Joe Raedle/Getty Images News

One of the largest and most iconic beverage companies in the world is Keurig Dr Pepper (NASDAQ:KDP). Created when Keurig and Dr Pepper merged in 2018, this company has been focused on growing and generating strong cash flows for its investors. Fast-forward to today and management has achieved just that. The business is larger than ever and looks set to grow further this year. Long term, it is highly probable that the enterprise will create additional value for its investors. However, this does not make the enterprise an attractive purchase at this time. Although the company looks slightly cheaper than its peers, it is rather lofty on an absolute basis. Because of this, I have decided to rate the enterprise a ‘hold’ at this time, which means that I believe its upside will more or less match the long-term prospects of the market more broadly.

A Quality Company At A Hefty Price

The management team at Keurig Dr Pepper describes the company as a leading beverage firm throughout the North American market. Although the company’s name is a giveaway add to the key brands the business owns, it is a far more diverse company than that. In addition to owning the Keurig and Dr Pepper brands, the company also has a significant portfolio that includes Canada Dry, Snapple, Bai, Mott’s, Core, Green Mountain, and The Original Donut Shop, to name a few. In all, in addition to the assets that it owns, as well as those that it licenses and has other arrangements with, the business touches on over 125 brands.

This being the case, all of the company’s operations really fit under the umbrella of its four operating segments. The first of these worth mentioning is the Packaged Beverages segment. This unit is responsible for the sales associated with the finished beverages that the company distributes either to warehouses belonging to retailers or to retailers directly, but only for the US and Canadian markets. This unit with responsible for 46.4% of the company’s revenue last year but for only 28.8% of its profits. Next, we have the Coffee Systems segment. This unit is responsible for the production and sale of the company’s Keurig brewers and for the K-Cup pods that go with them. Last year, this segment made up 37.2% of the company’s revenue and 37.6% of profits.

The Beverage Concentrates segment is responsible for the sale of branded concentrates and syrup that are sold to third-party bottlers throughout the US and Canada. These products are then used in the production of additional beverages that the bottlers then sell through their own distribution networks. This is a common strategy in the beverage market aimed at maximizing margins and increasing the rate of sales growth. This strategy’s success can be seen by looking at the numbers. Last year, this segment accounted for 29.8% of the company’s profits despite making up just 11.7% of revenue. And finally, we have the Latin America Beverages segment. This unit is responsible for sales of all products, including concentrates, syrup, and finished beverages that are made throughout Mexico, the Caribbean, and other international markets. This segment accounted for just 4.7% of the company’s revenue and for a modest 3.8% of profits last year.

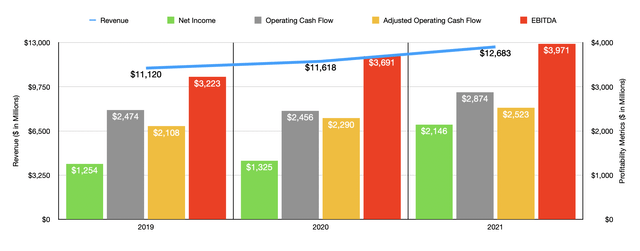

Over the past three years, any financial performance achieved by Keurig Dr Pepper was rather robust. Despite the COVID-19 pandemic, revenue continued to climb, rising from $11.12 billion in 2019 to $12.68 billion in 2021. This growth was largely broad-based across the company’s major product categories. For instance, K-Cup pod volume increased by 6.3% in 2020. This was followed up by a 5.6% rise in 2021. Brewer sales volume was 21.2% higher in 2020 than it was in 2021, while in 2021 it increased a further 10%. Carbonated soft drink sales for the company inched up just 0.1% in 2020 before climbing a further 4.8% in 2021. The only real weakness experienced involved sales of non-carbonated beverages. After rising by 1.4% in 2020, sales volume dropped by 5.5% last year.

As revenue increased, so too did profitability. Net income for the company expanded from $1.25 billion in 2019 to $1.33 billion in 2020. In 2021, profits jumped to $2.15 billion. Other profitability metrics have also been positive for the company. Operating cash flow went from $2.47 billion in 2019 to $2.87 billion in 2021. If we adjust for changes in working capital, however, the increase was from $2.11 billion to $2.52 billion. Meanwhile, EBITDA for the company also increased, climbing from $3.22 billion to $3.97 billion.

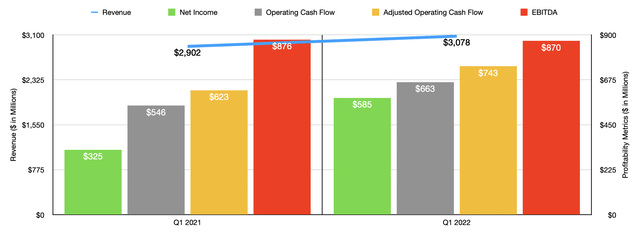

So far this year, results have been somewhat mixed but generally positive. Revenue for the company came in at $3.08 billion for the first quarter of 2022. This is 6.1% higher than the $2.90 billion reported the same time one year earlier. Interestingly, this rise was driven by a mixture of price increases and a 3.8% increase in carbonated soft drink volumes. All other major categories decreased year over year. According to management, both K-Cup pod volumes and brewer volumes decreased 5.2% compared to the same quarter last year. Meanwhile, non-carbonated beverage sales volumes dropped by 0.4%.

When it comes to profitability, the picture is a bit complicated. For instance, net income at the company rose materially, climbing from $325 million to $585 million. But once again, the company was impacted by one-time items. The largest example was a $299 million gain on litigation settlement the company booked for the quarter. Fortunately, management provides an adjusted net income estimate that is more conservative. Using this, net income rose more modestly from 2021 to 2022, inching up from $471 million to $474 million. Operating cash flow for the company also increased, climbing from $546 million to $663 million. If we adjust for changes in working capital, the rise was from $623 million to $743 million. The only profitability metric that worsened year over year was EBITDA. It dropped from $876 million to $870 million.

For the full 2022 fiscal year, management currently anticipates revenue rising at the high single-digit rate. Earnings per share, meanwhile, are forecasted to rise at a mid-single-digit rate. However, management has not provided any further guidance than this. Taking the company’s guidance literally, I have decided to project a 5% increase in profitability for the business. For adjusted net income, this would imply a reading of $2.09 billion. Adjusted operating cash flow would be $2.41 billion, while EBITDA would total $4.17 billion.

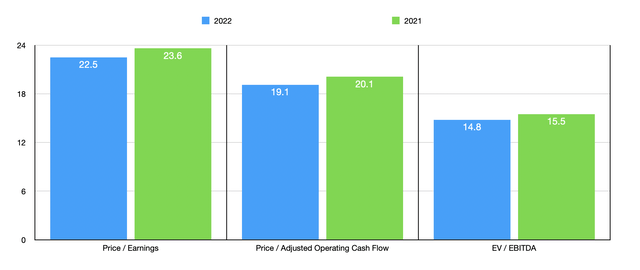

Using this data, we can value the enterprise. Using our 2021 results, we can see that the firm is trading at a price-to-earnings multiple of 23.6. This drops to 22.5 if we use the 2022 estimates. The price to adjusted operating cash flow multiple is lower at 20.1, a number that decreases to 19.1 on a forward basis. Meanwhile, the EV to EBITDA multiple of the company should be 15.5. That should decline to 14.8 if we use the 2022 estimates. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 22.2 to a high of 34.4. Using our 2021 results, we can see that only one of the four companies that had positive earnings was cheaper than Keurig Dr Pepper. Using the price to operating cash flow approach, these companies ranged from a low of 8.7 to a high of 47.6. In this case, two of the five were cheaper than our prospect. And finally, using the EV to EBITDA approach, these companies range from a low of 12.1 to a high of 23.6. In this case, two of the five were cheaper than Keurig Dr Pepper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Keurig Dr Pepper | 23.6 | 20.1 | 15.5 |

| Monster Beverage Corporation (MNST) | 34.4 | 47.6 | 23.6 |

| The Coca-Cola Company (KO) | 25.8 | 23.0 | 18.9 |

| PepsiCo (PEP) | 26.8 | 18.6 | 14.4 |

| National Beverage Corporation (FIZZ) | 22.2 | 31.1 | 17.9 |

| Primo Water (PRMW) | N/A | 8.7 | 12.1 |

One thing I would also like to touch on is that management has undergone some interesting financial engineering over the past couple of months. In April of this year, management announced the issuance of $3 billion worth of notes with staggered maturity dates and interest rates ranging from 3.95% to 4.50%. The company then engaged in a tender offer to buy back just over $2 billion worth of senior unsecured notes, with some having near-term maturities and others having longer-dated maturities but higher interest rates. The company also expressed interest in using the excess cash to buy back some additional debt. But sticking strictly to the tender offer, the company ended up acquiring $2.01 billion of notes in exchange for $2.11 billion. Though this may seem odd, the move will save the enterprise about $10.2 million in interest expense annually. Having said that, I don’t necessarily see this as a win. That is because the cost of buying back these notes, because of the premiums they had to pay, totaled $102.38 million. Even so, it is nice to see management focusing its efforts on ways to increase profitability and cash flow.

Takeaway

Based on the data provided, I must say that I am impressed with the business model championed by Keurig Dr Pepper. The company is truly a quality operator that has done well for itself and its shareholders in recent years. Long term, I fully expect this trend will continue. It also helps that the business is trading add a site discount to what some of its peers are going for. Having said that, shares are still pricey on an absolute basis and I see upside potential as being limited. I believe that, as the market eventually goes higher again, shares will probably generate returns that are similar to that rise. This is not to say that buying into the company would be a horrible idea. Given the company’s track record, I fully suspect that shares might fall less in the event that the market continues its downturn. This could mean that it makes for a good place to park your money in a down market. But for those focused on long-term capital appreciation as opposed to short-term stability, I do believe there are better prospects to be had, leading me to rate the enterprise a ‘hold’ at this time.

Be the first to comment