olm26250

Income investors certainly have a lot of options these days, as the days of T.I.N.A. (there is no alternative) may now seem like the distant past. This is especially considering the fact that the 2-year Treasury now yields 4.2%, a level that would have been hard to believe only a short 12 months ago.

It’s important to keep in mind, however, that locking your money into a Treasury bond means that you’d have to find another place to park it when the bond matures, and there’s no guarantee that this high yield will continue. This is considering this week’s statement by Atlanta Federal Reserve President Bostic the Fed can tame inflation and bring it back down to 2%.

As such, investors looking longer term may want to stick with higher-yielding equities that also benefit from higher interest rates. Plus the full benefits from compounding can be realized in a tax-advantaged retirement account. This brings me to BlackRock TCP Capital Corp (NASDAQ:TCPC), which now yields over 10%, giving income investors plenty to cheer for.

Why TCPC?

BlackRock TCP Capital is an externally-managed BDC that was formed after the well-respected asset manager BlackRock (BLK) acquired Tennenbaum Capital Partners LLC. TCPC is managed by BlackRock, which has $148 billion in AUM across credit asset classes supported by a team of global professionals, giving TCPC a line of sight and a level of deal flow that it would not otherwise have as a standalone company.

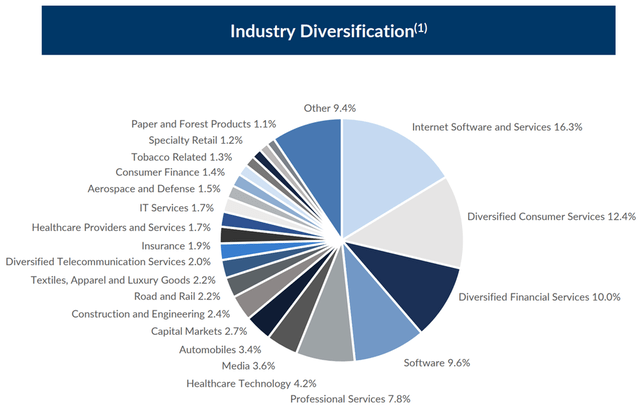

TCPC currently has a portfolio fair value of $1.8 billion that’s diversified across 122 portfolio companies. The portfolio is concentrated on less-cyclical companies with strong covenants and investments in cyclical companies are typically structured with significant collateral provisions, with robust downside analysis performed at underwriting. As shown below, TCPC invests in a cross-section of middle-market companies with internet services, consumer services, finance, and software comprising nearly half (48.3%) of the portfolio.

TCPC Portfolio Mix (Investor Presentation)

Moreover, TCPC’s portfolio leans towards a safer investment structure, with 89% exposure to senior secured debt (74% first lien), and generates healthy weighted average yield of 9.8%. TCPC has no exposure to junior subordinated debt and the entire remaining 11% balance is in equity investments, giving the portfolio better potential for NAV per share upside in the event of successful investment exits.

Meanwhile, TCPC’s portfolio remains in good shape. While NAV/share declined by $0.30 to $13.97 in the second quarter, this was due primarily to mark to mark impact of wider market spreads as the investors require higher risk adjusted returns in a rising rate environment, rather than meaningful weakness in the portfolio. This is reflected by no new investments being added to non-accrual status during the second quarter, and by the very low 0.3% non-accrual rate as a percentage of portfolio fair value.

Looking forward, TCPC is set to benefit from elevated rates, as 95% of its debt investment portfolio is tied to floating rate. It also has plenty of balance sheet capacity, with a net regulatory leverage ratio of 1.05x, sitting well below the 2.0x regulatory limit. It also retains plenty of cash flow after paying the dividend, as it generated $0.37 in NII per share in the latest quarter, sitting well above its $0.30 quarterly dividend, and has an additional $187 million of available liquidity in its credit facility.

Lastly, TCPC appears to be rather cheap at the current price of $11.70, equating to a price to book value of just 0.84x. As shown below, this sits at the low end of TCPC’s trading range over the past 3 years outside of the 2020 timeframe. Sell side analysts have a consensus Buy rating on TCPC with an average price target of $14.21, equating to a potential one-year 32% total return including dividends.

TCPC Price to Book (Seeking Alpha)

Investor Takeaway

Investors looking for attractive yield in the current rising rate environment may wish to consider BlackRock TCP Capital. It sports a well-covered 10.3% dividend yield and trades at a significant discount to tangible book value. Meanwhile, TCPC’s investment portfolio is in good shape with a low non-accrual rate. It also maintains a strong balance sheet, pays a well-covered dividend, and is set to benefit from rising rates. TCPC is a sound buy for high income at current levels.

Be the first to comment