milan2099/E+ via Getty Images

A Quick Take On Xponential Fitness

Xponential Fitness (NYSE:XPOF) went public in July 2021, raising approximately $120 million in gross proceeds from an IPO that priced at $12.00 per share.

The firm operates various fitness franchise brands in North America and overseas.

XPOF is well-managed by highly experienced executives operating an asset-light business and is well positioned with a large backlog of studio openings ahead.

My outlook on XPOF is a Buy at around $19.00 per share.

Xponential Fitness Overview

Irvine, California-based Xponential was founded to create a fitness franchise business focused on the North America market.

Management is headed by founder and CEO Anthony Geisler, who previously purchased Club Pilates in 2015 and used that as the platform on which to create Xponential.

The company’s primary franchise studio offerings include:

-

Club Pilates

-

pure barre

-

CycleBar

-

StretchLab

-

Row House

-

YogaSix

-

Rumble

-

AKT

-

Stride

- Body Fit Training

The firm seeks well-capitalized franchises who are entrepreneurial and energetic.

Xponential Fitness’ Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global health and fitness club market was an estimated $81 billion in 2020 and is forecast to grow at a CAGR (Compound Annual Growth Rate) of 7.21% from 2021 to 2026.

The main drivers for this expected growth are a continued rise in the benefit of health awareness and increasing incidence of obesity leading medical caregivers and governments to encourage exercise as a regular feature of individual habits.

Also, the North American region will continue to dominate the health and fitness center market in the coming years.

Major competitive or other industry participants by type include:

-

Full service health clubs

-

Other studio concepts

-

Other sports clubs and activities

-

At-home and digital fitness offerings

Xponential Fitness’ Recent Financial Performance

-

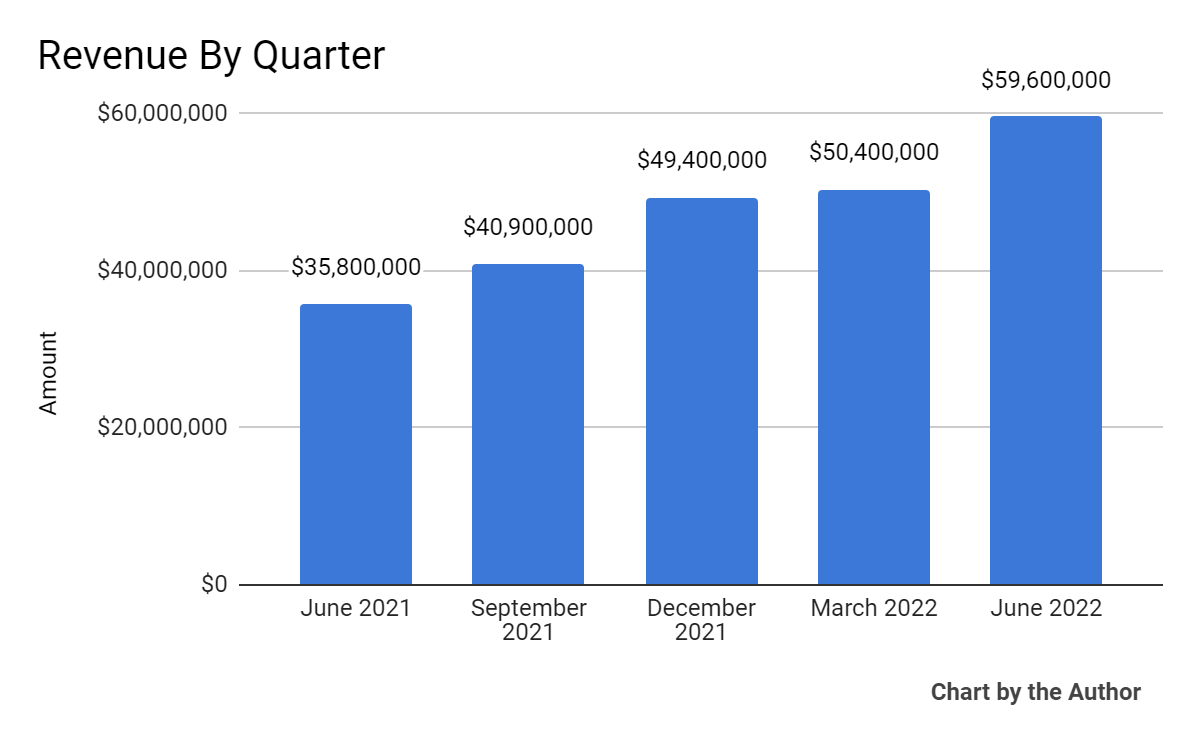

Total revenue by quarter has risen as the chart shows below:

5 Quarter Total Revenue (Seeking Alpha)

-

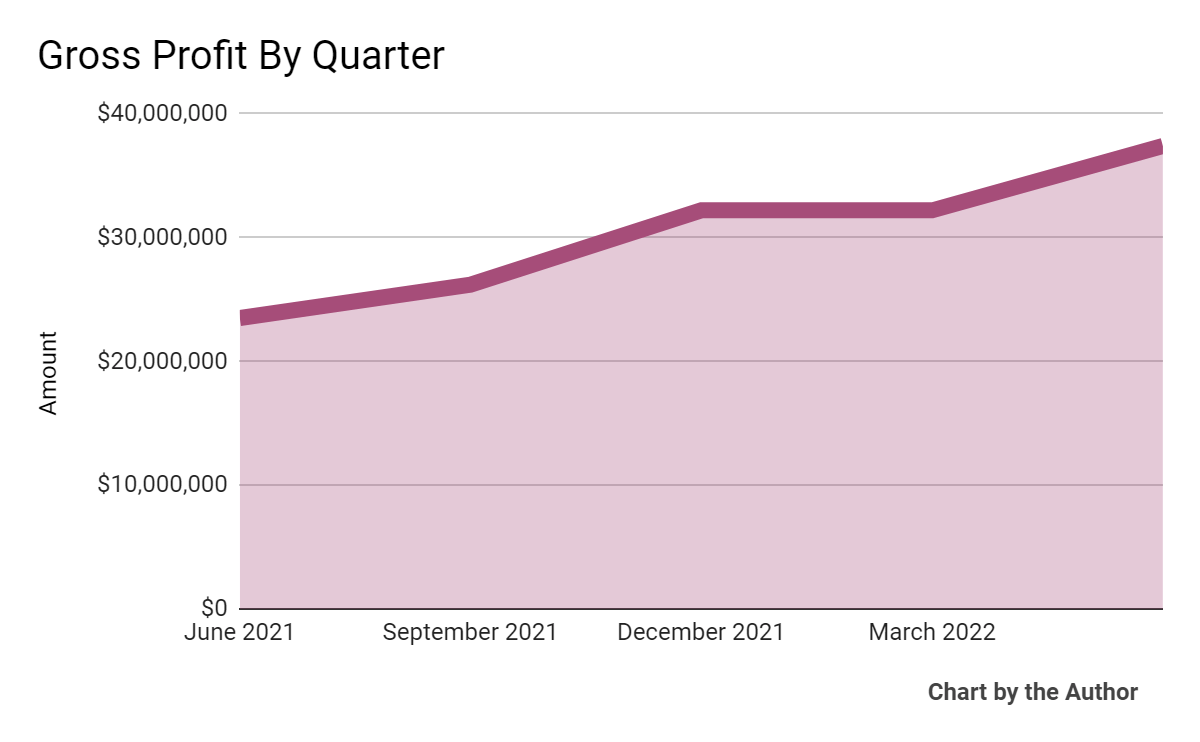

Gross profit by quarter has also grown in a similar trajectory as that of topline revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

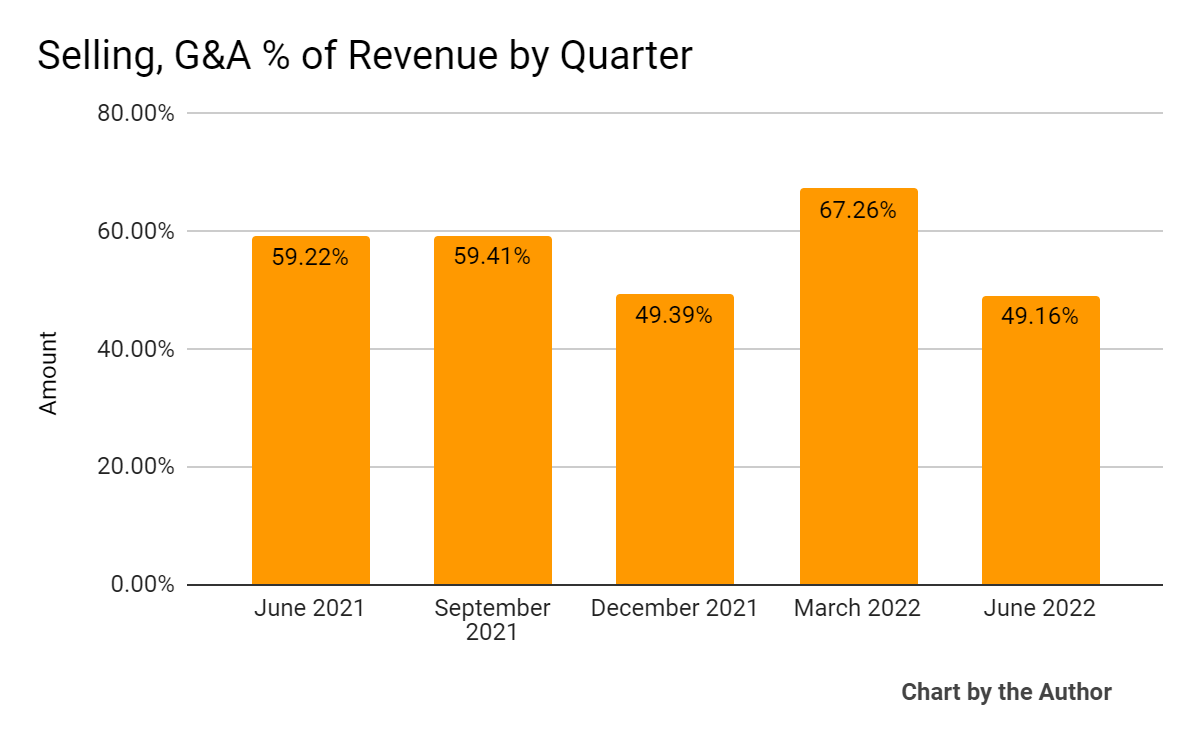

Selling, G&A expenses as a percentage of total revenue by quarter have varied in the past five quarters as follows:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

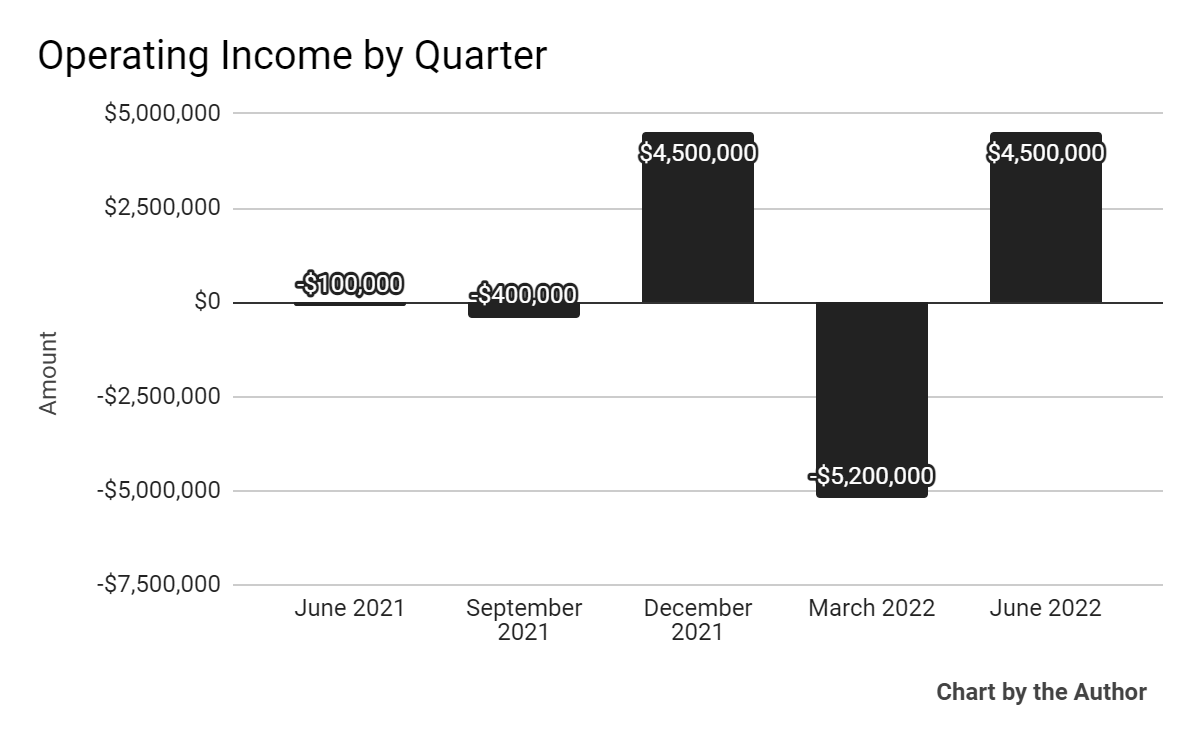

Operating income by quarter has recently returned to positive territory:

5 Quarter Operating Income (Seeking Alpha)

-

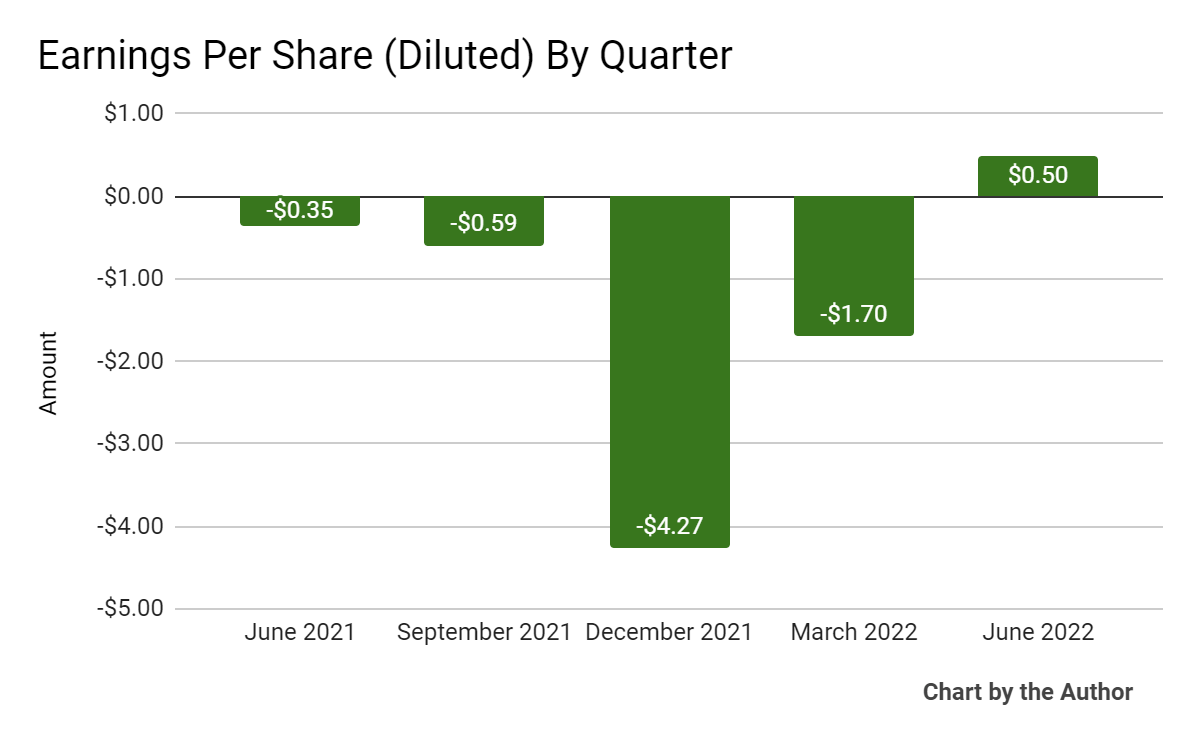

Earnings per share (Diluted) have also recently turned positive for the first time in five quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

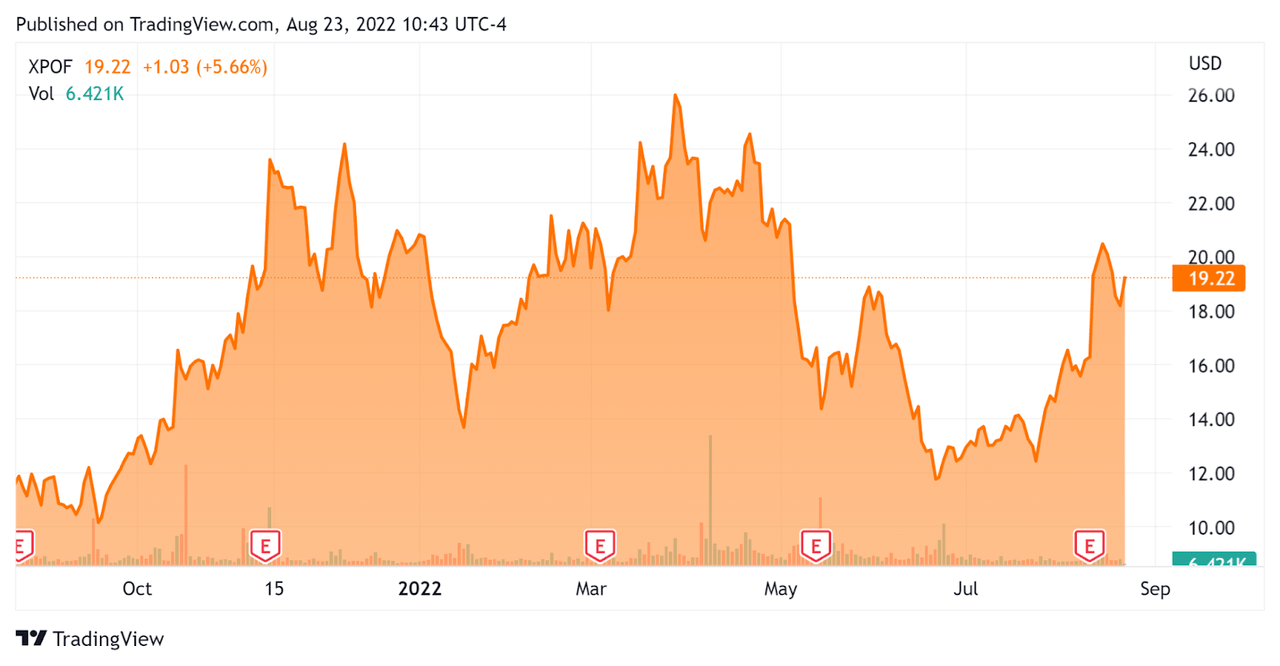

In the past 12 months, XPOF’s stock price has risen 63.8% vs. the U.S. S&P 500 index’s fall of around 7.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Xponential Fitness

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.84 |

|

Revenue Growth Rate |

69.4% |

|

Net Income Margin |

1.6% |

|

GAAP EBITDA % |

8.5% |

|

Market Capitalization |

$889,470,000 |

|

Enterprise Value |

$767,970,000 |

|

Operating Cash Flow |

$40,140,000 |

|

Earnings Per Share (Fully Diluted) |

-$6.06 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be F45 Training (FXLV); shown below is a comparison of their primary valuation metrics:

|

Metric |

F45 Training |

Xponential Fitness |

Variance |

|

Enterprise Value / Sales |

1.50 |

3.84 |

156.0% |

|

Revenue Growth Rate |

98.8% |

69.4% |

-29.8% |

|

Net Income Margin |

-87.4% |

1.6% |

-101.9% |

|

Operating Cash Flow |

-$104,370,000 |

$40,140,000 |

-138.5% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Xponential Fitness

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted member growth at its franchise locations, rising in North America by 32% year-over-year.

As of June 30, 2022, the firm’s franchisees operated more than 2,350 studios in 14 countries.

Notably, the firm counted ‘an active pipeline of approximately 2,800 studios contractually obligated to open globally.’ 1,900 of those studios are located in North America, the company’s primary focus by region.

XPOF recently acquired Body Fit Training, which has operations in Australia, New Zealand and Singapore and the company seeks to bring the brand concept to North America.

Management does not expect studio openings ‘to slow anytime soon, continuing to drive profitability.’

The firm’s franchise clientele definitely skews to a higher income group, with a majority of members with a household income of $130,000.

As to its financial results, revenues grew by 66% year-over-year, while adjusted EBITDA increased by 112%.

Operating income, which has been choppy in recent quarters, returned to positive $4.5 million in the current quarter, while earnings were positive for the first time in the last five quarters.

For the balance sheet, the firm finished the quarter with cash, equivalents and restricted cash of $29.3 million and with long-term debt of $131.7 million.

The company generated $20.7 million in free cash flow, an impressive result but one that is not typical. Operating cash flow has been highly variable from quarter to quarter.

Looking ahead, management intends to invest in growth in the UK and Japan, among others.

The company expects adjusted EBITDA margin for the full year of 2022 to be increased to $70 million at the midpoint of the range, representing a 156% increase year-over-year.

Total revenue is expected to grow by 39% over 2021 due to increasing franchising revenue, higher B2B and brand fee partnerships and ‘better performance in our company-owned transition studios.’

Regarding valuation, compared to competitor F45 Training, the market is valuing XPOF at a much higher EV/Revenue multiple of 3.8x, likely due to a range of better performance metrics and forward outlook.

The primary risk to the company’s outlook is the combination of a slowing global economy and continued inflationary pressures, which may reduce growth and increase costs, impacting net results.

However, it appears XPOF is well-managed by highly experienced executives operating an asset-light business and is well positioned with a large backlog of studio openings ahead.

My outlook is a Buy on XPOF at around $19.00 per share.

Be the first to comment