cemagraphics

The WisdomTree CBOE S&P 500 PutWrite Strategy Fund (NYSEARCA:PUTW) is an index ETF which sells cash-secured S&P 500 put options. The fund’s investment strategy is extremely similar to selling in-the-money S&P 500 call options, a strategy followed by the Global X S&P 500 Covered Call ETF (XYLD), previously covered here. Said strategy is also very similar to that of other covered call ETFs, including the Global X NASDAQ 100 Covered Call ETF (QYLD), and Global X Russell 2000 Covered Call ETF (RYLD).

Due to the similarities between PUTW and these other funds, a comparison might prove instructive.

PUTW and its peers tend to outperform when markets drift down or are flat, as has been the case YTD. PUTW and its peers tend to underperform when markets are going up, as was the case in 2021, and most other prior years. PUTW and its peers tend to underperform long-term, as markets mostly go up.

PUTW performs most similarly to XYLD, but its strategy is a little bit more profitable, with PUTW having slightly higher realized / expected total returns. PUTW chooses to retain most of its profits, so it has a relatively low 1.0% dividend yield. XYLD and its peers distribute most of their profits, so dividend yields are high, almost always in the double-digits. The same is true for after-tax total returns, although these are strongly dependent on the circumstances of each specific investor. As such, PUTW seems like a slightly stronger alternative relative to XYLD for most, if perhaps not all, investors.

PUTW – Overview

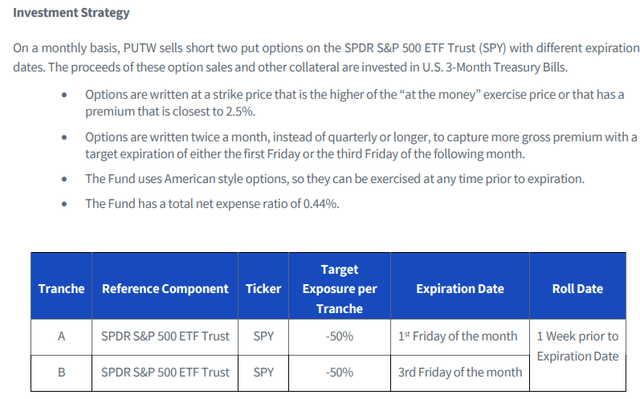

Simplifying things a bit, we can say that PUTW sells cash-secured S&P 500 put options, and invests the proceeds, collateral, and all remaining proceeds in 3-month treasury bills. PUTW’s actual strategy is as follows.

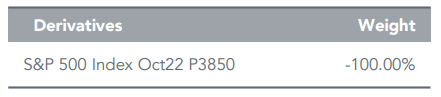

Let’s go through the implications of the above. As of 3Q2022, the fund had sold the following put.

PUTW

Let’s go through what selling this specific options means.

PUTW sold to a counterparty the right to buy shares in the S&P 500 index for 3850 in October 21st 2022 (date not specified, but implied by index rules).

By selling the option, PUTW might have been forced to buy shares in the S&P 500 index from the counterparty at said price, at said date.

Regardless of what happens with S&P 500 prices, PUTW receives premiums for selling these options. These premiums account for effectively all of PUTW’s returns, and are held as cash by the fund.

Funds with similar strategies tend to distribute these premiums to shareholders, which seems both more logical, and closer to what shareholders want and expect. In any case, holding the premiums as cash increases fund NAVs and hence share prices, leading to capital gains (all else equal). As such, this has little impact on the fund’s total shareholder returns, it just means these come in the form of capital gains instead of distributions.

Option profitability depends on S&P 500 price movements.

If the S&P 500 drops lower than 3850, then the options can be profitable exercised by PUTW’s counterparty. As an example, let’s say the index drops to 3000 by said date. PUTW’s counterparty would buy the index at 3000, and then force PUTW to buy it from them at 3850, pocketing the spread. PUTW would then sell the S&P 500 at market prices, 3000, which they bought from the counterparty at 3850, experiencing losses of 850. The more the S&P 500 drops, the higher the losses for PUTW and its shareholders.

If the S&P 500 stays flat or goes up, nothing much happens. PUTW’s counterparty would sell index shares in the open market, which would see strong prices in this scenario. No need to force PUTW to buy S&P 500 shares if the market will do.

Option profits might look as follows:

So, the options are unprofitable with low S&P 500 prices, profitable with moderate / high S&P 500 prices, but profits are capped as option premiums are fixed.

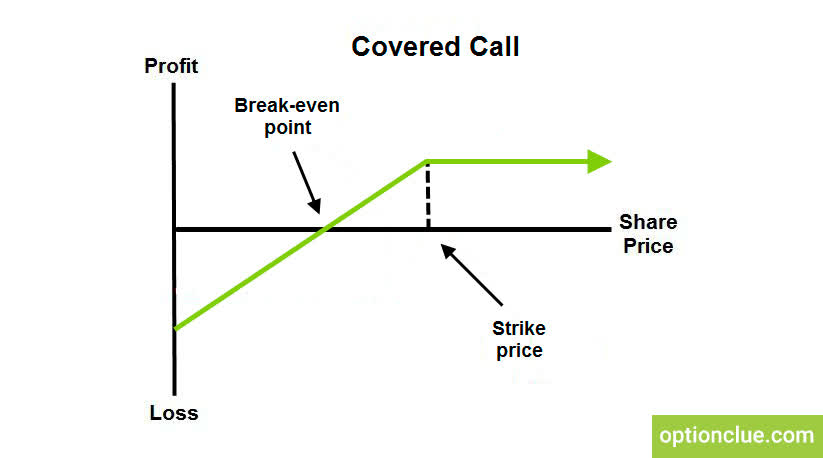

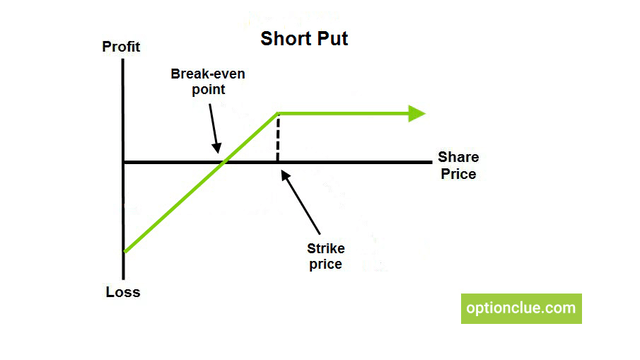

Interestingly, selling a covered call has an extremely similar, one might even say identical, payoff profile:

Optionclue.com

As can be seen above, selling a covered call is also unprofitable when the underlying index is down, it is profitable when the underlying index moves sideways or up, but profits are capped too.

Selling a covered call is conceptually very different from selling a put option, but the results are effectively the same.

Selling a covered call basically trades away most potential capital gains for an increased dividend yield, while downside potential remains the same.

Selling covered calls and put options both generate substantial option premiums, have capped profits, but full downside potential.

The strategies are extremely similar, and so one should expect similar performance from these.

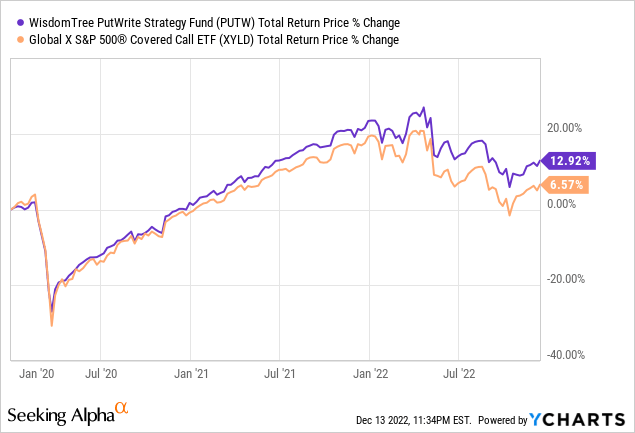

Due to the above, PUTW should behave quite similar to an S&P 500 covered call funds. The Global X S&P 500 Covered Call ETF (XYLD) is, as one might expect, an S&P 500 covered call fund. PUTW behaves quite similarly to XYLD, with both funds having very similar performances since early 2020.

XYLD followed a different strategy before 2020, so performance between these two funds was quite different before said date.

Due to the above, PUTW could plausibly act as a replacement fund for XYLD, and for other similar covered call funds. As such, thought to do a quick comparison between these, to better understand the implications of replacing these funds with PUTW.

PUTW – Covered Call Fund Comparison

PUTW compares unfavorably to most other covered call funds in two key ways.

First, is the fact that covered call funds are conceptually easier to explain and understand, in my opinion at least. I’ve written quite a few articles on covered call funds recently, and these were much easier to write, and I think also easier to understand. I would not have understood certain issues or details with PUTW if I wasn’t able to compare it with XYLD, and the same could be true for other investors or readers. This is a small issue all things considered, but I do think that simple is best.

Second, covered call funds generally offer strong distributions, while PUTW does not. As mentioned previously, I think distributing option premiums is closer to what investors want and expect from these funds. Retaining most gains instead of distributing these does not materially impact the fund’s total shareholder returns, but it does complicate matters for investors.

A retiree invested in PUTW would need to sell a portion of its holdings every month to fund their retirement needs, while an investor in XYLD would simply receive a monthly distribution. PUTW’s investors would need to decide / estimate how much they want to sell, and could see significant capital depletion if sells prove excessive. Selling also exposes PUTW’s investors to capital gains tax. Said tax could significantly reduce PUTW’s after-tax total returns, and might make the fund an unattractive choice for many investors.

Distributing option premiums also makes covered call funds easier to understand. As an example, XYLD yields 13.6% versus 1.6% for the S&P 500. XYLD is basically trading away most potential capital gains for that increased 13.6% yield. This is an easy tradeoff to understand and to analyze. PUTW, in practice, behaves in an incredibly similar manner, but I would have been unable to ascertain this if I could not compare these two funds.

PUTW compares favorably to its peers in two key ways.

First, is the fact that PUTW retaining most of its option premiums means investors have some flexibility in the timing of their taxes / when to trigger a taxable event. PUTW’s investors can avoid most taxes by simply holding the fund without selling, while the same is not true for XYLD and most other covered call ETFs.

In general terms, PUTW and XYLD have different tax situations / implications. The impact from these is somewhat dependent on the specific circumstances of each individual investor, and so are outside the scope of this article.

Second, but a bit more speculative, is the possibility / trend of PUTW selling its put options for more completive prices than XYLD sells its call options. Selling S&P 500 call options is a very popular, crowded strategy, so options prices are somewhat lower than expected. Selling put options is a bit more of a niche strategy, so PUTW does not suffer from these issues.

Due to the above, PUTW should slightly outperform relative to XYLD long-term, as has been the case since 2020.

Bear in mind, the above might not necessarily be the case moving forward. Option prices are incredibly volatile, after all.

In any case, PUTW and XYLD are both very similar funds, with only small differences between them.

Conclusion – Buy

PUTW is likely to outperform relative to XYLD on a before-tax total return basis, net after-tax returns would be somewhat dependent on the individual investor’s tax situation. As such, PUTW seems like a reasonable alternative to XYLD, for many, if perhaps not all, investors.

Be the first to comment