Jaroslaw Kilian

The U.S. TSA reports that 2.56 million air passengers flew the friendly skies this past Sunday, the highest figure since 2019. That positive headline did not result in upside price action among the major airline stocks. It was yet another disappointment for those looking for price confirmation between a rallying Dow and a struggling transports index.

The Dow Theory is widely regarded in the technical analysis community. The notion that stock market averages must confirm each other to support uptrends (and downtrends) makes intuitive sense – if one key area lags, fewer participants are pushing up prices in bull markets. What’s key is keeping tabs on how the Dow Transports are moving relative to the Dow Jones Industrial Average.

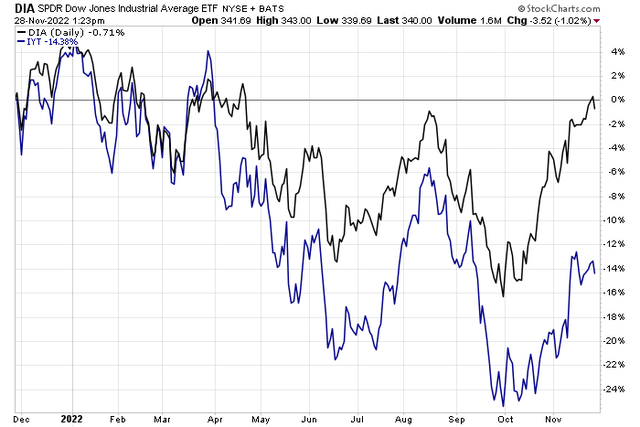

Right now, the latter is performing strongly – near its highest level dating back to April. The former, however, languishes well under its August peak. The iShares Transportation Average ETF (IYT) has faltered recently despite falling oil prices – typically a boon for the industry. I take this as a warning sign for the broader market which is currently being led by some new names – industrials and materials stocks as well as foreign shares.

Dow Transports Struggle Vs. The Dow Jones Industrial Average

Stockcharts.com

A significant chunk of IYT is the Airlines industry at more than 15%, according to iShares. How does this key group look from a valuation and technical perspective right now? Fasten your seatbelts – there is some volatility.

According to U.S. Global ETFs, the U.S. Global Jets ETF (NYSEARCA:JETS) provides investors access to the global airline industry, including airline operators and manufacturers from all over the world. The thematic ETF features a somewhat high 0.60% annual expense ratio and has $2.2 billion in assets under management.

With a portfolio price-to-earnings ratio of just 4.1 as of October 31, 2022, this is a niche value investors might be eyeing as value continues to lead growth this year. The weighted-average market cap within the JETS portfolio is $15.5 billion so it is on the border between mid and large-cap domestic exposure.

Digging deeper into its holdings, it’s a concentrated fund with the ‘big four’ airlines comprising more than 40% of the ETF. Investors should closely monitor how the fundamentals and technicals are shaping up with United Airlines (UAL), Delta Air Lines (DAL), American Airlines (AAL), and Southwest Airlines (LUV).

JETS: More Than 40% In Four Stocks

U.S. Global ETFs

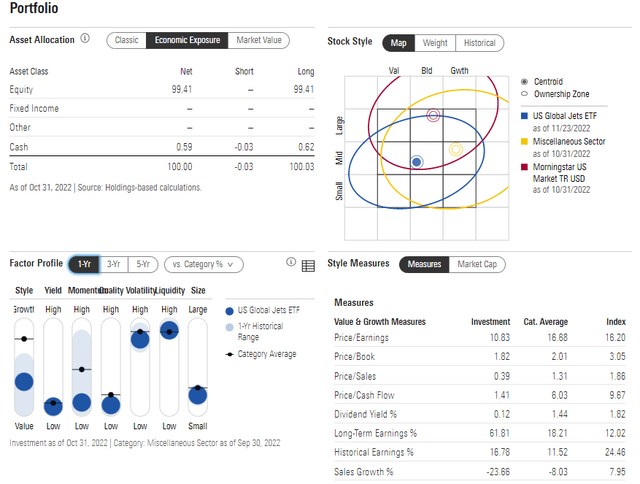

Morningstar reports that JETS acts like a mid-cap blend fund, with a bias indeed to value. Notice that, unlike many value equities, JETS has a very low dividend yield at just 0.12%. Also on the factor analysis, the fund is a low momentum product and low quality while volatility and liquidity are high.

JETS: Portfolio X-Ray, Factor Profile, Portfolio Statistics

Morningstar

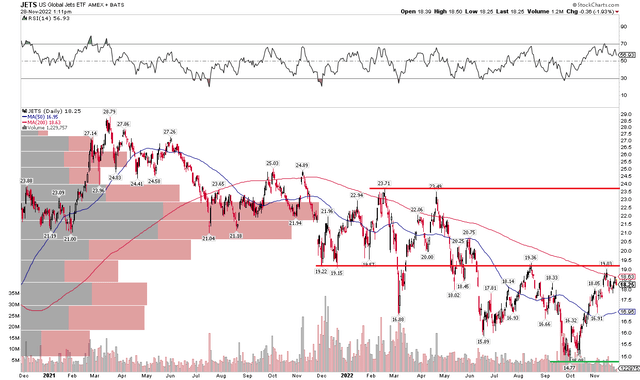

The Technical Take

I had a sell on JETS back in May and upgraded the fund to a hold in September. Since the last report, shares are indeed up modestly – just 3% compared to an overall return of 2% on the S&P 500. Right now, I see the ETF trading around important resistance near $19. JETS initially found some support around $19 on high volume a year ago, but the bears eventually took it lower. Shares then found resistance just above that price during their summer rebound and once again earlier this month. The falling 200-day moving average is also just under this key technical level.

A breakout above the $19 to $20 zone would trigger a bullish price target of near $24 – the February and April double top. I see support near $17 – the November low and where the rising 50-day moving average comes into play.

Overall, there’s bullish potential with JETS, but more work needs to be done. It is also a big underperformer this year with a broader downtrend still in place. I maintain my hold recommendation.

JETS: A Broad Downtrend, But A Near-Term Breakout Could Be Shaping Up

Stockcharts.com

The Bottom Line

JETS has a low P/E ratio, but earnings growth is often volatile with the airline stocks. Technically, there’s bullish potential, but a broader downtrend remains an arrow in the bears’ quiver. I would get near-term bullish above $20.

Be the first to comment