jetcityimage/iStock Editorial via Getty Images

Kroger Q1 Earnings

Kroger (NYSE:KR) since announcing its first-quarter earnings numbers last week is now roughly $3 per share or 6% down from its pre-earnings share price. To some, this may seem baffling given the strong sales and earnings beat we witnessed in the quarter. Furthermore, Kroger reported growth in top-line sales, gross profit, operating profit as well as net profit over the first quarter of 2021 and also increased its forward-looking guidance for fiscal 2022 to boot. However, it was the old reliable “gross margin” metric in Kroger that caught Wall Street’s eye in the first-quarter results this year. Kroger’s gross margin in Q1 this year came in at 21.63% whereas the same metric in the first quarter of last year came in at 22.64%. The lower comparable temporarily sent shares into a tailspin, but what investors need to keep in mind is the following. The market will always have short-term fears (which presently is inflation) and the uncertainty surrounding these fears will always lead to elevated volatility. Long-term investors for the most part blot out this “noise” and instead focus on the trends which got Kroger to the position it currently is in.

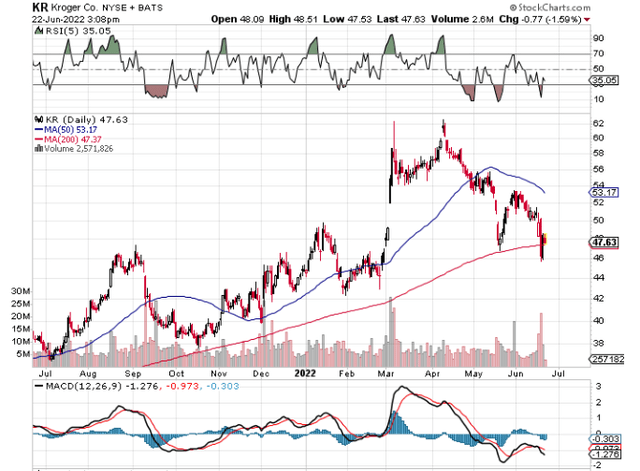

Furthermore, as alluded to earlier, the lower gross margin print in Q1 this year was not a repeated pattern as we move down the income statement. In fact, the retailer (knowing what was coming) did excellently in controlling operating costs, which resulted in a significant increase in operating and net earnings over the same period of 12 months prior. The post-earnings slide in Kroger resulted in shares briefly dropping below the stock’s 200-day moving average before buyers stepped in quickly to recover the level in recent sessions. Suffice it to say, we believe we have a prime long-term buying opportunity in Kroger at present for the following reasons.

Kroger Technical Chart (Recovers 200 Day Average) (Stockcharts.com)

Management Stewardship

Although external factors such as inflation and supply-chain headwinds are for the most part outside of the company’s control, management is fully responsible for areas such as the dividend, share-count as well as shareholder equity growth. From these perspectives, management continues to bring down the number of shares outstanding (730 million), book-value looks on course to take out $10 billion shortly and the company dividend has now increased for the past 13 years running. Although the forward yield of approximately 1.74% may not a significant calling card for Kroger, investors need to look at the “total return” potential of the stock, which we see in the company’s fundamentals below.

Fundamentals

CEO Rodney McMullen spoke on the recent earnings call on how bullish trends in Fresh, Kroger’s brands, Personalization & Digital and Boost members all work together to create more value for the customer overall. Despite the growth issue alluded to above concerning gross margin, Kroger is still returning almost 9% off its capital, and trailing free cash flow of over $5 billion has never been as buoyant. Followers of our work will be aware that we believe growth metrics are overrated in the short term, especially when you are dealing with a company that is generating the amount of cash flow that Kroger is presently generating. Guidance was raised for fiscal 2022 on the assumption that inflation will remain elevated, so we may even see higher growth than the projected 6%+ in this fiscal year. Suffice it to say, whereas Wall Street wants you to focus on the inflation ramifications for Kroger (Fear), long-term investors are far more focused on the retailer’s financial model (Fundamentals) and how value is being increasingly added to customers across the company.

KR Stock Valuation

Given Kroger’s forward GAAP earnings multiple of 13.34 and forward cash-flow multiple of 5.56, we see shares keenly priced here. In fact, Kroger’s trailing free-cash-flow yield of close to 15% at present really demonstrates the lack of importance of the company’s current dividend yield. It is all about total return and even if we pare back our expectations and bring that free-cash-flow yield back to the 10% mark, investors should still beat the prevailing inflation rate, which is obviously key at present to protect one’s purchasing power.

Conclusion

Gross margin is an easy target for Wall Street to exploit in high inflation environments. The reason is tied to growth, as costs are expected to match if not exceed inflation on the front-end. However, when we take a long-term approach and look at Kroger through the lens of its profitability, valuation, and how it rewards its shareholders, Wall Street’s argument looks over-exaggerated, especially seeing that shares have bounced off long-term support. We look forward to continuing coverage.

Be the first to comment