Buy land, they’re not making it anymore.

– Mark Twain

Though Kimco Realty Corp. (KIM) widely beat Q4 2019 analyst estimates by reporting an EPS of $0.37 as against an estimated $0.17, it is a stock to avoid. The primary reason is that the retail industry is going through a lot of pain and the economy is passing through a major disruption (COVID-19). I am neutral on KIM, and here’s my analysis starting with the good news.

Profitability

KIM’s focused on neighborhood open air malls that thrive on the live-work-play concept – for example, grocery stores, gyms, discount retailers, and items/services that aren’t much impacted by e-commerce. 96% of its shops are leased out, and that is another positive.

The economic downswing has just started in February 2020. If it persists for another 3-4 months, all REITs are likely to take a hit. However, KIM seems set to survive any downfall even if its revenues tank by 30%. Here are some likely scenarios:

(Image Source: Author-generated)

The REIT can take advantage of the recent and forthcoming Fed cuts to reduce its interest burden.

KIM’s Debt Profile

KIM’s total debt as of December 2019 is $5.41 billion. In 2019, the company issued debt worth $466 million and acquired assets worth $445.6 million. The net change in cash at the end of the year was $(19.6) million.

KIM has an excellent debt maturity profile of 10.6 years. In 2020, the company faces debt maturities of $90 million on account of mortgage debt and about $150 million on account of joint venture debts. It has access to $2 billion liquidity that can be made immediately available. Therefore, even if the REITs business were to stumble, KIM’s operations will be adequately safeguarded.

That was the good news; let’s now move to the bad.

Retail Industry Slowdown

KIM faces headwinds in 2020 and beyond. Deloitte reckons that the retail industry will be hit by uncertainty in 2020. Its report was published before the COVID-19 outbreak, and yet, it reasoned that the industry will pass through a dull economy.

Then, there’s the COVID-19 outbreak, which should make people take precautions and avoid crowded places. They are likely to shift to online shopping. In the near term, neighborhood shopping centers may face adverse consequences.

Pier 1 Imports (PIR), Chico’s (CHS), Gap (GPS), Walgreen’s (WBA), Destination Maternity (DEST) and some more chains have already announced store closures in 2020. Pier 1 Imports has filed for Chapter 11 Bankruptcy, and it has 11 leases with KIM.

So, it’s a double whammy for KIM – the first from the regular slowdown, and the second from the CVID-19 disruption. No one can predict how the current disruption will shake the industry, but the clouds look ominous.

Peer Analysis

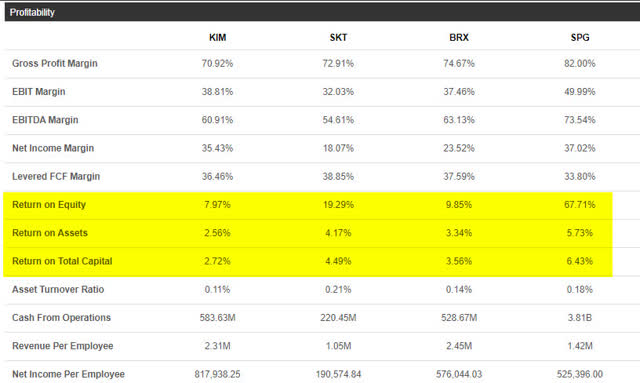

KIM’s peers include Tanger Factory Outlet Centers (SKT), Brixmor Property Group (BRX), and Simon Property Group (SPG).

KIM’s return on equity at 7.97%, return on assets at 2.56%, and return on total capital at 2.72% are the poorest in the group.

(Image Source: Seeking Alpha)

The price performance of all the companies in the group is disappointing. Investors who bought KIM three years ago have lost 24% of their capital and have gained about $4 per share in dividend payouts for the period. It’s a loss maker for dividend chasers.

Summing Up

In its Q4 2019 earnings call, KIM’s management team had estimated to sell $200 million to $300 million worth of properties this year. It had also planned to diversify by exploiting its entitlement to 4,500 apartment units, 800 hotel keys, and 1.2 million square feet of office space. It is unclear if these goals will be realized given the current business climate.

The odds are stacked against KIM in 2020. The rough weather faced by the retail industry, combined with the COVID-19 disruption, is likely to drag down REIT profitability. The silver lining is that KIM is in a position to deliver net income even if its revenues were to fall by 30%.

KIM is a stock to avoid given the current REIT business atmosphere and the fact that the entire peer group has failed to deliver meaningful returns over the last 5 years. My rating is Neutral/Avoid.

*Like this article? Don’t forget to hit the Follow button above!

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment