hapabapa

Investment Thesis

JFrog (NASDAQ:FROG) is the leader in the “liquid” model for updating software, which makes its sticky offering the backbone for many (if not most) of the world’s largest enterprises. In addition, JFrog has been expanding into security and IoT.

Overall, this is a rock-solid growth company at a reasonable valuation that operates near breakeven (but cash flow positive) as it prioritizes growth over near-term profits.

Background

JFrog is a DevSecOps software and SaaS company that intends to make software “liquid”, which is a more modern approach to updating software. Through acquisitions, the company has also improved its security offering.

With just around a $250M run rate, JFrog still has ample runway for growth, which is further evidenced by its over 130% net retention rate. JFrog is also used by 85% of the Fortune 500. Its more nascent cloud offering has also been growing substantially faster than the overall business, which is why I initially wrote that the company reminded me of MongoDB (MDB).

Q2 Results

For about the last four quarters, JFrog has been able to grow at nearly 40%, and Q2 was no different, with revenue of $68M up 39% YoY. Investors may remember that growth dipped to the low 30s during COVID-19, so the company has successfully executed on its plan to reaccelerate growth. The official long-term guidance is for 30% over time. In addition, Q2 revenue was also up a healthy 8% QoQ.

In Q2, JFrog revenues exceeded the midpoint of our guidance by more than 3% for the second straight quarter. And we are excited to report that our strategic sales team, again, broke all-time records with multi-year hybrid, full platform deals signed with some of the world’s leading enterprises. (…) Our customers tell us that JFrog is a mission-critical piece in how they [pull] software from public hubs build, manage, secure and distribute it to production. JFrog Artifactory serves their software organization as the single system of record and we continue to see that JFrog is an infrastructure backbone and remains a cornerstone of our customer software delivery processes scale.

Net retention came in at 132%. Further, 94% of revenue came from multi-product subscriptions. As mentioned, cloud has been a growth driver, and grew 68% in Q2 to 28% of revenue, up from 24% a year ago. Notably, the growth was also an acceleration from the 63% growth in Q1. Customers with over 100k in ARR (annual recurring revenue) grew 56%. JFrog now also has 17 customers with $1M ARR, up from 12 last year.

Guidance

Q3 guidance calls for 5% sequential growth, which would decelerate the revenue growth to 32%. However, JFrog expects a strong(er) Q4 with $77M revenue, finishing the year with 35% revenue growth.

Regarding the current macro environment, which JFrog has factored into its guidance, JFrog said it is experiencing elongated sales cycles and Asia Pacific growth below expectations. JFrog did maintain its long-term target for 30% growth, unlike for example Palantir (PLTR), a company valued at over 10x P/S.

Valuation

JFrog is currently valued at 8x P/S its 2022 exit run rate. For a company growing at 30-40%, although it is not cheap, this does seem a compelling valuation, as the company has guided to continue to grow at 30% for the foreseeable future. That means that in 2-3 years, the valuation may be reduced to just 4x P/S, which would only be justified if the growth rate would materially slow down.

However, there is no evidence there would be a material slowdown on the horizon given the elevated cloud growth rate and the historical ~130% net retention rate, proving JFrog has a successful track record of land and expand.

Although JFrog has no material earnings, this is because the company has opted to invest in growth. Nevertheless, JFrog has delivered over 5 years of positive free cash flow. The long-term model calls for 30% FCF margin and 23% operating margin.

Product innovation

JFrog also detailed how it is adding IoT as a third pillar to its product suite, next to its DevOps liquid software offering and its security software. JFrog also announced integrations with ServiceNow (NOW) and Microsoft (MSFT).

Last May, at our user conference ramp-up, we announced and demonstrated JFrog Connect, a product combining JFrog DevOps platform capabilities with the technology of Upswift, a company we acquired in Q3 of last year. We are already seeing early demand for the product in the enterprise and how it will drive broad platform expansion. No other company provides a complete end-to-end DevOps and security flow all the way to connected devices. Today, over-the-air update solutions are made by companies forced to build their own technology that doesn’t connect to the CI/CD flow, making them insecure and [ slow ]. The market of software updates on devices takes DevOps beyond not just the data centers and the cloud, but all the way to the edge. We believe JFrog Connect is the next logical step in fulfilling the Liquid Software vision and it is now offered in the [GH] version.

Investor Takeaway

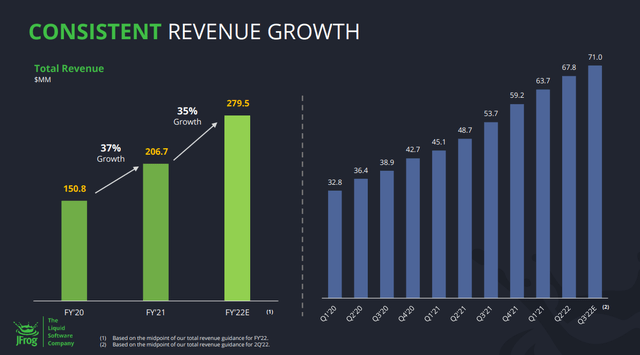

The graph shown above neatly illustrated that JFrog is a reliable high-growth software and SaaS company, as revenue has doubled in a bit over two years. The company continues to innovate to maintain its leadership position in its category of “liquid software”, and the cloud growth in particular suggests that the near to mid-term future of JFrog will likely look very similar to the past.

The stock, meanwhile, has been on a multi-year decline from its extremely elevated IPO valuation. Hence, combined with the revenue growth, the valuation has become much more reasonable in the high single digit P/S. In the current environment, investors are also wary for profits. In that regard, JFrog has been managed diligently to operate close to breakeven in order to invest in further growth.

Overall, JFrog’s software has proven to be very sticky, even “mission-critical”, which is demonstrated by its successful history of land and expand. Although the stock is up from its recent all-time low, the current price still offers a compelling entry point.

Be the first to comment