RiverRockPhotos

Investment Thesis

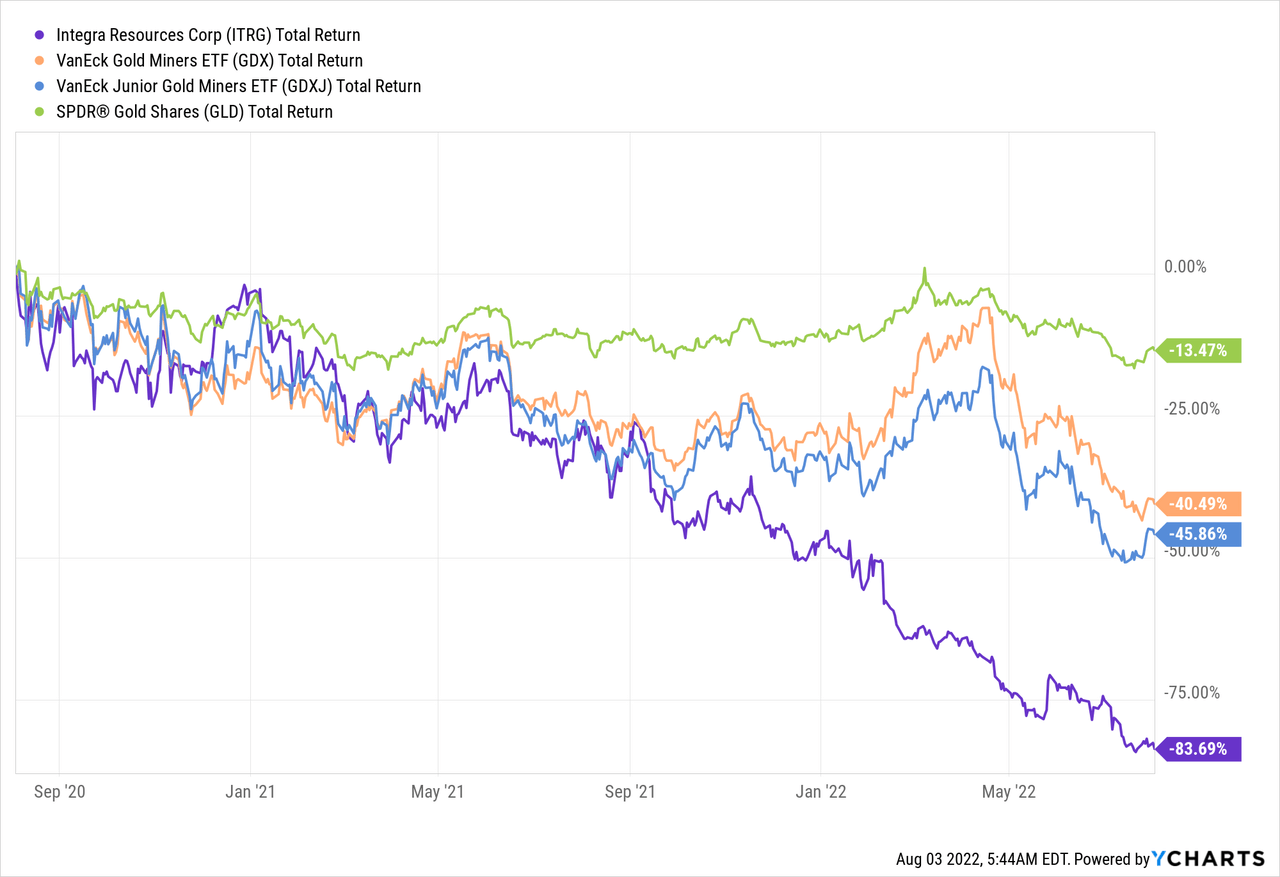

Integra Resources (NYSE:ITRG) (ITR:CA) has seen the stock price be decimated over the last two years. Part of the decline makes sense given the concern for inflation in build projects, lower metals prices, and a very poor sentiment among precious metals mining shares. However, the decline has been excessive, which has led to a very attractive valuation.

Figure 1 – Source: YCharts

I was a bit early when I started building my position a few months ago and wrote the last article on the stock, as the decline has continued due to the poor sentiment in the industry and the need to finance. Now that the company has announced the financing, the extremely low valuation makes less sense for a low-cost asset in a Tier 1 jurisdiction.

DeLamar Project

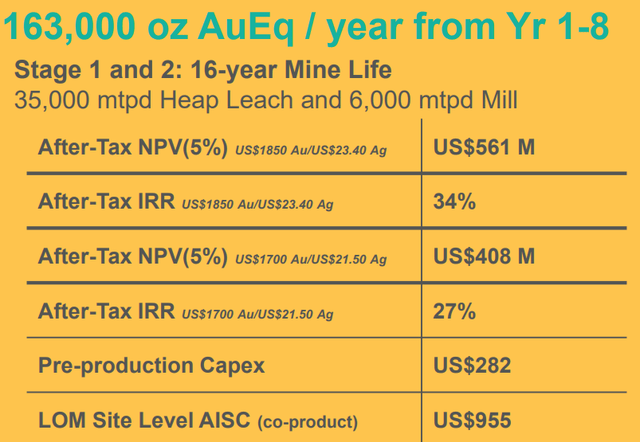

Integra did earlier this year release a pre-feasibility study for the DeLamar project which included the heap leach operation and a mill. The economics were relatively good, with an NPV of $408M using a gold price of $1,700/oz and a $21.50/oz silver price, which is relatively close to spot prices today given that the project is mostly gold.

Figure 2 – Source: Integra Corporate Presentation

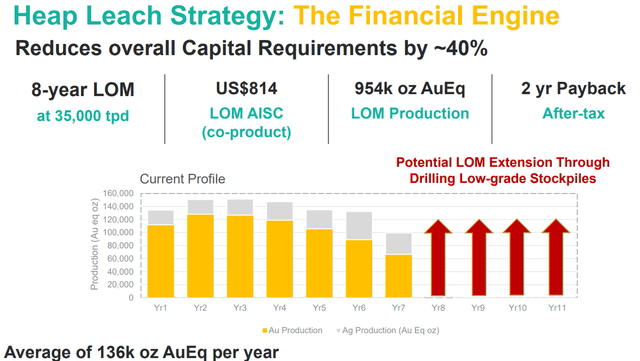

The company did however after the pre-feasibility study was released decide to only focus on the heap leachable material in order to decrease the initial capital & the development risk, and simplify the permitting process. Even if the mill can make sense down the line, this is probably a good strategy.

This will shorten the mine life and decrease the average annual production, but we are still talking about a decent size project, with very low costs, where the AISC is estimated to $814/oz. The NPV using a gold price of $1,700/oz and a silver price of $21.50/oz is still a very respectable $314M.

Figure 3 – Source: Integra Corporate Presentation

Financing Announcements

Integra Resources did late last week announce a $10M bought deal and a convertible deal up to $20M. This will provide the company with enough capital to complete the current 15Km drill program and an updated resource with a focus on the heap leach operation only.

The bought deal will be at $0.66, which equates to about C$0.85. This financing should in retrospect have been finalized a long time ago, but at least I went into this investment with my eyes wide open, knowing that a financing was needed. The extremely poor sentiment among junior precious metals miners has naturally exacerbated the situation and would have been difficult to predict in advance.

Integra did as of March have 62.6M shares, where the bought deal will add another 15.2M shares. If we assume the 15% over-allotment is exercised as well, which is probably likely, we are talking about another 2.3M shares. This would increase the share count by about 28%.

The convertible deal is structured so that the company will take out $10M now and have the option to take out the remaining portion upon submittal of an approved mining plan, which can hopefully work in Integra’s favor if the sentiment and terms improve from today’s level. If we treat the first $10M convertible tranche as equity, I estimate we are roughly talking about another 10.5M shares, taking the increase in shares to 45%.

If the remaining $10M convertible tranche is taken out and converted at the same level as the first one, the total increase in shares comes to 61%, but I will in the example below only assume the first $10M tranche of the convertible is used. If the stock price improves over the next 6-9 months, it might make more sense to do another bought deal or rely on the ATM offering for the additional funding.

Valuation & Conclusion

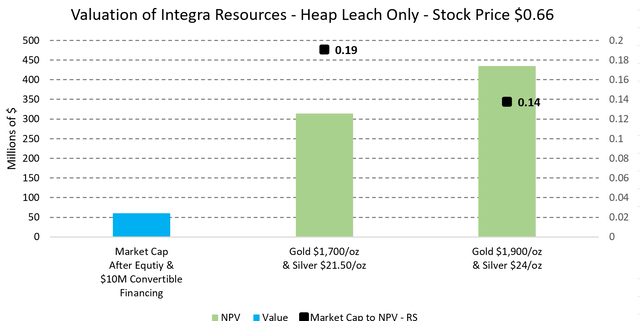

So, with the bought deal, over-allotment, and $10M in convertibles, the current market cap would be $60M. The NPV of the entire DeLamar project is many multiples above that, but let’s just focus on the heap leachable material at this point, where the NPV is around $314M using metals prices close to spot, and $435M in the higher metal price scenario.

Figure 4 – Source: My Estimates

As the above chart highlights, Integra is very cheap in relation to the NPV of the heap leachable portion of the project.

It should also be noted that DeLamar is after all in a Tier 1 country, have very low estimated costs, and I think it has significant growth potential with the next resource update when we include drill results from 2021 and 2022. I have also assigned no value to the resource ounces not available for the heap leaching, which is a conservative assumption.

I am well aware of how painful it can be to be long junior precious metals stocks in a decline, which looks to be without a bottom. Having said that, once the sentiment eventually turns, the upside can be very violent as well. You don’t have to use extremely aggressive assumptions to see an upside of 150-200% from here. A great deal of patience is likely required though.

DeLamar is in my view a quality project and the near-term liquidity concerns will be gone once the financing is finalized in the next few days. So, I really like Integra Resources at this level which I think offers an excellent risk-reward.

Be the first to comment