designer491

Have you tried to buy a brand-new car during the COVID-19 pandemic? My guess is that it wasn’t easy and you had to wait for months, if not years. Even haters of used cars like my father were considering used cars. Yes, it’s not new and someone has already driven it before you. But what do you do if you need a brand-new car and the carmaker tells you to wait a couple of years before it will be delivered?

Many people like my father have driven up the prices for used vehicles over the last few years. Prices for used cars increased by 27% in 2021 and 14% in the first six months of 2022. It brought a lot of profit not only to car dealers, but also to leasing companies that resold the used vehicles at higher prices or, as they call it, “auction values.” As Ford (NYSE:F) and GM (GM) have one of the largest leasing companies in the US, established carmakers profited from it too. Higher auction values helped them boost their profits and increase dividends.

Recently, the tide has started to turn. Interest rates went up while used car prices went down. Of course, it dragged on the profits of leasing units and of the traditional car producers. The key question is if the trend is just a short-term one or if it will have a long-lasting effect on the leasing companies.

I believe that the recent changes will have a long-lasting effect on the entire car industry and the leasing units. Increasing interest rates and higher demand for electric vehicles will penalize prices for combustion engine cars. If customers turn away from combustion engine cars when the interest rates are high, it will be a kiss of death for the leasing business. Although all leading car manufacturers will suffer, some of them will be penalized the most. We are busy searching for which ones.

Leasing: What? How? Why?

We all know how expensive cars can be. And still, we love them a lot. Sometimes you want to buy one but you don’t have enough money to purchase it. But no worries! Leasing is here to help you. You pay a bit of the price in the beginning and you can drive the car, paying some money every month over 4-5 years. After several years, you can choose to either pay the rest and become the car owner, or you can just give the car back to the leasing company.

The leasing company issues debt, owes money to clients for several years, and gets the car as security. If the car is returned after several years, the leasing company sells the car at the secondary market. Alternatively, the company may get paid for the car at the initially agreed on price.

When car prices go up, it becomes profitable for customers to buy the car at the initial price and resell it at the secondary market. When car prices go down, then the consumer will likely return the car to the leasing company. If the car prices go down too much, then the leasing company will have to resell a car at a loss.

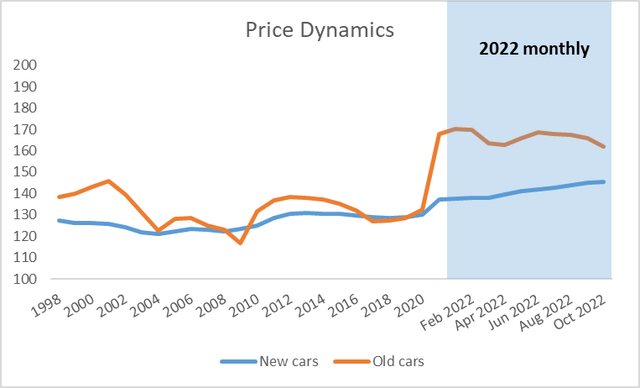

Historically, prices for used cars were very volatile, causing big earnings swings. From the chart below we can see how rapidly prices increased in 2021. It created a huge support for the carmakers with leasing divisions.

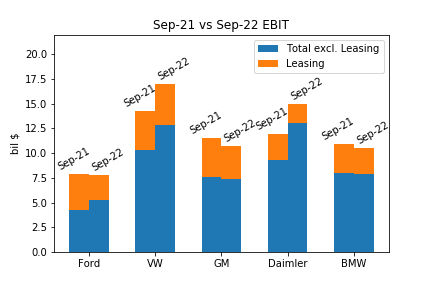

To assess the significance of leasing for different car players, we gave a detailed look at Ford, GM, VW (OTCPK:VWAGY), Daimler / Mercedes (OTCPK:MBGAF), and BMW (OTCPK:BMWYY). We can see that Ford got almost 50% of its EBIT from the leasing divisions. The leasing contribution by other players was lower, but above 25%. I’m talking about EBIT. Leasing brought a much smaller portion of revenue, as it has a much greater profitability than car manufacturing. Therefore, almost every car player does also leasing.

Source: financial statements. Author’s work

Actually, leasing played a critical role during Covid-19. It became the business stabilizer. In 2022, used car prices decreased, which had a huge negative impact on the leasing business. We see it especially well by Ford. Its EBIT was roughly the same in 2021 and 2022, but the leasing contribution was completely different.

In the past, prices for used cars always recovered after the sharp declines. Now, it may be different. Most used cars are combustion engine vehicles, but the share of electric vehicles in sales is rapidly rising. For example, the US share of electric vehicles was only 1.6% in 2021, but it accounted for 6% in October 2022. The trend is expected to continue in the future, with McKinsey estimating the EV share at around 30% by 2026. Such a wide adoption of EV vehicles can penalize the demand for combustion engine cars. In this case, clients will be ready to buy them, but only at much lower prices. In case EV adoption reaches such a wide acceptance when interest rates are still high, it may create an ideal storm for leasing companies.

Ideal storm or kiss of death: leasing becomes expensive due to high interest rates and curbs car demand. Decreasing prices for used cars force leasing companies to sell used cars at a loss.

Ford, GM, BMW, Daimler, VW: Who will be left out?

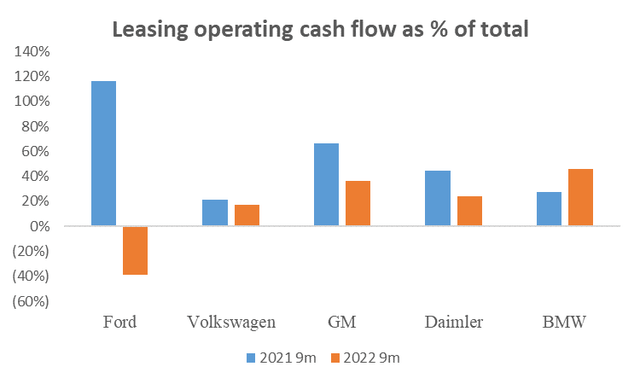

To understand which companies will suffer the most from the storm, we compared car manufacturers in terms of leasing size. We benchmarked them based on leasing. Below, we see that leasing contributed a lot to GM and BMW, while cash flow from Ford Leasing fluctuated widely.

Source: financial statements. Author’s work

Leasing operations were much smaller by Daimler and Volkswagen. Daimler’s lease contracts in relation to the total assets are only 7.3%. Also, the leasing segment is not separated from Mobility services in its reporting. It’s a clear sign that the company doesn’t consider leasing a significant driver.

Volkswagen’s leasing doesn’t produce a lot of cash either, and doesn’t really affect the company’s financial stability. Operating cash flows from Financial Services is approximately 20% of the entire cash flow. The EBIT generated by Financial Services is about 25%. Although financial liabilities related to Financial Services of Volkswagen are high, only 11% of debt consists of floating rate bonds and 89% of fixed bonds, which mitigates interest rate risks.

Therefore, to identify the most vulnerable stocks, we focused on Ford, GM, and BMW.

Ford, GM, BMW: Where is the risk?

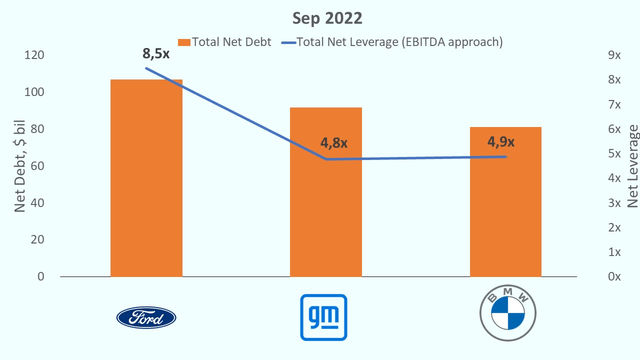

Looking at the debt structure, Ford has the highest debt vs. EBITDA (Net Leverage). This metric is useful for debt benchmarking because it shows it in relation to business performance. It is also reflected in Ford’s credit rating of BB+. On the other side, GM has an investment grade rating of BBB- and BMW of A.

Source: financial statements. Author’s work

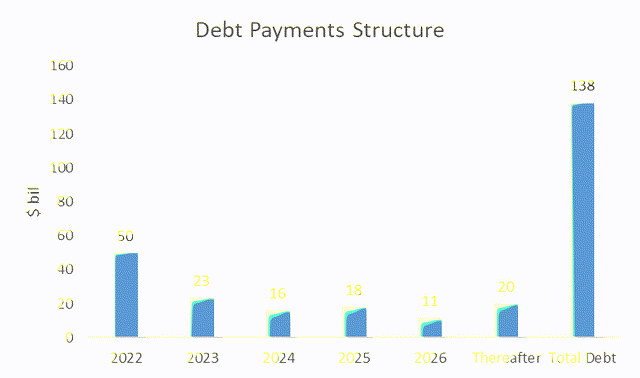

If we look at Ford’s debt, we see that a great chunk of debt will mature over the next few years. Even though the large part of debt is fixed, it still needs to be refinanced over the upcoming years. It is a typical practice to refinance the debt rather than repaying it, but higher interest rates make the debt refinancing much more expensive. It would put an additional drag on the earnings. In 2021 Net Income was of $17.9 billion, while Interest was of 1.3%. 2.0% increase in the interest rate corresponds to the interest of 3.3% and hence Net Income decreases by $2.15 billion.

Source: financial statements. Author’s work

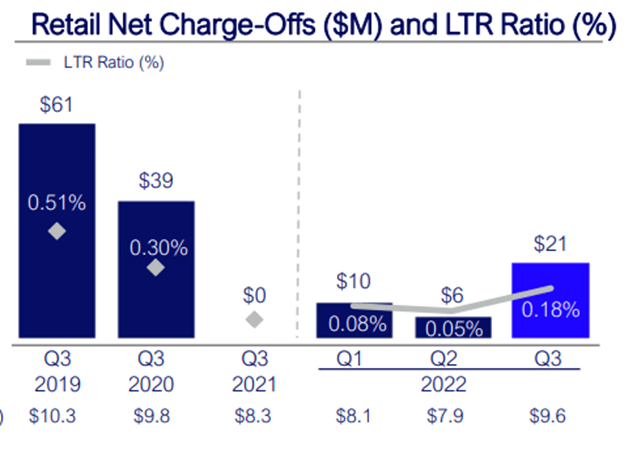

Higher interest rates will also result in higher leasing costs and a larger share of defaulting customers. We don’t see any alarming dynamics so far, but as the interest rate policy works with the lags, we can expect more issues in the future.

Source: Ford’s financial statements.

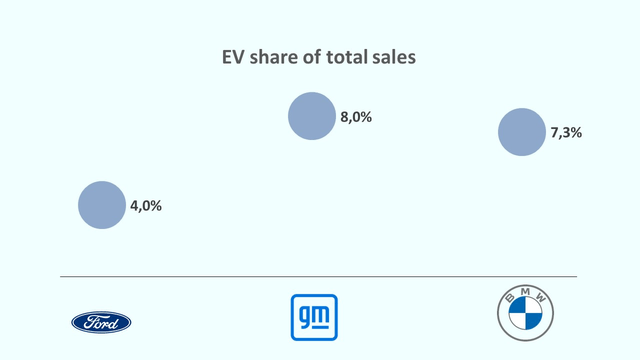

Car manufacturers mainly use leasing divisions to finance the sales of its own cars. Therefore, the share of electric vehicles in total sales of respective car producers plays a major role. The more electric vehicles are sold, the more of them are sold via leasing. This means that the overhang of previously sold combustion engine cars will get smaller in case of a larger EV share in sales. According to the latest available data, Ford had the lowest share of EV cars at 4.0%, GM at 8.0%, and BMW at 7.3%. It makes Ford the most likely candidate for SELL if used car prices decline significantly.

Source: financial statements. Author’s work

Valuation

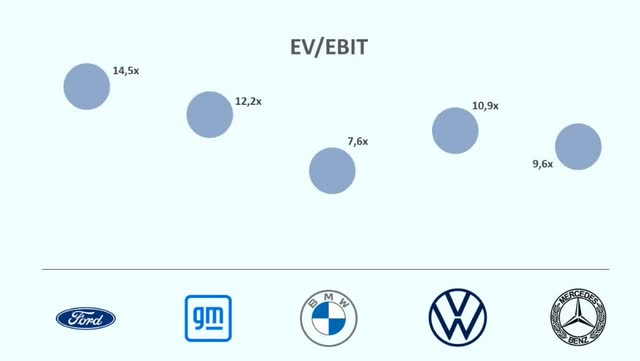

To compare the valuation of all five car producers, we used EV/EBIT metrics. From the chart we see that Ford has a higher EV/EBIT of ~15x. It is higher than the GM’s and is higher than its European peers. This is one more argument that Ford can suffer the most from negative leasing trends.

Source: financial statements. Author’s work

Risks

Interest rate and inflation risk

The current high inflation can abate if the Fed gets the wage dynamics under control. The interest rate would decline following inflation moderation, decreasing the recession probability. This could be a positive catalyst for highly cyclical automotive stocks.

Timing risk

Interest rates will likely fade away soon while the market transformation to electric vehicles will be delayed due to scarce raw materials and poor charging infrastructure. It would give leasing divisions enough time to get adapted to the new dynamics.

Conclusion

Leasing could transform from a car business stabilizer to a business destabilizer. After looking at five leading car players, we believe that the most destabilizing effect could be on Ford. A combination of high debt levels, low EV share, and high relative valuation only support our previous skeptical opinion towards Ford.

Although established car players have very low valuations compared with EV players, they seem to be justified as a lot of risks can materialize in the future. But not all of car producers are like that. We’ve found one that has solid chances to outperform Tesla (TSLA) in terms of self-driving capabilities. We’ll publish our analysis of this stock very soon.

In the meanwhile, keep riding the cycle.

Be the first to comment