pidjoe/E+ via Getty Images

What happened?

I have been around for a long, long time when it comes to investing. I made my first investment in the stock market in 1994 after graduating from college and starting my professional career with Ernst & Young, a public CPA firm. I have been hooked ever since. I was able to successfully navigate the 2000 and 2008 bubbles, and one of only a few Financial Experts who was quoted in a published article warning market participants of the coming 2020 COVID Crash. Below is an excerpt from the article on Yahoo Finance:

“David Alton Clark, founder of Clark Capital, with 25 years’ experience managing his own portfolio clearly understands the full cycle the market can take. He successfully navigated the 2000 and 2008 bubbles and subsequent crashes. Furthermore, Clark was one of few financial experts who called the COVID-19 crash advising investors to raise cash in late January when President Trump restricted travel from China. According to TipRanks, an investing platform that tracks and measures the performance of financial experts, Clark’s investment ideas have seen an average yearly return of 25.3% with a success rate of 70%. Therefore, it’s no surprise Clark has held down the #1 spot on TipRank’s Top 25 Financial Bloggers list for a majority of the previous decade.”

Now, please forgive me for being so verbose when detailing my credentials, but I wanted you to be aware I am no rookie. I have been here many times before and have some knowledge to drop on you.

Macro market narrative takes precedent

There are periods in the market where macroeconomic and geopolitical issues tend to take a backseat to the micro market achievements, earning misses/bests etc. This was made evident by the market recently rallying higher even as many of the mega cap tech stocks were reporting earnings misses.

CNBC

We have just been through a long period of time where the Fed had the market’s back with the omni-present “Fed put” in place. It seemed as though nothing could take down the market. Now, with the Fed put removed, the macro market indicators have taken precedent. Furthermore, when the Fed on the rate hiking warpath, many of the high flyers and fallen back down to earth.

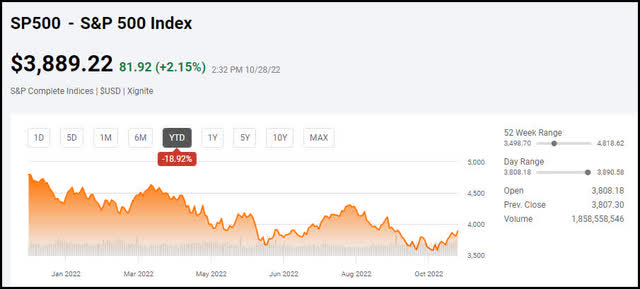

Bear markets and recessions are necessary

Bear markets and recessions are a necessary evil. They serve the purpose of “taking out the trash” so to speak. During an era of free money and zero interest rates, many profitless risky business ventures are green lit. Yet, when the tide goes out as Warren Buffett says, “It’s only when the tide goes out that you learn who has been swimming naked.” The tide is definitely out and a lot of businesses were caught swimming naked. That is why the S&P 500 Index (SP500) (SPY) is down substantially year-to-date.

S&P 500 Chart (Seeking Alpha)

Now I’d like to expound on a few lessons I’ve learned over the years when attempting to successfully invest during times of market duress. As Huggy Bear would say, “I am here to lay it out for you to play it out.” Let’s get started.

Don’t Fight the Fed

If you have been around for the last decade, you’ve obviously heard the phrase “Don’t fight the Fed.” Well, market participants need to realize the mantra “Don’t fight the Fed” works both ways.

When the Fed is supporting markets with a zero-interest rate policy and unending liquidity via quantitative easing, speculative high growth stocks soar to sky high valuations. Yet, when the Fed shifts gears and begins raising rates, those very same stocks crash back down to earth with astounding speed. As the saying goes, “stocks take the stairs up, and the elevator down.” Many get caught up in the “sunken cost” fallacy syndrome. They overstay their welcome hoping for a turnaround and end up as bag holders, unfortunately. I had to learn the hard way myself.

The bottom line is when you hear the Fed start talking about raising rates and unwinding the balance sheet, it’s time to lighten up on speculative high multiple stocks. Take those proceeds and keep most as dry powder to redeploy once the coast is clear. The seeds of the coming boom are inevitably sewn during the current bust. Next lesson learned; the pendulum always swings too far.

The Pendulum always swings too far

Just as markets rally to unjustified, stratospheric valuations that look irrational now, but seemed quite apropos at the time, they also fall well below their intrinsic values during time of market duress, like now. The most often quoted line for this was Fed chair Greenspan’s colloquialism for describing the market in the late 90s as a period of “irrational exuberance.”

What makes things even worse now is the algorithmic computerized trading that pushing the markets right up to the limit in either direction. Many times, this causes the market to over and under shoot by vast amounts these days. The next lesson learned is don’t try to be a fortune teller.

Don’t try to be Carnac the Magnificent

Carnac the Magnificent always knew exactly what was going to happen before it did. He was a character played by Johnny Carson on the Tonight Show! It was a very funny bit. For those of you unfamiliar, I suggest googling it and watching a few of the skits.

When investing in markets where the uncertainty or volatility levels are ultra-high, as they are now, I always wait until after the news is out or event is over prior to making a decision on what to do. The bottom line is you will have plenty of time to catch the wave either way. You will hear a lot of old timers say “I am fine missing out on the first 10% of upside for the increased margin of safety of missing out on the potential 20% downside.” That is usually a good idea. Investing is a marathon, not a sprint. Which leads me to my last and most important lesson learned from my years navigating these treacherous markets, even if you know the future, you don’t know the future. Let me explain.

Even if you know the future, you don’t know the future

There is no scarcity of fortunetellers, soothsayers, and run of the mill stock pickers that have no problem telling you what is going to happen next, heck I am one of them! Yet, the bottom line is even if you were able to see the future and know, for instance, the CPI number was going to come in hot, you have no idea how the markets will react. We had a great example of this just occur a few weeks ago when the September CPI number was released on October 13th and came in hot. Prior to the release on October 12th there was an unending number of pundits parroting the same line:

“If the next CPI number comes in hot, it will lead to a very big drop in the market.”

To be completely honest, I was in complete agreement with them. Yet, I did not make any bets prior one way or the other even though the odds were extremely high it was going to come in hot.

There was a plethora of participants positioned for downside based on the fact the PCE number came in hot and there is a high level of correlation between the PCE and CPI numbers. So, everyone was loaded up to benefit from a downside move. Nevertheless, the market has a way of sniffing this out and that’s when a “face ripping” rally occurs. Catching the shorts with their pants down, so to speak. Whenever everyone crowds over to one side of the boat, it capsizes. The market fell at first, but then ripped 800 points higher in one of the biggest turnaround rallies in history.

CNBC

So, the bottom line is even if you are lucky enough to have advance notice of what is going to happen, you still don’t know how the market will react. There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. You will want to have plenty of dry powder if the stock you’re interested in continues lower, hence my investing motto “patience equals profits.” Take your time and build new positions slowly, dollar cost averaging in. Don’t try to time the market based on certain events. I am a contrarian at heart. With the market down 20%, I am in the process of selectively and slowing building positions in stocks I feel are trading below their intrinsic values and offer buying opportunities. We are in a time of high uncertainty and volatility. That is why I am taking my time building positions slowly and buying as much as possible on the down days. Now let’s wrap this up.

The Wrap Up

Let me start by saying no one can predict the future. The best we can do is assess the current state of affairs and use our experience, intuition, and due diligence to make the best decision for ourselves. The market is at a point where this may just be a “run-of-the-mill” 20% correction, or the beginning of a major bear market. Only time will tell.

What’s more, there are some very important dates and events I want everyone to be aware of going into the third quarter that could cause a lot of volatility. Below is a quick calendar reminder of important upcoming event dates:

- November 2- Fed Decision

- November 4- Jobs Report

- November 8- Midterms

- November 10- CPI Data

- December 2- Jobs Report

- December 13- CPI Data

- December 14- Fed Decision

Personally, I believe the Fed will “pause” not “pivot” prior to year-end as I see many signs inflation is waning and just hasn’t shown up in the numbers just yet as they are for the most part backward looking. This will cause the market to rally on the news.

Final Note

Use articles such as these as a starting point for your own due diligence before putting your hard-earned money at risk. Those are my thoughts on the matter, I look forward to reading yours.

Your Input Is Required!

The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you think we will end the year in the red or black? Why or why not? Thank you in advance for your participation.

Be the first to comment