Should’ve hired the plumber! sturti/E+ via Getty Images

Co-produced with Treading Softly

Have you ever met a jack-of-all-trades type of person? They’re great at many things but never mastered any one thing.

I’ve spent years becoming skilled in high-yield investments and studying the market. I will openly admit that I am not a skilled plumber or electrician. So when my light switch stops working or a pipe breaks, I’m not going to start trying to fix things. What do I do? I hire someone who is skilled.

That being said, I do often do my own automotive work. Why? Because it is a hobby I have pursued and enjoy. I’ll do a tune-up. I’ll do an oil change. I’ll even replace a heater core or camshaft. I also know my limits in my hobby. I’m not going to spec bearings or rebuild a complex transmission. I’ll hire someone skilled enough to do so.

When it comes to the market, I know I cannot do it all. I have a team of experts who work diligently beside me to help evaluate great opportunities or conduct research. Each of us has mastery over certain types of investments, and as a team, we have the skills to evaluate any dividend stock. If you’re looking for the best opportunity among EV startups or crypto-currency, coming to us would be like going to an electrician for a plumbing problem.

Still, as investors, we want to be diversified. This means we want to invest in sectors that we might not have personal expertise in or that don’t traditionally pay high enough dividends to achieve our goals.

Fortunately, there are ways we can get significant diversification, a high yield, and expert management. One route to do this is to invest in Closed-end Funds. CEFs allow you to buy shares and have that capital managed by skilled portfolio managers.

Today, we will look at two excellent funds that I have hired to manage sectors of my portfolio to help me gain income from areas that they are more skilled in than I am.

Let’s dive in!

Pick #1: THQ – Yield 7.2%

The healthcare sector has been impacted by narratives throughout the economy. COVID brought about a renewed interest in healthcare, and now that COVID is no longer prominent in the headlines, the traders are running away from it. They act as if nobody is going to go to the hospital, or get vaccinated, and disease is now a thing of the past.

When news-oriented traders leave a sector, it creates an excellent buying opportunity for investors with a long-term investment mindset. We can buy excellent long-term investments at cheap prices.

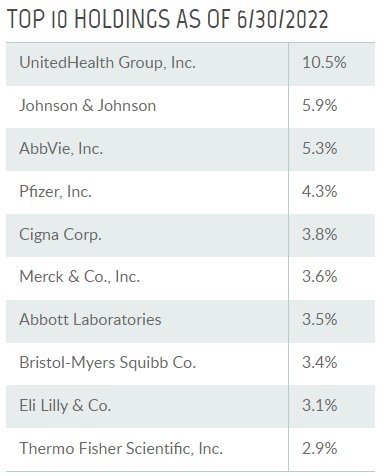

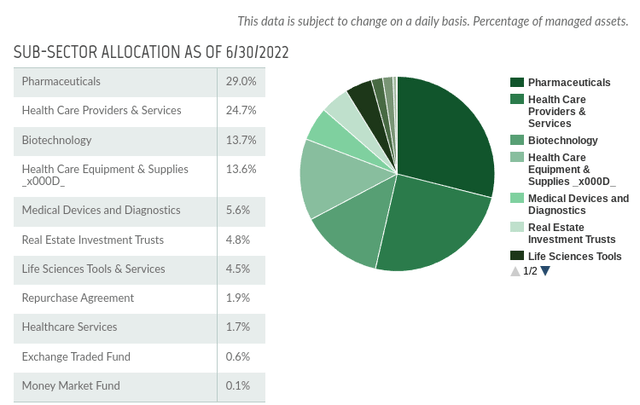

One such opportunity is Tekla Healthcare Opportunities Fund (THQ). THQ invests in a diverse array of healthcare-related companies. From Pharmaceuticals to providers, equipment, and even real estate. (Source: Tekla Capital Management)

You are likely familiar with most of the names in THQ’s top 10 holdings.

Tekla Capital Management

One thing we love about CEFs is their ability to translate investments in companies with relatively low or no dividends and convert them into a high yield. CEFs are required to pay out the majority of their income and realized capital gains as dividends.

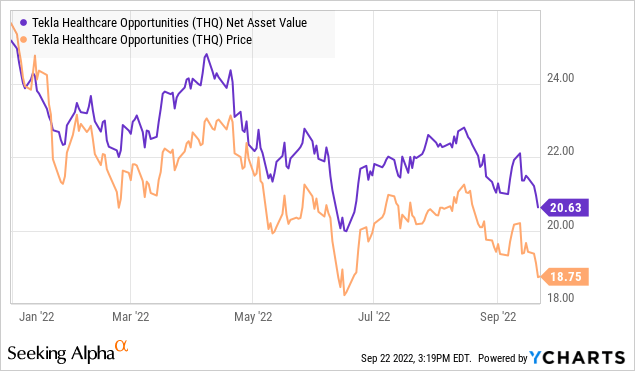

What makes CEFs unique from other types of funds, like ETFs, is that the shares trade independently from NAV (net asset value). This means that the share price for the fund is often disconnected from the underlying value of the portfolio held by the fund. CEFs frequently rise or fall further and more aggressively than the portfolio.

Since the beginning of the year, THQ’s price is down nearly 27%. However, THQ’s NAV has fallen much less.

Ycharts

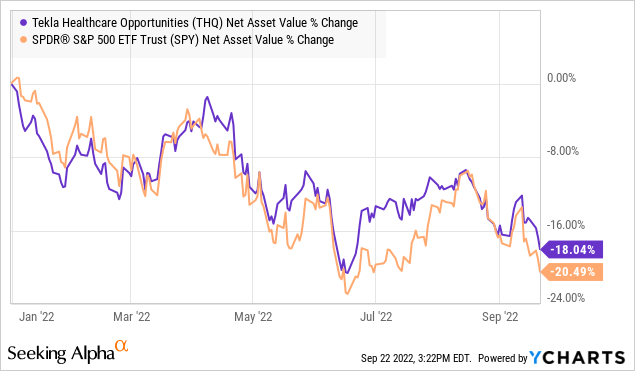

In fact, THQ’s NAV has significantly outperformed the S&P 500.

Ycharts

THQ is trading at a 9%+ discount to NAV, providing us with a higher yield and additional upside when prices rebound.

There are challenges in the healthcare sector. Inflation is a big one, where costs increase immediately, but for most healthcare companies raising prices is a process that takes time. Medical care has been lagging behind average inflation over the past year but had a big step up 0.7% in August. This is what we would expect in healthcare. Expenses can be passed along to the consumer, but it is not something that can be done immediately. It is a process that takes time.

Healthcare has been a strong and reliable sector over the decades. That isn’t going to change, especially with the Baby Boomer generation increasing demand for healthcare. This dip in THQ is an excellent buying opportunity to gain exposure to this strong sector.

Pick #2: PDI – Yield 13.1%

When it comes to investing in equities, investors are trained to view declining prices as “bad” and rising prices as “good”, this is a simplistic and unhealthy way to view investing.

Prices are not good or bad, they are always both. In any exchange, there is a seller and a buyer. If prices are low, then that is “bad”… only for the seller! For the buyer, low prices are better than high prices! If prices are high, then that is good for the seller but not so much for the buyer.

When interest rates rise, the prices of existing bonds decline. This is because new bonds can be bought at a higher yield, so the price of older bonds needs to decline to attract buyers.

Interest rates are up, and mortgage rates are up even more. Many traders interpret this as “bad” for debt funds like PIMCO Dynamic Income Fund (PDI), which owns a variety of debt with high-yield credit and non-agency mortgages making up about 70% of its portfolio.

But wait: what does PDI do? PDI’s very purpose of existing is to buy debt. PDI doesn’t originate loans. It is not underwriting mortgages and selling them to other investors. It is not going to sell debt and turn around and buy bitcoin. PDI might sell debt, but it does so to buy different debt that the managers believe is a better deal. PDI buys debt, that’s what it does and is the sole purpose of its existence.

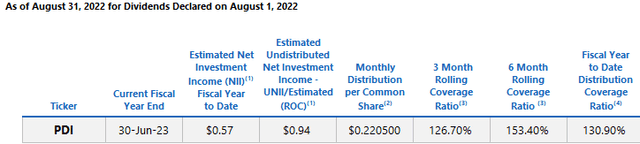

So are lower prices on debt good or bad for PDI? Since PDI is always a buyer of debt, low prices are positive in the long run, even though it might be a headwind to NAV as the prices of existing holdings decline. We can see the benefits of higher yields reflected in PDI’s UNII (undistributed net investment income) report. This is income that PDI has not distributed in excess of its regular monthly dividend.

PDI’s dividend coverage has been over 126% in the past three months, and PDI has an excess of $0.94 in UNII, representing more than four months of its regular dividend. In February 2022, before interest rates were hiked and bonds fell dramatically in price, PDI’s dividend coverage was only 106%.

Lower debt prices cause higher cash flow because PDI receives principal payments every month. Especially with its significant exposure to mortgages, which are amortizing debt, meaning that principal is paid with each payment. When PDI receives that principal, it reinvests it into new investments, which are at a higher yield.

Low prices are good for the buyer. Therefore, when prices are low, you want to own the companies that are buyers. Debt prices have fallen a lot thanks to an aggressive Federal Reserve, so we want to own PDI because it is a buyer of debt.

DepositPhotos

Conclusion

With PDI and THQ, we can access extremely skilled portfolio managers who seek to provide their shareholders with excellent income and long-term capital appreciation. I get to kick back and relax, knowing they are doing the heavy lifting while I enjoy the income my positions produce.

As we get older, I’ve seen the simplest things get more complex. Long gone, it seems, is the shade tree mechanic tinkering away with their 4-barrel carburetor. Now we have mechanics using computers alongside the toolbox. Technology has a way of making things more efficient but also more complex.

So in your retirement, you don’t always need to become a master of every sector, every skill, every investment type. Sometimes, it is wise to outsource the legwork to another who spends their life mastering that skill.

Broken wiring? Hire an electrician.

Water leak? Hire a plumber.

Sector outside of your knowledge base? Look for an excellent portfolio manager.

This way, you can return to enjoying your retirement and doing what you love.

That’s the beauty of financial independence. That’s the result of our Income Method.

Be the first to comment