Daniel_Kay/iStock via Getty Images

Thesis

BNY Mellon High Yield Strategies Fund (NYSE:DHF) is a fixed income closed end fund. The vehicle has a long track record, having IPO-ed in 1998. The fund has a classic build with a 33% leverage ratio and a preponderance of fixed rate high yield bonds. There is nothing outstanding though about this fund. The vehicle has posted absolutely mediocre results in the past decade, with a total return that is moving in towards zero. Yes, you read that correctly – if you had purchased this fund ten years ago your total return now would be something close to zero.

The market has been trading the CEF at a discount to NAV due to its underperformance and we expect it to continue to do so, unless there is a management overhaul on the CEF side. The vehicle seems to be a fee churning fund at this stage, with extremely poor investment and statistics breakdowns in order to ascertain risk/rewards. On a year to date basis the CEF has a negative performance in line with other funds in the cohort, but on a long term basis the vehicle underperforms significantly.

There is not much to like here. It feels like DHF sort of just exists, clips some fees and posts mediocre performances when benchmarked to the market. We feel 2023 will see better results across risk assets as a whole, so we cannot suggest to long term buy and hold investors to sell here, but there is nothing to like about this fund, with much better alternatives out there.

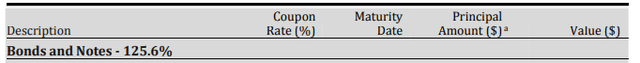

Holdings

The fund holds a mix of bonds, CLOs and leveraged loans, but is extremely poor at breaking out exposures. Its collateral pool is not broken out in the fact sheet, nor is it presented in a user friendly fashion in its annual report. By parsing out long form data we get the following:

Allocations (Annual Report) Allocations (Annual Report) Allocations (Annual Report)

Please note that the above percentages add up to a number higher than 100% because the fund factors in the leverage which is 35%. To be very frank we find it shocking that in this day and age this CEF that clips high management fees is unable to put a simple pie chart on its fact sheet to break out its exposures. It speaks very ill to the management team, and together with the mediocre performance posted in the past decade by this fund it adds up to just a fee churning endeavor here rather than an investor dividend generating fund.

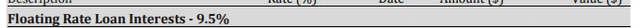

The fund takes a balanced perspective from a credit rating standpoint:

Ratings (Fact Sheet)

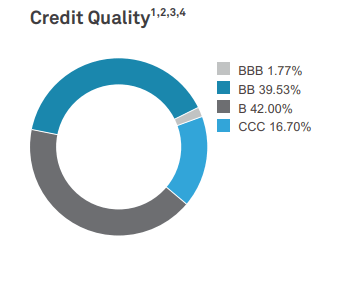

The build is commonplace for high yield vehicle, with a granular approach across credit buckets. The same approach is observed at the industry level, with a granular approach:

Top Industries (Fund Fact Sheet)

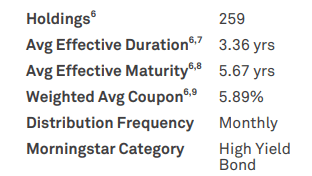

The fund has over 250 holdings and a middle of the road duration profile:

Stats (Fund Fact Sheet)

Performance

The fund is down almost -30% year to date:

YTD Total Return (Seeking Alpha)

The fund is fairly in line with the other CEFs in the cohort, although on the lower side in terms of year to date total return.

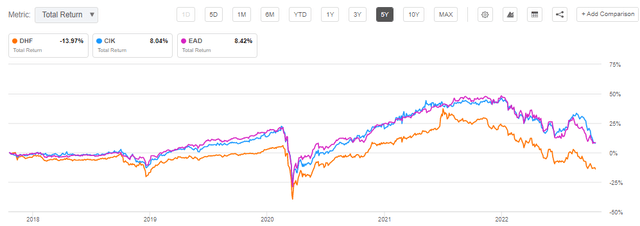

The CEF significantly underperforms on a 5-year time-frame:

5Y Total Return (Seeking Alpha)

The picture is similar on a 10-year time-frame, where DHF is flat on a total return basis. In our minds these are red flags, symptomatic of a management team that does not do its job. Ultimately we would be looking for this vehicle to make a return on a decade long basis, even with the ups and downs of rate and credit cycles. Other high yield CEFs have managed to do just that.

Premium / Discount to NAV

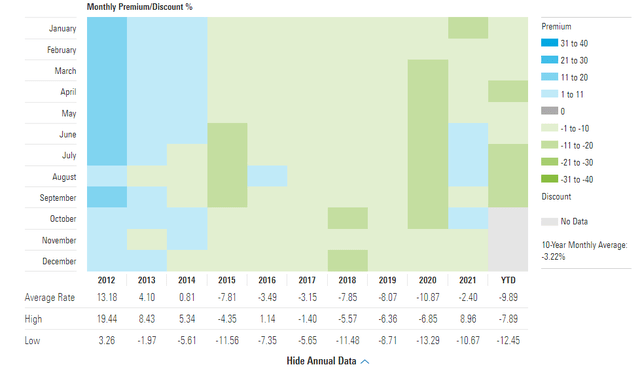

The fund usually trades at a discount to NAV:

Premium / Discount to NAV (Morningstar)

We feel this is appropriate since the portfolio managers have posted fairly mediocre returns in the past decade. The vehicle clips large management fees, yet it is flat from a total return perspective in the past decade. Do expect a discount in the future as well, unless there is a re-vamp of the portfolio management team and we see the fund start to outperform its peers. At this stage we view this vehicle as a management fees churning instrument rather than a leveraged outperformer.

Conclusion

DHF is a fixed income closed end fund. The vehicle has a classic build, with a 33% leverage ratio and an even distribution across below investment grade ratings. The fund holds a preponderance of high yield bonds, with small buckets for leveraged loans and CLOs. The fund has a mediocre long term performance, significantly underperforming its peers on a 5- and 10-year basis. The vehicle is currently trading at -14% discount to NAV and we expect this to continue. There is nothing here to warrant an investor’s capital and the market is pricing that in. We feel the portfolio management team has gotten extremely complacent, and is just clipping management fees at this stage. Given an expected rebound in risk markets in 2023, we would not divest here, but investor capital is much better served across a plethora of other fixed income CEFs.

Be the first to comment