Nebasin/iStock via Getty Images

As I said in a previous article a few weeks ago, I’ve been trying to understand the younger generations. Millennials, yes, but Gen Z especially.

Based on their age alone, they can make the most out of the stock market. And I want to help them do it.

That’s why I was browsing through Spaces the other day – Twitter’s (TWTR) new feature that allows groups to have audio conversations. There have been some great discussions there that I’ve seen (or heard).

Maybe I’ll share about them some time. But for now, it was one parting line that really captured my interest: “Let’s go shake the 8 ball.”

First, I’ll admit it made me laugh to myself. And then it made me wonder: Is the Magic 8 Ball making a comeback?

As far as I remember, the toy was popular in the 1960s but didn’t have its real heyday until the 1980s – right along with turtlenecks, Kool-Aid, and mixtapes.

Regardless, I do understand the sentiment. There’s something to be said about holding the answers in your hand.

Will the stock market go up or down tomorrow?

Should you put all your money into a CD?

Are tech companies going to hit their bottom next week, only to bounce “big time” from there?

Wouldn’t we all like to know. Of course, we all know on some level – whether we’re Gen Z or Gen X like I am – that it isn’t that simple.

If only it could be.

You Deserve Better Than a 50-50 Shot at a Positive Answer

Here’s something I’m not sure I knew about the Magic 8 Ball (or at least I can’t remember if I knew)…

It holds 20 different possible answers. According to Wikipedia, 10 of them are positive, five are negative, and the rest are inconclusive. They read as follows:

- It is certain.

- It is decidedly so.

- Without a doubt.

- Yes, definitely.

- You may rely on it.

- As I see it, yes.

- Most likely.

- Outlook good.

- Yes.

- Signs point to yes.

- Reply hazy, try again.

- Ask again later.

- Better not tell you now.

- Cannot predict now.

- Concentrate and ask again.

- Don’t count on it.

- My reply is no.

- My sources say no.

- Outlook no so good.

- Very doubtful.

I would argue that some of those positive ones (the first 10) are pretty inconclusive. I mean, “Signs point to yes?” I’m not sure if I would stake any bets on that.

But that’s just me personally. Maybe you’re different. Maybe you don’t mind making decisions based on “probably.”

Now, I’ll be the first to admit – as I always do – that there is no such thing as a definitive yes when it comes to any one individual stock. In fact, I’m not even going to promise you that putting your faith, trust, and money into a well-diversified collection of safe and sound dividend stocks is a guaranteed way to be rich and ready for retirement.

Magic 8 Balls are for fun. And the kind of crystal balls portrayed in movies and media don’t exist.

But there are better answers we can get than “Signs point to yes” or even “As I see it, yes.” There are stocks out there that don’t have to rely on opinions at all – whether mine or anyone else’s.

I’ll Take a Blue-Chip REIT Over a Magic 8 Ball Any Day

These stocks have already proven themselves over and over and over again until you really can practically rely on them.

By that, of course, I’m talking about blue-chips.

Blue-chip real estate investment trusts, or REITs, specifically. As I explained in The Intelligent REIT Investor, “… those who are less adventurous with their money can consider turning to the stalwarts of REITdom.”

The stability they offer is a beautiful thing considering the turn the markets have taken, where – all of a sudden – as one Yahoo Finance headline stated: “Wall Street is finally getting the Fed’s message on interest rates…”

In other words, they’re going down, no longer buoyed by the idea that the Fed will return to easy-cash policies anytime soon. That has a lot of investors nervous, but not me. I know that:

“Just like every other investment, blue-chips are subject to sector-specific ups and downs here and there. However, they deliver consistently rising growth in FFO [funds from operations], dividends, and asset value over reasonably long periods of time.

Because they’re financially strong and widely respected, they also tend to have access to additional equity and debt capital that can fuel above-average growth. They rarely provide the highest dividend yields or even necessarily the best total returns. And they’re not usually the type to trade at bargain prices. However, they are the type that provide years of 7%-8% total returns, on average, with only modest risk. “

As such, they offer much better odds than any Magic 8 Ball can. In fact, they offer much better odds than most any other investment you might make.

Even in a market like this.

Alexandria Real Estate (ARE): Outlook good

ARE is a Life Science REIT that owns around 426 properties with GLA of 47.4M square feet, and the occupancy of this space at the latest quarter was 94.7%.

The company has some extremely strong companies that aren’t going anywhere occupying the top of its ABR list. These include Bristol Myers Squibb (BMY), Moderna (MRNA), Eli Lilly (LLY), Sanofi (SNY), and Takeda Pharma (TAK).

ARE began by focusing only on life science and tech, and then further by leasing significant amounts to only the best in the business, and then even more by diversifying to where its top tenant, BMY, is less than 3.6% of the REITs total ABR.

ARE has been able to generate double digit same store rent growth in each of its last 10 quarters.

This is an amazing feat and these rising rents, combined with ARE’s ~95% occupancy ratio, has allowed the company to generate strong fundamental growth in quarters.

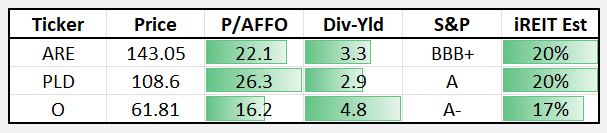

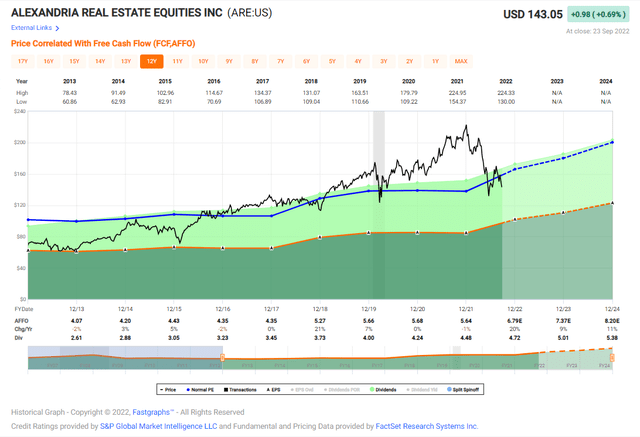

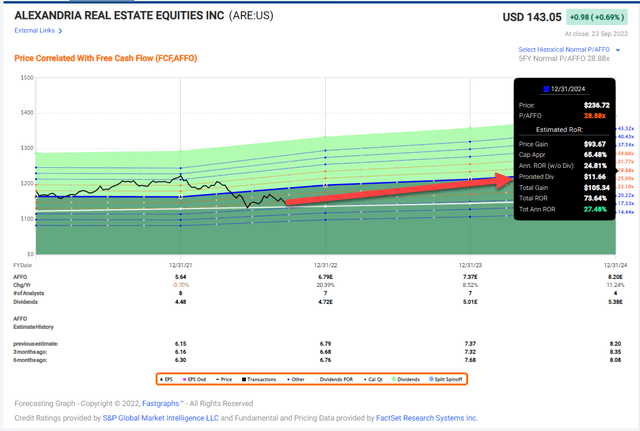

ARE’s AFFO is expected to rise by roughly 20% during fiscal 2022 and this, combined with the company’s recent sell-off (ARE shares are down by 35.1% on a year-to-date basis) is resulting in the cheapest forward P/AFFO ratio that we’ve seen attached to ARE in many years.

ARE’s 5-, 10-, and 20-year average P/AFFO ratios are 28.9, 23.5x, and 21.5x, respectively.

Looking at the stock’s current share of $142.07 and our current estimate for 2022 AFFO of approximately $6.80/share, we see a forward P/AFFO ratio of 20.9%.

This represents a 27.7% discount to the stock’s 5-year average.

What’s more, the ~20% AFFO growth that we expect to see this year, as well as the ~10% AFFO growth that we expect to follow in 2023 and 2024, are all above ARE’s long-term average growth rates.

Therefore, it’s reasonable to conclude that ARE should be trading at a premium to its historical averages today, not a discount.

Relative to today’s prices, that represents an upside potential of approximately 19%.

When you factor in mean reversion to that 25x level, AFFO growth, and the stock’s steadily growing dividend into future growth expectations, we’re looking at a 20%+ total return CAGR opportunity over the next couple of years.

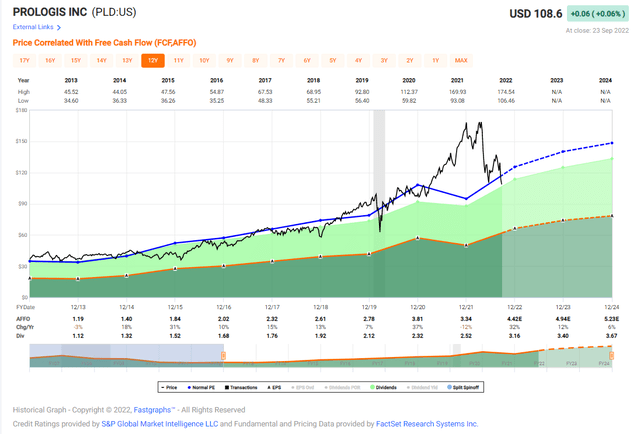

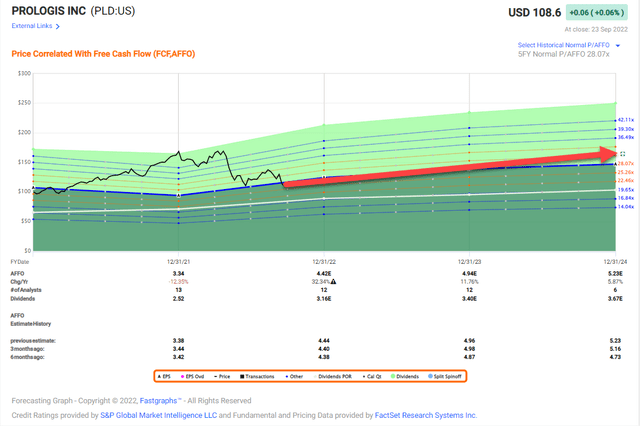

Prologis, Inc. (PLD): You may rely on it

PLD is an industrial REIT that was founded in 1983 and owns over 1 billion square feet of space on four continents (19 countries). On July 13th, the company announced it was merging with Duke Realty (DRE) in a deal in a $26 billion all-stock transaction.

PLD noted it plans to hold about 94% of Duke’s assets and will divest assets in one key market. The deal adds 1,228 acres to PLD’s land bank and 165 million square feet of industrial assets. Duke’s buildings have a 98.4% occupancy ratio, so the move will provide reliable cash flows from the start.

The merger also provides PLD with nice exposure to markets in the Southeast, the New Jersey coast and Southern California.

The company also has a significant “wide moat” cost of capital advantage, which is reflected in iREIT’s perfect “100” quality score and A-ratings from two agencies (Moody’s and S&P).

PLD’s balance sheet remains strong with 4.9x Debt/Adj. EBITDA excluding development gains (+20bps q/q). During Q2-22, PLD and its JVs issued $5.1B of debt at a weighted average interest rate of 1.4% ($4.0B refinancing/$1.1B new issuances) and the company has $5.2B in cash and availability.

Shares are now trading at $108.60 with a P/AFFO multiple of 26.3x (in-line with normal) and a dividend yield of 2.9% (71% payout ratio based on AFFO). Analysts are forecasting average growth (based on AFFO per share) of ~12%in 2023, which translates into our total return estimate of 20% per year.

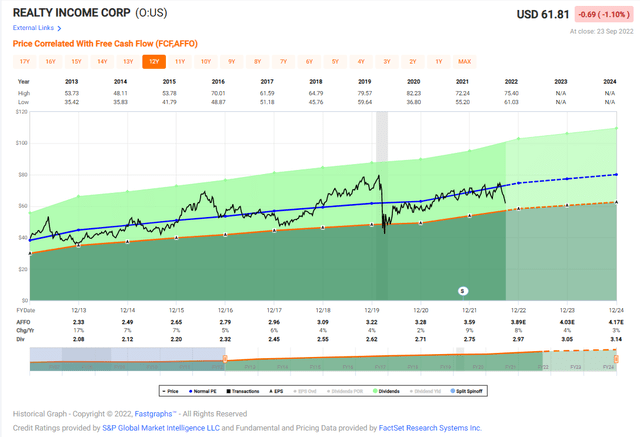

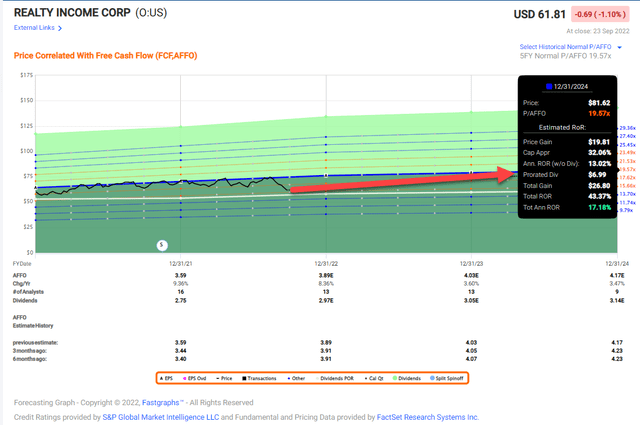

Realty Income (O): Without a doubt

O is a net lease REIT that owns 11,427 commercial real estate properties in 50 states and Europe. The company has been known for owning top notch real estate in the U.S. and in recent years the company has taken advantage of this expertise, combined with low rates across the Atlantic, to build out a European portfolio as well.

At the end of the second quarter, O owned more than $5 billion worth of European real estate investments, increasing its overall diversification.

Overall, 43% of Realty Income’s tenants carry investment grade credit ratings, providing peace of mind during markets like this when more and more investors are talking about an impending recession.

O also maintains a fortress balance sheet (A3 with Moody’s and A- with S&P) – one of only seven S&P 500 REITs with A3/A- ratings or better. This means that the company has significant liquidity ($3.25 billion) and low borrowing costs that support enhanced financial flexibility.

With all of that in mind, you’d think that the market would be willing to pay a premium for O shares; but, as you can see below, O is currently trading at a discount to its long-term average P/AFFO multiple.

Realty Income shares are down by ~12% during the last month and this sell-off has pushed the blended P/AFFO ratio attached to shares down to 16.2x, compared with the normal P/AFFO multiple of 18x.

The dividend yield is 4.8% and well-covered. We maintain a BUY with a 12-month Total Return forecast of 17%.

In Closing…

I hope you enjoyed my “shake the 8 ball” article and always remember that with dividend paying stocks, especially REITs, there’s no need to “shake the ball” and guess, because when you own shares in these highly predictable stocks…

“Signs point to yes”.

As always, thank you for reading and commenting!

I can assure you, once you begin investing in dividend growth stocks, you will never want to shake the 8 ball again.

iREIT

Be the first to comment