Tonpor Kasa/iStock via Getty Images

The market continues to sell off and the healthcare sector has been hit hard. The small-cap biotech ticker has been crushed with some tickers being down over 90% since February of 2021. As other investors panic, I make a short list of tickers that I have been waiting to buy at a discount or are being overlooked by the market. VBI Vaccines (NASDAQ:VBIV) is in my Compounding Healthcare “Bio Boom” speculative portfolio and is on my shopping list after hitting my Buy Target 1. Typically, I will wait for a reversal setup before clicking the buy button, but the company just announced updated tumor response and overall survival “OS” data from their ongoing Phase II study of VBI-1901 for recurrent glioblastoma “GBM”. As a result, I am confident in the company’s long-term prospects and will hit the buy button during the market’s maelstrom.

I intend to provide a brief background on the VBI Vaccines and VBI-1901’s potential to treat GBM. In addition, discuss why I am willing to buy as the market continues its downward trajectory. Finally, I go over the second half of the 2022 strategy for VBIV.

Background on VBI Vaccines

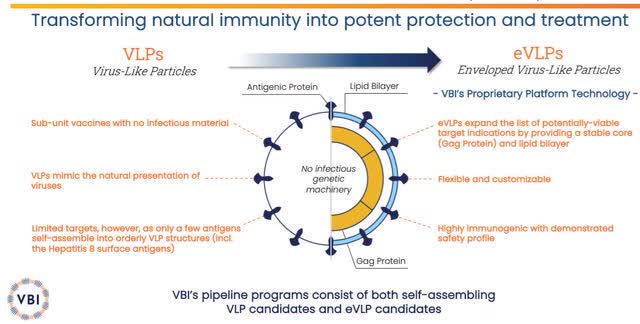

VBI Vaccines is a biopharmaceutical company devoted to augmenting the body’s immune system to prevent and treat diseases. The company’s technology is centered on virus-like particles “VLPs” with their enveloped VLP “eVLP” being able to produce several vaccine candidates that mimic the natural structure of viruses, thus, stimulating the innate immune system.

VBI Vaccines VLPs and eVLPs Technology (VBI Vaccines)

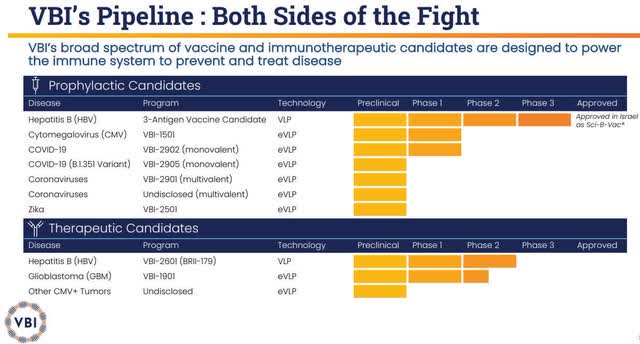

VBI’s pipeline programs are focused on infectious diseases including hepatitis B, coronaviruses, cytomegalovirus “CMV”, and Zika. Furthermore, VBI is taking up hard-to-treat cancers such as glioblastoma “GBM”.

VBI’s Pipeline (VBI Vaccines)

VBI-1901 vs. GBM

GBM is one of the most feared cancers owing to how aggressive it is and lethal it can be. Luckily, GBM is relatively rare with approximately 12K new cases being diagnosed in the U.S. annually. Nevertheless, the present standard of care for GBM is surgery with subsequent radiation and chemo. Despite these invasive and intense treatments, they are normally incapable of removing the whole tumor. This is a major issue because GMB tumors contain an assortment of cell types, so the surviving cells replicate rapidly and the tumor threat returns. Sadly, GBM has a 90% recurrence rate.

VBI is making an effort to take on this problem with their VBI-1901 cancer vaccine candidate. VBI-1901 uses VBI’s eVLP technology to target the gB and pp65 CMV antigens, which are regularly found in GBM and other solid tumors.

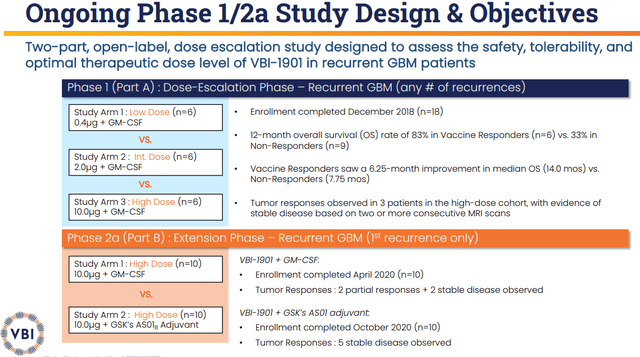

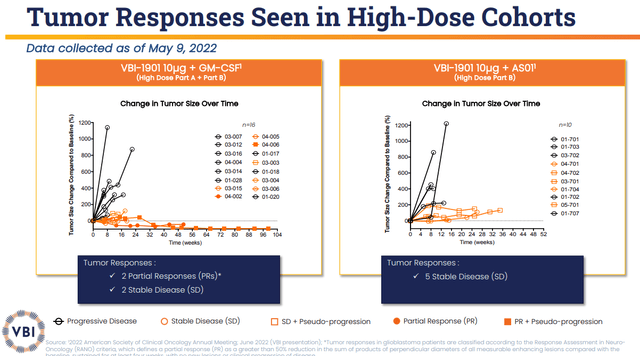

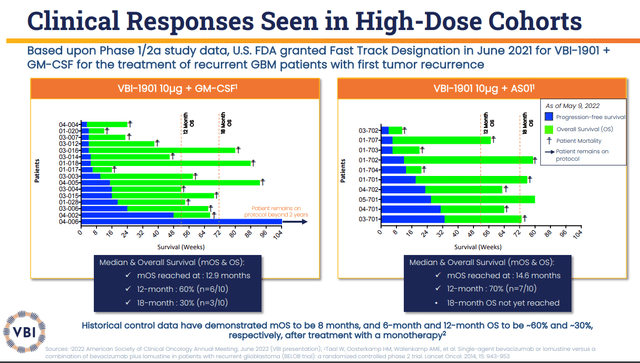

Thus far, VBI-1901 produced impressive data in recurrent GBM patients that showed imposing tumor response and overall survival “OS” data in both arms. The VBI-1901+GM-CSF arm had a 6-month OS of 80% and 60% OS at twelve months. The company reported partial responses and stable disease in a number of patients. The second arm of VBI-1901+GSK’s (GSK) AS01B adjuvant presented an 89% OS at 6 months with stable disease.

The company’s ASCO 2022 data showed that the VBI-1901+GM-CSF arm had two partial tumor responses and five stable disease patients out of 16. This arm had an 18-month OS of 25% (n=4/16). The median OS was 12.9 months, which is a significant improvement from the 8-month median OS for the standard of care. What is more, one of these patients has remained on the protocol for over two years, with a 93% tumor reduction that has been persistent for over 6 months.

The VBI-1901+GSK’s AS01B Adjuvant System2 had five (n=5/10) stable diseases observed with an 18-month OS at 40%. The median OS is at 14.6 months, which is superior to both the VBI-1901+GM-CSF arm and the standard of care.

VBI-1901 Trial Design (VBI Vaccines)

It is important to note that both of these arms beat the historical OS for monotherapy of ~60% at 6 months and ~30% at twelve months. Recurrent GBM patients have a median overall survival of around 13-15 months, whereas these two study arms are producing “an additional survival benefit of nearly six months in comparison with historical control data in the recurrent population after treatment with a monotherapy.” Additionally, the connection between tumor responses and clinical response benefit observed demonstrates that VBI-1901 is having an impact on the tumor, thus, improving patient outcomes.

The Center of the Thesis

Considering the data above, one can see why VBI-1901 has become the center of my bull thesis. It is hard to find another candidate that has this level of impact on the tumor and clinical outcomes… especially one that has the potential to be used in both the recurrent and frontline GBM settings. This potential has provided VBI-1901+GM-CSF a Fast Track Designation by the FDA for first-recurrent GBM. The FDA’s Fast Track program accelerates the review process for candidates in severe or life-threatening conditions. Fast-tracked programs have frequent meetings and communication with FDA to deliberate on the development plan and data necessary for approval. Furthermore, Fast-Tracked programs are eligible for Accelerated Approval, Priority Review, and/or Rolling Review, which could cut VBI-1901’s timeline to potential approval.

VBI is looking to move VBI-1901 into the next phase of development in recurrent GBM in Q3 of this year. The company is looking to increase the number of patients in their ongoing study and will add a control arm. Moreover, the company is looking to move VBI-1901 into a Phase II adaptive platform “INSIGhT” investigational trial for the frontline setting in GBM in Q4 of this year. The company believes the data from these studies could support accelerated approval.

To recap, VBI-1901 has produced impressive tumor responses and clinical marks in one of the hardest-to-treat cancers. Looking at the figures below, we can see the stark difference between responders and non-responders.

VBI-1901 Tumor Responses (VBI Vaccines)

VBI-1901 Clinical Responses (VBI Vaccines)

If the data holds up, VBI-1901 could be one of the only treatment options for GBM in the frontline and recurrent settings. It is possible VBI could succeed where many others have failed to make VBI-1901 a potential trailblazer that could turn into a blockbuster candidate.

Indeed, I am not claiming that VBIV’s bull thesis is solely based on VBI-1901. In fact, the company should be recording significant revenue from its hepatitis B vaccine that is now approved in the European Union/European Economic Area, the United States, and Israel. The company also has COVID-19 & coronavirus vaccine candidates, as well as an HBV immunotherapeutic in the pipeline. However, most of these other pipeline programs would be entering a relatively crowded market with potential competition not far behind. On the other hand, VBI-1901 would essentially be one of the first therapeutics for GBM and could be one of only a few contenders in the GBM treatment market that is projected to hit $4.2B in 2028. Even if VBI-1901 was only to claim 1% of that market, it would still pull in $42M. VBIV’s market cap is currently ~$211M, so $42M would be a 5x price-to-sales, which is the industry’s average. So, we can say that even a lackluster commercial performance from VBI-1901 could justify the stock’s current market cap.

Therefore, VB-1901 has become the center of my VBIV bull thesis.

Risks To The Thesis

Of course, my thesis could be ruined by a number of events or conditions. First and foremost, the company only has roughly $101M in the bank to fund the company and its commercial efforts. If their hepatitis B vaccine fails to gain traction in the U.S. and Europe, we could see VBI begin to throttle its pipeline efforts in order to support commercialization efforts. VBI cannot afford for VBI-1901 development to slow down or come to a halt due to the threat of growing competition that has GBM orphan drug designations. I am keeping a close eye on Kazia Therapeutics (KZIA) with their paxalisib and Kintara Therapeutics (KTRA) with their VAL-083… both of which have orphan drug designations and are in similar stages of development. If VBI-1901 can’t win the foot race to approval, they will have to convince the FDA that VBI-1901 offers a clear benefit and improvement over existing products. Otherwise, VBI-1901 might be barred from launching the product for seven years. Obviously, this would crush my VBI-1901 thesis and would force me to reevaluate my VBIV position.

Considering these risks, I still see VBIV to be a speculative investment and will remain in the Compounding Healthcare Bio Boom Portfolio.

Strategy

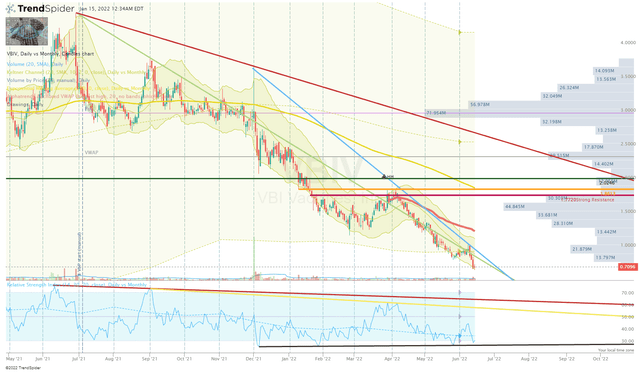

As I projected in my previous VBIV article, the market continued to grind VBIV down over the year despite several victories including their hepatitis vaccine being approved and launched in new territories.

VBIV Daily Chart (Trendspider)

I believe the market will continue to hyper-fixate on the company’s hepatitis B and coronavirus vaccines and will overlook VBI-1901’s clinical progress and commercial potential.

Consequently, I am going to stick to a cost-average approach by making minuscule periodic investments over the course of the next few years. However, I will increase share sizing if the share price drops below $0.50 per share to take advantage of the discounted price.

Indeed, like the rest of my other Bio Boom tickers, I will be looking to book profits on spikes in the share price in order to transfer my VBIV position back into a “house money” state.

The goal is to achieve a “house money” position after hitting Sell 2 and book profits at Sell 3, but still have a small core position for a longer-term investment. I still intend to maintain a VBIV position for at least ten years in order “to give VBI-1901 enough time to get close to peak sales.”

Be the first to comment