Justin Sullivan

Amid unprecedented pessimism for tech stocks and global growth in general, it’s important for long term-oriented investors to sift through the proverbial scrap piles to assess the damage. In many cases, companies’ share prices are a shell of their former heights, but there are still many bright spots in the fundamentals that are worth calling out.

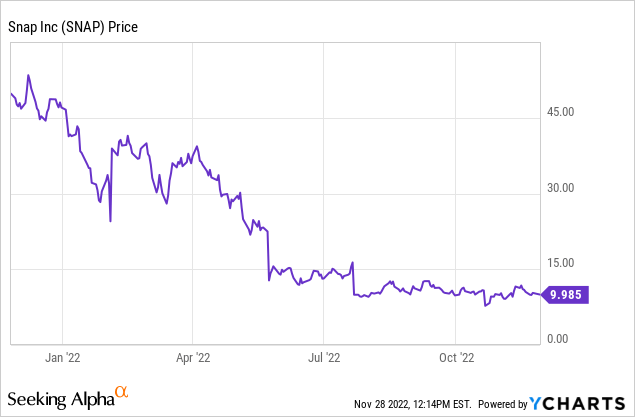

Snap (NYSE:SNAP) is a good example of this. Now, I have not always had a constructive opinion on this eclectic social media company. I challenged that the stock’s double-digit revenue valuation did not appropriately value a user base and revenue base that was ultimately subject to very volatile fad-based trends.

Now down nearly 80% year to date, however, and with the company managing to cling on to profitability at least on an adjusted EBITDA basis, I think the self-labeled “camera company” is worth a second look.

Now below $10 per share, I’m ready to call a near-term bottom on Snap and have raised my opinion on the stock to bullish. I think the chances for a rebound here in a 3-6-month timeframe are quite likely, with even more aggressive gains waiting in the wings for longer-term investors.

We’ll go into more detail in the following sections, but here is ultimately what is driving my bullish call on Snap:

- At the heart of the company is user engagement, which remains strong. Daily active users (DAUs) are still growing double-digits globally, with growth in the U.S. (whereas other benchmark social media companies have stopped growing in the U.S.) Certain segments, like older users, seem to be engaging more with certain features. In addition, new monetization schema like Snapchat+ has the potential to start diversifying the company’s revenue base away from being overly reliant on digital advertising. Headwinds in advertising will always ebb and flow with the global economy – but as long as underlying user engagement is holding up, Snap will ultimately be able to pull through.

- Significant cash resources to pull Snap through a potential recession, as well as expense discipline to preserve profitability. In September, Snap laid off more than 1,000 workers, reducing its global workforce by more than 20%. While an unfortunate move and headline, the layoffs demonstrate Snap’s commitment to self-preservation while not slowing down innovation in key areas like AR. The company continues to have significant cash reserves – enough to kick off a new buyback program that can take advantage of the current low share price.

The bottom line here: Snap is a company that will likely require plenty of patience. Pessimism for growth will likely take until early next year to tide over. At the same time, however, the market is likely overlooking a lot of the stabilization factors that will help Snap pull through an extended downturn. Take advantage of the recent slide in share prices to build up a position.

Strong user engagement differentiates Snap from competitors

A lot of the recent pessimism around Snap is driven by revenue deceleration and weakening financials, which are all symptoms of the global economic slowdown and a reduction in advertiser demand. When we take a step back from this macro noise, however, what will ultimately drive Snap’s long-term performance are its user trends.

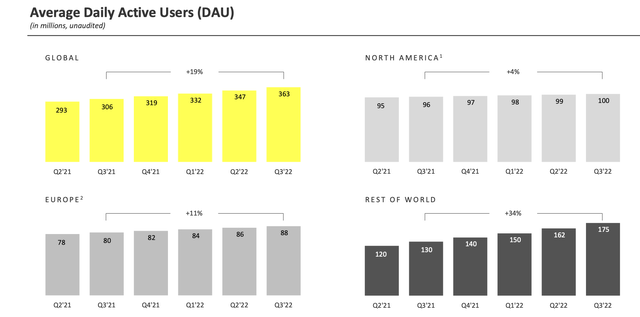

Through Q3 (Snap’s September quarter), Snap achieved 19% y/y growth in global DAUs to 363 million, adding 16 million net-new DAUs in the quarter (more than 15 million and 13 million in Q2 and Q1, respectively). As has been the case over the past several quarters, most of this growth was centered in the “Rest of World” segment excluding North America and Europe, which saw 34% y/y growth.

Snap DAU trends (Snap Q3 earnings deck)

Though a slightly less impressive growth figure, we want to key in on Snap’s growth in the U.S./North America – which has added roughly 1 million net-new MAUs each quarter. This is critical because the ARPU of a North American user is 4x a European user and nearly 10x that of a ROW user.

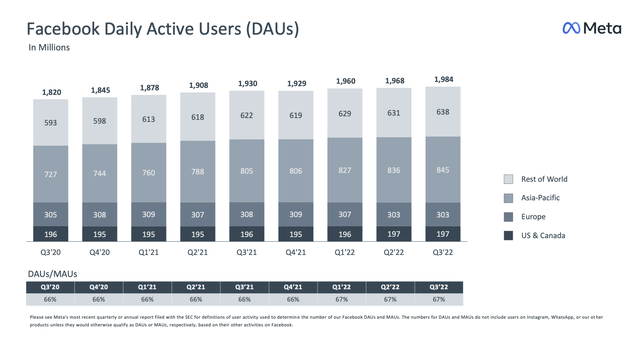

Other social media companies, meanwhile, have grown to a saturation point in North America. Meta/Facebook (META), meanwhile, has seen flatlined growth over the past two quarters in North America as shown in the chart below:

Facebook DAU trends (Facebook Q3 earnings deck)

Snap has also called out strong engagement trends among key products and demographics. Time spent watching content on Snapchat Spotlight grew 55% y/y. In addition, Snap signed a partnership with a European football league that allows for more coverage of the 2022 World Cup than ever before. The company also noted that time spent watching publisher content and Shows by Snapchat users aged 35 or older grew more than 40% y/y.

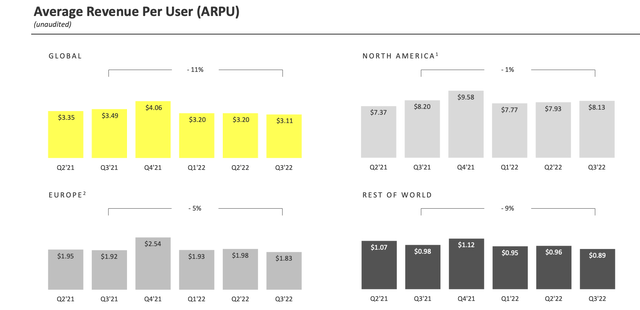

When taking all of these encouraging user trends together, we’re not concerned about the near-term -11% y/y decline in ARPU (primarily driven by declines in Europe and ROW; as North American ARPU held up relatively well):

Snap ARPU (Snap Q3 earnings deck)

We also like the fact that Snapchat has reached over 1.5 million subscribers for Snapchat+. This is a new subscription offering that the company launched this past June. Priced at $4/month, paid subscribers have access to premium features such as the ability to set longer custom expiration limits on Stories (versus a 24-hour window for free users) as well as Snapchat+ badges to feature on their profiles. At full price, 1.5 million subscribers translate to $72 million of annual revenue (roughly 2% of total revenue expectations this year). There’s a lot of potential here for Snapchat to expand into a bigger “freemium” model or offer a-la-carte services similar to what online dating apps offer, ultimately helping the company to build a bulwark against the volatilities of online advertising.

Firm balance sheet; layoffs helping to preserve profitability

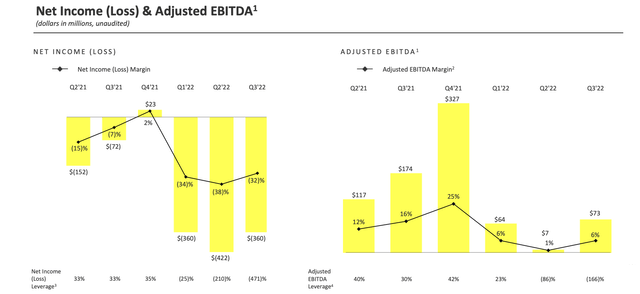

Even with the recent revenue hits, we’re comfortable with Snap’s profitability and balance sheet position to weather a downturn. In Q3, the company managed to hold onto a 6% adjusted EBITDA margin, generating $73 million in adjusted EBITDA.

Though the company has not issued forward guidance, we’re expecting that EBITDA should improve in Q4 – driven by the company’s September layoffs of roughly 20% of its headcount. The company had originally expected to target $500 million in annualized run-rate savings from its headcount reductions.

Snap profitability (Snap Q3 earnings deck)

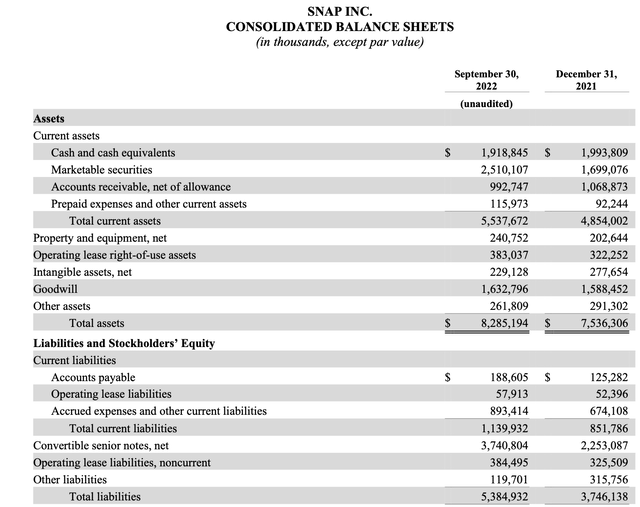

The company’s existing balance sheet is well fortified for an extended downturn. Snapchat has $4.43 billion of cash on its books, against $3.74 billion of convertible debt.

Snap Q3 balance sheet (Snap Q3 earnings release)

Note that Snap’s convertible debt is not due until 2028, and carries a negligible cash-based 0.125% per annum interest rate (with a $56 conversion price) – giving Snap quite long-term flexibility in repayment.

The company also recently boosted its share buyback program by $500 million, which at current share prices covers 3% of the company’s outstanding market cap.

Valuation and key takeaways

At current share prices just under $10, Snapchat carries a market cap of $16.15 billion. After we net off the $4.43 billion of cash and $3.74 billion of debt on Snap’s most recent balance sheet, the company’s resulting enterprise value is $15.46 billion. This represents quite a modest 3.1x EV/FY23 revenue multiple against Wall Street’s $5.03 billion (+9% y/y) revenue estimate for next year (data from Yahoo Finance), which I think undervalues a company whose underlying DAU growth is still sitting in the high teens.

Have patience here and use the recent downturn to snap up a position.

Be the first to comment