NicoElNino

(This article was co-produced with Hoya Capital Real Estate)

Introduction

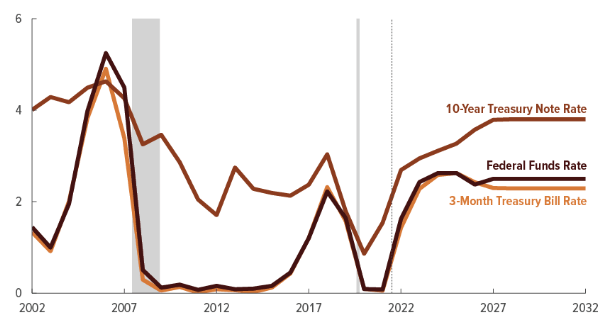

cbo.gov Rate forecast

Goldman Sachs sees the 10-Year Treasury yielding over 4% through 2024. With the Nuveen Preferred and Income Term Fund (NYSE:JPI) holding a mixture of preferreds and bonds with a planned termination on/before 8/31/2024, are investors protected from interest rates climbing between now on when the CEF is schedule to close? Currently, the 10-year TSY bond sports a yield near 3.5%. As the title implies and I will explain, I believe the answer is no. Whether that means investors should avoid JPI is another question that will be examined in the Portfolio strategy section of this article.

Nuveen Preferred and Income Term Fund review

Seeking Alpha describes this CEF as:

The Fund seeks to provide a high level of current income and total return by investing at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities, with a focus on securities issued by financial and insurance firms. At least 50% of its managed assets are rated investment grade. The Fund uses leverage and has a 12-year term and intends to liquidate and distribute its then-current net assets to shareholders on or before 31 Aug 2024. Benchmark: ICE BofA Fxd Rate Pref TR USD. JPI started in 2012.

Source: seekingalpha.com JPI

JPI has $434m in AUM and shows a Forward yield of 7.85%. Typical of many CEFs, the fees really cut into the return investors see; here being 224bps, up 18bps since the summer, mostly related to increased interest expense (+15bps) on the 37+% leverage ratio. Rising rates hit JPI twice: lower value of the assets held; more cost to leverage, currently 4%. Leverage drives the total assets involved to almost $700m.

- Common Net Assets: $434m

- Debt Borrowings: $195m

- Reverse Repos: $65m

Holdings review

JPI holds 229 assets with an effective duration of 3.11 years; which translates into late 2025; or past the planned termination date.

JPI’s asset allocation includes 32% in Contingent Capital Securities or CoCos. Nuveen provides this explanation for CoCos:

CoCos are hybrid securities created by regulators after the 2007-08 global financial crisis (GFC) as a way to reduce the likelihood of government-orchestrated bailouts. Issued primarily by non-U.S. banks, CoCos are designed to automatically absorb losses, thereby helping the issuing bank satisfy Additional Tier 1 (AT1) and Tier 2 (T2) regulatory capital requirements.

Today, European-domiciled issuers (mostly banks but also a small number of insurance companies) make up almost 80% of the outstanding CoCo market. Insurance companies may use these securities for capital purposes or to help manage their credit ratings.

But why are CoCos “contingent”? Because of a feature that automatically imposes a loss on the investor should an issuer’s capital fall below a predetermined threshold — typically 7% of its total risk-weighted assets in a “high trigger” structure and 5.125% in a “low trigger” structure. When this occurs, depending on the structure, there are three possible outcomes:

- The security is converted to common equity

- The investor is forced to assume a temporary write-down of the security’s value

- The investor is forced to assume a permanent write-down of the security’s value.

Source: nuveen.com CoCos defined

There are about 50 CoCos held, spread across 21 Issuers. These securities are included in the following allocations presented.

Par allocation

Institutional ($1000): 81%

Retail ($25): 19%

Country allocation

United States: 61.5%

Other: 38.5%

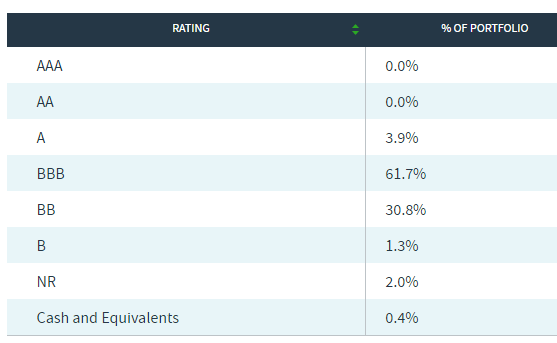

Credit ratings

nuveen.com ratings

Morningstar gives this allocation a BBB- overall rating: just above non-investment-grade.

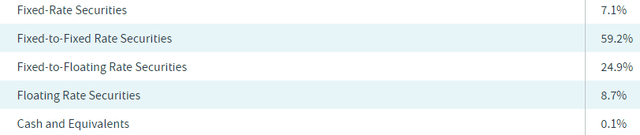

Coupon structure

nuveen.com coupons

Fixed-to-Fixed (59%) are assets where the coupon will change and the new rate is known, unlike the next two structures: Fixed-to-Floating rate and Floating Rate. Also unknown is which rate is the current one, the original or an adjusted/floating one. The more in the floating stage, the better JPI is protected from climbing interest rate curves.

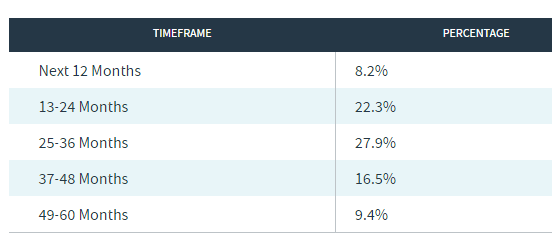

Call exposure

nuveen.com Call exposure

With a fund that terminates in under two years, the above tells investors that a majority of the holdings will need to be sold as they mature after that date; possibly over 60% of the portfolio: it is actually almost 100%!

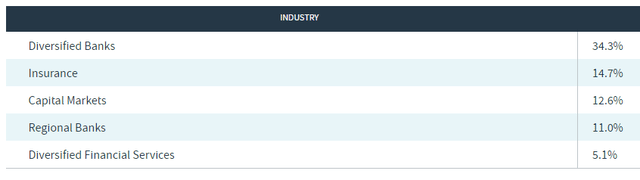

Industry allocation

nuveen.com Industries

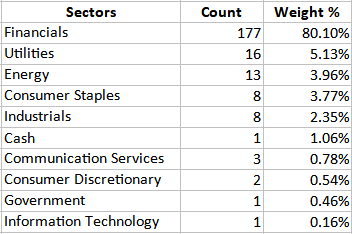

The full holdings data provides the following Sector allocation.

nuveen.com; compiled by Author

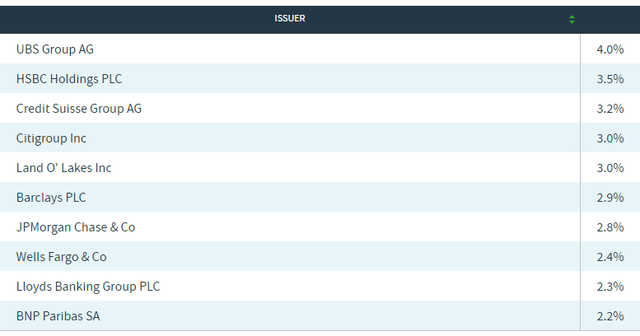

Top Issuers

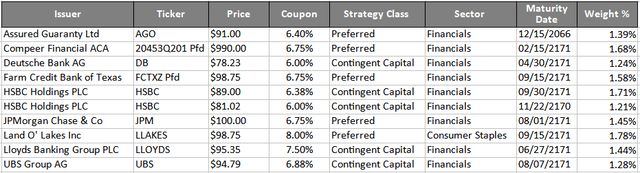

nuveen.com Issuers

Six of these are large foreign banks; three others are large US banks; only Land O’ Lakes is not a bank. Most of the preferreds held were issued by financial institutions, which adds payout risk as they are almost all non-cumulative. With a recession predicted between now and 2024, that needs to be factored in.

Top 10 holdings

nuveen.com; compiled by Author

With an average bond price of $90, there is room for price appreciation before JPI terminates even if rates are stable.

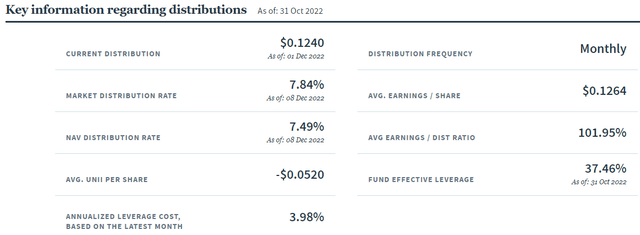

Distribution review

Nuveen provides some basic facts related to JPI’s payouts.

nuveen.com JPI

seekingalpha.com JPI DVDs

JPI has reduced its payout four times in the last five years; including one that started in November. As shown above, that reduction now has JPI earning its distribution.

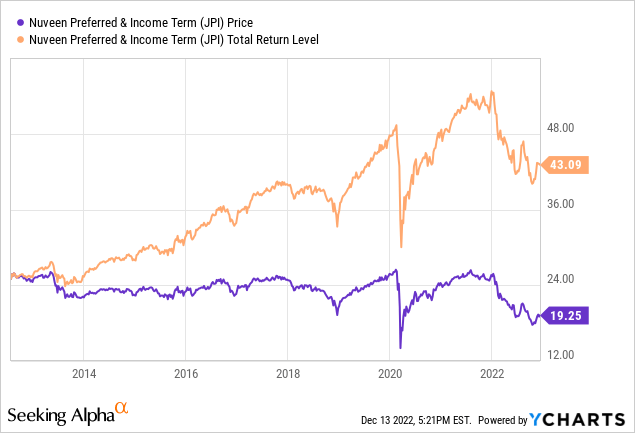

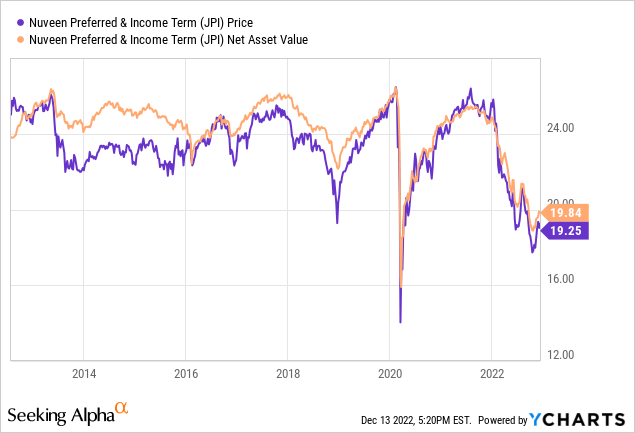

Price and NAV review

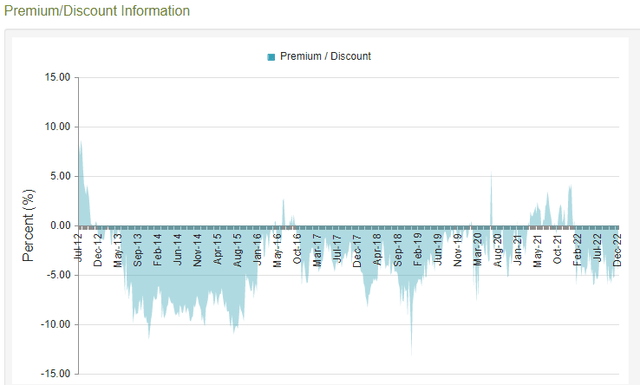

As the net chart will show better, JPI spends most of its time selling at a discount around 5%, but with a few times up to a 4-5% premium.

CEFConnect.com

Currently, JPI shows a 3.95% discount, with the deepest level of 6% in the past year. At the start of 2022, it reached a 4% premium, but as the chart shows, that is rate and a potential Sell signal.

Portfolio strategy

There is an important word missing from JPI’s name that changes the game for some investors: Target. A Target Term fund would have almost all assets maturing within six months of its closing date; unlike JPI which has literally none.

When reviewing the current portfolio, there is only ONE bond that matures before JPI is schedule to close: .16% of the weight. There are currently two interest rate swaps, totaling .32%, one of which expires on 7/1/24: not sure how much rate protection they will provide. Over 80% mature after 2160, split between preferreds and CoCos assets! Even ignoring those, the rest of the portfolio has a WAM of almost 7 years, way beyond the termination date of less than 2 years. No assets mature between 2025-2028.

Assuming interest rates are the same when JPI terminates as they are today, here is the best return I would anticipate is the Yield + minor asset price improvement assuming the YTC’s stay the same; or maybe a 8% total return. Investors need to compare that against other fixed income assets that mature around the date JPI is terminating and compare the differences in risk. Here are three possible alternatives.

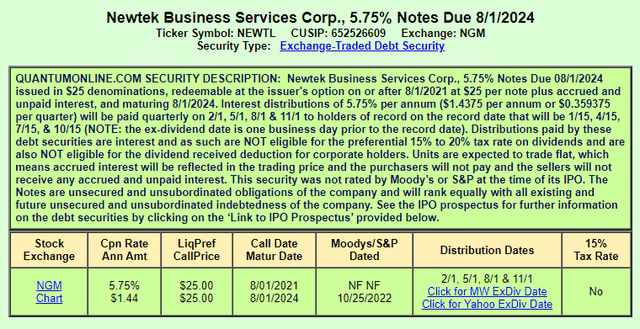

quantumonline.com NEWTL

The YTC is about 6.1% at the current price of $24.88, but there is the risk of being called. Another risk difference is this is a single preferred, not a fund, so potential investors need to examine the Issuer: Newtek Business Services Corp (NEWT).

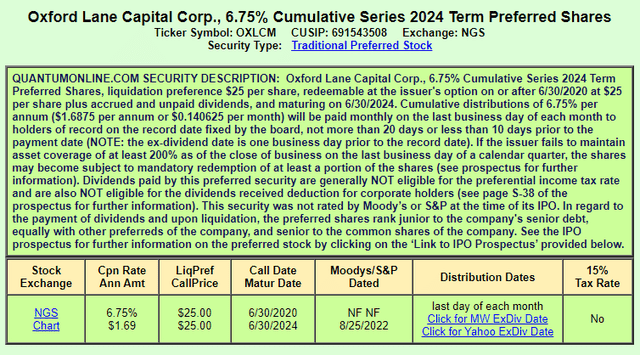

quantumonline.com OXLCM

This Oxford Lane Capital Corp (OXLC) term preferred offers a 7.1% YTC based on the current price of $24.88. Like the first, be sure to understand the risks of Issuer, though in both cases, the preferred stock owners are compensated before the common stock owners if things get really bad; but that can take years if the issuer enters bankruptcy.

For investors wanting a fund invested in 100% of its bonds maturing pre-closing in 2024, there’s the Invesco BulletShares® 2024 Corporate Bond ETF (BSCO). The trade-off is this ETF only yields about 2.5%, but should have little, if any, interest-rate risk.

Final thought

Those investors considering JPI should not look at this CEF as a Target Term which have limited interest-rate but like similarity invested CEFs that do not come with a termination date.

Be the first to comment