Joe Raedle/Getty Images News

Introduction

JetBlue Airways Corp. (NASDAQ:JBLU) is an intriguing American airliner with a medium-sized fleet and middle ground amenities that the company doesn’t play the low cost or largest size advantages. Therefore, in an industry where the big players set the tone, how has this airliner faired after the pandemic?

While JetBlue has seen a rebound, the company still needs more industry growth to become profitable again. But with air travel metrics leveling off and rising fuel costs, it doesn’t seem JetBlue will be profitable next year either. Trading at just 1.24x book value and 7.85x 2019’s EPS, the company is fairly valued, but I would need a bigger margin of safety to invest.

Historical Performance & Future Outlook

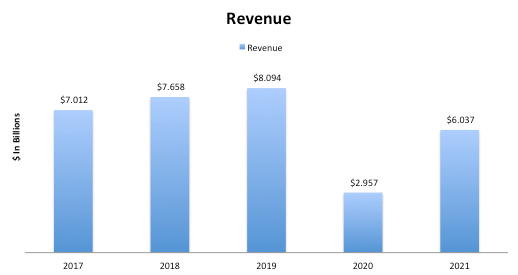

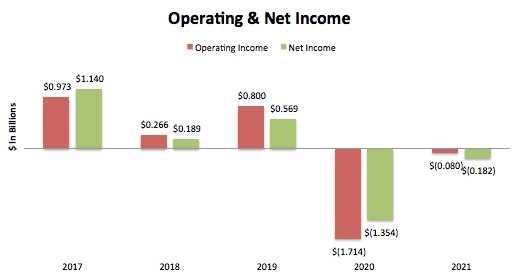

JetBlue Revenue (SEC.gov) JetBlue Operating & Net Income (SEC.gov)

As can be seen above, JetBlue was reporting consistent top-line growth until the pandemic shutdown of services in 2020. But since the 2020 low point, the airlines have seen total revenue bounce back by 104%. Still, this is just 74.6% of 2019 revenue. While the top line was consistent, the bottom half of the P&L is choppy. Smaller airliners often have a hard time capturing consistent margins, as the largest companies dictate pricing. Even so, the takeaway from the above operating and net income is that despite the operational bounds back in 2021, JetBlue was still not profitable, showing the airline needs more industry growth to see profits.

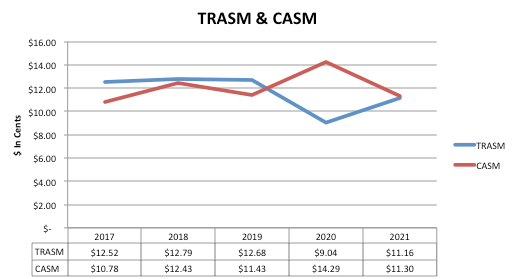

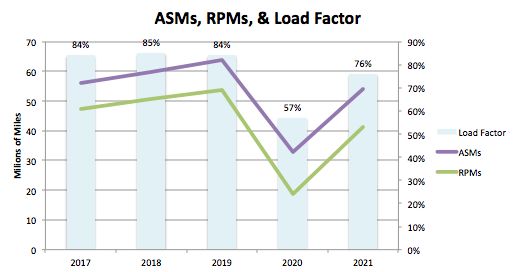

JetBlue TRASM & CASM (SEC.gov) JetBlue ASMs, RPMs, & Load Factor (SEC.gov)

The graphs above show operating metrics for the airline. As can be seen, the margins for JetBlue in 2020 were terrible and in 2021 are almost at breakeven point, just 0.14 cents away. This reiterates the need for industry growth to become profitable again, as CASM doesn’t include interest and taxes.

Of note is that the ratio of operating expenses to ASMs is 11%, equal to the years 2017 through 2019, thus showing the issue is not inflated costs. What also can be seen is that ASMs and RPMs have bounced back from 2020, showing the quick return for air travel demand post-pandemic. But JetBlue is still 8-9% percent below the normal load factor. Therefore, the issue is that the company is flying more but with fewer people on board, while the cost of flying the fleet is constant.

Industry Outlook

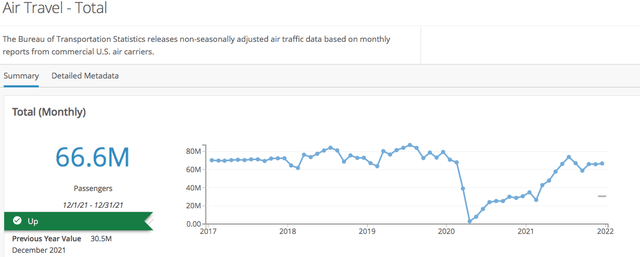

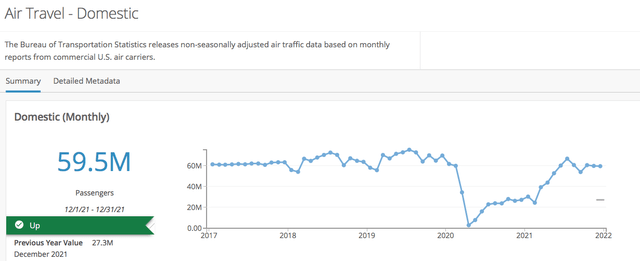

BTS Total Air Travel (BTS.gov) BTS Domestic Air Travel (BTS.gov)

And thus, the question for JetBlue in 2022 will be if the industry can grow more. Above is the data for total air travel traffic and domestic. What can be seen is the quick bounce back from all-time lows in 2020, but also a lull in this growth over the past half-year. This is concerning, as JetBlue needs the load factor to improve margins.

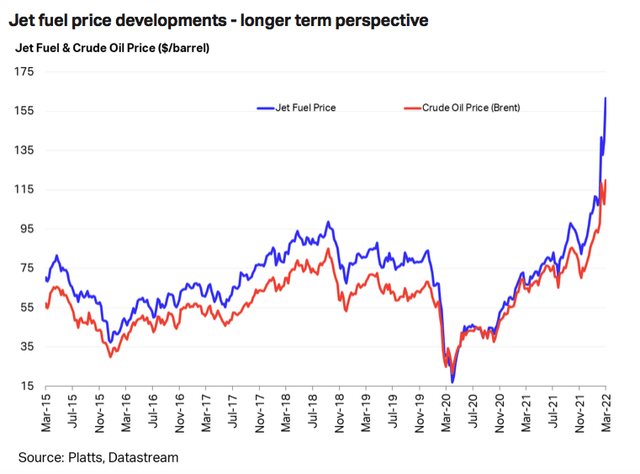

The issue is that fuel prices have gone crazy. Jet fuel has increased by 141.5% from last year. This is sure to increase airfare, thus lowering demand for air travel. This along with the simmered-down growth in the industry in general mean JetBlue likely won’t regain profitability in 2022.

Valuation

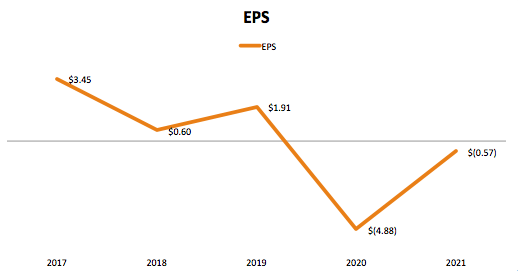

JetBlue EPS (SEC.gov)

As of writing, JetBlue trades in the range of $15 per share. At this price level, the airline has a P/BV of 1.24x. Using 2019 EPS of $1.91, the company would have a P/E of 7.85x if fully healthy. With the industry outlook changing, I would say JetBlue is fairly valued, but I would need a larger margin of safety to invest.

Conclusion

Taking everything together shows that while the airliner saw a very nice rebound since 2020, the economics for profitability are still not there. JetBlue would need the industry to keep growing to see fuller flights. If the company could get back to a load factor of around 84%, then normal profits would resume. But it is looking unlikely this will happen in 2022, as the industry has seen air travel numbers flatten while jet fuel prices rise.

These factors together could halt any further industry rebound. Overall, the company trades at a decent valuation but because of how the industry looks I would need a larger margin of safety to invest.

Be the first to comment