ValentynVolkov/iStock via Getty Images

One fairly small but interesting company that investors should be aware of is Alto Ingredients (NASDAQ:ALTO). Operationally speaking, the company has its hands in a couple of different areas that seem to be largely distinct from one another. But digging in deeper, you start to realize how these different spaces connect and, ultimately, make sense for the company to be involved in. Over an extended timeframe, the company’s operating history has been quite lumpy, with some rather disappointing results. But even so, performance over the past two years has been somewhat promising. Add on top of this the fact that shares of the business do look to be rather cheap on an absolute basis, and it could be a decent prospect for some investors moving forward. But for me, there are better prospects to consider at this time, leading me to rate it a ‘hold’ until we have more clarity on what the new normal might look like.

Understanding Alto Ingredients

Based on its name alone, you might guess that Alto Ingredients focuses on some sort of ingredients or related products in the food business. To a large extent that is true. According to management, the company specializes in producing and marketing specialty alcohols and other essential ingredients, with the firm operating as the largest producer of specialty alcohols in the US. As of the end of the company’s 2021 fiscal year, the firm boasted annual alcohol production capacity of 350 million gallons. This alcohol is produced from the five alcohol production facilities in its portfolio, with three of them located in Illinois and the other two split between Oregon and Idaho.

Some discussion is warranted regarding the specifics of exactly what the company sells. For instance, in what management refers to as the health, home, and beauty category, the company markets specialty alcohols that are used in the production of mouthwash, cosmetics, pharmaceuticals, hand sanitizers, disinfectants, and cleaners. Under the food and beverage category, it produces specialty alcohols that are used in alcoholic beverages, flavor extracts, vinegar, and other related products. It also markets fuel-grade ethanol that’s produced by both it and third parties, and it is responsible for the sale of 1.2 million tons of essential ingredients each year as well. On the fuel-grade ethanol side, the end use of the products the company sells includes transportation fuel and distillers corn oil that’s used as biodiesel feedstock. And on the ingredients side, examples include dried yeast, corn gluten meal, corn gluten feed, and distillers grains and liquid feed that are used in commercial animal feed and pet foods. These items, management says, are co-products of its own alcohol production.

To best understand the firm, we should probably break it up into the segments that it actually operates. The first of these is referred to as its Pekin Campus segment. This segment includes the company’s production and sale of alcohols and essential ingredients that are produced at its Pekin, Illinois campus. Last year, this particular segment was responsible for 56.5% of the company’s revenue. Next in line, we have the marketing and distribution segment, which includes its marketing and merchant trading for co-produced alcohols and essential ingredients, as well as the sale of third-party fuel-grade ethanol that it’s involved in. This segment accounted for 32.1% of the firm’s revenue last year. And finally, we have the ‘other production’ segment, which includes the company’s production and sale of fuel-grade ethanol and essential ingredients that are produced at all of its other production facilities combined. But this was a fairly small portion of the enterprise last year, representing just 11.4% of its revenue.

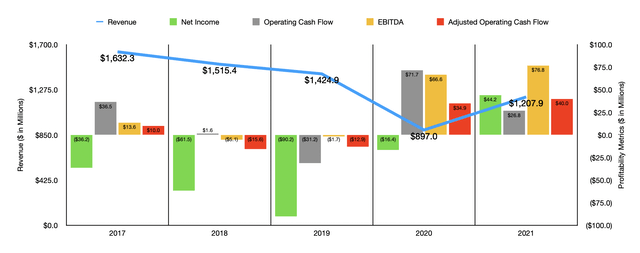

Over the past few years, the financial trajectory of the company has been less than ideal. Revenue actually dropped from 2017 through 2020, plunging from $1.63 billion to $897 million. It was only in 2021 that we saw something of a recovery, with revenue climbing to $1.21 billion for the year. This rise in revenue was driven by a number of factors. For instance, the company benefited from the average sales price per gallon of fuel-grade ethanol climbing by $0.83, or 51%, taking it from $1.63 per gallon to $2.46 per gallon. This was offset some by sales volume declining by 20 million gallons, or 11%, from 181 million gallons to 161 million gallons as a result of reduced production at its California facilities. These facilities were ultimately sold in 2021.

The company also experienced a 1%, or roughly 1 million gallons, decline in sales volume associated with specialty alcohol production. Meanwhile, third-party sales volume of fuel-grade ethanol dropped by 35 million gallons, or 13%, from 264 million gallons in 2020 to 229 million gallons in 2021. However, this was planned by the company as the firm shifted from selling a lot of third-party fuel-grade ethanol so that I could focus more on sales of inventory of its own production. During this same time frame, the company also saw the total essential ingredients sold, as measured by tons, drop as well. The company went from selling 2.82 million tons in 2019 to just 1.24 million tons in 2021. However, pricing here happened to increase, just as we saw with the rise in gallons of fuel and alcohol sold.

Just like revenue, profitability for the company has also been rather volatile. Between 2017 and 2019, the company’s net loss widened, going from $36.2 million to $90.2 million. The net last narrowed to $16.4 million in 2020 before turning to a profit of $44.2 million last year. As the chart above illustrates, other profitability metrics have also been all over the map. Perhaps the two most consistent though would be the adjusted operating cash flow figure and EBITDA. Operating cash flow, adjusted for changes in working capital, ultimately went from a negative $15.6 million in 2018 to a positive $40 million in 2021, while EBITDA turned from a negative $5.1 million to a positive $76.8 million over the same timeframe.

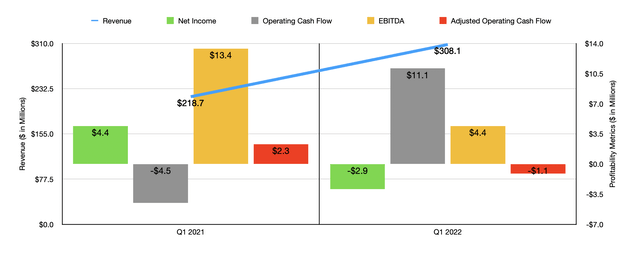

Performance for the company has been similarly volatile in the current fiscal year. In the first quarter, for instance, the company saw revenue come in at $308.1 million. That’s 40.9% above the $218.7 million generated the same time one year earlier. This increase in revenue came even as the total gallons of fuel and alcohol decreased from 112 million in the first quarter of 2021 to 103.2 million this year. However, the company saw a 26.8% rise in average sales price per gallon that helped to make up for this. Most notably, the decline in product sold was actually driven by a 43.1% drop in 3rd party renewable fuel gallons sold. Specialty alcohol gallons rose by 22.6%, while renewable fuel gallons the company sold grew by 26.2%. And all of this increase came from the company’s own facilities as it continues to make that transition away from relying on third parties and in the direction of benefiting from its own asset base.

For anybody who follows the company closely, this should not be much of a surprise. In its latest quarterly report, the company listed a number of changes that it is making to its business. In February, for instance, the company expanded its portfolio of certifications by qualifying for two additional internationally recognized certifications at its Pekin Campus. It also launched its first project to produce enhanced protein at its dry mill in Magic Valley, Idaho using the patented CoProMax system that it plans to roll out at three other dry mills in the near future and at a total cost of $70 million. The company is currently expanding corn storage at its Pekin Campus property in order to increase its corn buying flexibility and to reduce its need to purchase product at premium prices when farmers and elevators have stopped shipping it for various reasons.

The company has provided other examples of how it has changed its business model to prepare for the future. For instance, it is currently evaluating an investment that would bypass the local natural gas utility at its Pekin Campus that could result in the company reducing its natural gas prices by around 11%. Despite these improvements though, profitability metrics are still rather volatile for the year. In the first quarter, the company generated a net loss of $2.9 million. That compares to the $4.4 million profit achieved one year earlier. Operating cash flow went from a negative $4.5 million to a positive $11.1 million. But if we adjust for changes in working capital, it would have dropped from $2.3 million to negative $1.1 million. Meanwhile, EBITDA for the company also declined, falling from $13.4 million to $4.4 million.

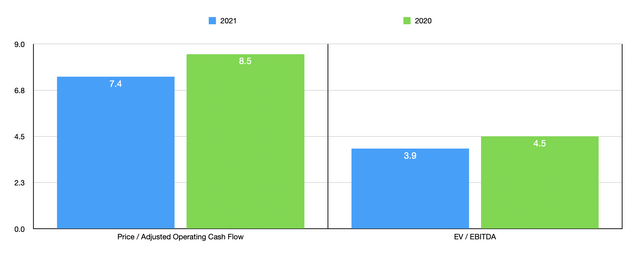

All of this volatility and the uncertainty caused by recent investments by the company have made it impossible to know what the future might hold. But if we value the firm based on 2020 or 2021 results, shares do look rather cheap. The price to adjusted operating cash flow multiple should come in at 7.4 using our 2021 figures. That compares to the 8.5 reading that we get using 2020 results. Meanwhile, the EV to EBITDA multiple should be 3.9, which would be down from the 4.5 reading we get if we relied on 2020 figures. Now, unfortunately, because of the specific niche the company operates in, there aren’t really any good firms to compare it to. Under the Peer section of the company page on Seeking Alpha, five companies related to the energy sector are listed as the most similar firms. Of these, only two had positive operating results. On a price to operating cash flow basis, these companies range from 2.1 to 8.9. And using the EV to EBITDA approach, the range was from 0.9 to 4.3. In both cases, Alto Ingredients was priced in the middle of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Alto Ingredients | 7.4 | 3.9 |

| Adams Resources & Energy (AE) | 2.1 | 0.9 |

| REX American Resources (REX) | 8.9 | 4.3 |

Beware earnings

Although the management team has not yet announced a date for the release of earnings for the second quarter of the company’s 2022 fiscal year, that date is expected to come up in the next several days. This is obviously a chance for the company to show improvements on its bottom line, but investors should not put too much faith into that kind of outcome. While analysts expect Alto Ingredients to report revenue of $320.83 million, an increase of 7.6% over the $298.11 million reported the same time last year, earnings are expected to plunge.

For the quarter, analysts believe that the firm will report profits per share of $0.03. That compares to the $0.11 per share seen for the second quarter of its 2021 fiscal year. In pecuniary terms, this translates to profits of $2.14 million compared to the $8.08 million reported last year. This naturally gives management the opportunity to surprise in a positive way, but if the first quarter is any indication, then investors might find themselves disappointed. After all, in the first quarter this year, the firm generated weaker performance year-over-year as I detailed already. This was due to costs of goods sold rising relative to last year, taking the company’s gross profit margin from 6.3% to 1.5%. Management attributed this pain to ‘extreme commodity price volatility’, supply chain issues, rail, and operational disruptions, and more. These issues will eventually get resolved, but not in a short timeframe.

Takeaway

All things considered, Alto Ingredients is definitely an intriguing prospect. However, it’s not the right kind of opportunity for me. The firm seems to be getting its act together and shares are cheap enough that they could warrant some nice upside potential. However, the company’s historical volatility is extreme and I don’t yet have confidence in the ability of the firm to achieve stable results for the long haul. I can definitely understand why some investors would view this as an appealing prospect. But for me, it only makes sense as a ‘hold’ rating at this time.

Be the first to comment