niphon

Investment Thesis

Johnson Controls (NYSE:JCI) stock is up ~30% since our last article. I believe the stock still offers a good buying opportunity. The company is currently experiencing good demand across its end markets, which is benefiting its backlog levels and order book. It is well positioned in the sustainable as well as healthy building end markets, which should benefit the order book in FY23 and beyond due to strong demand. The strong order backlog and order book should benefit the company’s revenue in FY23, along with the pricing actions taken over the last few quarters. The margins should benefit from a higher margin backlog, operational improvements, improved cost structures, and productivity enhancements.

Revenue Outlook

The company is experiencing strong demand for its products, which could be seen in its strong field orders. The orders in the field business were up ~10% Y/Y with backlog increasing 13% Y/Y to $11.1 bn in Q4 FY22. The install orders in the quarter increased by low double digits Y/Y with continued demand for applied HVAC and control systems. The orders in the services business were up 7% Y/Y driven by double-digit growth in both the EMEA and APAC regions. The Global Products third-party backlog grew more than 25% Y/Y to $2.3 bn in the quarter. The total orders across the company increased 12% Y/Y to $1 bn in FY22 with a meaningful contribution from pricing increases.

The orders in the Building Solutions North America segment were up 13% Y/Y with strong growth of more than 50% in the sustainability infrastructure business, such as decarbonization. Applied HVAC orders grew nearly 20% Y/Y with equipment orders being up 30% Y/Y. Total backlog at the end of the quarter was $7.5 bn, up 18% Y/Y. In the Building Solutions EMEA segment, orders were up 3% Y/Y driven by high single-digit growth in Fire & Security platform, and the backlog was up 7% Y/Y to $2 bn. The orders in the Building Solutions Asia Pacific segment were up 3% Y/Y driven by low double-digit growth in services. Install orders remained flat Y/Y. The backlog in the quarter declined 2% Y/Y to $1.6 bn.

Looking forward, the strong pricing momentum from 2022 should be carried forward in FY23, benefiting revenue growth. Additionally, the end market demand is expected to be strong in the near term boosting the company’s order rate and backlog levels. The company is continuing to grow its sustainability initiatives by working with other companies and developing products associated with sustainable technology. JCI recently partnered with Microsoft’s Beijing campus, China to reduce emissions and improve uptime and is also working with Colorado State University to transform the campus and reach net zero electricity. The company is well positioned to take advantage of the favourable tailwinds in this end market, including credits for renewable offerings of ~$369 bn from the Inflation Reduction Act (IRA). Additionally, Europe is continuing to reduce its dependence on Russian gas and pushing for low-emission alternatives. Heat pump sales in Europe are expected to grow 4x by 2030 as per European Heat Pump Association. Heat Pumps accounted for ~48% of JCI’s total HVAC sales in Q4 FY22 and can be a meaningful growth driver looking forward.

The healthy building opportunity remains strong for the company as its customers are investing in employee health, wellness, and productivity benefits associated with well-managed indoor environments. The company is well positioned for this given its OpenBlue indoor air quality service. It has approximately $1.3 bn of sales pipeline in the healthy buildings segment.

I believe JCI has good growth opportunities given the strong trends across its end markets. Additionally, the indicators in the commercial business, such as the Architectural Billing Index and Dodge Momentum Index, are showing positive signs of growth. The company exited FY22 with strong backlog levels and a healthy order book, which should benefit its sales in FY23. Along with this, the pricing actions taken should drive revenue growth in the next fiscal year. Management has guided the revenue growth guidance range for FY23 between high-single-digit and low double-digit with pricing being the major contributor.

Margin Outlook

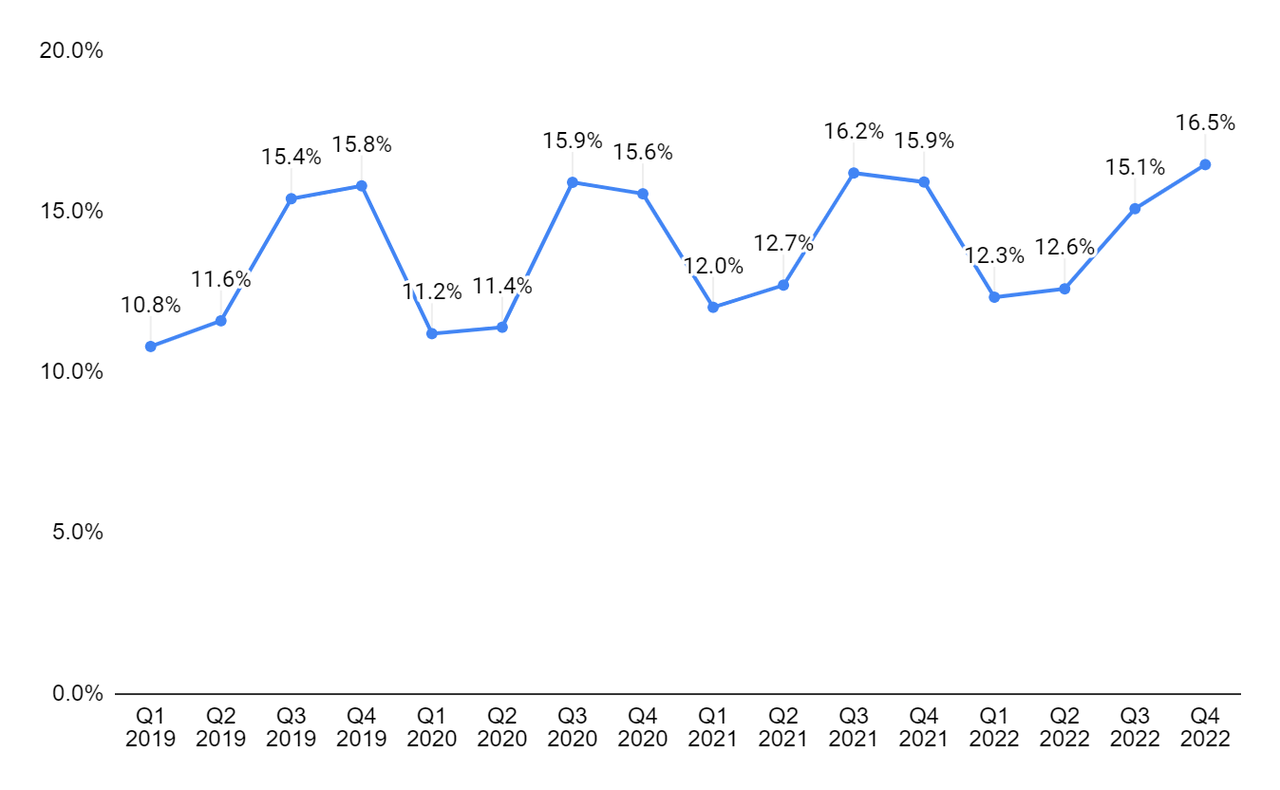

In Q4 FY22, the EBITA margin improved 55 bps Y/Y to 16.5% due to better leverage from higher volumes, a favorable mix, and incremental benefit from its ongoing SG&A and COGS costs reduction program, partially offset by continued supply chain constraints and dilutive but improving price/cost.

JCI’s segment-adjusted EBITA margin (Company data, GS Analytics Research)

Looking forward, the company is working with its suppliers to mitigate the impact of supply chain disruptions. The supply chain is expected to normalize by mid-FY23 which should help margins. Additionally, the sequential increase in pricing has benefited the company’s new orders which are booked at higher prices. As these higher priced orders in backlog are converted into revenues, it should help improve margins in FY23. JCI is also continuing its SG&A and COGS reduction initiatives through operational improvements, improved cost structures, and productivity enhancements. These tailwinds should offset the negative headwind from price/cost dilution. Management has guided for the segment EBITA margin to increase by 80 to 120 bps Y/Y in FY23 which is achievable.

Valuation & Conclusion

The stock is currently trading at 18.73x FY23 consensus EPS estimate of $3.50 and 16.41x FY24 consensus EPS estimate of $4.00. The company is experiencing good demand across its end markets, which is benefiting its backlog levels and order book. The company’s revenue should improve due to the elevated backlog levels and the pricing actions taken over the last few quarters. The margins should benefit from the SG&A and COGS reduction program as well as a higher margin backlog. According to consensus estimates, the company is expected to post 16.79% Y/Y EPS growth in the current year and 14.17% Y/Y growth next year. Given the reasonable valuation and good growth prospects, I have a buy rating on the stock.

Be the first to comment