Tom Cooper

Co-produced by R. Paul Drake

One of our favorite holdings is EPR Properties (NYSE:EPR). In case you are not familiar with the company, we recommend that you start by reading our investment thesis before going into this update.

EPR is a net lease REIT like Realty Income (O), Agree Realty (ADC), and National Retail Properties (NNN).

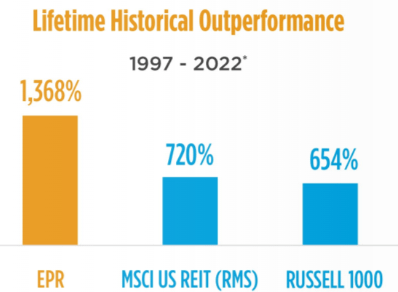

However, instead of investing in traditional net lease properties such as Walgreens (WBA) pharmacies or Dollar General (DG) convenience stores, EPR invests in experiential properties such as movie theatres, golf complexes, ski areas, and many others. These properties have provided higher total returns over long time periods, but they are also somewhat riskier and they suffered greatly during the pandemic.

EPR Properties

The big news this month is that Cineworld (OTCPK:CNNWQ; OTCPK:CNWGQ), which owns Regal Cinemas, is filing for bankruptcy.

Regal is a major tenant of EPR. EPR shares have dropped from around $55 to around $38, or about 30%.

So what should we do about our EPR holdings? Buy? Sell? Hold?

We asked our analyst R. Paul Drake to take a deep look. Here follows his report.

The bottom line at the end is that, in the long run, it matters little what Cineworld does. Looking out five years, EPR ends up with the same earnings, or likely more.

In both cases, the CAGR to fair value in 5 years would be above 15%. And you would get paid good money to wait.

But in the worst case, the road there could be rough.

Looks Like Chapter 11 for Cineworld

There is entertainment value in the announcements by Regal and their owner Cineworld that preceded the news that they are likely to file. They said that despite a gradual recovery of demand since reopening in April 2021, recent admission levels have been below expectations. These lower levels of admissions are due to a limited film slate that is anticipated to continue until November 2022.

What entertains me about this is that Regal management did not project revenues based on a film slate that has been well known for many months. One wonders where they got their expectations.

In Chapter 11 bankruptcies, the likely course here, the bankrupt firm can reject its leases and force a renegotiation. Regal might be dumb enough to try that. The problem is that in that case the landlord can just take back the properties, and EPR probably would.

I covered this aspect at some length in a separate article called EPR Properties: Those Darn Tenants Keep Paying Rent. What the pandemic led EPR to discover is that many of their theatre properties are worth far more for other uses than they are as theatres.

As CEO Greg Silvers put it at the Citi Global Property CEO Conference:

“We sold a theater late last year for industrial conversion, and people were asking us. So, how did they convert the building? They used a bulldozer…”

He also was asked if they would take advantage of the chance to repossess and sell more theatres if they could, and said yes.

This makes strategic sense; EPR wants to reduce its fractional theatre exposure (now 41% of base rent). It also makes tactical sense; EPR proved able to sell their theatre properties at a 6% cap rate on the Net Operating Income (“NOI”) they were producing for EPR as theatres.

The properties they acquire come in at cap rates of around 8%. This makes it accretive to shareholder value to sell theatres and buy something else.

But perhaps Regal pays as little attention to the value of the theatre properties they lease as they apparently do to the current film slate. We view this as unlikely but suppose Regal rejects the lease and EPR takes the theatres back.

What happens then?

After reviewing the basic EPR business model and gaining some context from recent history, we can look at a model assuming that EPR repossesses all Regal theatres.

EPR Properties – A Simple Summary

It is worth emphasizing that EPR has a stellar balance sheet and a history of managing it well. There is no risk of bankruptcy for EPR. The issues are earnings and dividends in the near term.

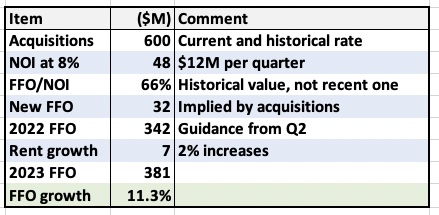

In the REIT business, what drives growth is increasing the number and value of the properties you hold. EPR is targeting annual acquisitions of $600M.

This reflects a certain group of people doing the work to find, underwrite, and acquire new properties. The number is not easily moved, although the outcome fluctuates from year to year.

EPR buys at a cap rate (the ratio of Net Operating Income, or NOI, to price) of 8%. Their base model for growing Funds From Operations, or FFO, works like this:

R. Paul Drake

In the absence of complications, here is how this goes for shareholders. In round numbers, to do $600M in net acquisitions, EPR uses $250M of debt, $50M of retained earnings, and $300M of capital from share issuance. They are and always have been on an external growth model.

The ballpark increase in the share count is between 6% and 8%, depending on stock price. So FFO/share should grow at perhaps 4% from acquisitions.

With a dividend that has run above 6% routinely, that pushes the anticipated total economic return above 10%. This is what we would anticipate if Cineworld retains their current leases. Ten years ago, the total return was higher because there was also ongoing multiple expansion.

Unfortunately, EPR has seen abundant complications since 2017. Looking at these below provides the context from which to build a model for the case that Cineworld rejects the lease and EPR repossesses all the theatres they operate.

The oversimplified summary is this: EPR would lose about $21M per quarter in NOI. In 2021, they were able to sell repossessed theatres at below a 6% cap rate on EPR’s NOI. Assuming they can now get 6.5%, selling all these theatres would produce $1,292M. But the loss of that $21M per quarter would take annual NOI down about 15% first.

Buying new properties at an 8% cap rate would garner an NOI of about $26M per quarter, a 20% increase on the new, lower NOI. But there are two problems with this. It would not quite make up the difference and it would take years to come about.

How this might play out is discussed in the next few sections. Readers with less interest in details may want to skip ahead to the section entitled “Summary and Valuation”.

Context from History

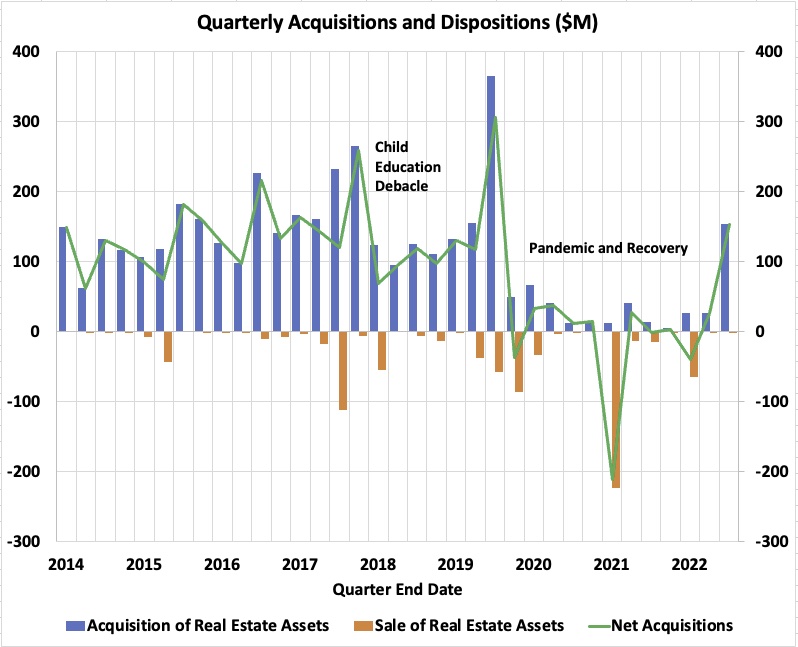

Here is the history of acquisitions and dispositions for EPR, which does little redevelopment and whose development for designated tenants is included in acquisitions:

R. Paul Drake

In the years before 2018, EPR was steadily increasing its annual acquisitions, reaching an average level above $150M per quarter in 2017. Unfortunately, their foray into childhood education facilities proved to be a poor decision with impacts in 2018 and 2019. Then in late 2019, a major theatre acquisition pushed their total for that year back up near $600M.

I did not explore that period just after 2017 in depth. It is clear that they had major issues with some mortgage loans and that this impacted their pace of acquisitions in 2018.

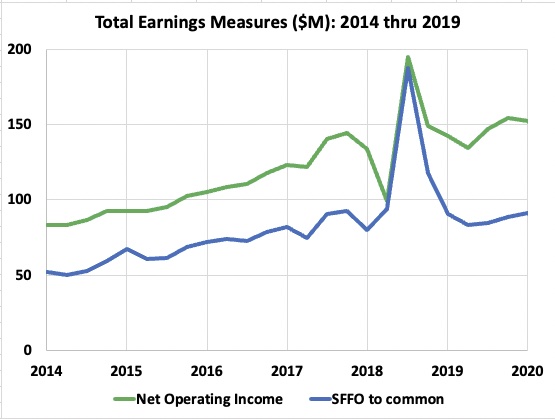

We can see the results in the history of two parameters. These are Net Operating Income, or NOI, and Simple Funds From Operation, or SFFO. Here SFFO (to common) is total revenues less property operating expenses, General & Administrative costs (“G&A”), other operating expenses, interest expense, and preferred stock dividends.

R. Paul Drake

[For REIT geeks: this SFFO comes out pretty close to the NAREIT FFO. EPR also has pretty small recurring capex as is often true of net lease REITs. They also have small straight-line rent. Between these and other factors, the REITbase AFFO comes out pretty close to the SFFO. So we stick with SFFO below.]

Looking at the graphic, what is important here is not the lumpiness in 2018, which reflects big and temporary changes in mortgage income and other operating expenses. NOI and SFFO both increased to new highs in 2019, compared to 2016.

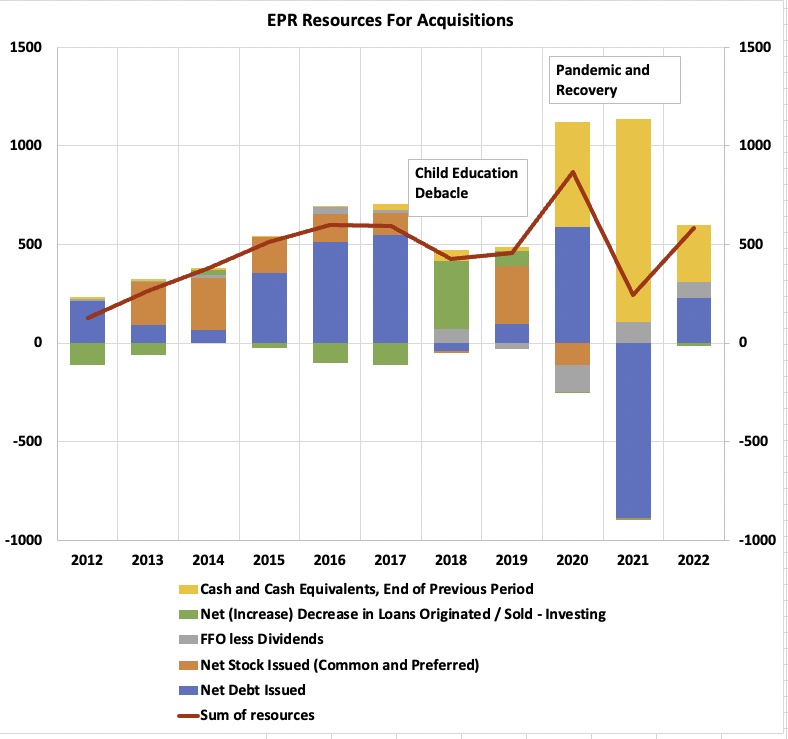

It also matters how a REIT finds the money to fund their net acquisitions. The story for EPR is more complicated than many:

R. Paul Drake

The long-term intent of EPR and most REITs is to use stock issuance, retained earnings, and new debt as the main sources of capital. This was the story from 2012 through 2017.

But in addition, EPR is in the mortgage loan business on top of their property rentals. They loan money to tenants for construction or other reasons.

The mortgage portfolio had a balance of $970M at the end of 2017. In 2018 EPR collected $350M from the payment of loans on ski areas and $70M from payment of other loans.

At the end of 2021, the mortgage portfolio was down to $370M (it includes no loans on theatre properties). On net, the reduction of that portfolio provided resources to support acquisitions in 2018 and 2019.

EPR entered 2020 with about $500M in cash (gold bar). They intended to use this to acquire new properties. But then the pandemic hit.

EPR increased their debt by more than $650M in 2020, just to have cash in case governments forced their tenants to stay closed for a very long time. (This involved a $1B draw from a credit revolver.) They entered 2021 with about $1B in cash but by the end of the year had paid down all that temporary debt.

EPR entered 2022 with nearly $300M in cash and should net about $80M in retained earnings. To meet their guided level of acquisitions for the year, which is $600M at the midpoint, they will need another $245M. My guess is that they will get this by raising more debt, which is what the graphic shows.

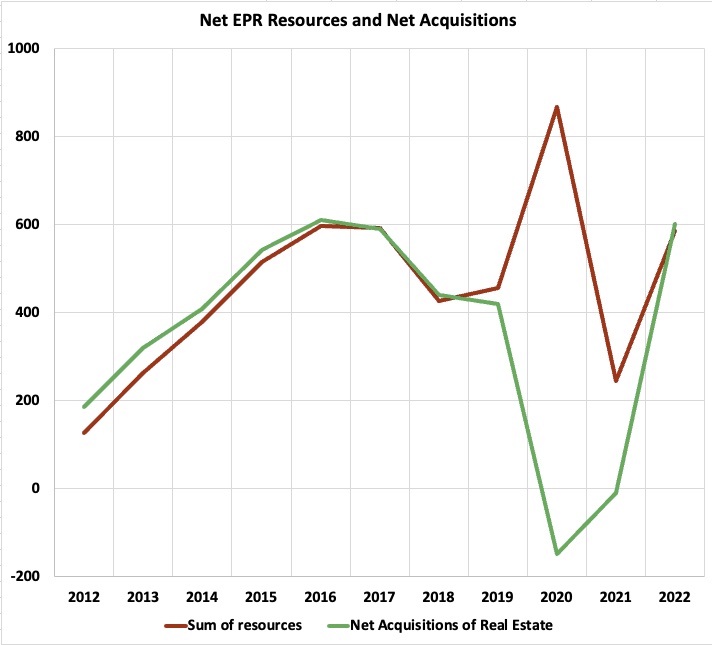

The above discussion informs the history of their net acquisitions of real estate, compared to the resources here:

R. Paul Drake

We can see that resources and expenditures were in close alignment until the gyrations of the pandemic. Going forward, EPR clearly hopes to get back to steady growth like that of the years before 2017 and has guided for $600M in acquisitions this year at the midpoint.

But then we get the news of the Cineworld bankruptcy, another ultimate consequence of the pandemic. Cineworld’s problem is not the viability of their theaters. Looking at their financials, operating earnings have covered rent by more than 3x.

Cineworld’s problem is their debt. If they and their creditors have any sense, they will keep the leases as they are.

If Cineworld is smart, the current shareholders will get wiped out or nearly so. A bunch of creditors will get equity, and the debt load will be much smaller on the other side.

But perhaps the group involved will pull a Toys-R-Us and commit financial suicide, ultimately liquidating the company. EPR would get all 52 of its Regal theatres back. Which might happen anyway if Regal rejects the lease.

What then? Let’s look.

Model Assumptions for Regal-mageddon

This section discusses details of my quarter-by-quarter model of how this could play out. Here are the assumptions that make sense to me for an (almost) worst-case model of how EPR could work through these theatres.

Assume that the payments from Cineworld ($23M per quarter) go away starting in Q4.

Revenues would grow from income from those theatres, as EPR would operate them until they were sold. Assume that the increase in property operating expenses is balanced by those increased revenues. This seems conservative to me.

Here are a few other assumptions:

- Existing rents increase 0.5% per quarter

- G&A remains at the historical 9% of NOI

- Other opex increases 4% per quarter, far larger than historical

- The debt increases as needed to support the acquisitions (see below).

- The average interest rate increases by 0.1% per year. Note that average debt maturities are long.

Assume EPR would market all the properties, though they probably would place some of them with other operators. However, concluding and closing the sales takes time. Assume that the (roughly 52) properties are sold over the four quarters of 2024, 25% in each quarter.

At that Citi conference, Silvers noted regarding theatre sales that “On a cash flow basis, we sold for a sub-six relative to the cash flow that we were enjoying.” Assume a 6.5% cap rate, worse than EPR got in 2021. This will provide $323M per quarter during 2024.

My first model assumed that EPR sustained their rate of $600M per year in acquisitions. They would then use the proceeds from theatre sales to reduce the need to raise cash.

However, this did not get FFO/share back up near the current value within 5 years. EPR would want to deploy those funds ASAP, but there is a limit to how much they can ramp up acquisitions.

My second model, with results shown below, assumes that they manage to push acquisitions up to $850M in 2024 through 2026.

All the assumptions above seem conservative to me, except the target for acquisitions. But to whatever extent they place those theatres with other operators for similar rent the need to push acquisitions up would drop.

There ought to be a fair bit of that. Remember, covering rent is not the issue for those theatres.

The Impact on Earnings

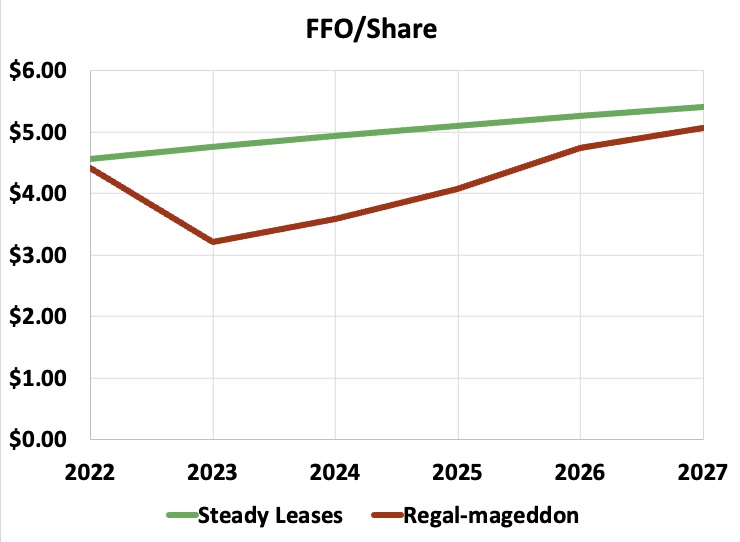

The earnings increase for the case when Regal does not reject the leases was discussed earlier. Now consider earnings for the case with repossession of all the theatres, followed by their sale according to the assumptions just detailed.

To make the calculation straightforward, I assumed that EPR first paid down debt using the proportion of the proceeds equal to the original debt issuance (40% of the property value as a theatre). Then they take on new debt when buying the new properties. This is an obvious oversimplification but should not make a difference on net.

This next graphic shows one way to have that play out in the resources for acquisitions.

R. Paul Drake

In the absence of the theatre sales, every year would look like 2023 and 2027. The reduced share issuance occurs when more cash is available.

However, the benefit is less than one might hope. For a share price of $50 to $70, the difference in total shares issued is only 5 to 7M out of about 100M in 2027.

Summary and EPR Stock Valuation

Comparing the two cases, one with steady leases and the other where EPR gets back all the theatres, here is what happens to FFO/share.

R. Paul Drake

FFO/share would drop to slightly below the present dividend in 2023 if the theatres were all repossessed and sold as modeled. After that, it would climb more rapidly, reaching nearly the value obtained in the case the leases are steady.

All but one of the assumptions above are pessimistic. EPR would manage to quickly place some of the theatres with new operators. In other ways, their earnings would be larger too.

My expectation would be that FFO/share would not drop as much as shown and would recover to higher level than seen here. But the optimistic assumption that is necessary to make that true is for EPR to ramp up their acquisitions to unprecedented levels for a few years.

The result of this story has two parts. One of them is that EPR could recover from the repossession of all the Regal cinemas, followed by their sale. But this would take several years. They have not yet finished closing the sale of the last of the 8 theatres they got back in 2020.

As to valuation, at the current $38 price, the current FFO/share multiple is 8.5. That is just too low. It would price no long-term growth rate on this year’s FFO/share.

But nobody should mistake EPR for a REIT that merits a 20x multiple, either. They cannot grow fast enough.

Assume growth of earnings per share at a rate near 3.1%, roughly representative of the base case above. Taking the growth to be indefinite, and applying a 10% discount rate, one gets an earnings multiple of 15x.

Multiplying the guided 2022 FFO/share of $4.47 times 15 gives you a share price of $67, relevant to the steady lease case. This will go up as FFO/share increases going forward, reaching $81 in 2027.

In the Regal-mageddon case, the FFO/sh in five years comes in $5.07. This would imply a $76 price. The result for both these cases is that the combination of FFO/share growth and a dividend of 8.6% should generate a total return well above 15% over the next five years.

But things also could go worse. And the price may take a good while to move much. The market hates uncertainty, and uncertainty has definitely gone up with the announcement from Regal.

Takeaways

My conclusion is that EPR should not accept a punishing lease renegotiation from Regal and Cineworld. If that is what those parties want, just take back the theatres.

Perhaps more likely, in the event of lease rejection, would be that EPR demands either the same rent or takes the property. This would produce a case intermediate between those discussed above.

The entire saga of EPR illustrates the downside of investing in properties at high cap rates. They are that expensive for good reasons.

Things can and sometimes do go wrong. This hurts returns.

That is why the market prices such REITs at a high dividend yield. At its current rate of $3.30, the EPR dividend still has 36% to go to return to its 2019 level of $4.50.

Seeing this any time soon looks unlikely to me. On any path, it looks like EPR will take about 5 years to push FFO/share to $5. The dividend for 85% of that would be $4.25.

My bottom line is that by holding EPR you will do well within 5 years, and perhaps sooner. You also get paid very well to wait.

What you choose to do with EPR may reflect your own context. One ultimately expects large gains. EPR is a fine holding for our Core portfolio. A Core-Portfolio investor, likely younger, with a time scale large compared to 5 years, could quite sensibly keep accumulating (and especially if the price keeps dropping). Paul, as a retired investor, prefers positions that seem more likely to produce gains sooner. But selling at a loss would not make sense. There are no grounds for desperation.

Be the first to comment