kynny/iStock via Getty Images

KLA (NASDAQ:KLAC) held its 2022 Investor Day Event on June 15, providing an impressive array of slides detailing its business performance for 2021 and outlook to 2026.

There are important takeaways from these types of events, which are jampacked with flashy graphics, charts, and positive hyperbole geared to pumping up investors and analysts. My intentions with this article are to probe deeper and add granularity, particularly against competitors that KLAC presentations didn’t disclose.

Process Control Sector

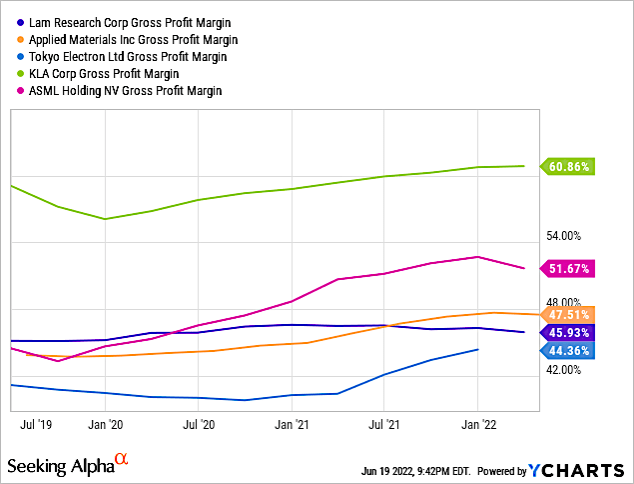

According to KLA President Kahn, KLA’s process control revenue outgrew WFE, growing at 19% from 2018 to 2021 compared to 15.8% for the WFE sector. Chart 1 shows KLAC’s revenues between 2010 and 2021. It also shows its market share reaching 54.4% in 2021, according to our report entitled “Metrology, Inspection, and Process Control in VLSI Manufacturing.”

Chart 1

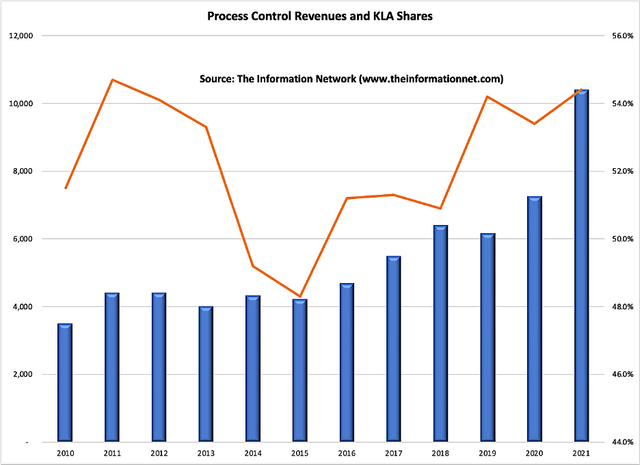

Kahn noted that KLAC’s share was more than 4x its nearest competitor and essentially achieved the team’s 2023 target of 53.5% share two years early. Chart 2 shows KLAC’s share and that of the next five competitors.

Chart 2

KLA focuses on the reticle inspection segment of process control, which is a $800M-$1.2B market with KLA having a >70% share. Perhaps it’s a matter of definition, but although I agree about the size of the market, I disagree with KLAC’s share of >70%. My analysis points to KLA’s share at 40%-50%, behind Japan’s Lasertec.

Share by Country

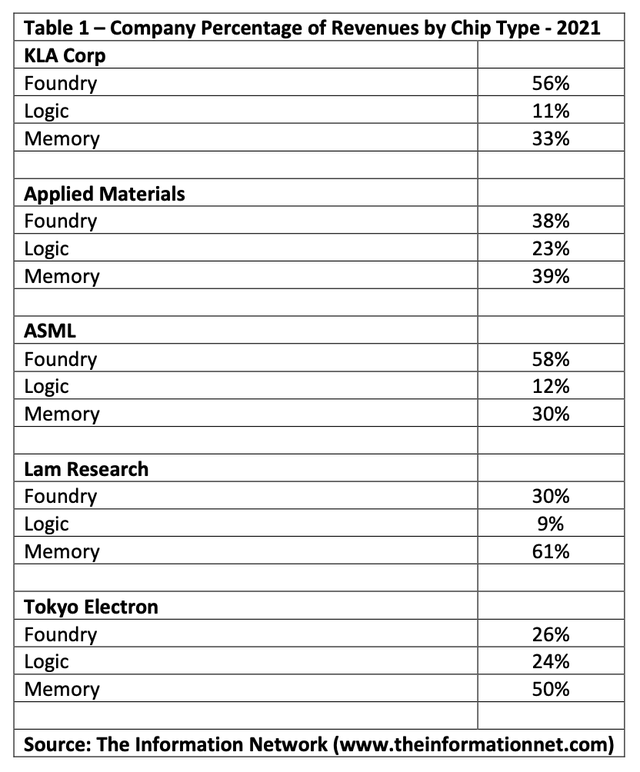

KLA’s CFO, Bren Higgins reported that the company expects a WFE mix of 55%-60% foundry/logic and 40%-45% from memory. In Table 1, I present KLAC’s revenue and peers by country for 2021.

Thus, Higgins expects memory to increase from 33% of revenues in 2021 to 40%-45% in 2022. Foundry/logic is expected to decrease from 66% in 2021 to 55%-60% in 2022.

For not only KLAC but the other companies listed in Table 1, their revenue is dependent on customers capex spend. For example, Micron (MU), Samsung Electronics (OTC:SSNLF) and SK Hynix (OTC:HXSCL) have a planned YoY capex spend between -4% and +75% for NAND and -15% and +18% for DRAM for 2022. For 2023, MU has a planned capex spend of +21% for NAND and +21% for DRAM.

Intel (INTC) (logic/foundry) plans a capex increase of 79% in 2022 followed by an increase of 0% in 2023. This strong growth in 2022 is due to new foundries capable of 7nm and smaller nodes.

Samsung’s foundry business plans a capex increase of 13% in 2022 followed by an increase of just 3% in 2023.

TSMC (TSM) (foundry) has a planned capex spend of 42% in 2022 followed by just 5% in 2023.

Investor Takeaway

For KLAC, its large exposure of 55%-60% in foundry that it projects for 2022 will drop in 2023. The catalyst for much of KLAC’s systems sales are the move by semiconductor customers to smaller nodes, where defects on the wafer can have a greater negative economic of more expensive small-node chips than larger nodes.

With capex spending plans of equipment showing no growth in 2023 for foundry and logic, KLAC revenues will be negatively impacted.

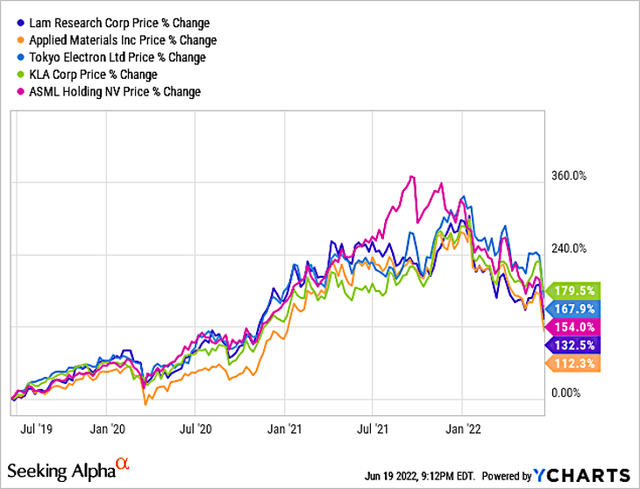

For the past three-year period, KLAC fared best for the five companies discussed in this article, growing 179.5%, with AMAT faring the worst with a three-year growth of 112.3%, as shown in Chart 3.

Chart 3

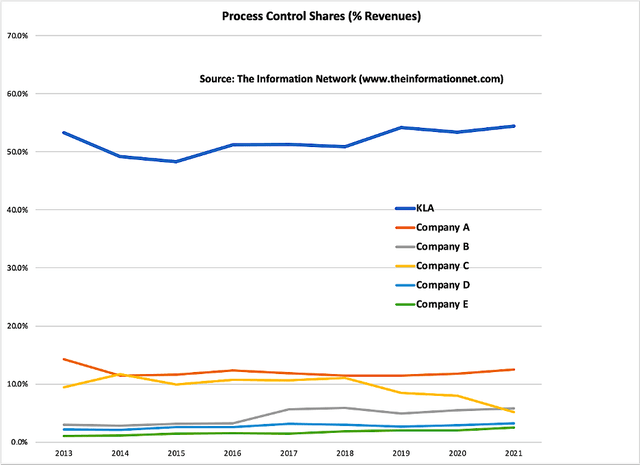

Chart 4 shows Gross Profit Margins for the five companies, with results for KLAC significantly better than peers.

YCharts

Chart 4

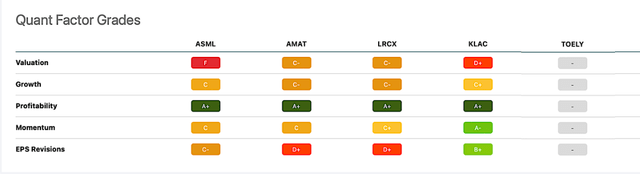

Chart 5 shows Seeking Alpha Quant Factor Grades for the five companies, with KLAC outperforming all peers.

Chart 5

According to Simply Wall St, KLAC at its latest close of $311.93, is trading below its estimate of fair value of $449.44. Currently I rate KLAC a hold, only because of the current macroeconomic and geopolitical situations. It’s the top company I would recommend as a buy once these issues moderate. It’s my top semiconductor pick.

Be the first to comment