Denis_Vermenko

Banks continue to trade rather cheaply relative to the overall market. This presents patient investors an opportunity to layer capital into this beaten down sector while getting paid an attractive dividend yield.

While the larger banks such as JPMorgan Chase (JPM) and Bank of America (BAC) attract a lot of attention, there are regional banks out there that are also value-priced while throwing off an even higher yield.

This brings me to KeyCorp (NYSE:KEY), which is trading materially below its 52-week high of $27 achieved as recently as February of this year. In this article, I highlight what makes KEY an attractive opportunity for income and growth.

Why KEY?

KeyCorp is a top 20 regional bank in the U.S., with assets of over $170 billion. It’s primarily centered around Ohio and New York with a footprint in a total of 16 states. KeyCorp operates as both a community and corporate bank, serving middle-market commercial clients.

KeyCorp has undergone drastic changes to its operating model since the Great Financial crisis, when it was forced to cut its dividend due to its foray into higher-risk commercial and construction-related lending in states outside of its footprint. Since then, management has wound down those businesses, and refocused the company towards core corporate banking and capital market services. Morningstar carries a favorable view of KEY’s turnaround efforts, as noted in its recent analyst report:

KeyCorp’s noninterest income comes primarily from investment banking and asset and trust management services. While noninterest income did not grow substantially for the decade prior to 2019, we think the bank has turned a corner here. We like that KeyCorp is expanding its relatively new credit card income base as well as its own mortgage and capital markets operations.

These efforts have largely paid off, and we think fees will be consistently higher from 2020 forward than they were for the previous decade. We expect the bank to continue to remain very competitive in its core middle-market niche, while also building out its focused retail operations.

Meanwhile, the bank is executing well amidst the market volatility, with revenue growing by 6% on a sequential basis (1% YoY) during the second quarter. Moreover, it posted strong earnings of $0.54 per share, beating analyst estimates by $0.02, and saw a robust 20.9% return on average tangible common equity.

These results were driven by strong loan growth across commercial and consumer businesses and higher interest rates, with net interest margin rising by 9 basis points, and net interest income increasing by 8% from the first quarter to $1.1 billion.

Also encouraging, KEY continued to gain market share and is seeing positive operating leverage due to increased corporate and bank-level efficiencies. Net charge-offs also remained low, at just 16 basis points.

Headwinds include average deposits declining by 1.8% from Q1, but I’m not concerned, as this reflects seasonal commercial outflows and public sector deposit outflows related to stimulus funds. It’s also worth noting that KeyCorp, like most banks, lacks an economic moat, especially considering its fragmented branch footprint which makes it harder to gain efficient scale.

Nonetheless, I see management positioning the company for growth, as it recently acquired GradFin, a leading loan counselor for healthcare professionals. KEY also expanded its embedded banking platform which added new payments facilitation capabilities. Management is also aggressively targeting loan growth this year in the 9-11% range, and explained how it expects to achieve this goal during the Q&A session of the recent conference call:

Q: So looking at the updated guidance and specifically I’m looking at the 9% to 11% loan growth and 1% to 3% decline in deposits, which is a pretty wide mismatch, how do you plan to fund loan growth beyond 2022? And at what loan-to-deposit ratio do you need to start fully funding loan growth one for one with deposits?

A: As far as the loan growth, you’re right, the updated guidance is 9% to 11%. Deposits are expected to be up 1% to 3% year-over-year. That implies relatively stable deposits through the rest of the year. We do have some investment security maturities. We also will tap the wholesale market as far as funding that one of the benefits of originating residential real estate loans adds to our capacity as far as borrowing at the home loan and we can do that in a cost-effective way. Loan-to-deposit ratios were currently below 80% on our balance sheet.

Typically, we would target between 90% and 95% loan-to-deposit ratio. So we’ve got plenty of room to work through that. I would say that we will continue to monitor this. But as Chris has highlighted a couple of times, we want to support our customers. And in these markets, we are going to see more customer demand for loans than we are probably going to see for capital markets opportunities.

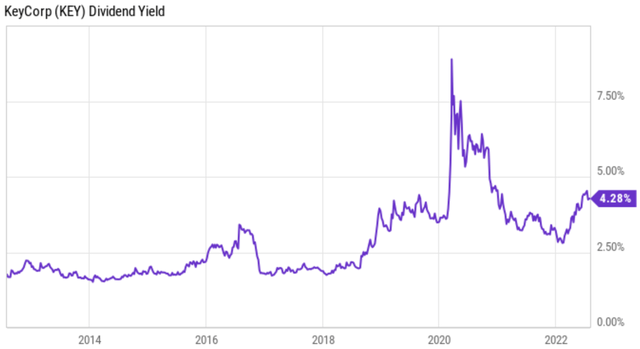

Meanwhile, KEY maintains a strong BBB+ rated balance sheet, and pays a well-covered 4.3% dividend yield with a 34% payout ratio and a 17.1% 5-year CAGR. As shown below, KEY’s dividend yield now sits at its highest level over the past decade outside of the 2020 timeframe.

KEY Dividend Yield (YCharts)

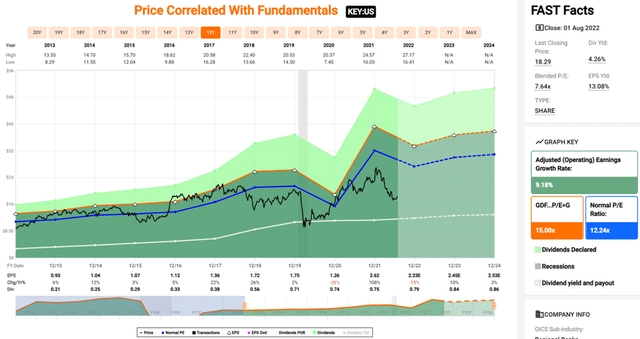

At the current price of $17.98, KEY trades at a forward PE of just 8.1, sitting well below its normal PE of 12.2 over the past decade.

KEY Valuation (FAST Graphs)

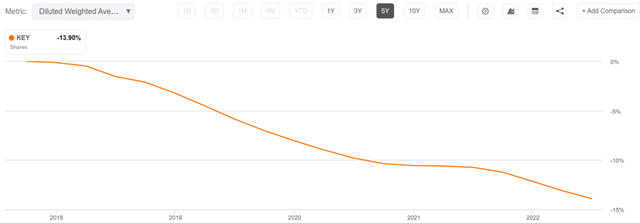

KEY could return significant value to shareholders simply by repurchasing shares at the current valuation. As shown below, KEY repurchased nearly 14% of its outstanding shares over the past 5 years alone. Sell side analysts have an average price target of $22.69, which translates to a potential one-year 30% total return including dividends.

KEY Shares Outstanding (Seeking Alpha)

Investor Takeaway

KeyCorp presents an attractive opportunity in the banking sector. It is a well-run company that is seeing improving trends and is positioned for loan growth. Its shares are attractively valued, pay a solid dividend yield, and have significant upside potential. Meanwhile, management can return significant value to shareholders simply by repurchasing shares at the current price. KEY is a buy for income and growth.

Be the first to comment