August Karlsson

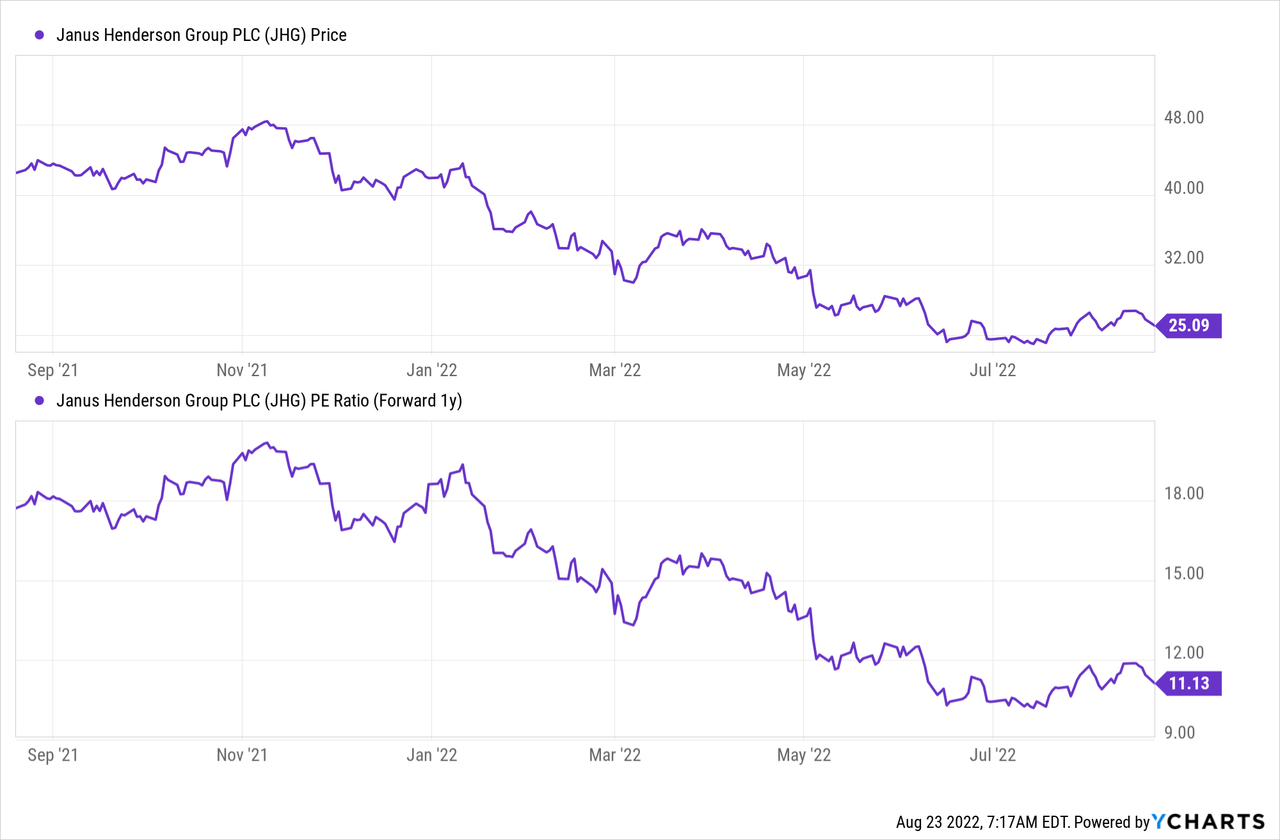

With leading global asset manager Janus Henderson’s (NYSE:JHG) new CEO, Ali Dibadj, at the helm, the company is entering a transition period that will ultimately take time to bear fruit. The Q2 2022 report highlighted the extent of the underlying problems, particularly on flows, which continue to see structural headwinds (likely much worse had it not been for a ~$3.7bn mandate win in alternatives this quarter). Plus, Janus is now also guiding to a much higher compensation expense ratio than before, offsetting any benefit from the low to mid-single digits non-comp expense growth. On balance, I remain neutral on the stock, even factoring in Trian’s interest and the inexpensive ~11x fwd P/E valuation, as the uncertain macro-outlook and structural industry headwinds could still lead to more downside from here.

Flow Headwinds Cloud Janus’ Quarter

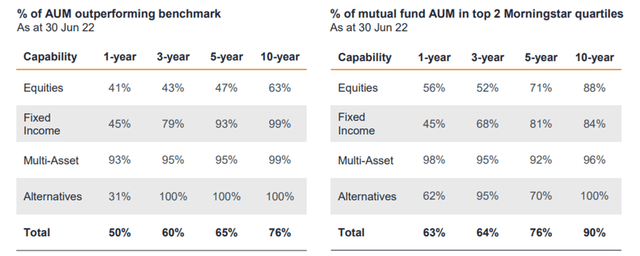

While Q2 tends to be a seasonally favorable quarter for performance fees, the subpar performance of JHG’s funds weighed on the latest numbers. Not only were the flagship funds well below their high watermark, but the flagship Absolute Return open-ended fund was also unable to contribute any fees at its annual measurement point. More broadly, performance on a three-, five-, and ten-year basis was significantly down at 60% (-2%pts QoQ), 65% (-9%pts QoQ), and 76% (-7%pts QoQ), respectively. No surprise then that it was a poor quarter for flows, with overall net outflows of ~$7.8bn. This was net of a major ~$3.7bn one-off mandate win in alternatives, though – excluding this mandate, alternatives flows would have been an underwhelming -$1.5bn for the quarter.

Of note, the quarter also saw ~$2bn of redemptions from a GBP buy-and-maintain credit strategy, with an additional ~$4bn of capital to be redeemed from this mandate later in the year. Inclusive of this mandate loss, the institutional channel is guided to drive net outflows for the rest of 2022. That said, there is incremental downside risk here – per management, in the likely event investment performance continues to lag, aggregate performance fees are guided to reach -$35-45m for 2022. This implies an accelerated performance fee drag in H2 2022, which coupled with the drag from US fulcrum fees (currently at -$15m out of the Q2 2022 performance fees of – $3.4m), entails a likely negative performance fee outcome for the full year.

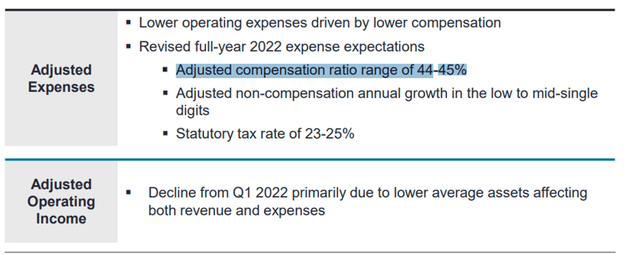

Revisiting the Expense Run Rate Guidance

With revenue likely to remain under pressure in the foreseeable future, JHG could be forced to cut back on some of its planned strategic investments, particularly in non-comp expenses. Having previously guided to a comp ratio in the low 40% in Q1 2022, management has since revised this upwards to the 44-45% range – likely a response to the negative performance fee trend. Similarly, JHG has lowered its full-year non-comp growth guidance to “low to mid-single digit” (from “low-teens” prior) – in stark contrast to the new CEO’s reiterated intention for “strategic investment” in the business. The move makes sense, in my view, given this challenging market backdrop, and could be an early step into further streamlining its non-comp cost base. On the flip side, the reliance on non-comp cost cuts suggests that funding any future investment may not be funded solely by revenue, in my view.

In the meantime, JHG will also have to contend with a sea of management change alongside the CEO transition – for instance, its global Head of Distribution and Marketing, Suzanne Cain, has just departed (after a ~3-year tenure) to be replaced by two senior members in its North American sales team. Suzanne’s departure follows that of the CIO at the start of Q2 – despite senior management retention incentives. Given the management reshuffle comes on the heels of a structurally challenged flow performance, this could be a pointer to broader internal rationalization ahead. It remains unclear, though, if this issue is ultimately fixable, given that JHG’s peers have suffered similar headwinds amid lagging active fund performance and the broader globalization of distribution in recent years. Still, new CEO Ali Dibadj’s confidence in a turnaround is a positive sign – even if it came with the caveat that there were no quick fixes to the near-term pressures from underperforming strategies and a challenging macro backdrop. Per Dibadj, significant investment will be required to initiate a turnaround, with any benefits likely more than a year away.

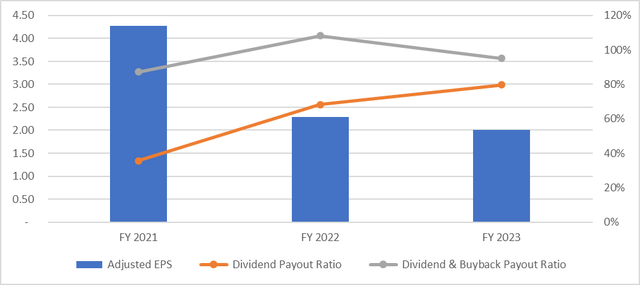

Capital Return at Risk Amid EPS Pressure

JHG’s insistence on strategic investment could have important implications for capital allocation, particularly if EPS moves closer to the ~$2 mark in 2023. Assuming H2 2022 headwinds continue and the updated compensation ratio guidance of 44-45% (vs. low-40% prior) remains intact, this could mean a potentially unsustainable dividend coverage of >70%. Not only could this result in a reduced capacity for stock repurchases, but it could also threaten the sustainability of the dividend should fund performance further deteriorate (e.g., if a market downturn materializes). Plus, reduced balance sheet capacity would impact JHG’s ability to deploy capital into major M&A and reinvestments (including management hires), likely delaying the outcome of the new CEO’s strategic plan for the business. In the coming months, I would keep a close eye on the pace of fund outflows, particularly given the ongoing macro uncertainties and the leadership transition.

Unfavorable Risk/Reward

With the change of leadership now done and dusted, JHG is set to enter a prolonged “transition” period, implying significant strategic investment and the resulting benefits likely years away. In the meantime, however, the lagging fund performance is a risk, along with the prospect of market fluctuations impacting the financial merits of the mid to long-term strategy. With the JHG comp expense base also largely inflexible and no low-hanging fruits available, a re-rate is likely some way off (if it materializes at all). While the stock trades at relatively inexpensive levels and could benefit from Trian’s interest, it is hard to look past the structurally challenged outlook for flows as well as the industry backdrop. Net, I would remain on the sidelines for now.

Be the first to comment