diegograndi/iStock via Getty Images

Investment Thesis

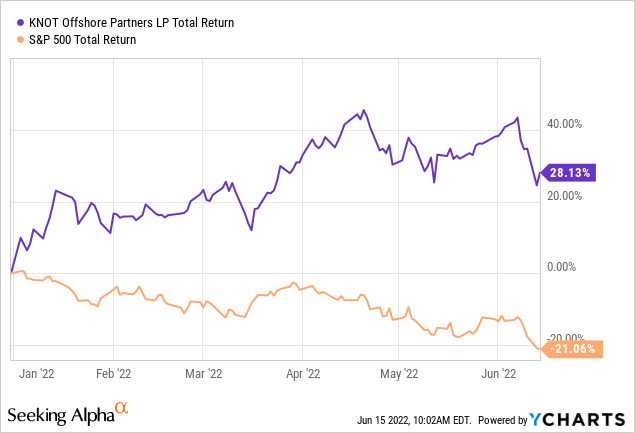

KNOT Offshore Partners LP (NYSE:KNOP) is an income stock that generated a total return of 28% YTD compared to a loss of 21% of the S&P 500 and the general downturn of the market.

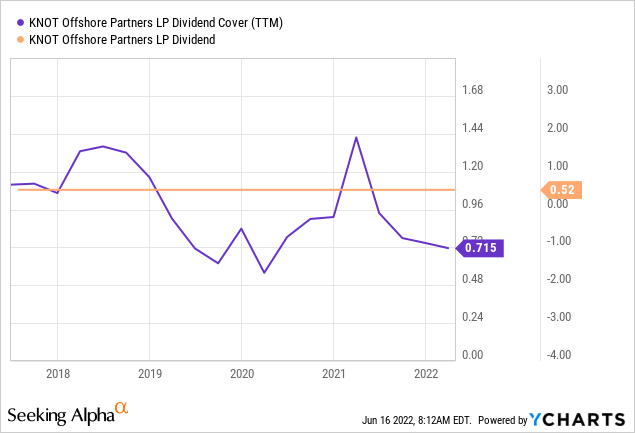

The company has distributed a consistent dividend of $0.52 per share for the last 27 quarters, currently yielding 12.5%. However, its distribution coverage ratio has fallen to 0.7x in the MRQ from 1.28x in Q4 2021 and 1.2x in Q1 2021, primarily because of the scheduled drydocking of its 3 vessels, which adversely affected the company’s financial statements. The company expects to carry out 3 more drydocking in Q2 and overcome the negative effects of drydocking by the second half of 2022.

Considering that its fleet utilization rate, including the scheduled drydocking, was 99.7%, I expect the company to bounce back from this slump and continue its normal trajectory of being a worthwhile shipping industry long-term investment stock.

Liquidity & Distributions

DNV reports that there are at least 22 new oilfields under development in the probable or the discovery phase worldwide, with indications of as many as 14 FPSOs to be installed by 2023. This is in line with my previous coverage of estimates portrayed by Rystad Energy which forecasted strong growth in the shuttle tanker market, signifying a solid availability of the market demand that KNOP may be able to leverage, as it is a major player in the global shuttle tanker market, accounting for almost 17% of the 102 shuttle tankers in service globally.

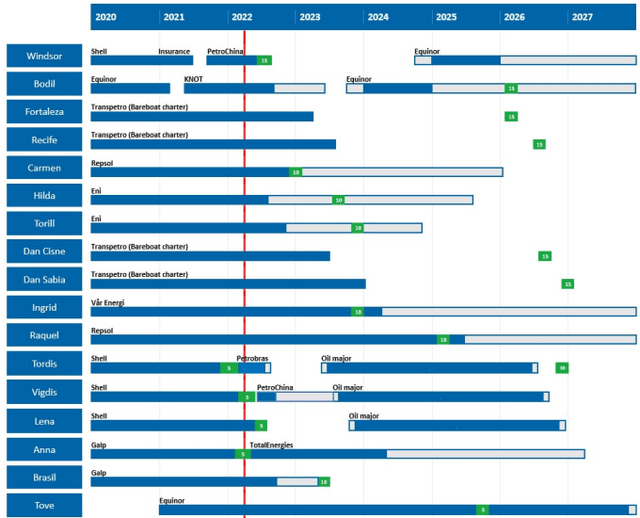

The global oil market is shaken amid the Russia-Ukraine situation, but KNOP isn’t affected by short-term oil price and volume volatility as it generally deals in medium to long-term time charters with average remaining charters of 1.8 years and options to extend these by a further 2.4 years on average by the MRQ. These contracts have a forward contracted revenue of $594 million (excluding options), up 6% QoQ, the majority of which is set to be realized before 2027.

The recent financial statements were underwhelming because of the sequential decline in its revenue, which may indicate stunted growth to investors, but as aforementioned, it is exclusively because of scheduled drydocking for the repair & maintenance of 3 vessels. This R&M activity also consumed significant cash, leading to the company’s cash reserves suffering a net reduction of $21 million, closing in at $41.3 million in the MRQ.

Even though KNOP’s free cash flow per share of $0.47 in the quarter fell from $1.13 in the previous quarter, and its earnings yield of 10.76% was not enough to cover the dividend, its levered FCF margin of 48.8% is over 6.5 times higher than the industry median, and its free cash flow yield of 21.92% is ample enough to cover its dividend yield of 12.5%, resulting in an FCF yield to dividend yield ratio of 1.75%. These numbers indicate a supple cash situation, meaning that when the revenues rebound later in the year, its liquidity will move toward a much healthier side, further improving its dividend coverage ratios.

One thing investors should not expect from KNOP is dividend growth, which may be a deal-breaker for some, but its dividend sustainability more than makes up for it, which persisted at the current levels even through the worst parts of the pandemic.

Valuation

Going by the relative valuation metrics compared to the industry medians and its 5-year averages, the stock seems fairly valued, despite the YTD gain. However, KNOP is currently trading at a 6.7% discount to its book value per share of $17.05, at a price of almost $15.9.

The company has improved its book value for the third quarter in a row and expects to further improve it through future acquisitions financed by debt and liquidity. However, in its earnings call, the management has said that the decision will be weighed against its ability to pay dividends, as that remains its utmost priority.

KNOP stock appears reasonably valued for long-term investors looking to earn a solid and safe quarterly dividend while preserving their capital.

Conclusion

The qualitative information about the scheduled vessel drydocking is extremely relevant to the current financial performance and position and always needs to be confirmed to ascertain any positive or negative profitability and growth anomalies.

While important, the dividend coverage ratio should not be considered in isolation to paint a bleak picture of the company but rather seen in conjecture with other financial and liquidity metrics that iterate the company’s solvency position.

With a 60-month beta of 1.02 and a short interest of less than 1%, the stock is a very reliable and low volatility investment, good for preserving capital while generating a consistent quarterly dividend. I expect the company to rebound to its prior financial health once the R&M activities subside in Q2.

Even though the stock may experience some upward volatility, I expect it to keep reverberating between the $15 and $20 per share mark, so growth investors looking for capital appreciation may be well suited to look elsewhere, but income investors interested in maritime stocks should definitely keep KNOP in watchlists.

Be the first to comment