whyframestudio/iStock via Getty Images

“Even the finest sword plunged into salt water will eventually rust.” – Sun Tzu

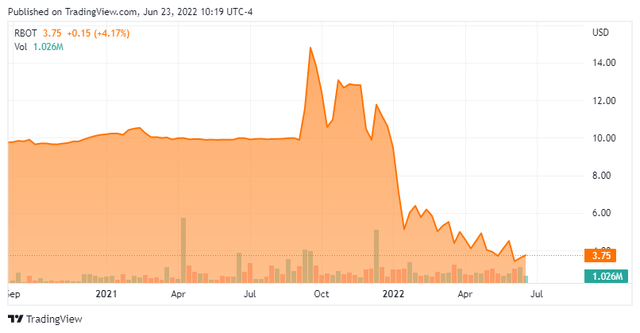

Today, we take our first look at the surgical robot concern Vicarious Surgical Inc. (NYSE:RBOT). Earlier this week, it was announced that the company would be joining the Russell 3000. The shares could use the good news, since coming public last year via a business combination with D8 Holdings Corp, the equity has been in somewhat of a free fall and is deep in “Busted IPO” territory. Can the shares rebound? An analysis follows below.

Company Overview:

Vicarious Surgical Inc. is based just outside of Boston. The company is focused on developing and selling single-incision surgical robot that virtually transports surgeons inside the patient to perform minimally invasive surgery. The stock trades just south of four bucks a share and sports an approximate market capitalization of $450 million.

March Company Presentation

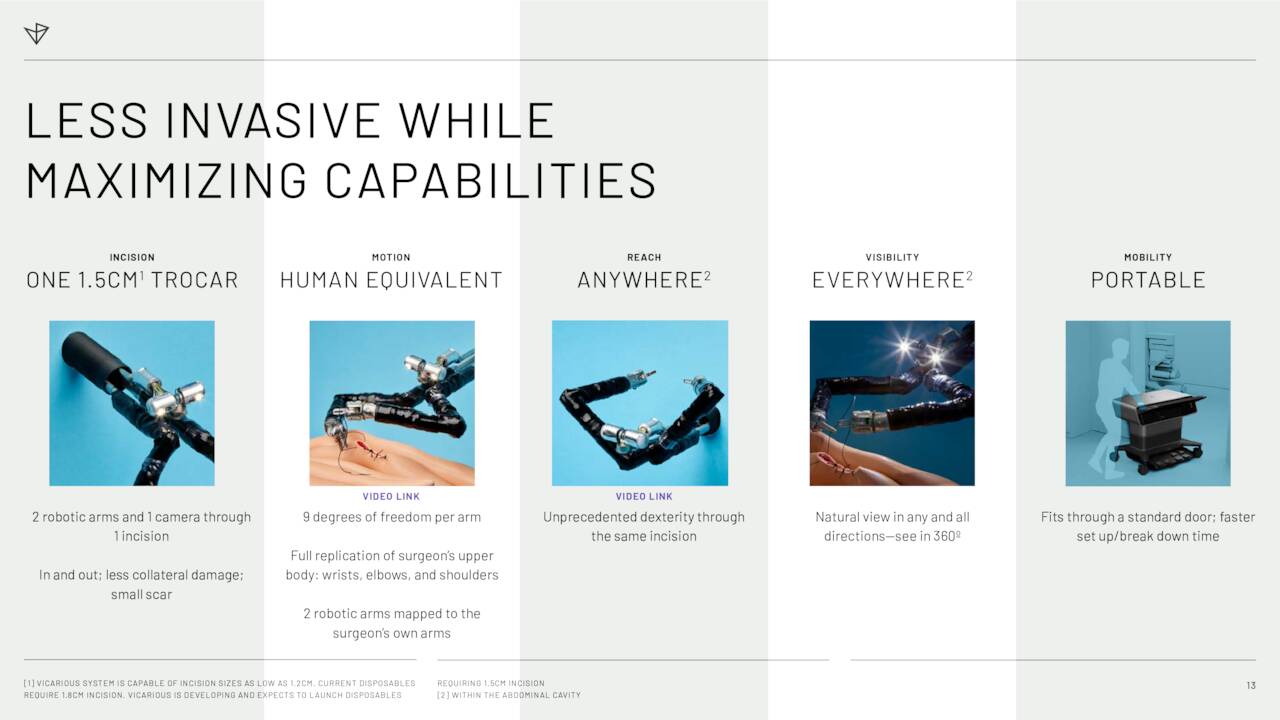

The company is developing a surgical system that uses robotics and virtual reality to enable minimally invasive surgery. This device has garnered Breakthrough Device Designation for ventral hernia repair from the FDA.

March Company Presentation

The system has promise but is a long way from crossing the finish line into commercialization. The company’s vision is to improve on the deficiencies currently present in traditional surgery and minimally invasive techniques which can result in long hospitalization and recovery times as well as high long-term cost of care.

March Company Presentation

The company aims to do this by developing a system that combines advanced miniaturized robotics and software to build an intelligent single-incision surgical robot that “virtually transports” surgeons inside the patient to perform minimally invasive surgical procedures.

March Company Presentation

Among other capabilities, the Vicarious System contains 28 sensors per instrument arm designed to enable real-time feedback to the surgeon.

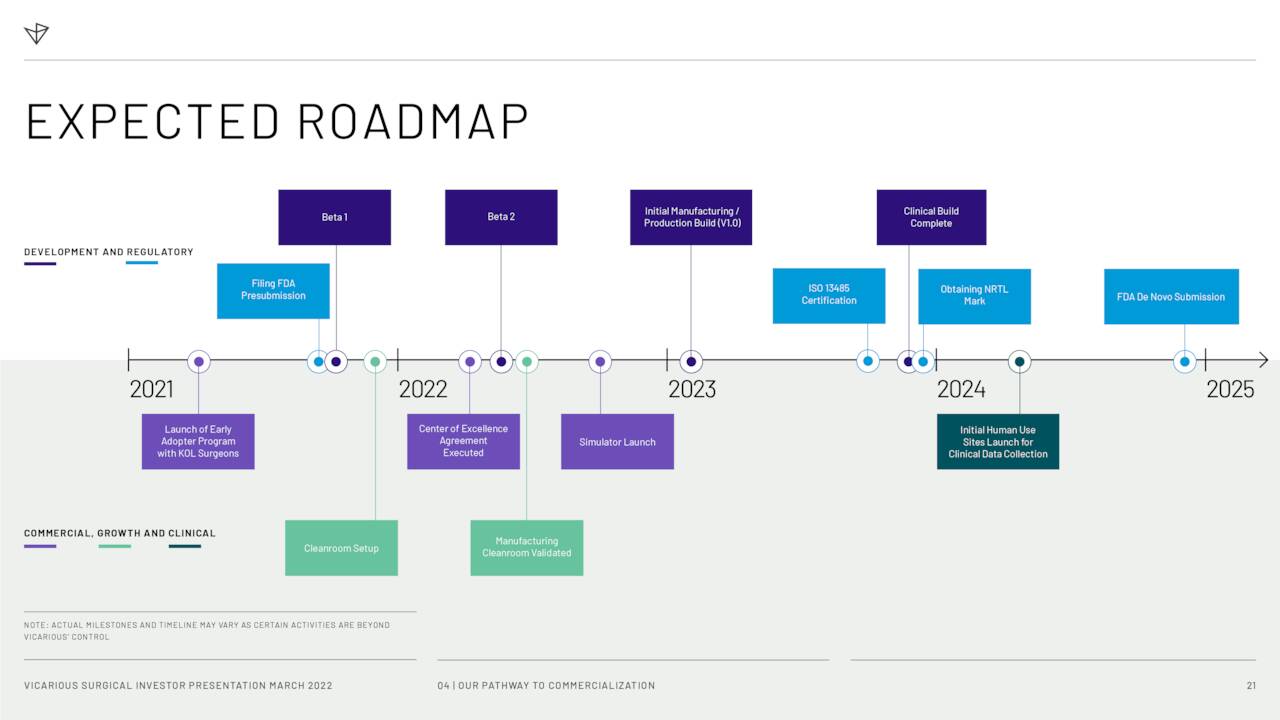

Some recent milestones on the way to commercialization Vicarious has recently accomplished include the qualification of their clean room for the manufacturing of the Vicarious System and the conclusion of cadaveric testing of their beta 1 unit. The company has begun testing some features of this beta system with surgeons and is already testing the first iteration of their beta 2 surgeon console to incorporate ergonomic changes and improved visualization based on feedback from surgeons.

Management is targeting rental hernia indication for their first clinical application with the intent to file a de novo classification request by late 2024. This will be followed by filing for inguinal hernia, cholecystectomy and hysterectomy indications.

Analyst Commentary & Balance Sheet:

The company gets scant mention on Wall Street. So far in 2022, Piper Sandler has maintained a Hold rating and $5 price target on RBOT. BTIG ($8 price target), Canaccord Genuity ($13 price target, down from $15 previously) and Credit Suisse ($13 price target, down from $16 previously) have reissued Buy ratings on the stock.

Numerous insiders have sold less than $150,000 worth of shares in aggregate so far in 2022. Just less than five percent of the outstanding float is currently sold short. The company ended the first quarter with just over $155 million in cash and marketable securities on its balance sheet. It has negligible debt and burned through $16.5 million during the quarter

Verdict:

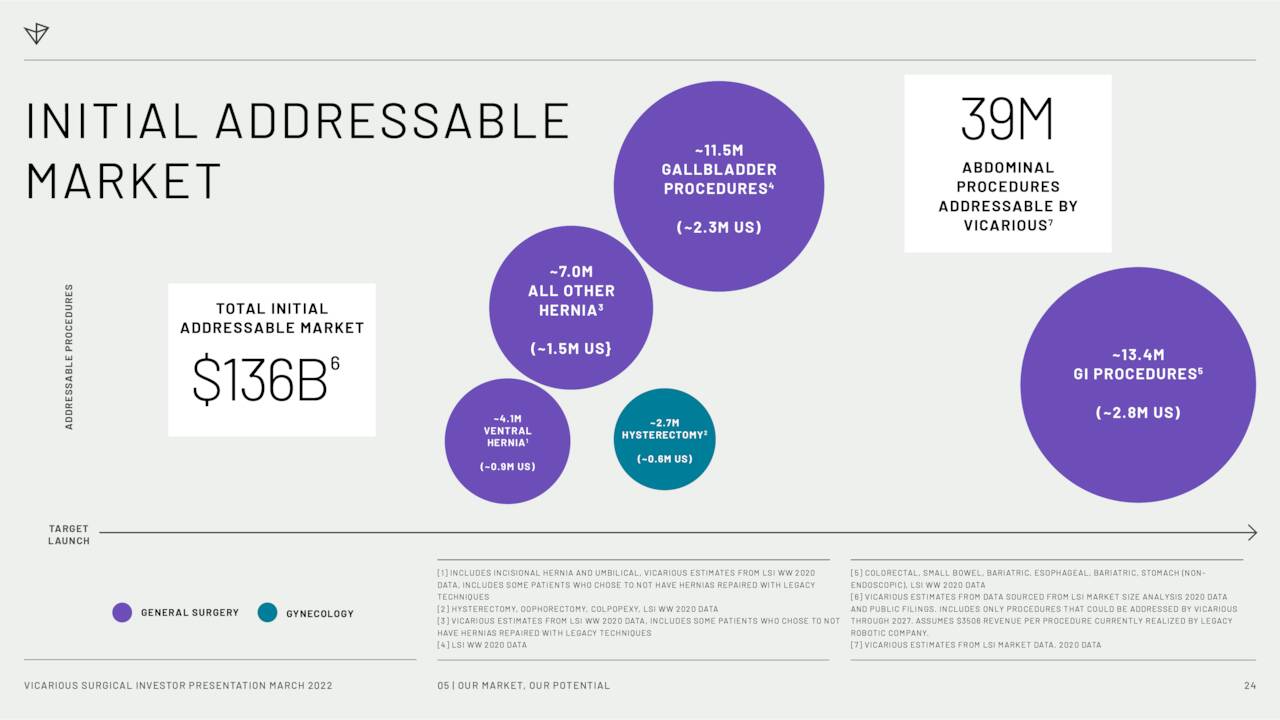

There is no doubt the company is aiming at a very large potential market. Leadership estimates that more than 50% of the 39 million annual procedures addressable by surgical robots are currently performed using open surgical technique.

March Company Presentation

The problem is that this system is years and at least one significant capital raise away from commercialization. And the market has not been kind in 2022 to “show me” stocks, to put it mildly. Therefore, I have no investment recommendation around RBOT at the present time. However, the company’s story is potentially a good one. This is a name we will probably circle back on in late 2023 or early 2024 to see how the company is progressing.

“Our ability to adapt is amazing. Our ability to change isn’t quite as spectacular.” – Lisa Lutz

Be the first to comment