ATHVisions

A Quick Take On Kaltura

Kaltura (NASDAQ:KLTR) went public in July 2021, raising approximately $150 million in gross proceeds from an IPO that priced at $10.00 per share.

The firm provides enterprises with a video capture and streaming platform.

Given management’s tepid revenue growth projection, IT budgets under reevaluation and continued operating loss generation in a higher cost of capital environment, I’m on Hold for KLTR in the near term.

Kaltura Overview

New York, New York-based Kaltura was founded to develop a unified horizontal technology offering for powering real-time, on-demand video applications across the enterprise.

Management is headed by co-founder, Chairman and CEO Ron Yekutiel, who was previously co-founder of VisualGate Systems, a video surveillance company.

The company’s primary offerings include:

-

Video Portal

-

Town Halls

-

Video Messaging

-

Webinars

-

Virtual Events

-

Meetings

-

Learning Management System

-

Lecture Capture

-

Virtual Classroom

-

TV Solution

The firm acquires customers across a variety of industries including financial services, technology, education, healthcare, telecom, media and the public sector.

Kaltura’s Market & Competition

According to a recent market research report by MarketsAndMarkets, the global market for enterprise video applications was estimated at $16.4 billion in 2020 and is expected to reach $25.6 billion by 2025.

This represents a forecast CAGR of 9.3% from 2020 to 2025.

The main drivers for this expected growth are a growing demand for video streaming and communicating across distributed workforces.

Also, North America was estimated to have the largest market share in 2020 and is forecast to remain the largest market size of the major global regions.

Major competitive or other industry participants across all of the platform’s functionalities include:

-

Microsoft

-

Amazon

-

Twilio

-

Cisco

-

Zoom

-

Adobe

-

Intrado

-

Hopin

-

Synamedia

-

MediaKind

-

Comcast Technology Solutions

Kaltura’s Recent Financial Performance

-

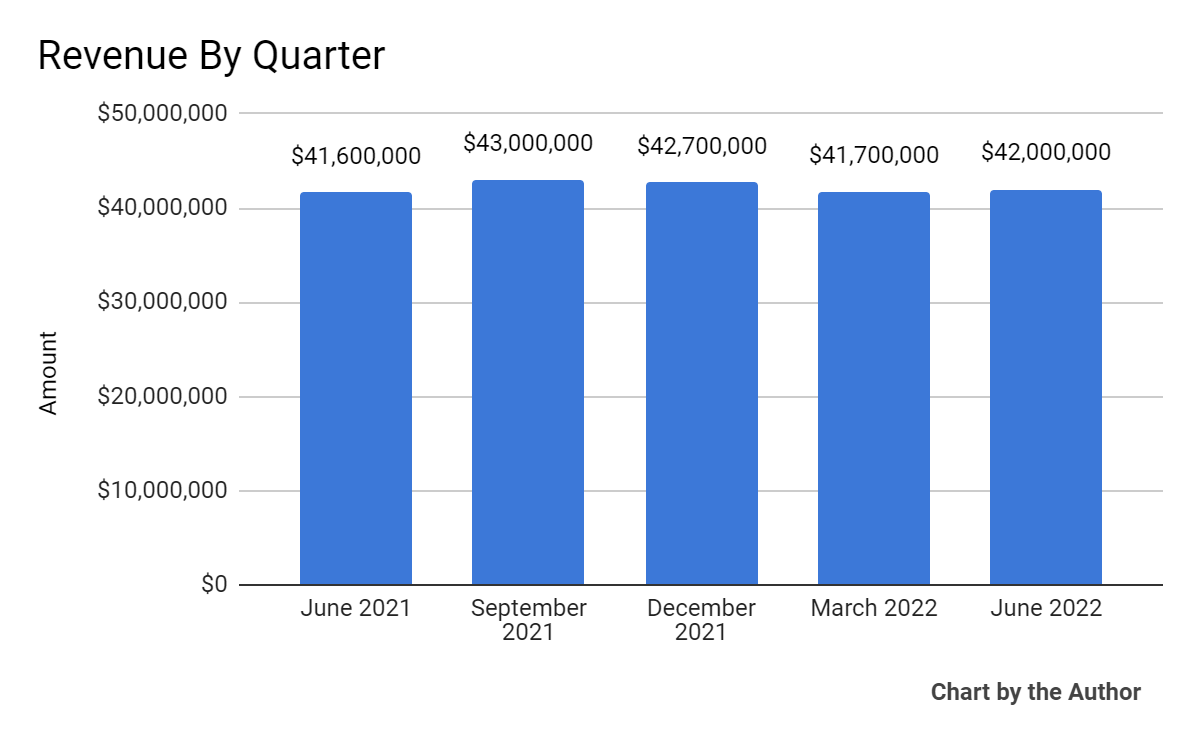

Total revenue by quarter has remained essentially flat over the past several quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

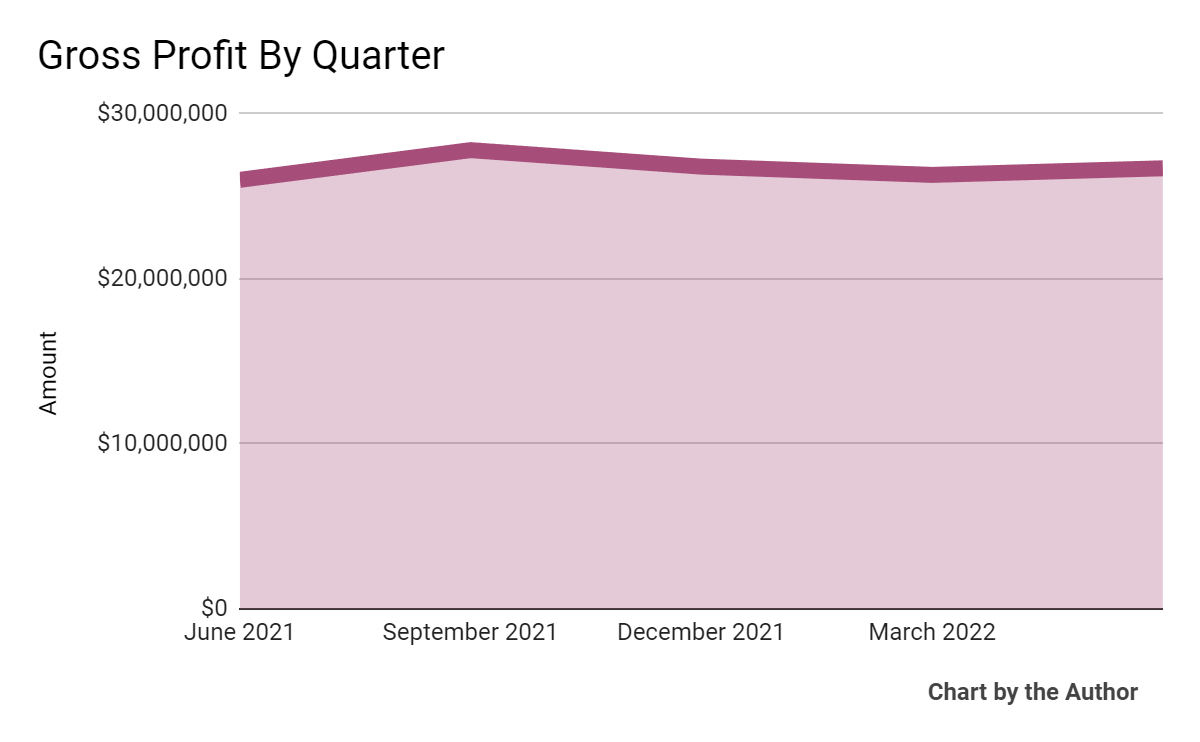

Gross profit by quarter has also plateaued:

5 Quarter Gross Profit (Seeking Alpha)

-

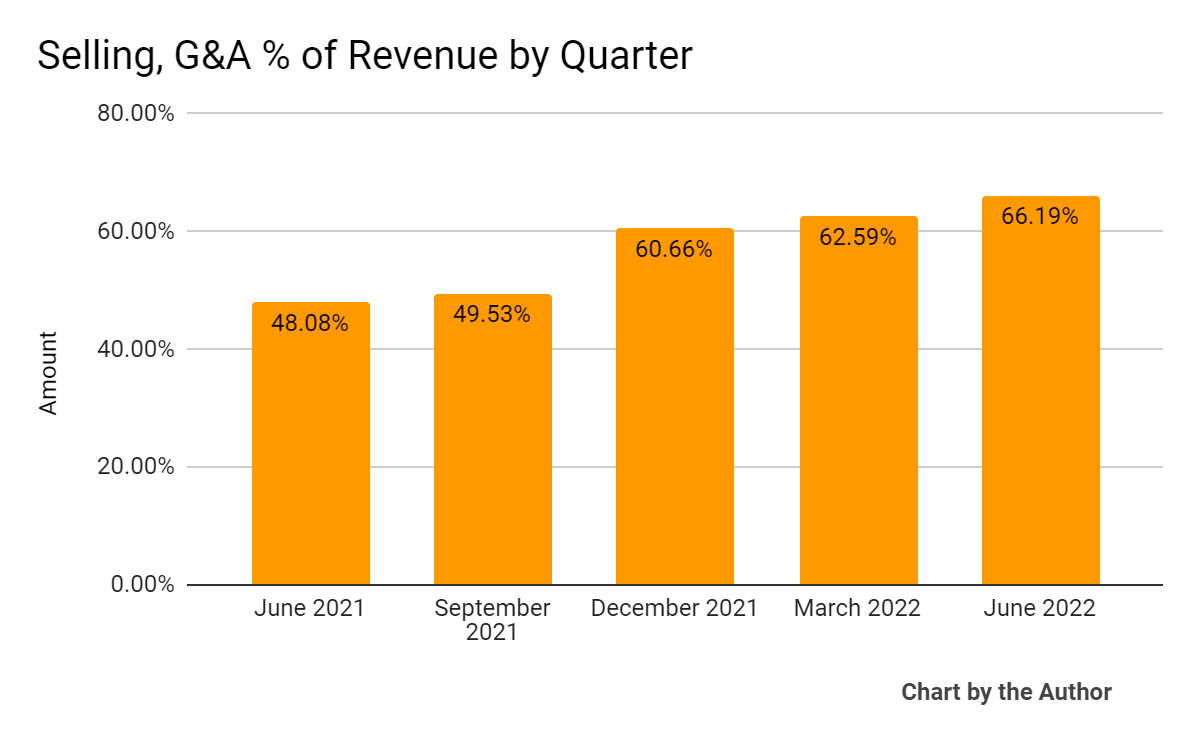

Selling, G&A expenses as a percentage of total revenue by quarter have increased significantly in the past 3 quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

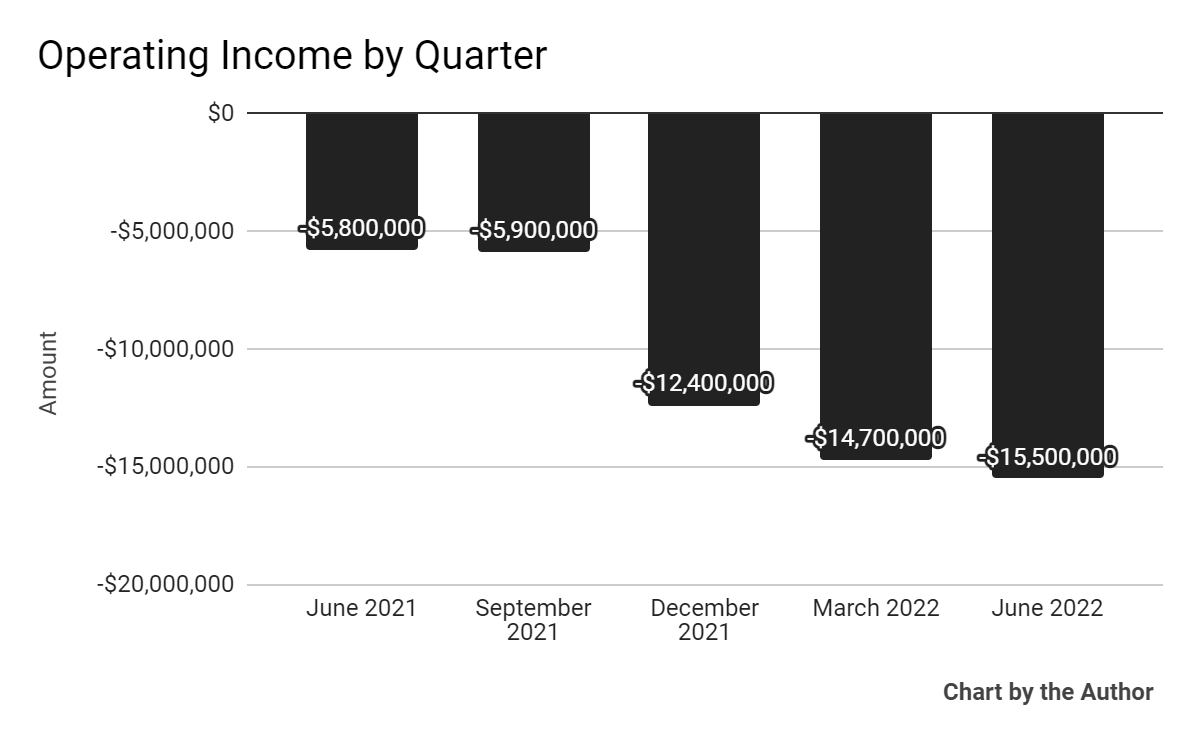

Operating losses by quarter have worsened materially in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

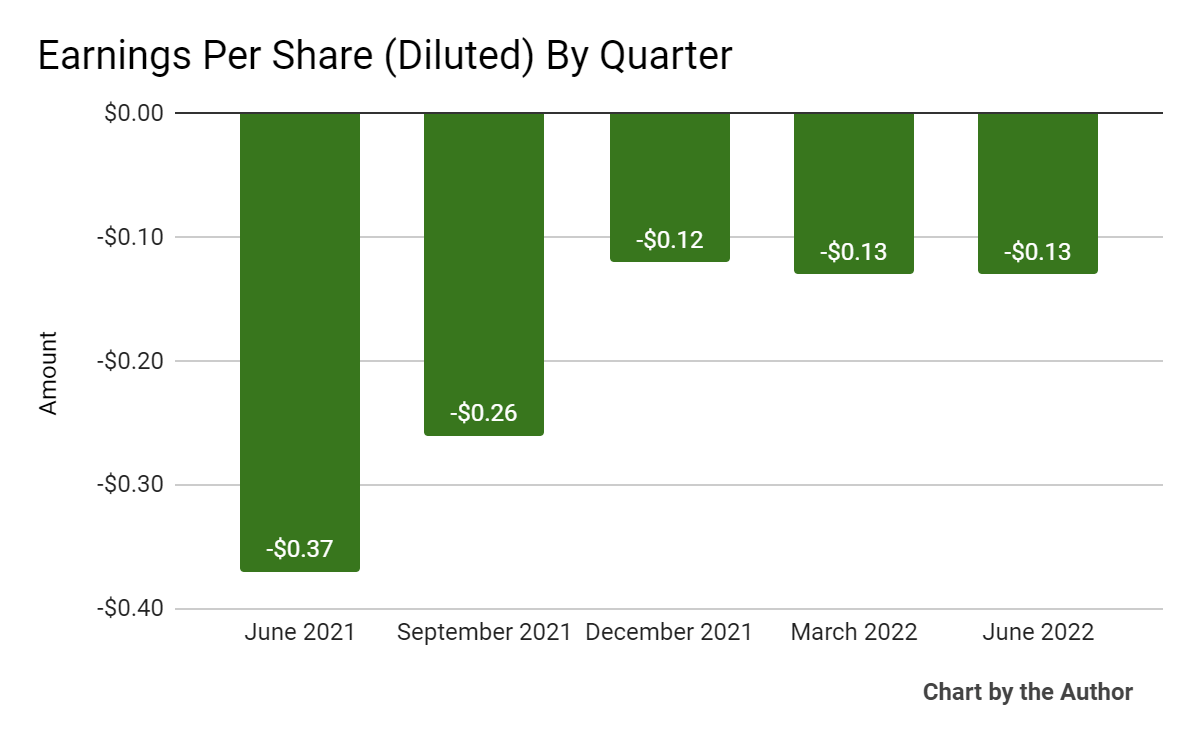

Earnings per share (Diluted) have remained negative in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

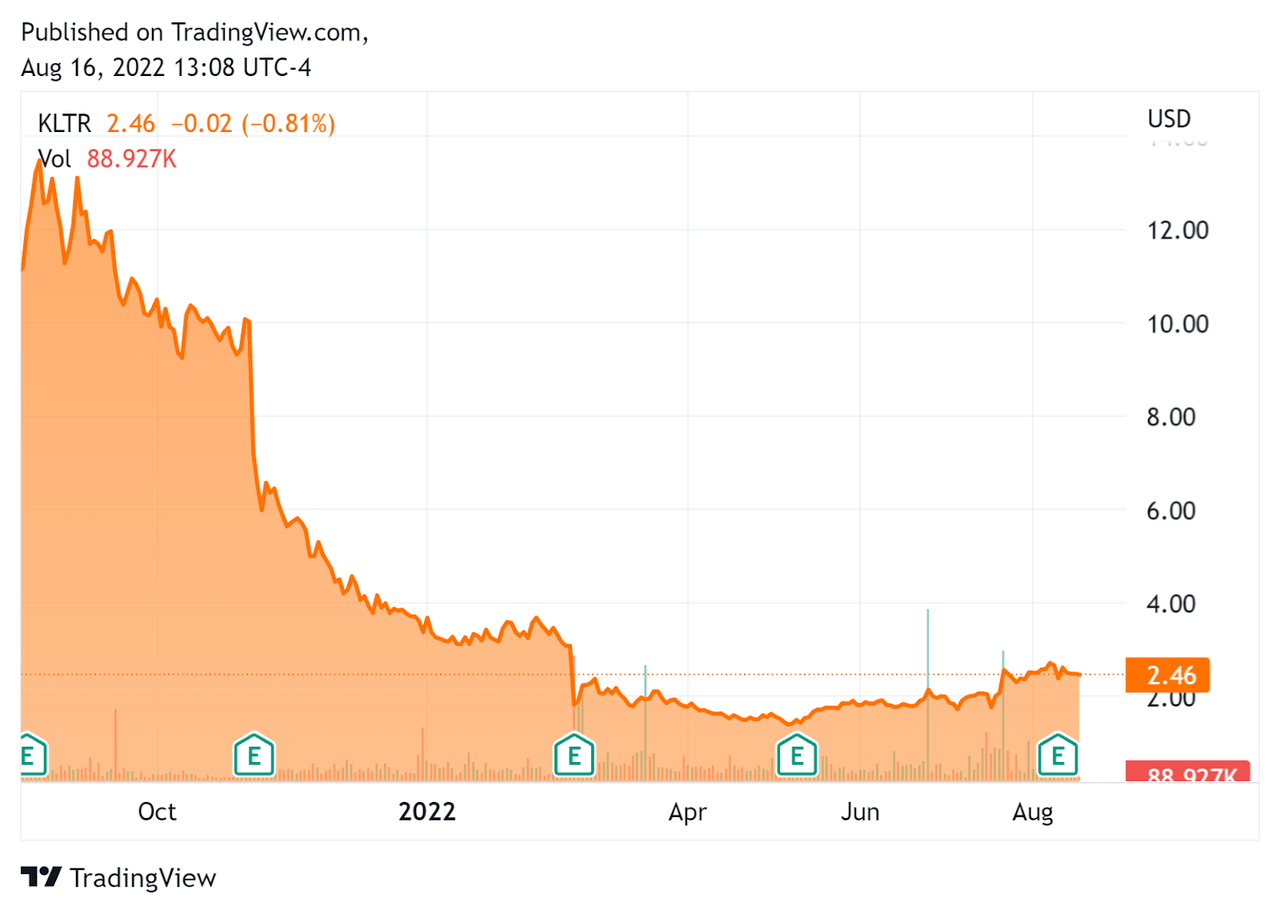

In the past 12 months, KLTR’s stock price has dropped 78.1% vs. the U.S. S&P 500 index’s drop of around 3.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Kaltura

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$290,220,000 |

|

Market Capitalization |

$325,440,000 |

|

Enterprise Value / Sales |

1.71 |

|

Revenue Growth Rate |

16.7% |

|

Operating Cash Flow |

-$58,540,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.64 |

|

Net Income Margin |

-44.5% |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Brightcove (BCOV); shown below is a comparison of their primary valuation metrics:

|

Metric |

Brightcove |

Kaltura |

Variance |

|

Enterprise Value / Sales |

1.32 |

1.71 |

29.5% |

|

Operating Cash Flow |

$21,440,000 |

-$58,540,000 |

-373.0% |

|

Revenue Growth Rate |

1.7% |

16.7% |

878.9% |

|

Net Income Margin |

-1.2% |

-44.5% |

3606.7% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

KLTR’s most recent GAAP Rule of 40 calculation was negative (10%) as of Q2 2022, so the firm needs a lot of improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17% |

|

GAAP EBITDA % |

-27% |

|

Total |

-10% |

(Source – Seeking Alpha)

Commentary On Kaltura

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the resumption of sequential growth, due in part to the recent launch of its updated event platform.

However, management is seeing IT budgets ‘being reevaluated, presenting headwinds to the slope of the rebound.’

As to its financial results, revenue was up 1% year-over-year, with the professional services revenue component down 22% and annualized recurring revenue increasing 4%.

Its net dollar retention rate fell from 107% to 100% year-over-year, indicating increased customer churn, mostly as a result of a revenue drop from a large customer that has ‘since renewed various existing projects and has partnered with us on new ones.’

Management also recently announced a 10% employee lay-off and related cost reduction efforts; that was after a previous hiring drop.

Still, the company has produced increasing operating losses, since it takes time for these changes to show up in the financials.

For the balance sheet, the firm finished the quarter with $94 million in cash and marketable securities, but used $22.8 million in free cash. Over the past year, KLTR has used $60.2 million in free cash.

Looking ahead, management guided full year revenue to grow by 6% at the midpoint of the range and adjusted EBITDA to be around negative ($29.5 million) at the midpoint.

Regarding valuation, the market is valuing KLTR at an EV/Sales multiple of around 1.7x.

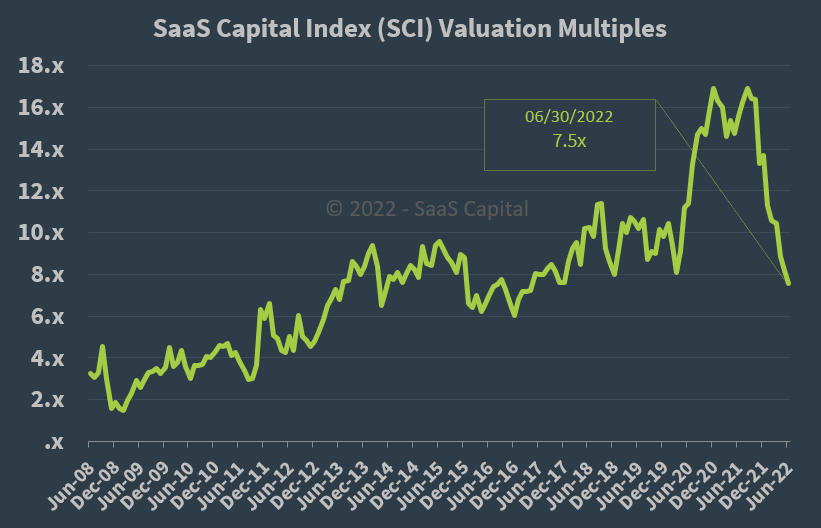

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, KLTR is currently valued by the market at a substantial discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its already small revenue growth estimates.

A potential upside catalyst to the stock could include a ‘short and shallow’ economic slowdown and resulting pause of end to interest rate hikes in the coming quarters.

However, given management’s tepid revenue growth projection, IT budgets under reevaluation and continued operating loss generation in a higher cost of capital environment, I’m Neutral on KLTR for the near term.

Be the first to comment