ablokhin

Introduction

I maintain a Strong Buy rating on Cassava Sciences, Inc. (NASDAQ:SAVA). Cassava Sciences is working on an Alzheimer’s Disease (AD) small molecule drug called Simufilam, currently in phase 3 trials. Over 99% of AD therapies attempted have failed, which is why the company has chosen to take a novel approach.

I believe that Cassava Sciences currently presents the best risk to reward in the stock market. I think Bloomberg’s senior equity research analyst specializing in the biotech sector, Marc Engelsgjerd, said it best:

“If you can develop a small molecule pill for Alzheimer’s disease that can definitively improve cognition, that would very likely become the most successful product in pharmaceutical history.”

For context, the current best-selling drug of all time is Lipitor from Pfizer (PFE), which sold for an incredible $150 Billion. Pfizer acquired Lipitor’s original creator, Warner-Lambert, in 2000 for $110 Billion. The second highest of all time is Humira by AbbVie (ABBV), which is significantly lower at $109 Billion. Regardless, a drug of this magnitude has an incredible potential value.

Simufilam

Simufilam is a pill with no known safety issues after over a quarter of a million doses. Many other AD therapies are full of safety issues, such as Aduhelm from Biogen (BIIB), a good face of the amyloid theory drugs, that had a major problem with brain swelling and bleeds. Further, Simufilam is a pill compared to competitors who have chosen to pursue an IV injection method, such as Aduhelm. A pill is cheaper, safer, and more manageable. If Simufilam and an IV method are approved with the same benefit, the pill would far outperform the IV in sales.

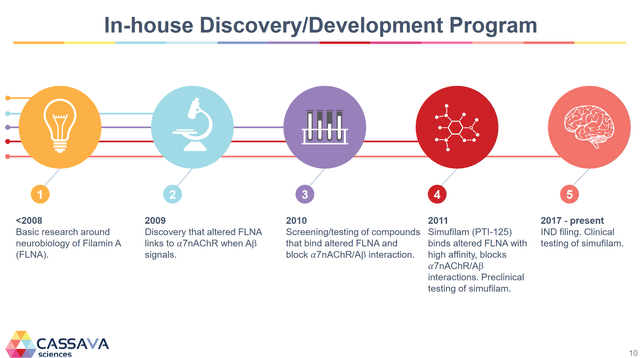

While this drug and theory on AD is new to many investors and is still unknown by many scientists, it has actually been in development for over 15 years. Below is the company’s slide on the development history.

Method of Action

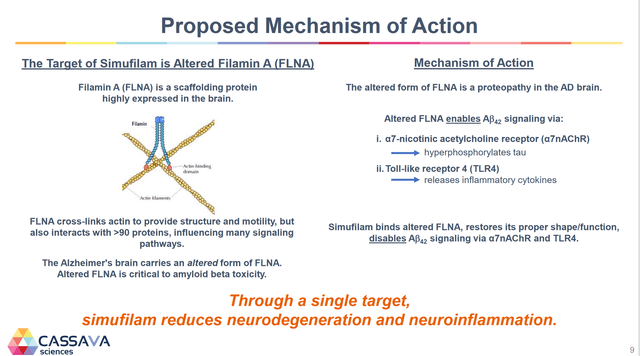

Simufilam had a dual method of action from binding to a single target. The result of this is the reduction of neurodegeneration and neuroinflammation. The traditional approach for years has been around the Amyloid theory, which:

“suggests that the deposition of Amyloid β (Aβ) in the brain triggers a chain of events, involving the deposition of phosphorylated Tau and other misfolded proteins, leading to neurodegeneration via neuroinflammation, oxidative stress, and neurovascular factors.”

Cassava Sciences’ theory is around Altered Filamin A (FLNA). What differentiates Cassava Sciences is that it is an entirely new theory on what causes AD. Below is the company’s corporate slide on the method of action.

Clinical Data

AD is a disease of continual decline. A successful drug would noticeably slow the decline. An incredible drug could stop the decline. A Nobel prize-winning drug could reverse cognitive decline. Dr. Robert Howard, a professor of old age psychiatry and an expert in clinical trial design at University College London, said, “Generally, in this area, we would regard slowing or stopping of cognitive decline as a win.”

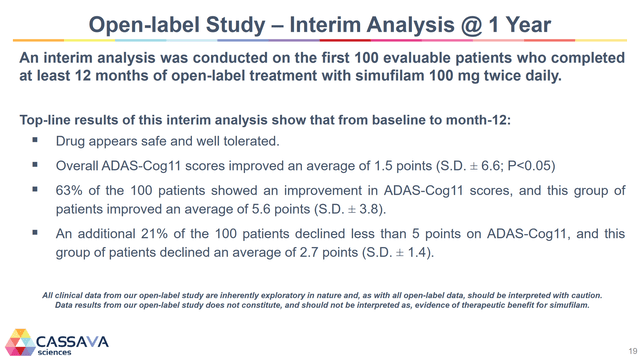

Simufilam has reversed cognitive decline in 100 patients in an open-label trial at 12 months. Previously, the longest cognitive decline that has been reversed was six months. Below is the highlight of that trial.

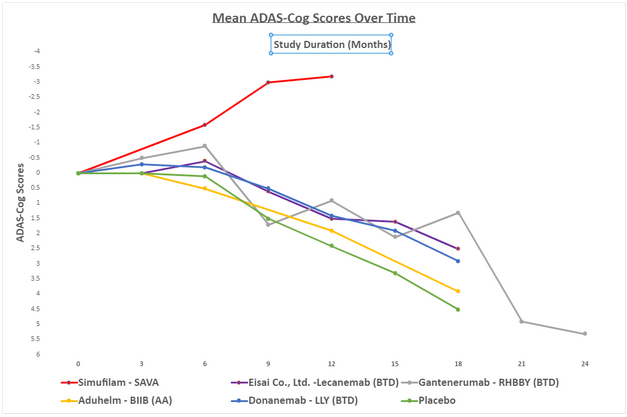

To show how drastic Cassava Sciences results are compared to other AD drugs, I have a graphic comparing them. In the chart are the clinical results of Biogen’s Aduhelm, which received accelerated approval, Eisai’s Lecanemab, which received breakthrough drug designation, Eli Lilly’s (LLY) Donanemab, which received breakthrough drug designation, placebo averaged from multiple drug trials, and Roche’s (OTCQX:RHHBY) Gantenerumab, which received breakthrough drug designation. Check out the graphic below.

Created

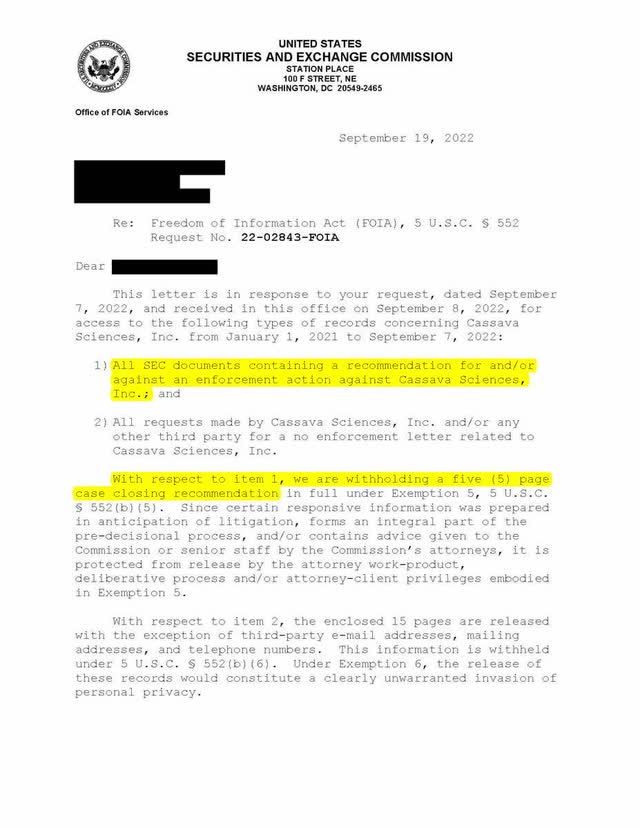

SEC Clearance

As seen below, the SEC has officially closed its case. The below document was obtained through a FOIA request. I have highlighted crucial wording.

Chart Patterns

While I view this play as a long-term play on Simufilam, there is also a play to be made from the charts. When I write this on September 20th, Cassava Sciences currently sits above its 9, 50, and 200 day moving averages, indicating the stock is on an incredibly bullish run-up. Even if you have no indication of trading on charts, they are still important because many Quants rely on charts for their algorithms. When so many bullish indicators align as they currently do in Cassava Sciences, this will cause many momentum-based algorithms to buy into the company to ride the bullish wave. The capital inflow from these algorithms will help propel the stock.

Five Future Catalysts

1. Cassava Sciences has stated that it intends to release 12-month data for 200 patients (100 patients have already been released) from its open-label extension trial.

2. In addition to 200 patient data, the company plans to release the biomarker data for 25 patients in that trial.

3. Recently, the company stated that results from its blood-based diagnostic test SavaDX should be released sometime between now and the first half of 2023. SavaDX could be worth over a billion dollars, but the company has put it on the back burner as it focuses on the real prize in Simufilam.

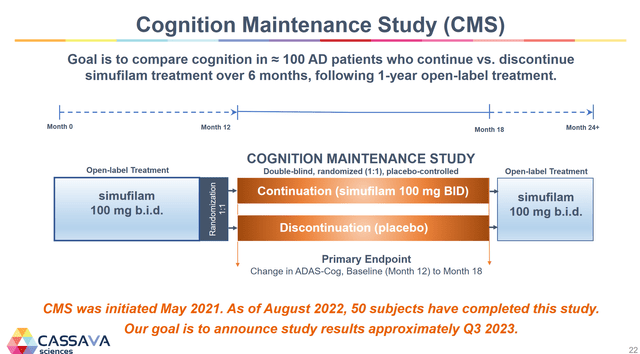

4. In mid-2023, the company will release data from its cognitive maintenance study. In this study, patients who have been on the drug open-label for 12 months will be randomly split into placebo and drug group trial arms for six months. This trial will give out placebo-controlled, drug withdrawal, and 18-month open-label data. All three of these pieces of data will give a much better picture to investors and could potentially propel the company to some elevated regulatory status considering that the company only added the CMS trial after meeting with the FDA in 2021.

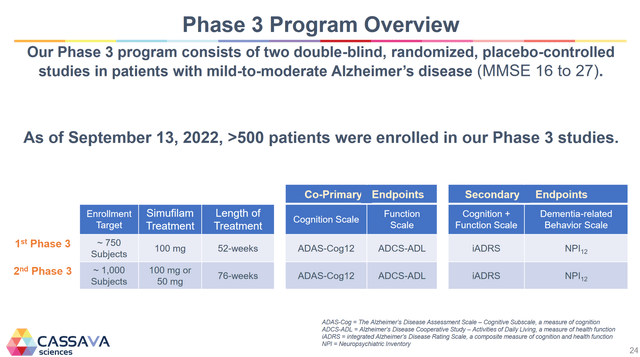

5. Finally, we can expect phase 3 trial results in mid-2024 from both of the company’s phase 3 trials. This is the data that will get the drug approved or denied and is the most critical event for the company.

Financials

The company has worked to be in as good of a financial shape as possible as it deals with getting Simufilam through trials. Per the last quarterly filing, the company has $197 million in cash and $0 in debt. The burn rate from last quarter was ~$20 million. Taking in this burn rate and cash on hand, the company could operate for ~ten quarters or two and a half years, which would put them past 2024, when the drug would be approved or denied.

Additionally, the company has stated that they believe they have the cash to fund their operations through phase 3 trials, echoing the above sentiment. The company will either need to partner, sell out, or raise money for the distribution of Simufilam upon approval. I suspect the company will do some combo of the three. This will be the next time the company looks to the market for money. Until then, the share price does not affect the company.

Risks & Conclusions

Over 99% of AD drugs have failed. AD is a place where innovative scientists go to see their careers stalled. Investing in an AD company is a very risky matter. Additionally, Cassava Sciences only has one drug in its pipeline, so if they miss it, there is no backup plan.

I remain very bullish about this company and have had multiple catalysts reaffirm my belief over the past two months. Today’s news that the SEC officially closed its investigation is just another step in the positive direction. The journey will be rocky, but I believe that in the end, it will be well worth the struggle.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment