TriggerPhoto

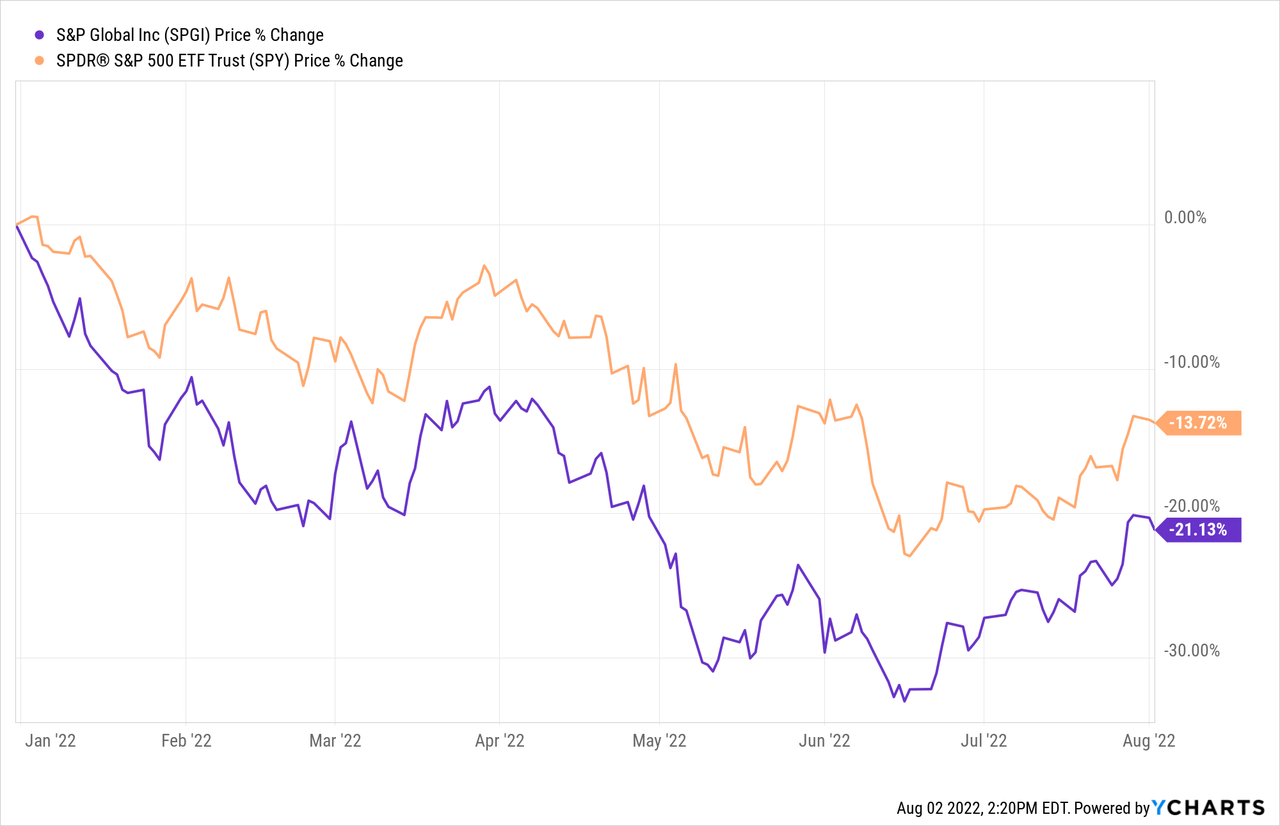

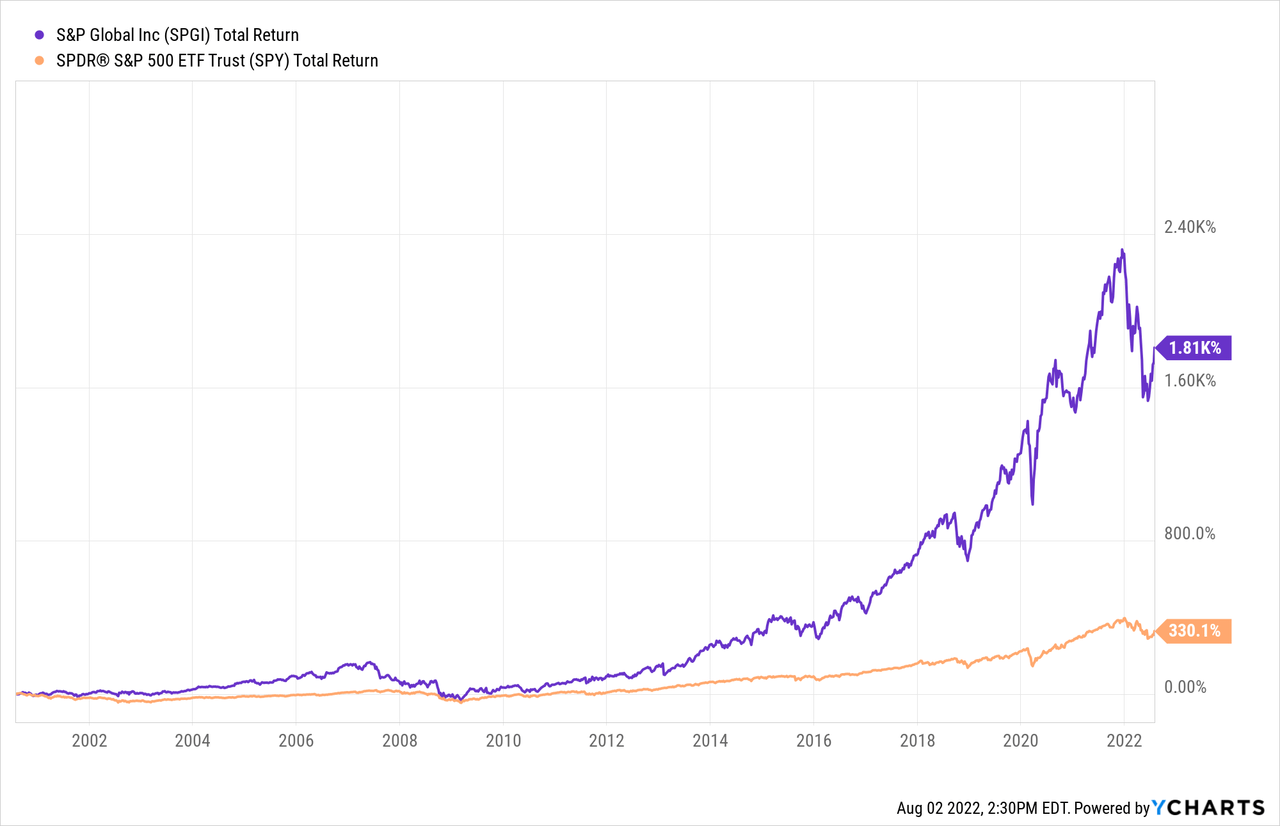

S&P Global Inc. (NYSE:SPGI) released earnings yesterday, reporting $2.81 in adjusted EPS and guiding for $11.35 to $11.55 for full-year 2022. These missed expectations of $2.93 and $12.22, respectively. S&P Global is best known for providing credit ratings for bonds, and for creating the S&P 500 index. The main driver of the miss was a slowdown in the issuance of corporate debt, which SPGI makes a lot of money for providing ratings on. Management and analysts expect the slowdown to ease with time, and they noted in the earnings conference call that five of six segments of SPGI saw growth. SPGI stock has underperformed the market this year but has crushed it since the turn of the century, even after the company’s guest role starring as a Global Financial Crisis villain.

SPGI Stock: Year-to-Date

S&P Stock: 2000-Present

S&P Global’s Game Plan

Earnings and the stock price are falling for the year, but the company has done exceedingly well over the long run. So, what’s the plan?

- Acquisitions. S&P Global acquired IHS Markit (INFO) in February for $44 billion in stock and are in the process of integrating the businesses now. IHS Markit provides business intelligence that helps companies transact, such as import/export data, inventory data, macroeconomic data, etc. They’re best known for owning Carfax, the infamous data provider for used cars. Integrating a $44 billion acquisition is going to take a lot of time, but management believes it will be pivotal in growing earnings. SPGI has always been a fairly acquisitive company and has been able to outperform the market over the long run.

- Buybacks. To this point, SPGI is buying back a lot of stock – roughly 10% of the outstanding shares. They recently accelerated this. To me, this says that they believe they’re executing the business well and the market is not giving them enough credit for the secular success they’ve had. S&P Global has issued more stock than it has bought over the past 10 years, so this will be interesting to see play out. The stock is kind of expensive for buybacks to be super effective (they just issued a bunch of stock for acquisition too so this is sort of canceling out). I’d rather see a dividend instead.

- Cost Savings. If you look at its income statements, S&P Global has been able to increase its revenue nicely over the past 10 years while holding operating expenses down. This is likely the plan going forward as well. I would expect the company to continue to make frequent acquisitions and roll up smaller competitors. If done right, this will support continued growth in earnings per share.

SPGI Stock: Valuation and Risks

SPGI trades for roughly 31x 2022 earnings and roughly 26x 2023 earnings. This is significantly higher than the market and higher than SPGI has traded in the past. A 26x multiple doesn’t scare me too much for a fast-growing company, but this seems a bit high here given the amount SPGI seems to have benefited from the COVID boom, especially since we already know that EPS is down since last year. If I’m going to pay 25-30x earnings for a company, I like to see a smoother earnings growth curve rather than stops and starts.

There are a few risks that immediately come to mind:

- Earnings skyrocketed after COVID caused a boom in junk-rated credit issuance. An open question is whether these earnings are sustainable if the Fed is forced to end the credit party to stop inflation.

- SPGI is a secular grower, but the stock is by no means immune to the business cycle.

- SPGI has a good track record with acquisitions so I don’t worry about this as much, but if they make a big acquisition and the integration goes poorly, it’s going to dilute EPS. This is always a risk, especially since star M&A executives have a tendency to either retire or get poached by other companies.

Bottom Line

As a company, S&P Global has a strong long-term track record and the good outweighs the bad. However, as a stock, you’re paying 31x earnings for earnings that are down year-over-year. There’s no guarantee that credit market conditions will be normal in 2023, and if the Fed has to hike rates more than expected or the economy enters recession, then debt issuance will slow even more. There’s too much reliance on future growth here, leaving the potential for this stock to fall 30%-40% if growth slows. I’ll consider SPGI a hold here, with the potential to be a buy at a lower price.

Be the first to comment