bjdlzx

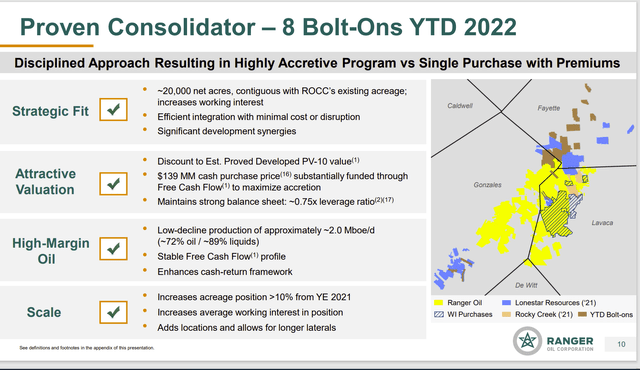

Ranger Oil (NASDAQ:ROCC) is one of the few companies that I follow where management is willing to put the effort into small “bolt-on” acquisitions that are not only usually very low risk acquisitions, but also build tremendous shareholder value over time. The reasons many managements do not do this kind of acquisition is because these acquisitions usually are not very visible to shareholders when it comes to the benefits they achieve. Each acquisition itself often does not “move the needle”. In aggregate, they build into a far more profitable and valuable position over time. Therefore, in the long-run, shareholders end up with a far more profitable company.

Generally, these small bolt-on acquisitions are made with selling shareholders that have an amount of acreage that is too small to be cost competitive. The market for these properties is very limited (usually to neighboring operators). So, the selling price is often well below the “going rate”. This allows the acquisition of cheap acreage. When that acreage is combined into a larger more valuable holding, the result is a sizable increase in market value.

But many shareholders only see the results of the income statement. Therefore, such a process generally does not impress the market until sometime in the future unless there are periodic sales of the more valuable acreage. Since the purpose of the acquisition is to acquire cheap drilling sights, the corresponding benefit is unknown until the superior profitability appears.

That gives shareholders an advantage over Mr. Market because this type of acquisition program is generally low risk. So, shareholders can get in ahead of the institutions and just wait for the market to realize what is going on.

Ranger Oil Review Of Small Bolt-On Acquisitions (Ranger Oil Presentation At Capital One Energy Conference December 2022)

Management has been consolidating in the Eagle Ford. What is different about this strategy is that not many companies have done this in the Eagle Ford. Yet there are a lot of small operators that cannot sell. This company is avoiding the bidding wars that happen for a lot of larger companies while adding acreage at a good price (or working interests).

Just looking at the 20,000 acres compared to the gross amount spent is only $7,000 (approximately) an acre. I cover companies that spend many times that amount because they only want to purchase acreage that “moves the needle”. Each of these individual purchases is small enough to probably not be significant alone. But as a group, they will move the needle.

The advantage here is in the location cost for a well drilled. Any company that purchases acreage for at least $50,000 per acre (and more) has a well location cost of $5 million when wells are spaced 100 acres apart. That is going to make a very large difference in company profitability from the well reported profitability because that $5 million has to also be recovered by the well in addition to the company reported breakeven costs.

This company clearly has no such worries because the location costs for that same 100 acre spacing are roughly $700,000. That is an amount that can easily recovered by most wells drilled in the current environment. Then the difference between company profitability and well profitability is less as the book asset value is far lower.

Finances

Another advantage of the small block acquisition strategy is the management can execute the strategy as free cash flow becomes available. There is no need to leverage up or to use a dilutive share offering. Yet as shown above, management in total has materially changed the acreage holdings and has gained a lot of drill sites that allow for longer more profitable wells to be drilled.

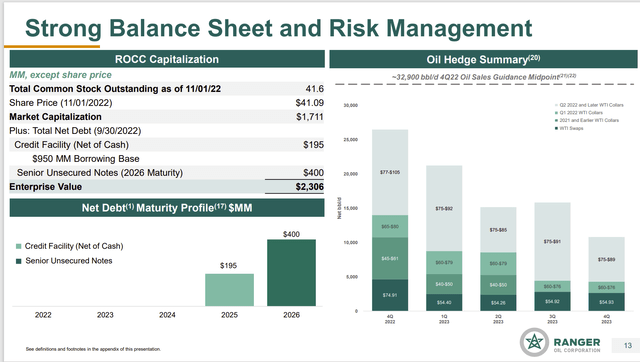

Ranger Oil Description Of Balance Sheet Strength And Risk Management (Ranger Oil Presentation At Capital One Energy Conference December 2022)

I would maintain that the consolidation strategy pursued by management is more beneficial to shareholders than the current market pressure for a dividend. Management is growing the company which should increase the production available in the next inevitable cyclical downturn. That alone could lead to acceptable debt ratios during that industry downturn. Of course, there is always the risk that prices go so low that the strategy fails.

In the meantime, the cheap acquisition strategy will build the balance sheet because there are undervalued assets “protecting” that debt. Drilling on that acreage should lead to increasing profitability because management spent less money to acquire the acreage, drill on it, and complete the wells to production. That also would lead to increasing financial strength ratings. Of course, it is a slower process than is the case for one properly executed acquisition. But it also appears to have a far larger payback to shareholders in the future.

As long as finances remain conservative, this company should have no problems refinancing that debt to continue the consolidation strategy. But that looks like an easy goal the way things are currently executed.

Moving Forward

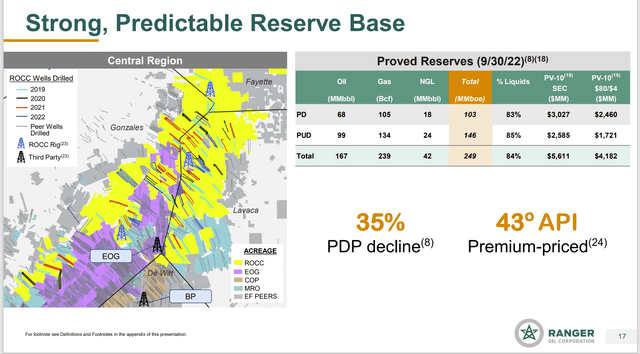

The company has some excellent operators as neighbors.

Ranger Oil Reserve Base And Eagle Ford Acreage Map (Ranger Oil Presentation At Capital One Energy Conference December 2022)

Getting acreage next to strong operators like EOG Resources (EOG) is no small accomplishment for a smaller company like this one. It leads credence to the profitability of the acreage and the boasts about leading margins.

The cash flow reported backs up the reserve report and assures investors that the costs to develop more reserves are either reasonable or cheap. That helps to assure investors that there will be a fair amount of reserves should commodity prices drop (and the expensive reserves go off the report).

Forward Strategy

This management has come up with a way to avoid direction competition for acreage with larger companies that have more resources. In fact, management came up with a way to acquire a fair amount of acreage at a discount to the market. Since there is a lot more potential acquisitions like this in the Eagle Ford, this appears to be a very good way to grow the company long-term.

I have followed a lot of companies that make good significant acquisitions. The current strategy pursued by this company is a lot more work. But it is also likely to prove to be very low risk and very profitable in the long-term. The dilution risk to shareholders is non-existent. The strong balance sheet will maximize consolidation options during times when there are less buyers than now.

As long as the strategy continues to be well executed, it is as good as a competitive moat that will provide a long-term major cost advantage when compared to a lot of competitors. The company is already located in some of the best Eagle Ford acreage around. This strategy builds upon that advantage to make a larger advantage.

Managements willing to do the extra work that this strategy entails are not real common. These managements are often worth investigating by potential investors. Investors can expect this company to grow in the teens for the foreseeable future as an annual average.

Be the first to comment