Tippapatt

Investment Thesis

SoFi (NASDAQ:SOFI) reported Q2 results that were very much in line with expectations. At the end of Q1 2022, its total number of shares outstanding was 853 million. Now, this number has increased sequentially by 6.7% to 910 million.

In other words, for SoFi to grow its revenues by approximately 50% in 2022, it will probably dilute shareholders by approximately 26% in 2022. Once this consideration is put in perspective, my enthusiasm for SoFi rapidly dwindles.

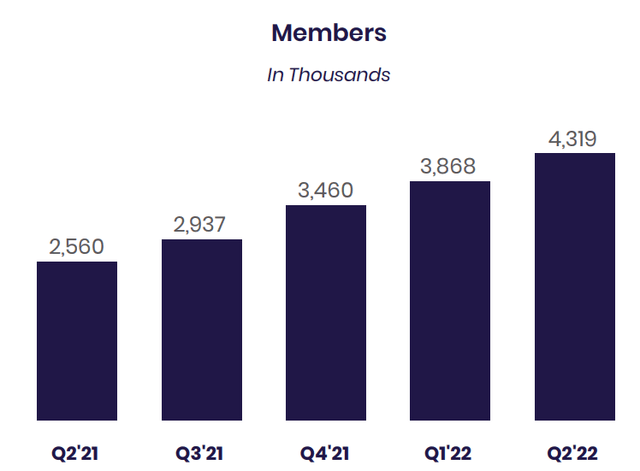

That being said, on a positive note, despite it being more than two years since the start of the pandemic, SoFi’s total members grew by 69% y/y. This is a strong testament to the value and trust that members have in SoFi’s platform.

On the other hand, I believe that the biggest issue that SoFi has stems less from its ability to grow revenues, but its inability to grow a profitable business.

Altogether, as I go through and discuss some of the pluses and minuses facing this company, I turn neutral on the stock, a notable change from when I was previously bearish on the name.

Author’s coverage

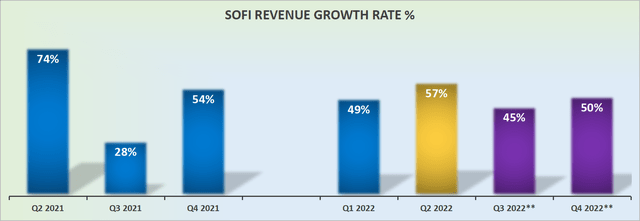

SoFi’s Revenue Growth Rates Reaffirmed

SoFi reaffirms what investors had hoped to see, that its revenue growth rates are still going to end 2022 strong, despite the myriad of macro factors from inflation, rising interest rates, and higher energy costs.

Simply put, SoFi had every excuse to downwardly revise its guidance. And the fact that it has not done so, is a bullish signal, no doubt.

SoFi’s Near-Term Prospects: On the Up and Up

I’ve often said that when it comes to investing, you are better off ignoring revenues and focusing on user adoption curves. On this front, SoFi continues to shine.

That being said, I highlight for you two cases where this has not worked. In the case of Roku (ROKU) and Snap (SNAP). Where user numbers continued to climb, but investors have nevertheless punished the stock.

However, I’m inclined to believe that those instances have micro-related elements plaguing those companies. Generally, when you see strong user adoption, I contend that bodes very well for the platform over time.

Profitability Profile: Do Cost Matter?

SoFi upwardly revised its full-year EBITDA by $5 million and investors welcomed this renewed guidance. That being said, what value does SoFi’s adjusted EBITDA actually hold?

Anyone investing in SoFi is very familiar by now with the fact that SoFi’s EBITDA profile is nearly exclusively made up of stock-based compensation, at $80 million in Q2, and other add-backs, such as depreciation and amortization, which reached $38 million in Q2. Together, these two ”unimportant” costs match SoFi’s total adjusted EBITDA of $116 million.

Yet, the market continues to look favorably towards these metrics and I’m not the one to judge. After all, investing is mostly about perception. And if everyone believes in these profitability metrics, it becomes futile to take an opposing stance.

Incidentally, I argue that SoFi’s bull case is built upon the ”illusion” that SoFi is not a bank.

And the fact that SoFi’s H1 2022 was negative $2 billion in cash flows from operations and saw $2.5 billion infusion from customer deposits. Hence, if this is not a ”bank”, it’s a bank in everything but its name.

The problem here is we should not call SoFi a bank, since that would see its stock traded on a multiple commensurate with that of other banks, and not a jazzy fintech platform, something we’ll discuss next.

SOFI Stock Valuation – Priced at 3x

For bulls, they’ll charge that SoFi’s growth rates are materially faster than those of banks.

To which, bears would counter that although banks grow slower that’s because there’s more regulation facing them. And that if SoFi’s new bank charter started to clamp down on its financial products, its ability to rapidly deploy financial products could equally hinder its revenue growth rates.

As it stands right now, SoFi is priced at 4x this year’s revenues. But since this year is now starting to come to a close, investors have to form an opinion of how 2023 is going to shape up.

Now, remember the reason why SoFi’s revenue growth rates in 2022 have been as strong as they have, it was in no small part supported by its inorganic acquisition of Technisys. Will SoFi be able to repeat another needle-moving acquisition?

Which brings me to the following question, what sort of growth rates is SoFi likely to have in 2023?

For now, analysts still remain resolutely bullish on SoFi and expect that SoFi’s revenues could grow by 40% in 2023. This would imply that the stock today is priced at 3x sales. Is this cheap or expensive?

The Bottom Line

The saying goes that just because something is down 50% doesn’t make it deep value. But what about once it’s down 70% from its previous highs? I believe that the risk-reward starts to skew towards the positive.

On balance, I continue to have an issue with SoFi’s profitability. That being said, with the stock down so significantly, despite the company reporting reasonably positive results, I believe this now sets up investors for a positive risk-reward opportunity. Hence, I rate the stock a hold.

Be the first to comment