1.

It‘s worth noting that the company defines its active accounts as “[any] account registered directly with PayPal or a platform access partner that has completed a transaction on our platform, not including gateway-exclusive transactions, within the past 12 months.” Due to the long-twelve month window involved in the calculation of active accounts, the figure won‘t reflect the adverse effects of the company‘s Russian exit until next year.

Now, let‘s shift attention to PayPal‘s financial performance.

Financial Expectations

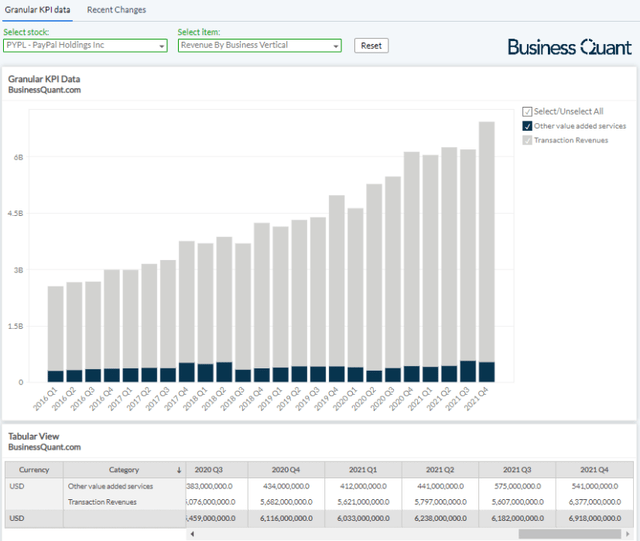

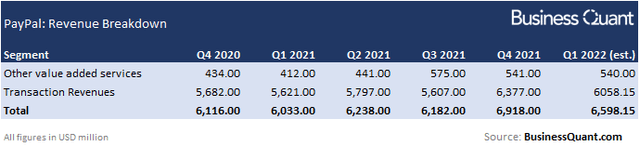

PayPal generates revenue from two segments, namely, transaction revenues and other value-added services segments. Its transaction revenues accounted for roughly 92% of the company‘s entire top-line last quarter and the segment primarily comprises of the commission/fees charged on its total payment volume. Since I‘m expecting TPV to sequentially decline by 4.9% in Q1, its derivative transaction revenue is likely to also drop by a similar magnitude and amount to $6.05 billion.

The company‘s second reporting segment, which goes by the name “other value-added services”, includes the sales earned through partnerships, referral fees, subscription fees, gateway fees and other ancillary services. This revenue figure has more or less remained range-bound for several years and there aren‘t any specific catalysts at play that would suddenly catapult it to new highs. So, I‘m estimating PayPal‘s other value-added services revenue to more or less remain flat sequentially and post revenue of around $540 million.

This brings us to a company-wide revenue estimate of $6.6 billion for Q1 FY22, which is slightly higher than the Street‘s estimates that are spanning from $6.33 billion and $6.45 billion.

But having said that, investors must also pay close attention to the company management‘s revenue and TPV guidance for Q2. The interest rates, although currently still low, are expected to rise as we head further into 2022. This is likely to limit the disposable funds floating around in the economy and weigh down on TPV growth for companies such as PayPal. So, look for management‘s comments around how much will their growth be hindered in a rising interest rate environment. From the company‘s last 10-K filing:

Interest rates may also adversely impact our customers‘ spending levels and ability and willingness to pay outstanding amounts owed to us. Higher interest rates often lead to larger payment obligations by customers of our credit products to us, or to lenders under mortgage, credit card, and other consumer and merchant loans, which may reduce our customers‘ ability to remain current on their obligations to us and therefore lead to increased delinquencies, charge-offs, and allowances for loans and interest receivable, which could have an adverse effect on our net income.

Final Thoughts

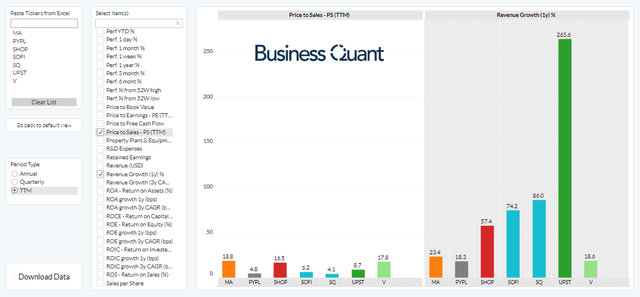

PayPal‘s shares are trading at about 5-times its trailing twelve-month sales at the time of this writing. This is considerably lower than the company’s peers, and investors may be tempted to invest in this seemingly undervalued stock. However, we must also take into account that PayPal‘s revenue growth rate is significantly low in its peer group. So, in a way, the stock is fairly valued and its relatively lower price-to-sales multiple is justified.

But all that could change should the company post particularly strong operating and financial results in Q1. So, for the time being, investors should keep a close eye on PayPal‘s total payments volume, its active accounts additions, its segment financials and its management‘s guidance for their next quarter. These important levers will highlight PayPal‘s near-term growth prospects and are likely to determine where its shares head next. Good Luck!

Be the first to comment