krblokhin

Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The defense sector is an exciting area as it is an integral part of the economy and is likely to remain so, especially as the war in Europe continues as nations understand the critical need for an army even in the 21st century. Companies like Raytheon (NYSE:RTX) and Lockheed Martin (LMT) are well-positioned to take advantage of it and have a track record of financial performance and innovation. Additionally, the industry is changing, with an increased focus on technology and innovative solutions to emerging threats. In this article, I will focus on Raytheon Technologies.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Raytheon Technologies, an aerospace, and defense company, provides systems and services for the commercial, military, and government customers worldwide. It operates through four segments: Collins Aerospace Systems, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense. The company is headquartered in Waltham, Massachusetts.

Fundamentals

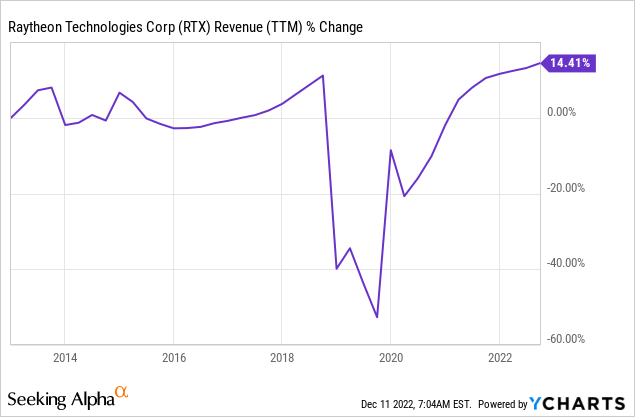

Revenues of Raytheon Technologies are up 14% over the last decade. It equates to roughly 1% annually, which looks very disappointing. However, Raytheon merged with United Technologies, and Carrier (CARR) and Otis (OTIS) were divested in spin-offs. Therefore, the graph is somewhat misleading, and the focus should be on the future of the defense and aerospace business combined. In the future, as seen on Seeking Alpha, the analyst consensus expects Raytheon to keep growing sales at an annual rate of ~7% in the medium term.

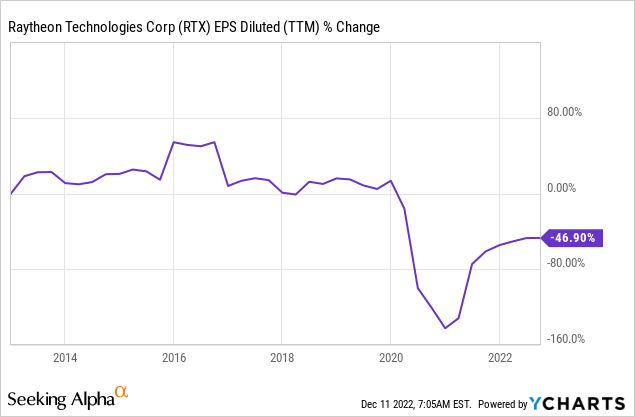

For the same reason as above, the 47% decline in the EPS (earnings per share) may be very misleading. The forecasted EPS for 2022 is $4.76, which is 36% higher than the 2020 EPS following the merger. The EPS grows faster as the company realizes synergies following the merger and buying back its stock. In the future, as seen on Seeking Alpha, the analyst consensus expects Raytheon to keep growing EPS at an annual rate of ~12% in the medium term.

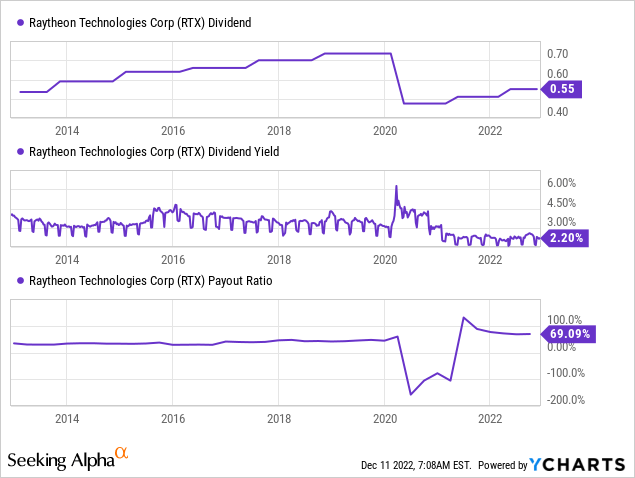

The dividend has been increasing since the merger between Raytheon and United Technologies. Before the merger, both companies were dividend aristocrats. The merger involved two spin-offs. Thus, the dividend was reduced, yet the management is fully committed to the dividend. The dividend yield of 2.2% is relatively safe and unlikely to be cut, with the payout ratio at 69% when GAAP EPS and 45% when using non-GAAP metrics.

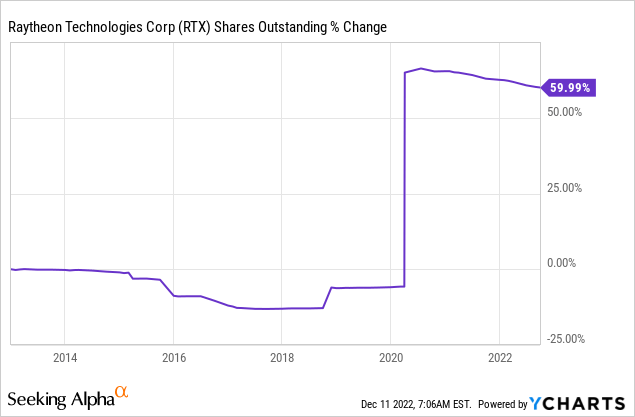

In addition to dividends, companies return capital to shareholders via share repurchase plans. Buybacks supplement EPS growth by lowering the number of outstanding shares. Over the last decade, the number of shares increased by 60% due to the merger between Raytheon and United Technologies. Since the merger, there has been a 4% decrease in shares as the company is working on reducing the share count.

Valuation

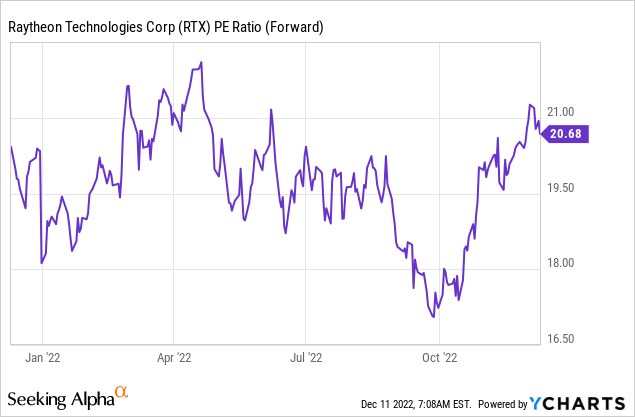

Raytheon’s current P/E (price to earnings) ratio is 20.7 when considering the forecasted EPS for 2022. Over the last twelve months, the P/E ratio has been moving between 17 and 22, and it is now on the higher side. However, a P/E ratio of 20 for a company that is growing at a double digits rate and has the U.S. government as its leading client doesn’t seem unacceptable to me.

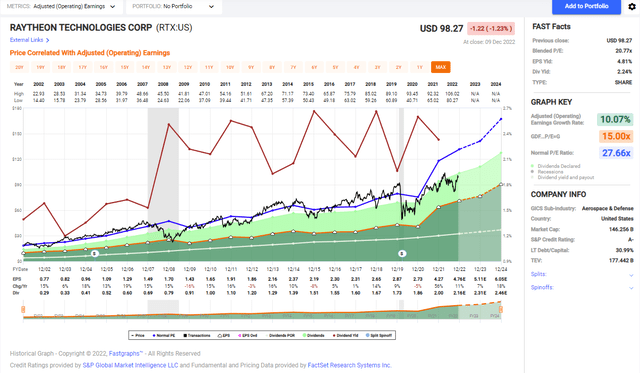

The graph below from Fastgraphs implies that the current valuation is decent. Over the last twenty years, the average P/E ratio of Raytheon Technologies and United Technologies before the merger was almost 28. During that period, the average annual growth rate was 10%. Therefore, the current P/E of 20.7, with a growth rate of around 12%, seems to make sense for investors seeking solid companies trading for a decent valuation.

In summary, Raytheon has strong fundamentals across the board. The company’s sales and EPS growth enable it to provide shareholders with a growing stream of dividends and buybacks. Despite slightly slower growth than average, the current valuation appears to be logical, in my opinion, and with decent growth opportunities and limited risks, the shares may be attractive.

Opportunities

Raytheon has a strong track record of financial performance. The company has consistently generated significant revenues and profits and has a diverse range of products and services that provide a solid foundation for continued growth. The war in Ukraine will promote the need for defense spending, and following Germany’s defense budget increase, other countries will seek contractors like Raytheon to innovate their armies.

In addition, the defense industry is likely to remain a significant part of the American economy, with companies like Raytheon being well-positioned to take advantage of it. The tensions between China and Taiwan and the American commitment to its pacific allies will require the United States to maintain a significant defense budget. Thus, Raytheon will have its largest customer continuing to spend while European NATO members rebuild their armies.

Moreover, Raytheon has a significant advantage over its peers. Its diversification presents an opportunity for the company to reduce its reliance on any specific product or service. Raytheon is not solely a defense company. It also has roughly 50% of its revenues from its civilian business. By offering a wide range of products and services, the company can withstand fluctuations in demand for any product or service. It can help to improve the stability and predictability of the company’s financial performance.

Risks

While there are decent short- and long-term opportunities, risks cannot be ignored. Raytheon has a considerable reliance on one client, the U.S. government. Military spending is heavily dependent on political and economic factors and global events. As a result, Raytheon and its peers can be risky if there is a significant change in the geostrategic atmosphere in the medium or long term.

Another risk is the tight regulation and the market regulation in the form of ESG. The American government limits what Raytheon can sell and to whom it can sell it. Not having complete flexibility in choosing your client and the products you sell may hinder growth. Moreover, there are concerns about the ethics of the defense industry and the actions of companies like Raytheon. As ESG funds are growing in popularity, there is an increasing risk that some investors will avoid Raytheon resulting in a lower share price.

The likely recession may have a significant negative impact on Raytheon’s aerospace business. As economic activity slows down and consumer spending decreases, demand for air travel is expected to decrease. It will likely lead to a decline in revenue for airlines, leading to a decrease in demand for new aircraft and aerospace products. Moreover, a recession may lead to slightly lower defense spending as lower taxes may force budget reductions.

Conclusions

Raytheon has strong fundamentals, with sales, EPS dividends, and buybacks growing. Its valuation is decent as it trades below its historical valuation and shows double digits growth. The company has a proven track record of financial performance and a diverse range of products and services that provide a solid foundation for continued growth.

The risks are limited, in my opinion, as the industry is likely to remain crucial for the global economy. Raytheon is expected to secure lucrative contracts in the future, even if a recession will make it grow a bit slower. Therefore, despite the risks and challenges, Raytheon is an attractive investment opportunity, and I rate it as a BUY.

Be the first to comment