R.M. Nunes

I am cautious on real estate funds like the iShares U.S. Real Estate ETF (NYSEARCA:IYR) as implied capitalization rates have only reverted back to 2020 levels while economic conditions continue to worsen and long-term treasury yields trade near decade highs.

Investors are encouraged to keep up to date with developments in the private REIT space, as the recent redemption gating of Blackstone’s gigantic $125 billion REIT could ripple through the real estate markets in the months to come.

Fund Overview

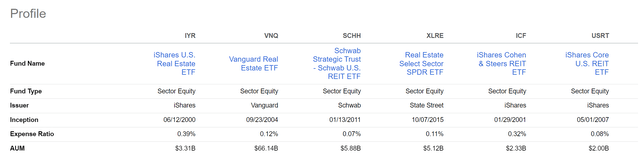

The iShares U.S. Real Estate ETF provides exposure to companies that operate in the real estate sectors and REITs. IYR is one of the larger ETFs focused on real estate and has been in existence since 2000 (Figure 1).

Figure 1 – IYR and peer funds (Seeking Alpha)

Public Real Estate Equities Have Been Hit Hard By Interest Rate Hikes

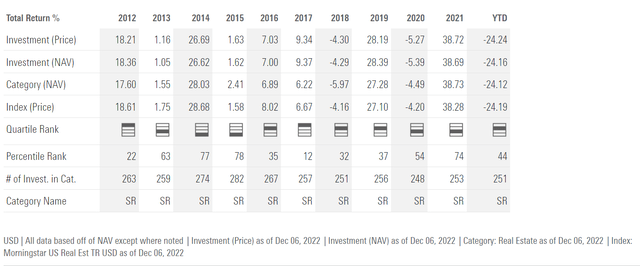

As long-duration assets, real estate valuations are inversely proportional to interest rates. To say the real estate sector has been hit hard by interest rate hikes in 2022 is an understatement. So far in 2022, the IYR ETF has lost over 24% to December 6, 2022, recording the worst annual performance in the past decade (Figure 2).

Figure 2 – IYR annual performance (morningstar.com)

But Private Real Estate Funds Have Held Up?

In the last few days, a couple of interesting news stories have caught my eye regarding private real estate funds. Specifically, on December 2nd, I saw an article on Bloomberg confirming that Blackstone was limiting withdrawals from its mammoth $125 billion (gross asset) private real estate fund (“BREIT“).

According to the article, BREIT allows for up to 2% of assets to be redeemed per month or 5% of assets per quarter, and a recent flurry of redemption requests overwhelmed the fund’s liquidity.

Shortly after the Blackstone news broke, a number of other private REITs also gated their funds, limiting investor redemptions. Notably, these funds included the $26 billion net asset value Starwood REIT (“SREIT”), owner of one of the largest multi-family property portfolios in the U.S. Blackstone also gated withdrawals from its $50 billion Blackstone Private Credit Fund (“BCRED”) for similar reasons.

Spot The Odd One Out

Investment funds limiting withdrawals during a bear market is not unusual, since there is an inherent liquidity mismatch between illiquid real estate assets and investors’ desire for monthly liquidity.

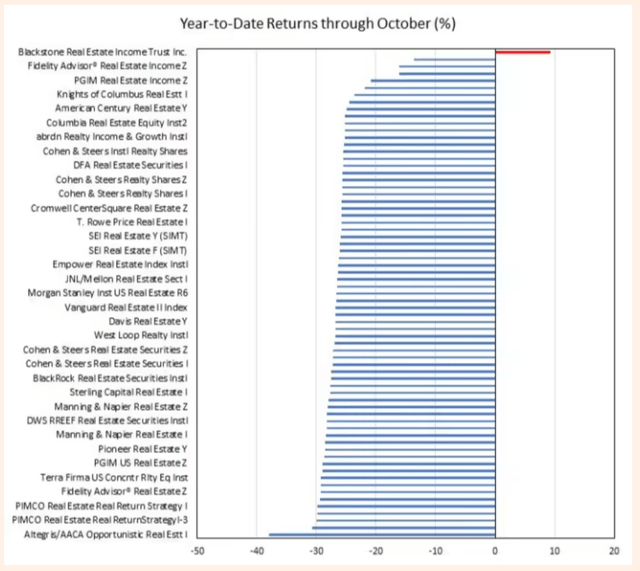

What is unusual with respect to BREIT is that while public real estate funds have suffered massive drawdowns YTD, BREIT has been reporting a fantastic 2022, with the fund returning 9.3% YTD to October (Figure 3)

Figure 3 – BREIT have bucked the trend? (Financial Times)

Periodic-Appraisals Hide The Damage

The key difference between public and private REITs is that while public REITs trade every day and have transparent price discovery mechanisms, private REITs rely on periodic appraisals for their net asset values, and these appraisals can become stale very quickly.

BREIT’s surge in redemptions could be savvy investors realizing its NAV was marked at inflated levels and were redeeming to monetize the gains before a year-end appraisal that could true-up the fund’s NAV much lower.

Implications For IYR

“Ok,” you might say, “that’s an interesting news story, but what does it have to do with me and IYR?”

There are a number of implications for the financial markets and public real estate funds like the IYR. First, investment funds don’t gate redemptions when things are going well; it is usually an act of last resort. Gating redemptions is a death knell for asset managers as investors quickly lose trust in their management. For BREIT to gate its redemptions, it must mean that they have run out of assets that can be readily liquidated, highlighting a large gap between buyers and sellers in illiquid real estate assets.

Second, gating by a few funds can spark a cascading wave of selling in the asset class as investors redeem from other similar funds that have yet to gate redemptions, forcing them to sell assets to raise cash. Since ultimately the IYR ETF owns companies that operate real estate assets, forced selling of these assets could negatively impact IYR.

Finally, on the positive side, investors could be redeeming from private REIT funds and reinvesting the proceeds into public REITs like the IYR ETF to capture the wide 30-40% YTD return gap.

Canaries In The Coalmine?

A more sinister take on the whole situation is that the gating of BREIT and SREIT could be similar to the collapse of the two Bear Stearns hedge funds in 2007 that heralded the beginning of the Great Financial Crisis.

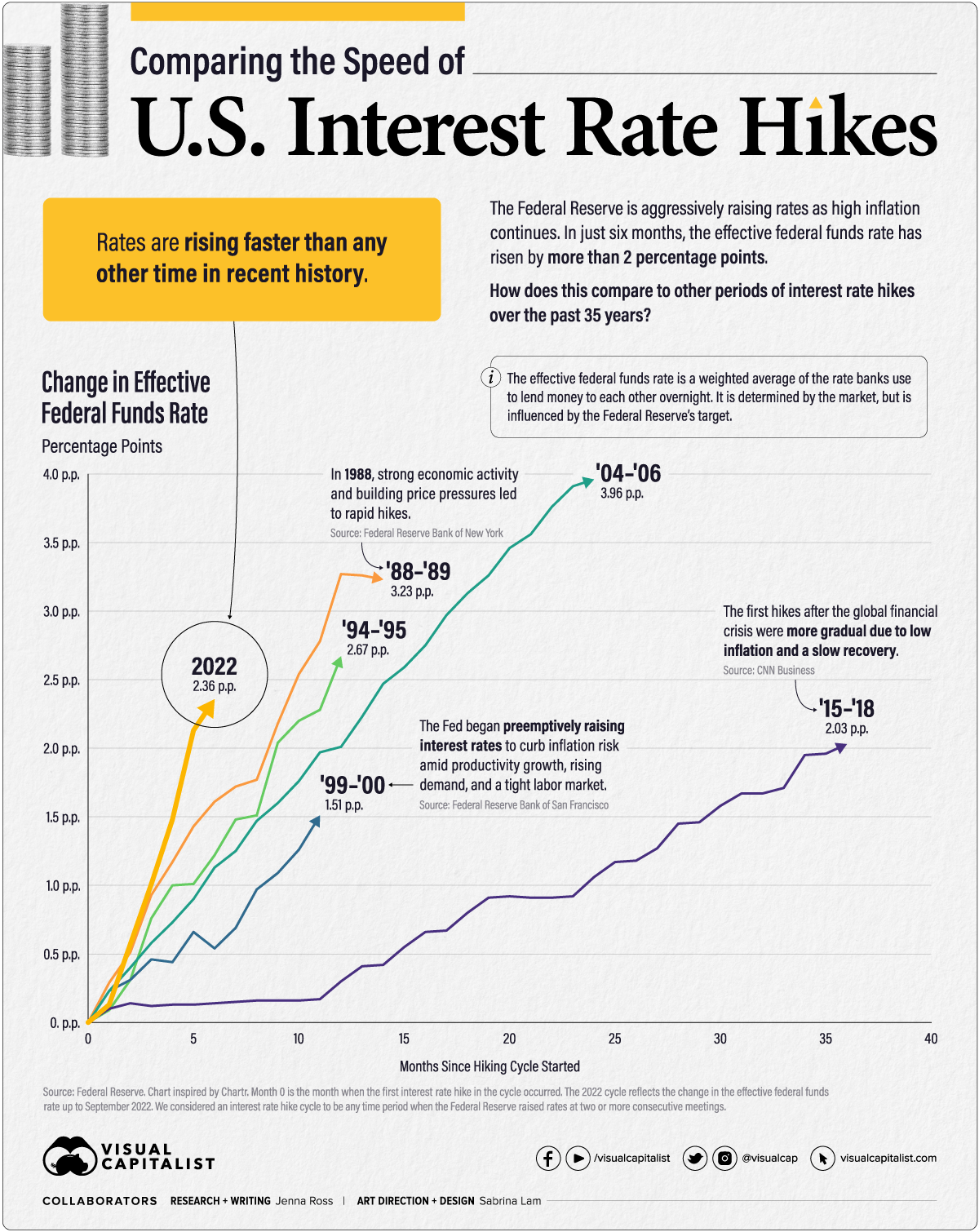

Clearly, stresses have been building in the financial markets in the past few quarters as the Fed embarked on the fastest pace of interest rate increases in history (Figure 4). Could we now be seeing the next phase of the 2022 bear market as real estate assets start to crack?

Figure 4 – Fed have raised rates at fastest pace in history (Visual Capitalist)

Risk

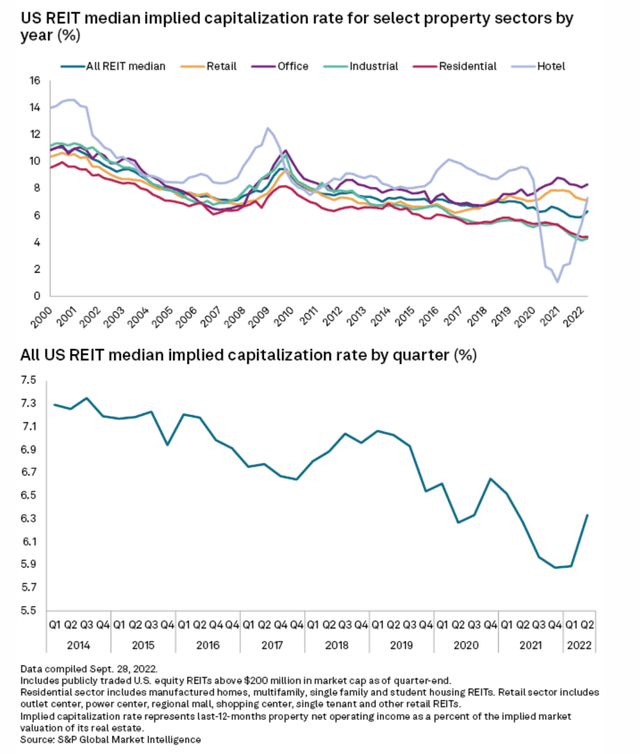

While IYR’s 24% YTD decline has been eye-catching, if we look at the implied capitalization rates for REITs, we can see that valuations are only back to 2020 levels (Figure 5).

Figure 5 – REIT implied cap rates only back to 2020 levels (spglobal.com)

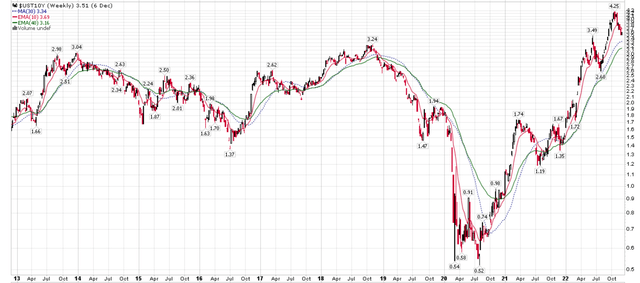

This is in stark contrast to long term treasury yields which have risen to decade highs (Figure 6).

Figure 6 – US 10 year treasury yields at decade highs (stockcharts.com)

Since cap rates and treasury yields are highly correlated, I believe there is still significant upside to REIT implied cap rates as the economy continues to deteriorate heading into 2023, and downside for the IYR ETF.

Conclusion

I am cautious on real estate funds like the IYR ETF, as implied cap rates are still near multi-year lows while long-term treasury yields have risen to decade highs. Investors are encouraged to keep up to date on developments in the private REIT space, as the recent redemption gating of Blackstone’s BREIT and Starwood’s SREIT could ripple through the real estate markets in the months to come.

Be the first to comment