DKosig/iStock via Getty Images

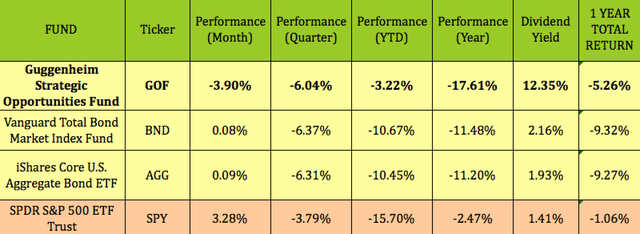

Looking for some diversification in your portfolio? The Guggenheim Strategic Opportunity Fund (NYSE:GOF), a closed-end fund, or CEF, which offers a mix of fixed income and equity strategies. We began covering GOF at the start of 2022. So far in 2022, GOF has outperformed these 2 other bond funds, and the S&P 500, by a wide margin.

Looking back over the past year, GOF has lagged the S&P quite a bit on a price basis, while its ~12% dividend yield brings its total return to -5.26%, still lagging the S&P’s -1.06%, but better than the -9.3% for these 2 other bond funds:

Profile:

“The Fund’s investment objective is to maximize total return through a combination of current income and capital appreciation. The Fund will pursue a relative value-based investment philosophy, which utilizes quantitative and qualitative analysis to seek to identify securities or spreads between securities that deviate from their perceived fair value and/or historical norms.

The Fund’s sub-adviser seeks to combine a credit managed fixed-income portfolio with access to a diversified pool of alternative investments and equity strategies.” (GOF site)

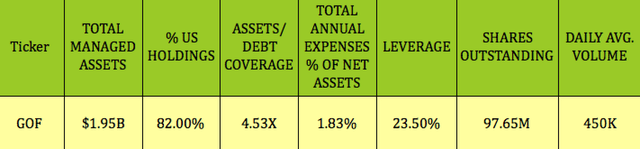

GOF has $1.95B in managed assets, with 82% of its holdings U.S.-based. Management uses 23.5% leverage, (down from 30% earlier in 2022), and the Expense Ratio is 1.83%. Average daily volume is 450K, with 97.65M shares outstanding. The Assets/Debt ratio is 4.53X:

Holdings:

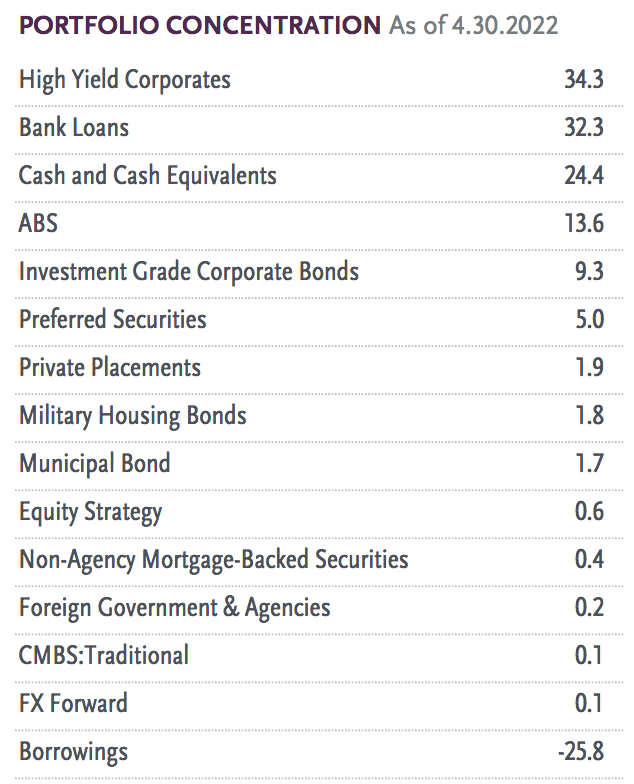

High Yield corporate bonds and Bank Loans are the 2 heaviest concentrations, at 34.3% and 32.3% respectively, followed by Cash and Equivalents at 24.4%, Asset Backed Securities, ABS, at 13.6%, investment grade Corporate Bonds, at 9.3%, and Preferred securities, at 5%.

Overall, Fixed Income formed 80%, of GOF’s portfolio as of 4/30/22, with Equity strategies down to less than 1%, vs. over 13% as of 1/31/22.

GOF site

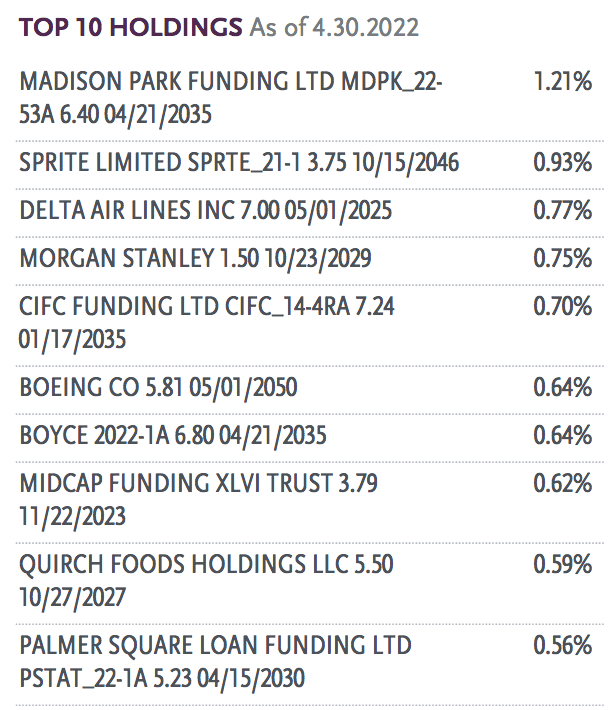

GOF’s top 10 holdings were mostly in corporate bonds, and only comprised ~7% of its holdings, as of 4/30/22:

GOF site

Management has decreased the weighted average duration to 3.34, as of 4/30/22, vs. 4.59 on 1/31/22.

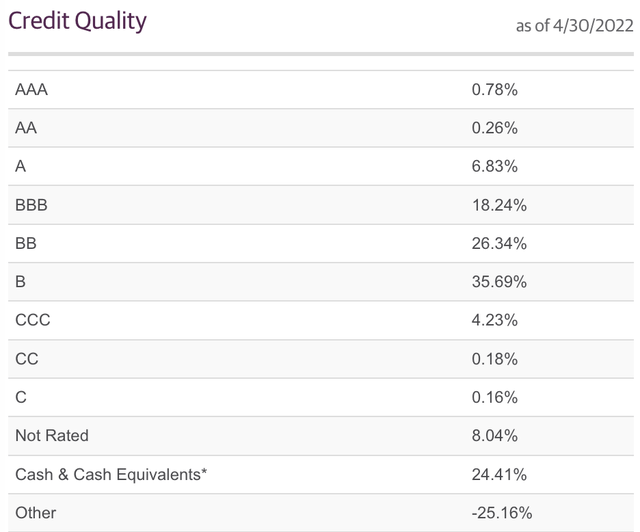

Credit quality has moved more into sub-investment grade, with investment grade, (AAA – BBB), at 26.11% as of 4/30/22, vs. ~48% as of 1/31/22 , while ~67% of the investments are till rated non-investment grade, (BB and lower):

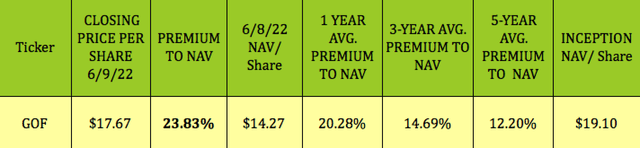

NAV Pricing:

At its 6/9/22 closing price of $17.67, GOF was selling at a premium to its 6/8/22 NAV/share of $14.27, which is higher than its 1-, 3-, and 5-year premiums of ~20.3%, 14.7%, and 12.2%, respectively.

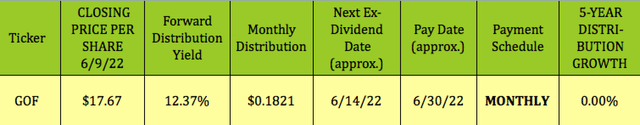

Distributions:

At $17.67, GOF yields 12.37%, and goes ex-dividend on 6/14/22, with a 6/30/22 pay date. Management has kept the monthly distribution at $.1821 since Q2 2013.

Parting Thoughts:

While GOF has outperformed so far in 2022, you may want to wait for a lower premium. Buying CEFs at lower than historical premiums or deeper than historical discounts can be a useful strategy.

If you’re interested in other high yield vehicles, we cover them every weekend in our articles.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment