Sakorn Sukkasemsakorn

One of the sectors that could report high growth rates in the last decade were semiconductor companies – especially companies like NVIDIA Corporation (NVDA) and Advanced Micro Devices (AMD) outperformed the S&P 500 (SPY) in an impressive way. But companies like Texas Instruments (TXN) and Skyworks Solutions, Inc. (NASDAQ:SWKS) also outperformed the S&P 500 during the last 10 years.

|

NVIDIA Corp |

AMD |

Texas Instruments |

Skyworks Solutions |

|

|

10 year performance |

5,520% |

2,780% |

471% |

390% |

So far, I covered two companies – NVIDIA, which is still overvalued in my opinion and Intel (INTC), which seems like an extreme bargain in my opinion. In this article I want to take a closer look at Skyworks Solutions – a company that could become a great investment in the coming quarters as even lower stock prices seem likely (but from a fundamental point of view, the stock is already undervalued).

Business Description

Skyworks Solutions, Inc. is an American semiconductor company empowering the wireless network revolution. The company was founded in 1962 and is based in Irvine, California. Skyworks Solutions’ analog and mixed-signal semiconductors are connecting people, places and things and are found in aerospace, automotive, cellular infrastructure, connected home, entertainment, gaming, medical as well as smartphones and wearables. The product portfolio includes amplifiers, antenna tuners, automotive tuners, circulators and isolators, mixers, modulators, receivers, switches, timing devices or voltage regulators.

Key customers include Amazon.com, Inc. (AMZN), Cisco Systems Inc. (CSCO), Garmin Ltd. (GRMN), General Electric Company (GE), Alphabet Inc. (GOOG), Microsoft Corporation (MSFT), Nokia Oyj (NOK), and Samsung Electronics Co., Ltd. (OTCPK:SSNLF). But the most important customer is Apple, Inc. (AAPL), which is responsible for more than half of the company’s revenue (we will get to this). Competitors include companies like Analog Devices, Inc. (ADI), NXP Semiconductors N.V. (NXPI), Qualcomm Incorporated (QCOM), and Texas Instruments Incorporated (TXN).

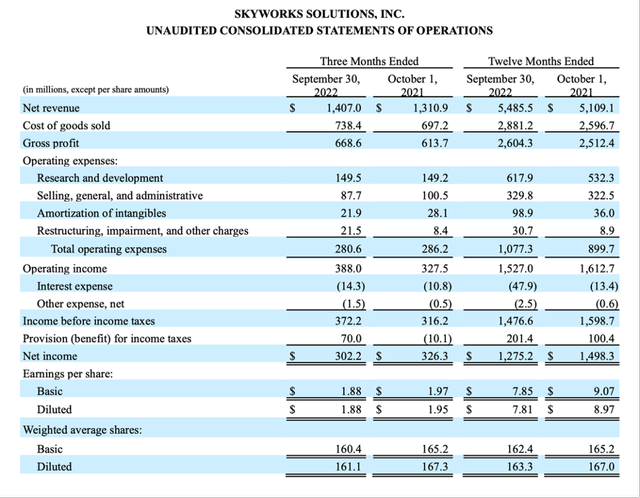

Fiscal 2022 Results

When looking at the full-year results for fiscal 2022, Skyworks Solutions could report solid numbers. Revenue increased from $5,109 million in FY21 to $5,486 million in FY22 – resulting in 7.4% year-over-year growth. While the top line was still growing, operating income declined slightly from $1,613 million in the previous year to $1,527 million in fiscal 2022 – resulting in 5.3% year-over-year decline. And finally, diluted earnings per share also declined 12.9% YoY from $8.97 in the previous year to $7.81 this year. However, when looking at adjusted, non-GAAP numbers, diluted earnings per share increased from $10.50 in 2021 to $11.24 in 2022 – resulting in 7.0% YoY growth.

Skyworks Solutions Q4/22 Earnings Release

Risks

One of the major risks Skyworks Solution is facing is the huge dependence on one single company – Apple. And this dependence might also be one of the reasons why Skyworks Solutions is trading for such a low valuation multiple despite solid growth rates (we will get to this). The dependence on one single company is always seen as a major risk and especially a huge corporation like Apple, which has the financial strength for major investments, can suddenly decide not to be dependent on a supplier like Skyworks Solutions anymore.

And such a move is certainly not unprecedented for Apple. One example would be Intel, which had Apple as one of its major customers and Apple suddenly ceased to use Intel chips and instead installed its M1 and M2 in the MacBook. And right now, Apple is trying to move production out of China, which will have major consequences for Foxconn.

In the past three years (fiscal 2020 till fiscal 2022) Apple was responsible for 56% to 59% of Skyworks Solutions’ total revenue and if that revenue should suddenly vanish, it would be a huge problem for Skyworks Solutions. Such a huge dependence on one single customer is giving Apple huge bargaining power over Skyworks Solutions. Apple is most likely able to demand large discounts from Skyworks Solutions as it can threaten to go to a competitor which would create a huge problem for Skyworks Solutions.

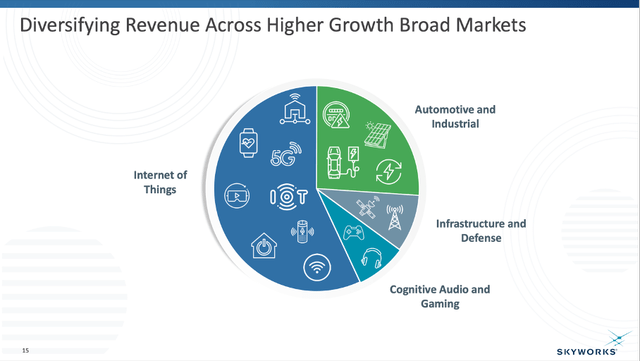

Shifting Away From Mobile

But management certainly seems to be aware of the problem and is trying to decrease its dependence on mobile revenue and diversifying its business. While mobile revenue grew from $1.2 billion in FY12 to $3.5 billion FY22 (resulting in a CAGR of 11%), broad market revenue increased from $0.4 billion in FY12 to $2.0 billion in FY22 (resulting in a CAGR of 17%). Broad market revenue is now 36% of total revenue and in fiscal 2022, revenue for this segment could increase with an impressive 37% growth rate year-over-year.

Skyworks Solutions Investor Presentation

And Skyworks Solutions is also expanding its customer base in an effort to diversify its business and be less dependent on a few individual companies. Between 2016 and 2022 the company could triple the number of customers from 2,000 to 6,000 right now.

Growth Potential

And this diversification leads to several growth opportunities for Skyworks Solutions. But when talking about growth, let’s start with the elephant in the room. Despite all growth initiatives and diversification, Skyworks Solutions – at least in the near term – is quite dependent on Apple’s iPhone sales. And at this point, it seems like the iPhone 14 Pro and iPhone 14 Pro Max continue to outsell the iPhone 13 predecessors. Apple also issued a statement a few weeks ago:

We continue to see strong demand for iPhone 14 Pro and iPhone 14 Pro Max models. However, we now expect lower iPhone 14 Pro and iPhone 14 Pro Max shipments than we previously anticipated and customers will experience longer wait times to receive their new products.

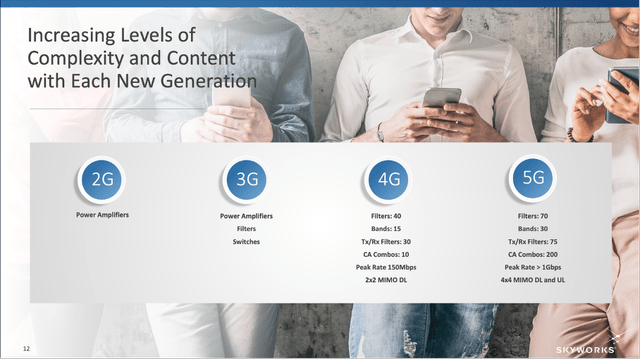

We should not really expect huge growth potential from iPhone sales as the number of iPhones sold is rather stable for several years now (with some fluctuations). However, the company can grow due to constantly increasing levels of complexity and content with each new generation. When only comparing the number of filters, bands, Tx/Rx filters and CA combos, the number quadrupled between 4G and 5G.

Skyworks Solutions Investor Presentation

And aside from its growth potential in the mobile market, Skyworks Solutions has high growth potential due to the Internet of Things, which will create a high demand. Skyworks Solutions is writing on its Investor Relations Page:

If you believe that connectivity is the future, then investors should start here. With technology experts predicting there will be 75 billion connected devices operating worldwide by 2025, Skyworks is uniquely positioned to capitalize on emerging 5G and Internet of Things opportunities. In every way the world is connected, Skyworks is there.

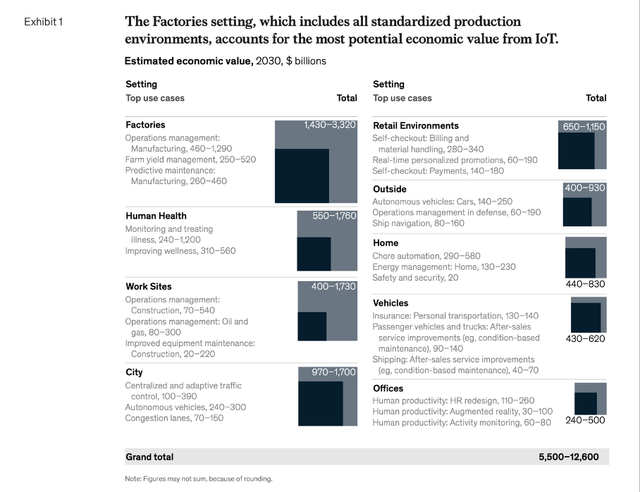

And although the “Internet of Things” market has not grown as fast as McKinsey expected in 2015, we are still looking at a gigantic market with huge growth potential. According to the study “The Internet of Things: Catching up to an accelerating opportunity” McKinsey is expecting that the Internet of Things could enable $5.5 trillion to $12.6 trillion in global value. And while value can be created in many different settings – like factories, human health, city, retail environments, home, vehicles and offices, operations optimization holds the most potential economic value – it is expected to be somewhere between $2 trillion and about $5.1 trillion (with a huge impact especially on factories, work sites, cities, and home).

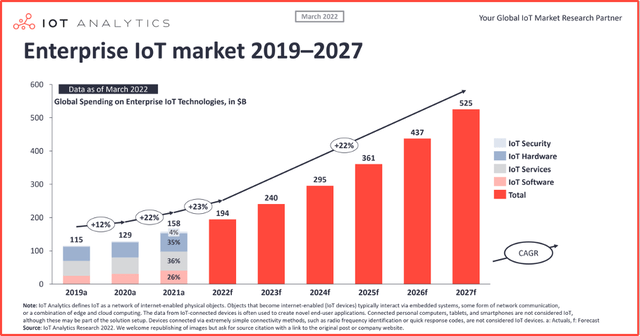

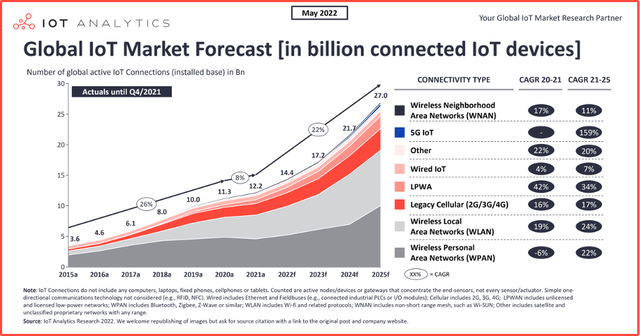

And when looking not at the total value that could be created but the spendings of corporations on IoT technologies in the years to come, we also see huge growth potential. IoT Analytics is expecting the market to grow with a CAGR of 22% in the years 2022 till 2027. And in 2027, global spendings are expected to be $525 billion.

Also, according to IoT Analytics, the number of global IoT connections reached 12.2 billion active endpoints (representing only 8% YoY growth). But in 2022, the number of active connections is expected to grow 18% to 14.4 billion and until 2025 growth is expected to accelerate and there will be approximately 27 billion connected devices.

Another segment with high growth potential is the automotive sector. During the last earnings call, management stated that autonomous driving is a huge opportunity for Skyworks Solutions as wireless high-speed connectivity is critical here. And during the Barclays Global Technology, Media and Telecommunications Conference, CEO Liam Griffin commented on automotive:

“Automotive, and this is another really tip of the hat to the guys at slab. We’re going to be, 200, 250 in automotive revenue within the next 12 months. I mean, that wasn’t, you wouldn’t have that at Skyworks two, three years ago. So it’s not all slab, but they actually have good relationships there. The technologies that you’re going to, you start to see now with EV, ADAS these kind of technologies require the things that we do well, you can, we can call it whatever we want to call it. We won’t call it mobile, but the technology vector to connect these vehicles is right in the sweet spot of what we do. So we think that market, we know that market is going to add significantly to us, and we’re going to invest more in that area.”

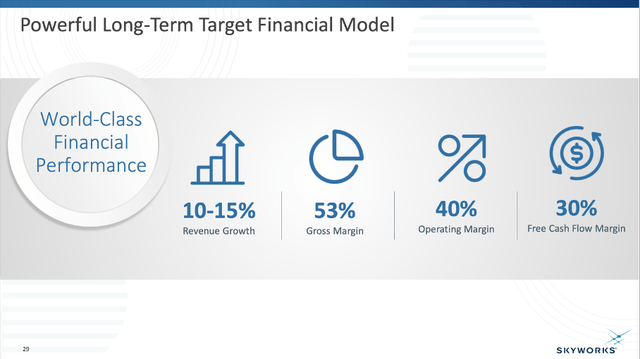

Summing all up, Skyworks Solutions has very ambitious targets for the future. It is expecting revenue to grow in the double-digits and has long-term financial targets of 10% to 15% revenue growth. Additionally, gross margin and operating margin are expected to improve further. Target for gross margin is 53% and operating margin is expected to reach 40%.

Skyworks Solutions Investor Presentation

And when looking at past growth rates, we can call these assumptions ambitious but realistic. Between 2012 and 2022 the 10-year revenue CAGR fluctuated between 11.24% and 17.28%. However, we should also point out that analysts are not so optimistic for the next few years. Between fiscal 2022 and fiscal 2027 analysts are expecting earnings per share to grow only with a CAGR of 5.44%.

Dividend and Share Buybacks

In 2015, Skyworks Solutions started paying a dividend and has been increasing the dividend not only every single year since then, but also with a high pace – resulting in a CAGR of 20%. Right now, the company is paying a quarterly dividend of $0.62 resulting in an annual dividend of $2.48 and a dividend yield around 2.6%.

Skyworks Solutions Investor Presentation

While the company is probably not interesting as dividend stock, it could be interesting as dividend growth stock. When looking at 2022 earnings per share of $7.81, the company was paying 31% of its earnings as dividend and when using the adjusted numbers (EPS of $11.24), the payout ratio is only 22%. It doesn’t really matter what number we use – the company is paying out only a fraction of its profits as dividend and still has the potential to increase the dividend further in the years to come.

Skyworks Solutions Investor Presentation

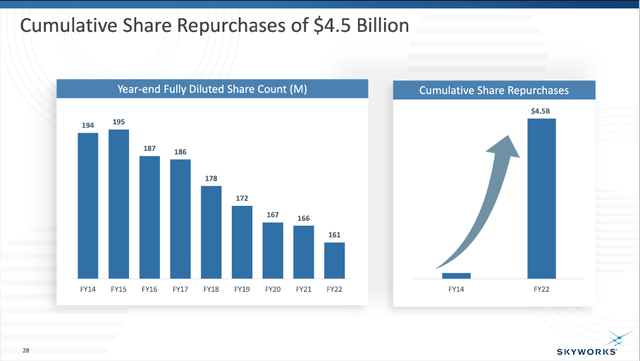

In 2015, Skyworks Solutions also started repurchasing shares and has spent about $4.5 billion on share repurchase so far, which resulted in outstanding shares declining from 195.4 million in 2015 to 160.9 million in 2022. This resulted in 17.7% decline of outstanding shares (resulting in a CAGR of 2.75%).

Intrinsic Value Calculation

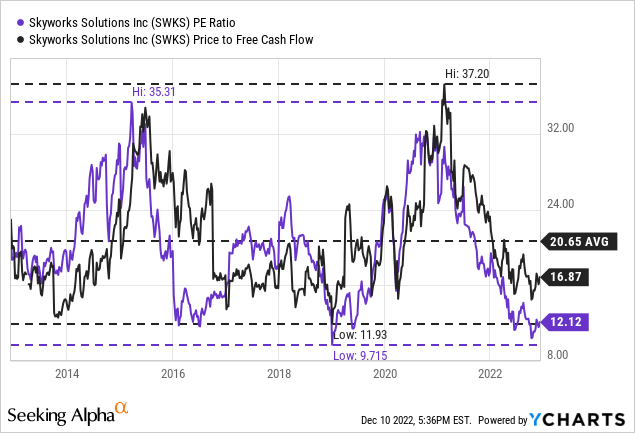

Skyworks Solutions seems to be extremely cheap. The stock is trading for 12 times earnings, which is one of the cheaper P/E ratios of the last ten years. And when using the company’s adjusted EPS, the stock is trading only for 8.4 times earnings right now.

When looking at the more important price-free-cash-flow ratio, Skyworks Solutions seems to be a little more expensive as the stock is trading for 17 times free cash flow. However, this is still below the average of the last ten years (20.65). And when keeping in mind, that Skyworks Solutions could grow in the double digits in the last 10 years, these valuation multiples seem extremely low.

As always, we are not just looking at simple valuation metrics, but also use a discount cash flow calculation. When taking the free cash flow of the last four quarters (which was $935 million in FCF and lower than in previous years and quarters), the company must grow its free cash flow only about 4% from now till perpetuity to be fairly valued (assuming 161 million outstanding shares and 10% discount rate).

But when looking at the growth potential described above and the company’s own long-term targets, we probably can be a little more optimistic. Skyworks Solutions is expecting revenue growth between 10% and 15% for the years to come and 30% free cash flow margin. So, let’s be more optimistic in our second calculation. For the next decade, we assume 10% annual growth and for fiscal 2023 we assume a FCF margin of 18% (leading to a similar free cash flow as in fiscal 2022). Over the next few years, we assume Skyworks Solutions can improve its FCF margin and reach its 30% target by 2029. And for the years following 2032, we assume 6% growth – as always when dealing with companies that have a (wide) economic moat. When calculating with these assumptions, we get an intrinsic value of $326.33 for Skyworks Solutions and we are looking at an extreme bargain.

Conclusion

In some ways, Skyworks Solutions seems like a risky investment as the huge dependence on Apple (between 55% and 60% of the company’s total revenue) is a major risk. But Skyworks Solutions is trading clearly below its intrinsic value, and it seems like the risk of Apple ceasing to be Skyworks Solutions’ customer is already reflected by the share price.

You must evaluate for yourself how huge the risk of losing Apple as a customer is and if you are willing to take that risk. But with Apple staying on board and Skyworks Solutions being able to grow with a solid pace, we are looking at a huge bargain.

Be the first to comment