Falcor

It’s been a mixed start to the Q2 Earnings Season for the Gold Miners Index (GDX), with a few names reporting solid results but others reporting disappointing results and increases to cost guidance. While Kinross’ (NYSE:KGC) report wasn’t nearly as bad as Newmont’s (NEM) Q2 results, which were affected by some abnormal items, Kinross’ results weren’t great. This was evidenced by rising costs and an increase in cost guidance, impacting the outlook for FY2022 margins. That said, Kinross trades at 3.4x FY2023 cash flow estimates, suggesting the weaker FY2022 outlook already priced into the stock.

Tasiast Operations (Company Presentation)

Production

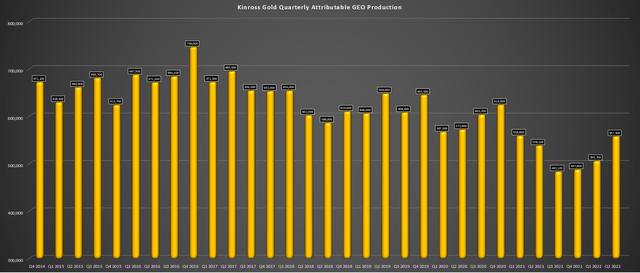

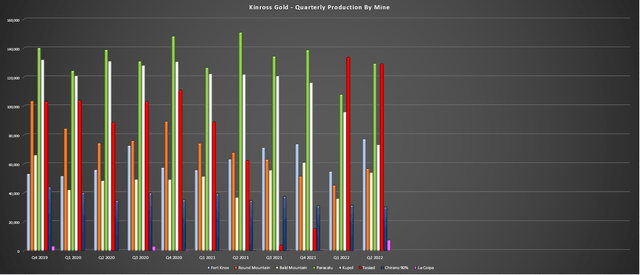

Kinross released its Q2 results last week, reporting quarterly production of ~557,500 gold-equivalent ounces [GEOs] vs. ~538,100 GEOs in the year-ago period, a nearly 4% increase. On a continuing operations basis (adjusting for divestments), production was much lower at ~454,000 GEOs, increasing 19% year-over-year. Although an impressive increase, it’s important to note that this was partially due to the easy year-over-year comps at Tasiast due to the mill fire in Q2 2021. Still, we saw a solid quarter from Paracatu (~129,400 ounces), Tasiast performed quite well with throughput at the 21,000 tonnes per day rate in June, and Fort Knox also had a solid quarter, producing 77,200 ounces.

Kinross – Quarterly Gold Production (Company Filings, Author’s Chart)

Unfortunately, while production increased for the third consecutive quarter on a non-continuing basis in Q2, we will see a sharp decline in production on a sequential basis due to the recent sale of Kupol/Dvoinoye and its Chirano Mine in Ghana. These assets contributed 130,000+ GEOs combined per quarter on a trailing-twelve-month basis, setting Kinross up for much softer production in Q3/Q4. The slower-than-expected mill ramp-up at La Coipa will exacerbate this decline, which would have otherwise picked up some of the slack.

Kinross – Quarterly Production by Mine (Company Filings, Author’s Chart)

The delays at La Coipa and weak quarter (~7,400 GEOs) were related to issues with the pumps and global supply chain challenges, impacting the availability of spare parts. This is simply deferring production, but the delay in the ramp-up to full capacity in Q4 2022 certainly isn’t ideal in a year where it’s seen a significant hit to production from its Kupol/Chirano sales. Fortunately, Tasiast remains on track to complete its 24k Project in mid-2023, providing a more than 10% boost to current throughput levels. Meanwhile, the 34 MW solar plant for the Mauritanian mine should help offset inflationary pressures long-term, potentially saving up to 180 million liters of fuel over the mine life.

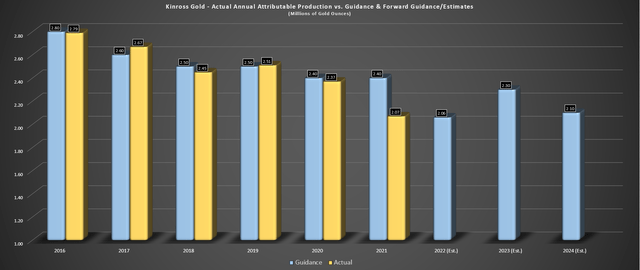

Finally, Kinross has approved its 70% Manh Choh Project in Alaska, which will drive higher production at Fort Knox, adding over 600,000 ounces to the mine life and boosting production to ~400,000 ounces per annum (2024-2027). This will help Kinross maintain a 2.0+ million GEO per annum production profile on a consolidated basis, with the plan being to truck high-grade ore to its Fort Knox mill. Given that this is a high-grade project with two small pits and the utilization of existing infrastructure (tailings, processing facility), upfront capex is modest at just $150 million on a 70% basis.

Overall, the Q2 results left a lot to be desired, but Kinross will benefit from higher grades in the second half of this year and should be able to produce just shy of 2.1 million GEOs this year. The higher production at its two largest assets (Paracatu/Tasiast) at lower costs will boost free cash flow generation. At the same time, La Coipa will provide a more respectable contribution in Q4, assuming it can meet the revised schedule. So, while this was a disappointing Q2 report on top of a very disappointing first half (sale of two solid mines and a phenomenal development project), Q2 2022 looks to be a low point for the company, and the market tends to look forward.

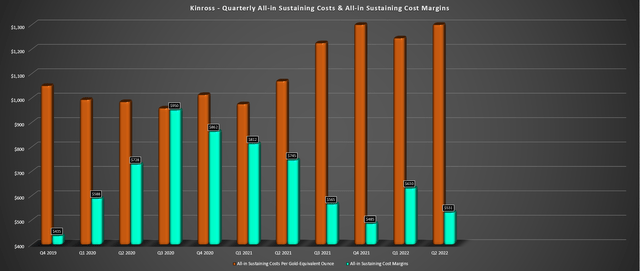

Costs & Margins

Moving over to costs, it was not a great quarter for Kinross. All-in sustaining costs [AISC] rose to $1,341/oz, up nearly 17% from the year-ago period. This was related to the impact of losing lower-cost production from Kupol/Dvoinoye, increased waste stripping, and inflationary pressures (labor, fuel, consumables). Fortunately, Kinross benefited from a higher average realized gold price in the period ($1,874/oz), but AISC margins still dipped 21% to $531/oz (Q2 2021: $671/oz) despite this $50/oz benefit.

Kinross Gold – Quarterly Costs & AISC Margins (Company Filings, Author’s Chart)

On a full-year basis, Kinross has raised its cost guidance to $1,240/oz for FY2022 vs. $1,138 in FY2021. This would translate to a 9% increase in costs related to inflationary pressures and the slower-than-expected mill ramp-up at La Coipa. Even if the average realized gold price manages to come in at $1,815/oz in FY2022 (H1 average: $1,874/oz), this would translate to AISC margins of $575/oz, down from $659/oz last year and $787/oz in FY2020. So, while Kinross’s annual production will be flat year-over-year despite the loss of Kupol/Chirano, this considerable margin compression explains the stock’s poor performance and the sharp decline in net asset value from the discounted sale of the Russian assets.

Fortunately, while margins will pull back sharply in FY2022 unless gold can somehow average $1,900/oz in H2 of this year, we should see an improvement in margins in 2023/2024. Hence, the forward outlook isn’t terrible, assuming the gold price can average at least $1,750/oz in FY2023, allowing Kinross’s margins to move back above $600/oz. Combined with higher annual production, Kinross should see a strong recovery in cash flow generation next year despite the loss of its breadwinner: Kupol.

Financial Results

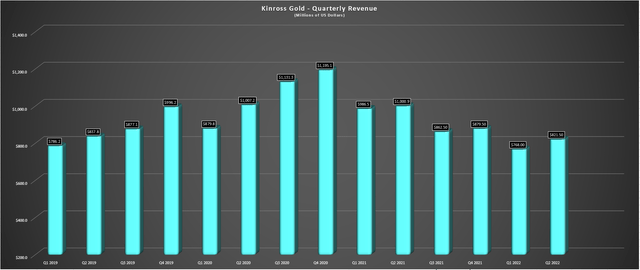

Despite the mediocre operational performance, revenue was up year-over-year (16%) to $821.5 million, benefiting from a higher average realized gold price ($1,874/oz vs. $1,814/oz) and relatively easy year-over-year comps. However, quarterly free cash flow dipped to $107.7 million (Q2 2021: $182.8 million), affected by the sale of Kupol. Free cash flow improved by 12% on a continuing operations basis, though this was due to the benefit of much lower capital expenditures in the period. While the company is tracking behind schedule on capex, Kinross expects to meet its FY2022 guidance of $850 million, suggesting significantly back-end-weighted spending ($250 million spent year-to-date).

Kinross Gold – Quarterly Revenue (Company Filings, Author’s Chart)

Fortunately, with the sale of Kupol ($300 million in cash upfront), Kinross was able to pay down $120 million of debt and has another $225 million coming to it in Q3 from the sale of Chirano. This should help reduce net debt to ~$1.5 billion by year-end ($1.9 billion currently), and Kinross noted that it plans to continue paying its dividend ($0.12 annualized) despite the decline in the gold price and could also look at additional share buybacks. In my view, not buying back shares between $3.10 – $3.60 would be a missed opportunity, but the company has certainly had a lot thrown at it this year with the loss of Kupol/Dvoinoye and Udinsk, inflationary pressures, and now a weaker gold price, so a less aggressive stance on buybacks is understandable.

Valuation

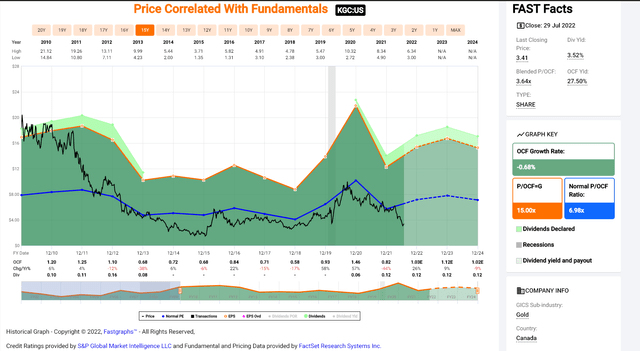

Based on an estimated 1,290 million shares outstanding and a share price of US$3.40, Kinross trades at a market cap of ~$4.39 billion and an enterprise value of roughly $6.0 billion, including the cash payment from the Chirano sale. This leaves the stock trading at barely 1.5x FY2023 revenue estimates ($4.1 billion) and approximately 4x EV/EBITDA. Meanwhile, from a cash flow standpoint, Kinross is expected to generate ~$1.3 billion in FY2023 operating cash flow ($1.00 per share), translating to a forward cash flow multiple of 3.4.

Kinross Historical Operating Cash Flow Multiple (F.A.S.T. Graphs)

Even if we assume a more conservative figure of $0.97 and a cash flow multiple of 5.6 (20% discount to its historical multiple of 7.0), this translates to a fair value of US$5.43 per share – 60% upside from current levels. However, this doesn’t place any value on Dixie, a world-class project that will increase Kinross’s exposure to Tier-1 jurisdictions at the end of this decade, or Curlew, which could provide an opportunity to boost production medium-term. That said, these projects are early stage, and if reserve growth isn’t successful, Dixie could just offset lower or limited production from Fort Knox/Round Mountain when it comes online (2029).

Kinross Gold – Actual Annual Attributable Production vs. Forward Guidance/Estimates (Company Filings, Author’s Chart & Estimates)

Given this outlook of low to no growth relative to some of its peers, I think more conservative valuation multiples for Kinross are justified, hence why I am choosing to use P/NAV and cash flow multiples below that of the peer group. Still, even at these conservative multiples, Kinross remains undervalued and a decent turnaround story, with considerable leverage in the event of a higher gold price, given that it’s an above-average cost producer relative to its million-ounce peers. So, while the company certainly wouldn’t make my top-10 list, I see lots of value at current levels, and investors are being paid a decent dividend yield to wait (~3.5%).

Kinross Operations (Company Website)

Summary

Kinross had a mediocre quarter at best, and the increase in cost guidance is certainly not ideal. However, costs should dip below $1,150/oz in 2023 as we see additional contribution from La Coipa and reduced waste stripping. Besides, the fact that KGC did not decline on the softer results suggests that considerable negativity is already priced into the stock. While not a perfect indicator, it’s often a bullish sign when a stock no longer falls on mediocre/bad news. Based on this, I remain bullish on Kinross, and I would not be surprised to see the stock trade back above US$4.50 in the next 12 months, translating to 35% total return potential.

Be the first to comment