nattul

We previously recommended investors buy Marvell Technology (NASDAQ:MRVL) shares due to its robust data center business and solid execution. Since we first wrote on MRVL, several companies such as Nvidia (NVDA), Micron (MU), Intel (INTC), Western Digital (WDC), and Seagate (STX) announced a lackluster demand environment. MRVL is a specialized semiconductor company with a laser focus on data center and enterprise networking markets. The company operates in computing, networking, security, and storage markets. Our sell thesis is based on our belief that data center segments are not safe from weakening consumer demand and supply chain issues. While investors recognize the weakening consumer markets’ impact on PC and smartphone shipments, we believe it’s also time to acknowledge the approaching demand headwinds in data center markets. In the longer term, we believe MRVL is well-positioned to beat the semiconductor peer group within enterprise and data center markets but expect the stock to pull back from the current levels in the near term. We recommend investors sell the stock now before data center headwinds fully materialize.

Data centers are next

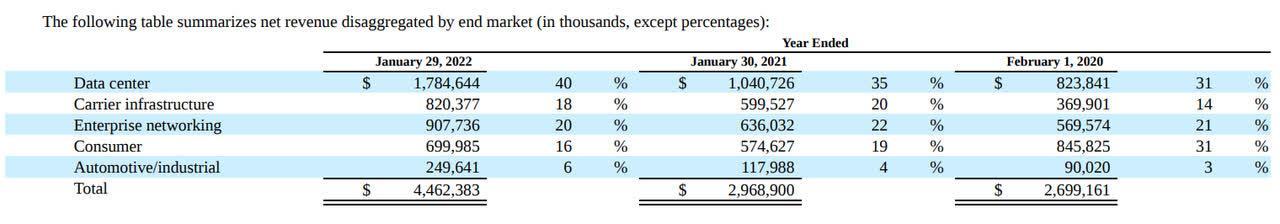

We believe data centers are next in line to face demand headwinds. MRVL operates in five principal segments, the biggest of which is data centers making up 40% of total revenues. The following chart from the company’s FY2022 10K outlines MRVL businesses.

Marvell 10-K

We are concerned about MRVL’s exposure to data centers. We expect data center demand to slow down, similar to the demand slowdown in PCs and smartphones. We believe that when the data center demand moderates, leading MRVL to lower its revenue and EPS estimates, the stock will come under pressure and likely pull back. We’ve seen this trend earlier with Micron, Nvidia, Intel, Western Digital Corp, and Seagate. For example, we saw MU grow at the beginning of the year and were buy-rated on the stock back in April. Weak consumer spending caused demand headwinds in PC and smartphone markets. At that point, we recommended investors sell their shares before profits vanish. MU’s stock dropped because the company was highly exposed to consumer demand in PC and smartphone markets. The PC and mobile segment alone made up 55% of total revenues. We believe a similar crash is coming to the data center market and recommend investors sell their MRVL shares before it gets a haircut. We expect data centers to guide down in the coming two to three quarters due to a combination of weakening consumer demand and supply chain issues.

Storage market crashing is a red flag for MRVL

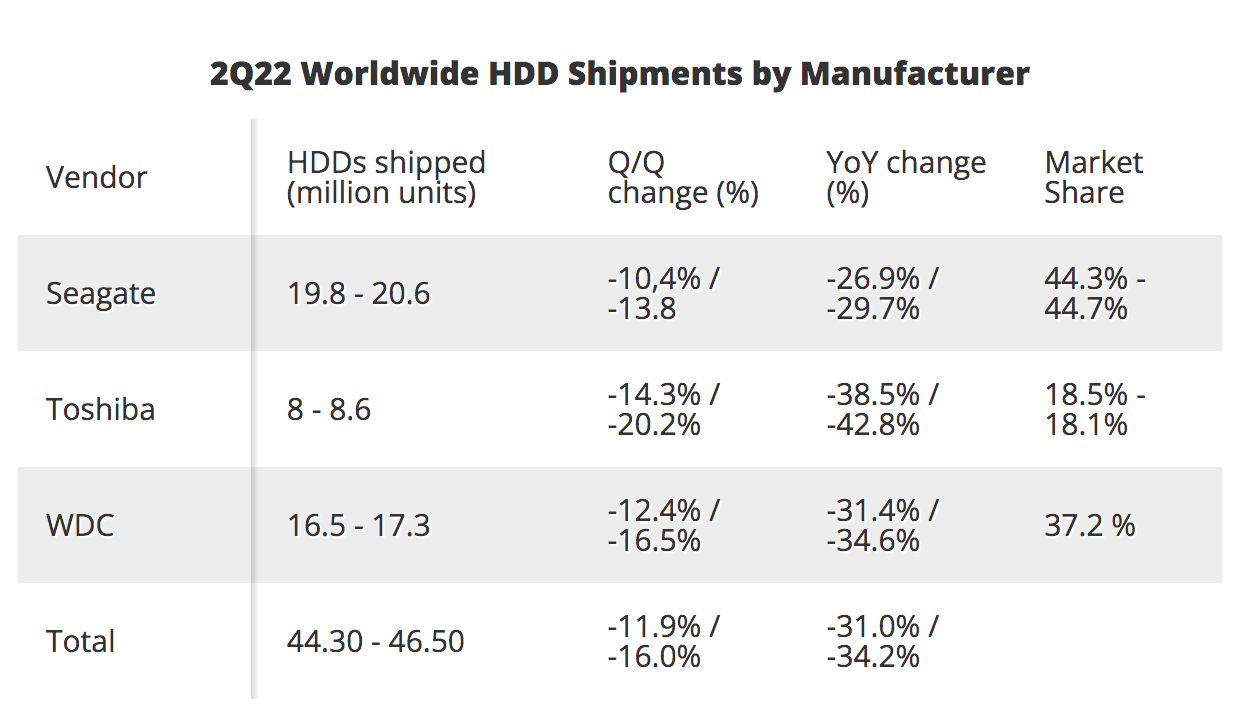

MRVL is highly exposed to the storage market through its data center and enterprise networking businesses. Both Hard Disk Drives (HDDs) and Solid State Drivers (SSDs) are forms of storage devices for data. HDDs are overwhelmingly used for data centers and clouds because of their large capacity to store data. On the other hand, SSDs are used more often on PCs and smartphones because they are smaller and faster. Over the past quarter, we have seen HDD and SSD demand drop in storage giants WDC and STX. HDD shipments have plummeted 33% year-over-over, according to Tom’s Hardware research. The following graph outlines how HDD shipments have declined by the manufacturer.

Tom’s Hardware

The same applies to SSD shipments. SSDs are currently in oversupply, and in response to excess inventory, SSD prices have dropped. We believe demand headwinds in the storage sector are a sign of the upcoming headwinds MRVL will likely face in its own data center and enterprise networking businesses.

Valuation:

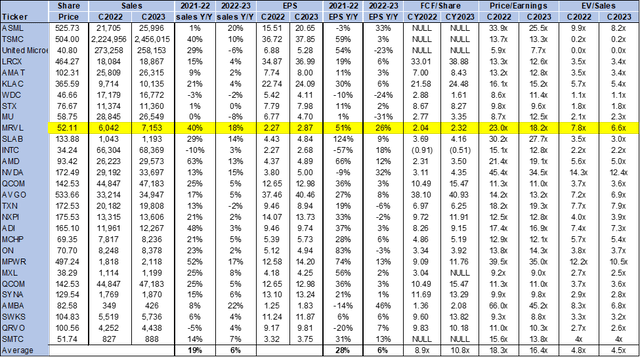

MRVL is trading at around $52. The stock is still relatively expensive, trading at 18.2x C2023 on the P/E basis EPS of $2.87 compared to the peer group average of 16.4x. On the EV/C2023 sales, MRVL is trading at around 6.6x compared to the group average of 4.5x.

The following chart illustrates MRVL’s peer group valuation.

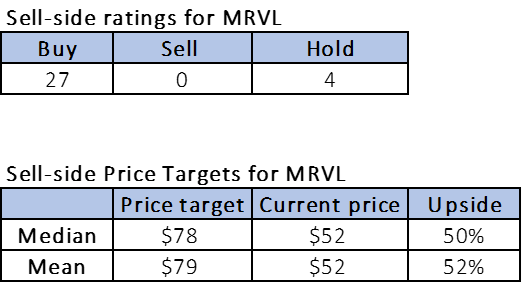

Word on Wall Street:

Consensus is buy-rated on MRVL. Of the 31 analysts, 27 are buy-rated, and the remaining are hold-rated. Sell-side price targets reaffirm the market’s buy sentiment on the stock. MRVL is currently trading at $52. The median price target is $78, and the mean is $79, with a potential 50-52% upside.

Refinitiv

What to do with stock:

We recommend readers to sell MRVL shares as we believe weakening consumer spending is spilling into its data centers and cloud. We do not believe the stock will work meaningfully in the near term because of upcoming headwinds in data center demand. We expect data centers to guide down within coming quarters and, in turn, recommend investors sell the stock before it dips.

Be the first to comment