Gold, Crude Oil, US Dollar, U.S. Fiscal Stimulus, Coronavirus, Stocks- Talking Points

- Gold prices fall on U.S. stimulus bets as crude oil rises with stock futures

- European and North American equities may rise, sinking XAU/USD rate

- Follow-through uncertain, key resistance may keep oil downtrend in play

Gold and Crude Oil Asia Pacific Session Recap – U.S. Fiscal Stimulus Eyed

Anti-fiat gold prices were on the retreat during Tuesday’s Asia Pacific trading session after Wall Street came off the worst single-day performance since 2008 as equities fast-approached bear market territory. This followed the White House announcing plans for fiscal stimulus to cope with the coronavirus epidemic which marked a sudden U-turn from the end of last week. XAU/USD fell as US government bond yields climbed.

Recommended by Daniel Dubrovsky

Traits of Successful Traders

Likewise, sentiment-linked crude oil prices aimed higher. WTI rose over 10% during APAC trade, pointing towards the best single-day performance since September. Prescriptions that the White House is expected to further unveil later today include a payroll tax cut and measures to ease the burden on hourly wage earners. S&P 500 futures recovered from about a -1.5% loss to gains showing a greater than 2.4% boost.

Gold and Crude Oil Prices Closely Watching European and North American Stock Markets

With that in mind, oil will likely be focusing on what could be a broad “risk-on” tone to come over the remaining 24 hours. German DAX and Euro Stoxx 50 futures are pointing notably higher ahead of the opening bell in Europe. That may continue offering an upside boost to the commodity as it attempts to recover from a price war initiated by Saudi Arabia after OPEC+ output reduction talks crumbled.

There may be some room for downside pressure if the EIA’s short-term energy outlook reveals demand further at risk amid the coronavirus. But given a strong enough upside reaction in stocks, that could be overwhelmed. A continued rise in U.S. government bond yields that benefits the US Dollar may thus keep the yellow metal under pressure. Follow-through is uncertain however and the Wuhan virus situation remains fluid.

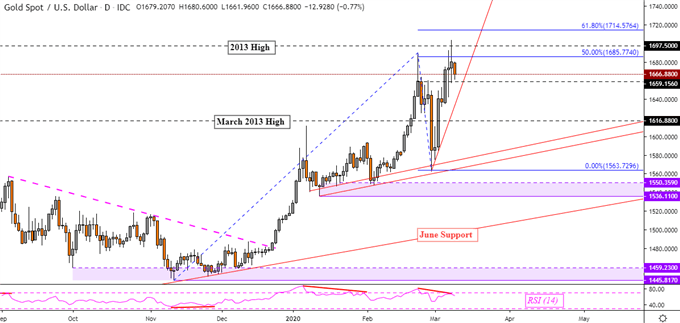

Gold Technical Analysis

The turn lower in gold prices followed a failed push above the 50% Fibonacci extension at 1685 that combined with the presence of negative RSI divergence. With downside confirmation, that may precede a selloff in the yellow metal. That places the focus on immediate support which appears to be a rising line from the end of February. A descent through it may pave the way to revisit upward-sloping support from January.

| Change in | Longs | Shorts | OI |

| Daily | 21% | 1% | 14% |

| Weekly | -3% | 13% | 1% |

XAU/USD Daily Chart

Chart Created Using TradingView

Crude Oil Technical Analysis

Crude oil prices appear to have found the next bottom just above the 2016 low. Prices left behind a lower shadow at 27.39 as the commodity struggled to close under the 161.8% Fibonacci extension. While there may be scope for a near-term bounce ahead, a couple of descending trend lines may maintain the dominant downtrend down the road. These include both inner and outer resistance on the WTI chart below.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 16% | 2% |

| Weekly | 32% | 6% | 27% |

Crude Oil Daily Chart

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment